NowNow Reimagining Fintech in Africa

24 May 2023•

As I sit down to interview Sahir Berry and Mahesh Nair, co-founders of Nigerian fintech startup, NowNow, I find myself both intrigued and simultaneously not at all surprised at this pairing. Sahir is tall, charming and consistently well-dressed; he makes small-talk easily and carries a quiet confidence, which allows him to share his vision for their startup with equal parts passion and measured control.

Mahesh, in comparison, is a man of few words, but when he speaks – it is something worth noting. He often has a stitched brow, as if he’s solving multiple problems in his head simultaneously, while quietly tapping away into his phone coordinating with his various teams sitting in Lagos, Delhi and Dubai. I get the impression that he is keen to just roll-up his sleeves and be left alone to get the job done.

From left to right: Leigh Flounders (Chief Commercial Officer), Sahir Berry (Co-Founder & CEO), Mahesh Nair (Co-Founder & COO), Matt Francis (Chief Strategy & Investment Officer)

From left to right: Leigh Flounders (Chief Commercial Officer), Sahir Berry (Co-Founder & CEO), Mahesh Nair (Co-Founder & COO), Matt Francis (Chief Strategy & Investment Officer)

When I ask Sahir what got him interested to become the founder of NowNow, a fintech startup born out of Nigeria, he pauses thoughtfully before answering. “It’s quite simple, really,” he starts. “There’s little to no job creation in Nigeria and much of Africa as a whole. The only way for people to survive has been to become microbusiness owners themselves. Despite Africa’s economy being built on the backs of these micro-entrepreneurs, few of them have access to financial products to run their business.”

He continues, “There was a clear opportunity to create a solid fintech product and commercially-viable company, while providing real impact to these people’s lives which would in-turn bolster Africa’s economy as a whole.”

He’s not wrong. It is estimated that up to 80% of jobs in Africa are created by small businesses, and 70% of the continent’s GDP is driven by MSMEs as well. Yet, more than half (51%) of them cannot access funding that they desperately need in order to sustain and grow their businesses. In Nigeria alone, it is estimated that there are over 41 million micro, small and medium-sized businesses. If more than 21 million small businesses don’t have access to loans in Nigeria alone, that has potential to be big business if NowNow can crack the code.

Courting Co-Founders

I find myself asking Mahesh and Sahir where they met. “We’ve known each other professionally for years,” says Sahir. “In fact, truth be told, I spent months convincing Mahesh to join me on this mission. We were both passionate about the payments space and could talk for hours about what opportunities existed in Nigeria. With Mahesh’s background, I knew he was someone I needed.”

Mahesh spent years working with telecom players dealing with service marketing for Mobile Money and other businesses in India, before he moved to work in Nigeria. “Telecommunications is an industry that is very close to my heart,” Mahesh says. “It’s an ever-changing industry, and clearly the frontrunner in large-scale technological applications. Mobile money was a major part of my responsibilities in that sector, and the transition to Fintech was quite natural for me.”

When I ask Mahesh what he had to ponder before joining Sahir, he replies, “the idea excited me from the very beginning, the pro’s were obvious, but I had to consider all the facts. What kept me up most nights was thinking about how sceptical people still were of banking in Nigeria. There were many stories of people putting money in Nigerian banks in the 1980’s to the 2000’s, and they simply didn’t get their money back. Cash is king in Nigeria, and I had to consider if this was the right time to go all-in to build a fintech in this market.”

This consumer scepticism explains why 57% of Africans today still have no bank or mobile money account, which also means the majority of Africans have no credit history and no access to personal loans. In Nigeria, for example, there are only 4 Bank branches and 17 ATMs for every 100,000 people. Comparatively, in Egypt, that number more than doubles to 8.8 bank branches per 100,000 people. In the United Arab Emirates and the United States, its 23.7 and 28.5 bank branches per 100,000 people, respectively. But the tides seem to be changing, as today’s young African population is keen to get themselves digital bank accounts.

“It is estimated that up to 80% of jobs in Africa are created by small businesses, and 70% of the continent’s GDP is driven by MSMEs as well. Yet, more than half (51%) of these small businesses cannot access funding that they desperately need in order to sustain and grow their businesses.”

With Sahir and Mahesh formally joining hands in 2018, NowNow launched to meet the specific needs of two underbanked customer segments: the SME owner, and the underbanked individual. NowNow empowers SMEs to grow their businesses through a suite of payment processing and business management tools. NowNow also has expanded to provide business loans, as well as remittance and insurance solutions.

