5 Most Funded Startups in Sub-Saharan Africa in February 2025

27 March 2025•

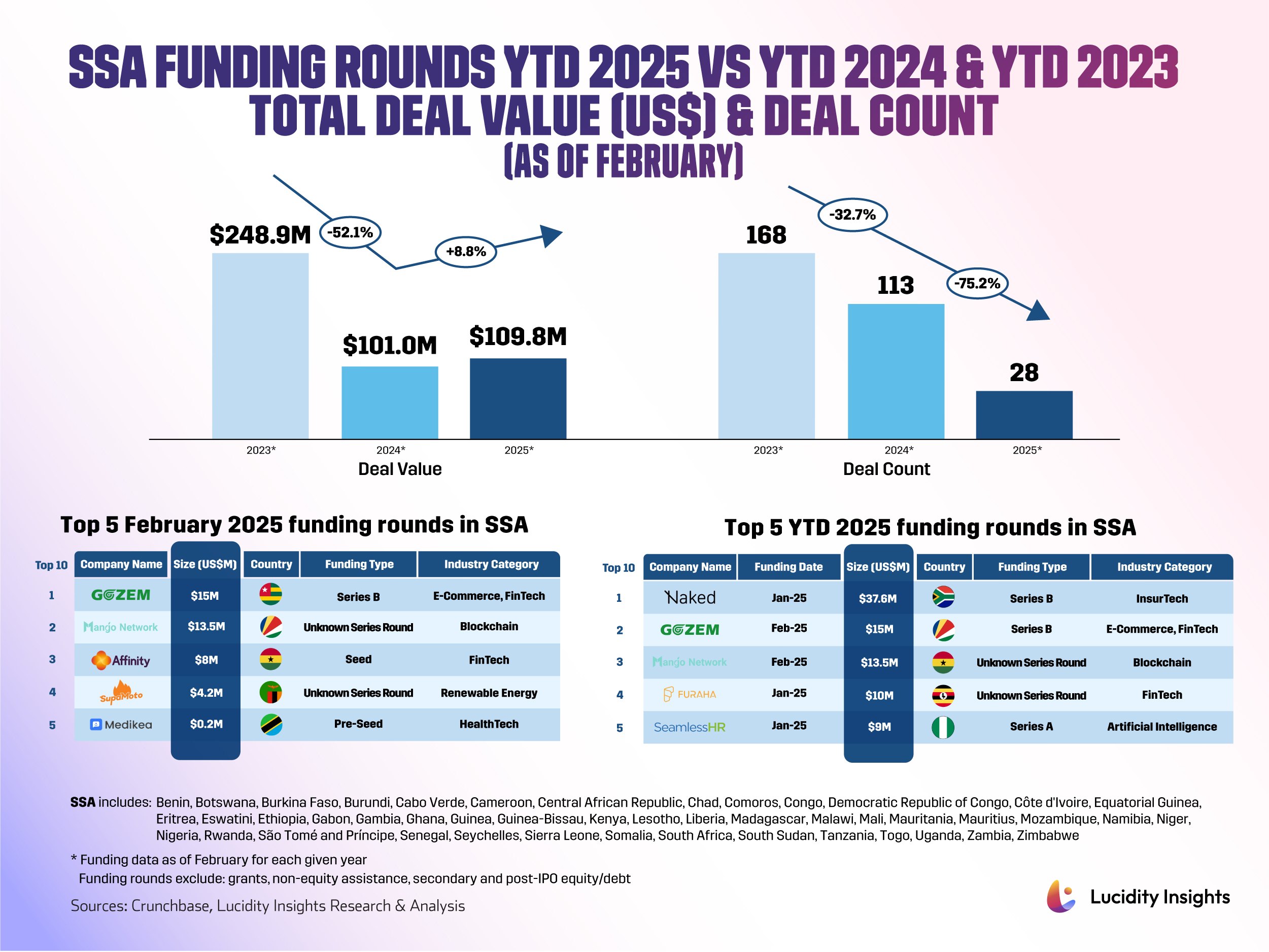

After a sharp 52.1% year-on-year decline in total deal value from US $248.9 million in 2023 to US $101 million in 2024 (as of February), early 2025 data shows a modest rebound. As of February 2025, total deal value has risen by 8.8% year-on-year to reach US $109.8 million.

However, deal volume tells a different story. The number of deals dropped from 168 in early 2023 to 113 in 2024—a 32.7% decline—and then plummeted a further 75.2% to just 28 deals by February 2025. This contraction in activity is stark and suggests a continued investor pullback in terms of volume, despite the marginal recovery in total capital deployed.

As a result, average deal size has risen significantly: from approximately US $1.48 million in early 2023 to just US $0.89 million in 2024, before surging to around US $3.92 million in 2025. This suggests a shift toward fewer, but larger, funding rounds.

The funding slowdown observed from 2023 to 2024 likely reflects broader macroeconomic pressures, including elevated interest rates and tighter global liquidity. These conditions have prompted more selective investment behavior, with capital flowing toward fewer ventures that demonstrate stronger fundamentals or clearer paths to scale.