Infographic: NowNow’s Customer Growth

Business-in-a-Box for small business owners

“Meeting the needs of the SMEs is critical on a macroeconomic level,” Sahir explains. “SMEs and microbusinesses are enormous drivers of economic growth across Africa – but the majority lack access to the tools and financial services they need to thrive.”

For small businesses, NowNow provides a “Business-in-a-Box” solution that allows offline businesses to bring themselves online through enhanced payment processing, ERP and digital storefronts. “For the Business-in-a-Box approach to merchants, we give them a digital identity,” says Mahesh. “The app has all the ERP tools to do inventory management, categorization, with digital payment acceptance through android POS, softPOS technology, QR codes and payment links which can be sent to customers through social media.”

NowNow’s softPOS technology allows Business-in-a-Box merchants to use their mobile phone as a POS system using NFC technology. This allows merchants to use their digital catalogue through their digital storefront, and ultimately paves the way for NowNow to eventually become a sort of Shopify for Nigeria’s MSME merchants.

As of Q1 2023, NowNow had over 60,000 merchants onboarded, and were onboarding 5000 new merchants every week. They expect to have a merchant consumer base of over 200,000 by the end of the year. “Latest estimates put less than 2 million POS systems operational in Nigeria today, across more than 40 million SMEs. That means there are more than 38 million MSME’s that could be potential NowNow customers in Nigeria alone,” Sahir explains.

This Business-in-a-Box offering to SMEs is so compelling, NowNow has begun to export it and offer it as a white label product to various banks, particularly in markets it has no interest in operating directly in themselves. In Abu Dhabi, for example, NowNow has provided one of the leading National Banks with this Fintech-as-a-Service, that the Bank can offer to the 300,000+ SMEs operating in the UAE without an operating POS system or ERP tools. “NowNow provides the full solution, and the Bank gets to roll it out at a fraction of the cost because it is plug-and-play”, says Mahesh.

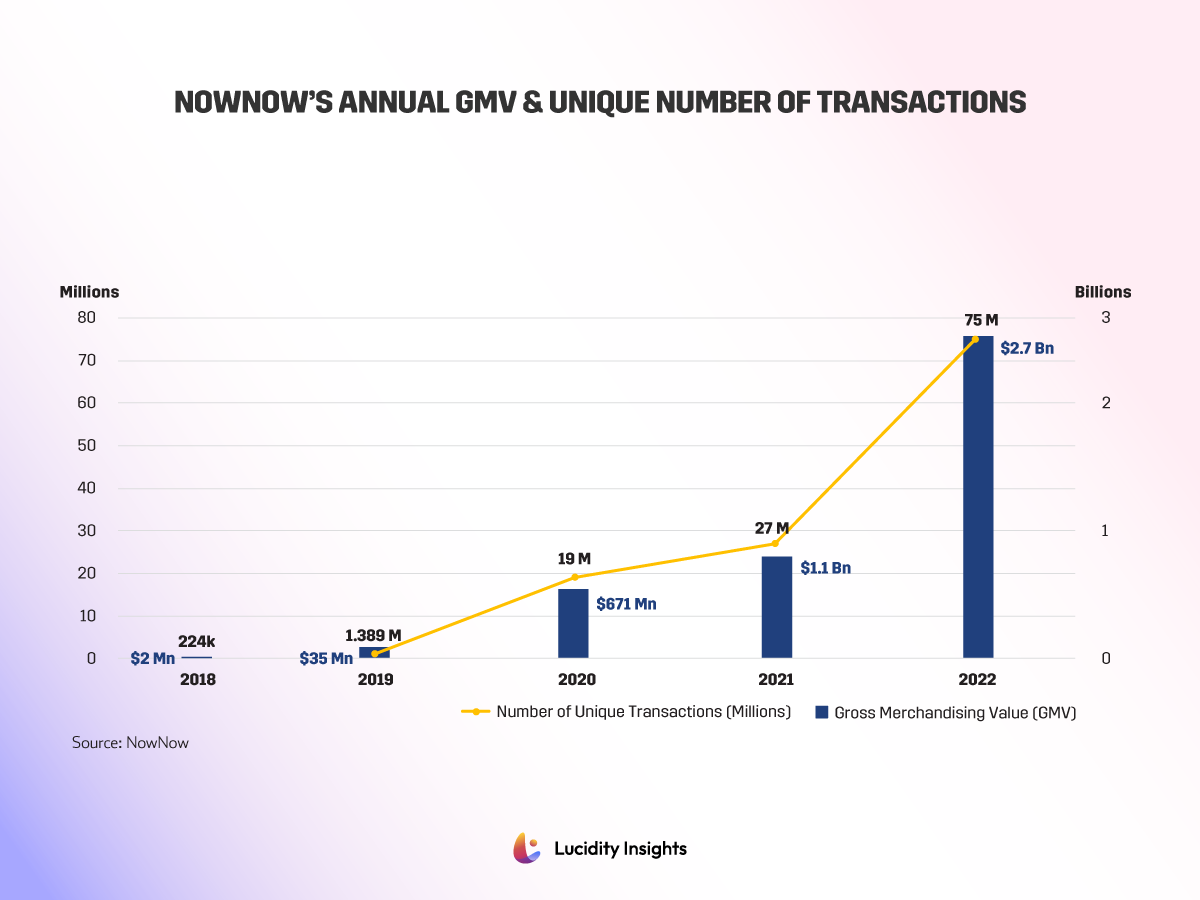

Infographic: NowNow’s Annual GMV & Unique Number of Transactions

Banking for the Unbanked

To the underbanked individual, NowNow increases financial inclusion by enabling access to digital bank accounts and debit cards through their Digital Bank. They primarily aim to bring offline consumers online through their growing network of local agents. NowNow’s Digital Bank is a consumer banking app that empowers individuals to take control of their financial lives by providing a suite of financial services that starts with the digital wallet which allows remittances and peer to peer transfers, as well as tap & pay transactions. The digital banking app also allows customers to pay and manage bills, buy airtime, and apply for personal insurance or personal loans.

In 2022, NowNow facilitated over 75 million unique transactions across their SME and consumer platform, equating to nearly US $3 billion in transaction volume. NowNow says their consumer application still has over 3000 downloads a day, but the company’s key focus for 2023 will be to build out their SME business. In January 2023, NowNow was facilitating 120,000 daily merchant transactions, and was tracking 160% MoM growth.

“After we got licensed by the Central Bank of Nigeria in February 2018, the first product we launched was consumer banking,” Sahir explains. “But we quickly understood that we needed to launch an Agent Banking product to establish a network of banking agents across our markets to guarantee ease, access and seamless transactions.”

“The truth is,” Sahir continues, “if we had the capital and the resources, we would focus on both the consumer and merchant businesses in equal measure, but we have to be realistic. Consumer products are still a very expensive endeavour. Customer loyalty is minimal in the markets we operate in.” Consumer apps, specifically when focused on reaching the unbanked and largely illiterate population in rural areas requires investment in skits, not billboards. The cost of customer acquisition and retention is immense, while switching costs for those customers is incredibly low, requiring a simple app download and a 10 minute set-up time.

Mahesh also notes that once Fintechs have the agent banking network in place, there is a real opportunity to transition their agents into merchants that could more easily become adopters of NowNow’s small business fintech solutions. “This is where we see things going,” says Mahesh.

Thank God We Didn’t Get Funded

Speaking to Matthew Francis, NowNow’s Chief Strategy and Investment Officer, he explains how the first four years of the business was a bootstrapped operation with capital provided by the founders. “NowNow didn’t raise any outside capital until July 2022, when we fundraised a US $13 million seed round,” says Matthew.

“It wasn’t for a lack of trying,” Sahir says with a wry smile. “We did try and fundraise in 2019, but we were trying to fundraise sitting in Nigeria, having video calls with investors on the other side of the world.” Sahir explains that it was also around this time that a few African fintechs established headquarters in California to be closer to investors. “I’ve learned that African startups can’t afford to fundraise sitting behind computer screens in Africa. We have to get up and take flights and shake-hands in person.” That’s exactly why he and Mahesh are spending more time in the air traveling across Europe, the US, Asia and the Middle East, as they begin their tour to raise their Series A.

Sahir piques my interest when he tells me that NowNow not getting funded in 2019 was the biggest blessing for the young company. “How so?” I ask.

“How many startups do you see now that got funded during the pandemic, and couldn’t spend their budgets fast enough in the name of growth? And now, as the capital dries up, there are start-ups all over the world in a world of trouble because they can’t recall how to operate profit-focused businesses.”

Matthew adds, “NowNow runs a tight ship, having scrutinized how to get the best ROI for every dollar the company spent over the last five years. We certainly have the profit-focused mentality, and we know that we can weather some tough storms.”

With macroeconomic headwinds shrinking venture capital pools, “it’s not going to be easy,” says Sahir about fundraising in the current climate. “But we are optimistic. A few months ago we were beginning conversations with investors in the US, but there has been a clear shift and a lot more interest coming from investors in places like London, Singapore and Dubai these days.”

Infographic: Top10 Most Funded Startups in Nigeria in 2022

The Fintech Future with NowNow

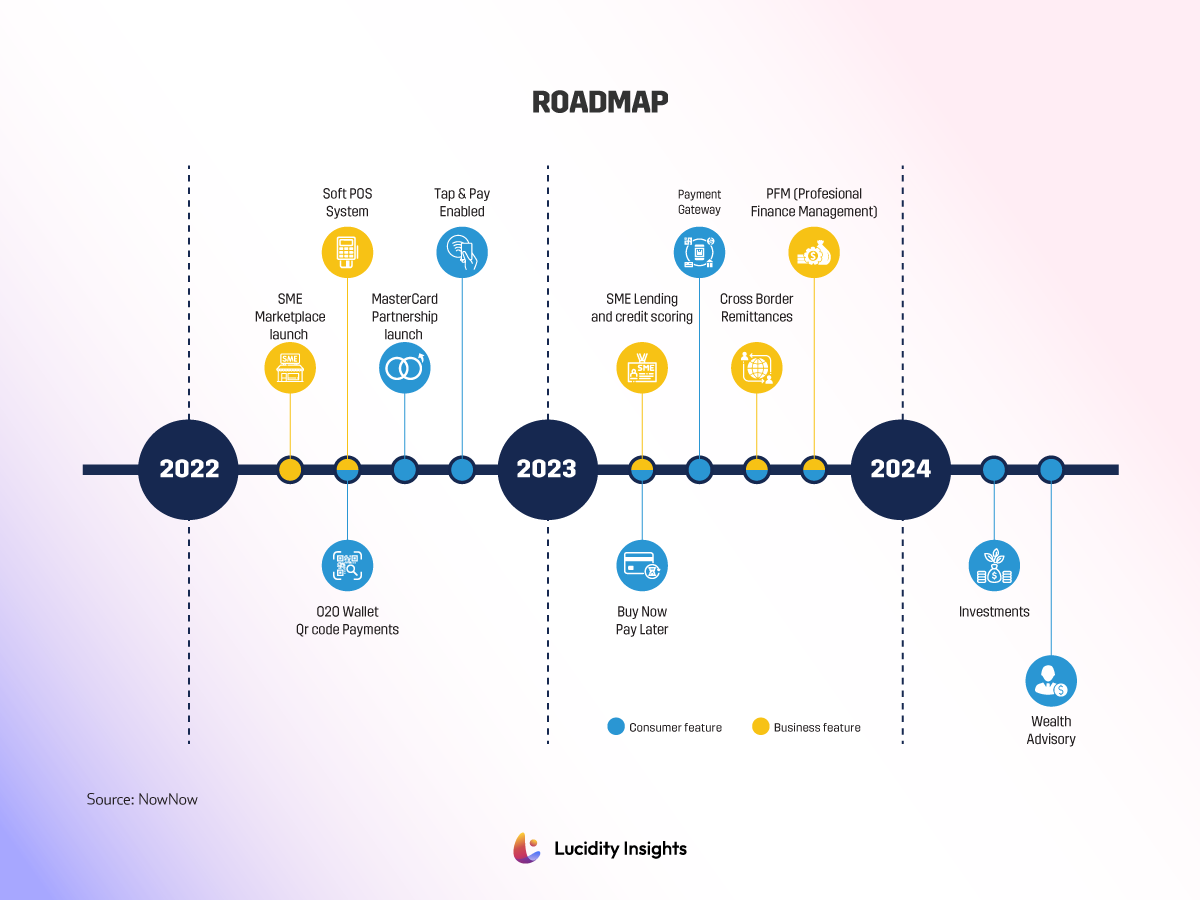

NowNow is hoping that their Series A will help them extend their reach in their active markets, namely Nigeria and Angola. But before NowNow focuses on panAfrican expansion, it is looking to add a few new product streams, including BNPL payments functionality, QuickCash options and Micro Loans into NowNow’s Digital Bank.

“With our unique credit data, we believe we are well-placed to better assess the risk of our users, enabling us to underwrite loans for our largely underbanked customers,” Sahir continues, “It’s a huge opportunity for us, because the most recent data from 2018 estimates that only 11% of Africa’s population has recorded credit data and scores.” It certainly begs the question, who is serving the other 89% of the African population? Even more interesting perhaps, is that NowNow, unlike many other BNPL players, sees the BNPL opportunity to be even greater between Merchant-to-Merchant payments, versus the more readily available Consumer-to-Merchant BNPL offerings.

“Managing working capital within small businesses are challenging. If we can offer MSME owners an opportunity to pay for their inventory in installments, it could be a game-changer,” says Mahesh. At the end of 2022, NowNow’s Digital Bank played host to US $2.7 billion worth of merchandise (GMV) being sold on the platform.

Future financing is ear-marked for integrating Artificial Intelligence and Machine Learning (ML) capabilities into NowNow’s tech stack to help the company sift through reams of data. NowNow wants to become smarter by using algorithms to upsell and cross-sell based off of an ever-improving algorithm. The company hopes its’ ML capabilities will begin to improve and speed up its microloan underwriting assessments, over time as well.

Growing Pains

When I ask Sahir and Mahesh what has been the most challenging aspects of building the business in the past five years, they both agree that finding and building the right team and building a cohesive culture across offices and teams in Lagos, Delhi and Dubai was harder than expected. Mahesh reflects, “we’re happy to be where we are today, after a few years of growing pains - we finally have a strong team that works well together across our geographies.”

NowNow grew significantly in 2022, from a global team of 100 at the beginning of 2022 to a team of well over 400 by the end of Q1 2023. A work exchange program between staff in India and Nigeria are also helping to build cross-cultural understanding and providing a unique work experience for those staff that want to take advantage of it.

“We also learned early on that the only way to scale the business was to build the NowNow platform in-house,” says Sahir. “It really has been a herculean effort building the platform from the ground-up, but we’re happy we made the decision. Today, we own our entire tech IP, and we’ve created a best-in-class technology platform that has been operating at scale for several years.”

NowNow’s Features, the Roadmap

Growing Room to Play

When I ask about the fierce competition that seems to be brewing across Nigeria in the fintech space, Sahir looks unfazed. He agrees that one day there will be a need for some level of consolidation amongst fintechs soon, but assures that there is also still significant room for multiple giants to be raised, before any definitive consolidations take place. He also reminds me that by 2050, Nigeria’s population is expected to balloon to 400 million people. The UN also says that Nigeria is one of eight countries that will account for more than half of the world’s population growth between now and 2050. It’s numbers like these that shows investors that Nigeria alone is the future’s high-consumer-growth market.

“We see more and more investors getting excited about the fintech opportunity in Africa,” says Matt. “Ultimately, we think the African fintech opportunity is too big to ignore, and hopefully with the backing we have from players like Mastercard, it not only helps to validate our business, but also attracts more international awareness.”

In 2023, NowNow was issued Mastercard’s trust centre certification, which indicates that NowNow is a fintech that has been thoroughly vetted by Mastercard, and that NowNow’s technology is safe and trustworthy, protected against cybersecurity attacks. “It was a rigorous process, and we’re proud to get the rubber stamp from Mastercard, especially as the only African Fintech going through the process,” says Leigh Flounders, NowNow’s Chief Commercial Officer.

“We have much larger plans for the future,” says Sahir. One day, he imagines someone walking up to any merchant anywhere in Africa, and asking to buy a bottle of water and pay through the NowNow Digital Banking app. “But there are only so many days in a year,” Sahir says with a smile.

“Often, the only way for people to survive in Africa is to become SME entrepreneurs themselves. But these SME owners have no access to financial products to run their business. It’s clear that there is a massive opportunity to create solid fintech products for these small business owners in Africa.”

— Sahir Berry, Co-Founder & CEO at NowNow

What Others are Saying About NowNow

“NowNow has a locally relevant business model that is agile and focused on delivering value to SMEs, which in turn are vital for economic growth and strong communities. Because NowNow is focused on inclusion, it’s success is also tied to “the greater good”. It has been wonderful to see NowNow thrive during the Mastercard Start Path program which offered mentorship, operational support, commercial engagement and network reach.”

— Mark Elliott, Division President, Sub-Saharan Africa at Mastercard

“In my opinion, NowNow have clarity about their approach to render financial services as a fintech aggregator, by making financial transactions faster, easier, and acceptable to their clients. We, at Providus Bank, have watched NowNow start with Agency banking, deploying devices through their agents’ networks, and creating a mobile money wallet with combo debit cards that enable financial activities. They are currently pushing the frontiers with payment services through e-commerce card acceptance and its Green lotto gaming business. NowNow works perfectly with the incumbents by creating an ecosystem that promotes financial inclusion for its target clients.”

— Walter Akpani, Managing Director at Providus Bank

“I sit on NowNow’s Board of Directors because NowNow is not trying to be all things to all men. On the retail-side, they are focusing on students, for example, and I can appreciate that customized approach.”

— Yinka David-West, Associate Dean of Lagos Business School & Board Member

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)