Nonetheless, favorable GDP growth projections for SSA in 2024 and 2025 may enhance investor confidence and stimulate venture capital activity. The SSA’s economy is expected to grow by 4.2% in 2025, an improvement over previous years that follows the gradual easing of weather shocks and supply constraints says the International Monetary Fund’s forecast.

Current funding deals indicate a focus on sustainable and innovative solutions with emerging sectors such as renewable energy and climate-tech joining e-commerce, fintech, and blockchain among the most funded industries in SSA. Driven by the potential for high returns in these sectors, this highlights the growing importance of sustainable solutions within the region parallel to global trends. SSA countries are ramping up renewable energy generation, part of a trend forecasted by the International Energy Agency to add almost 90 gigawatts of new renewable capacity to the region by 2030. South Africa, leading the continent's renewable energy expansion and accounting for 40% of the projected capacity, is predominantly focused on solar power generation. This sector's growth aligns with the increased funding into renewable energy ventures seen this month, suggesting a strategic alignment between economic forecasts and investment trends in SSA.

Let’s take a look at the top 5 funding rounds of February 2025 in SSA.

#1 - Gozem (Togo) | E-commerce, FinTech | US $15 Million Series B

Founded by Gregory Costamagna and Raphael Dana in 2018 as a moto-taxi service, Gozem has grown into a multi-service platform, operating in Benin, Gabon, and Cameroon.

Over time, it has evolved into a super app, integrating ride-hailing, food and supermarket delivery, digital ticketing, vehicle financing, and digital banking services including a digital wallet & cashless payment.

In February 2025, Gozem raised US $15 million in a Series B round led by Al Mada Ventures and SAS Shipping Agencies Services, bringing its total funds to US $41.7 million. With this fresh capital injection, Gozem aims to accelerate its footprint across West and Central Africa. as well as enhance its transport services by financing more new vehicles for taxi drivers and fast-tracking the rollout of its digital banking platform, Gozem Money.

#2 - Mango Network (Seychelles) | Blockchain | US $13.5 Million Venture - Series Unknown

Founded in 2023, Mango Network is a Layer 1 public blockchain featuring a Multi-VM Omnichain architecture. It focuses on resolving various challenges, including the fragmented user experience and liquidity issues commonly found in Web3 applications and DeFi protocols. By leveraging the strengths of OPStack technology and MoveVM, Mango Network creates an effective blockchain system that facilitates cross-chain interactions and multi-virtual machine interoperability. This provides developers and users with a secure, flexible, and high-performing Web3 infrastructure.

In February 2025, Mango network secured US $13.5 million in a Venture funding round led by KuCoin Ventures. The funds will be used to launch of the Mango Network mainnet, introduce its MGO token, support development of dApps (“decentralized applications’) and other projects built on the platform, as well as expand the community and spread awareness of Mango's unique value proposition.

#3 - Affinity Africa (Ghana) | FinTech | US $8 Million Seed

Founded in 2022 by Tarek Mouganie, Affinity Africa provides affordable and accessible financial services to underserved and unbanked individuals, as well as micro-enterprises which are often difficult to distinguish in the African context. It offers customers free savings and current accounts with no transaction limits, and it begins credit-scoring users immediately based on their transaction history. Among its 50,000+ customers, 65% of Affinity users had never previously accessed formal banking products, and over 60% are women engaged in the informal sector, highlighting the platform’s focus on underserved demographics.

In February 2025, Affinity raised US $8 million in its Seed round led by European venture capital firms Grazia Equity from Germany and BACKED VC from London. The funds will be used to further expand Affinity's financial products throughout Ghana, where mobile money remains the predominant financial tool.

#4 - SupaMoto (Zambia) | Renewable Energy | US $4.2 Million Venture - Series Unknown

Founded by Mattias Ohlson in 2013, Supamoto (Emerging Cooking Solutions) has been at the forefront of promoting biomass pellet fuel as an alternative to charcoal, integrating biomass pellets with fuel-efficient stoves equipped with internet-of-things (IoT) capabilities. Its stoves significantly reduce greenhouse gas emissions while utilizing locally sourced waste products.

In February 2025, Supamoto secured US $4.2 million in Seed funding from the Private Infrastructure Development Group (PIDG) and EDFI Management Company. The investment will accelerate Supamoto’s growth, particularly with its proprietary IoT platform, high-performing smart stoves, and an upcoming Article 6.2 carbon credit initiative in collaboration with the Zambian government.

#5 - Medikea Health (Tanzania) | HealthTech | US $0.2 Million Pre-Seed

Founded by Elvis Silayo and Desire Ruhinda in 2020, Medikea Health integrates telemedicine with physical clinics to provide affordable, personalized primary and specialty care across Africa. Medikea confronts dilemmas stemming from malnutrition, infectious ailments, heat-related illnesses, among others across Africa by offering a comprehensive care framework that harmonizes physical clinic facilities with telemedicine assistance offering virtual consultations, medicine delivery, at-home lab testing, and hospital referrals.

In February 2025, Medikea raised US $200 thousand in its Pre-Seed funding round led by Madica, bringing its total funds to US $250 thousand. The funds will be used to expand Medikea's telemedicine services and enhance their physical clinic network, aiming to provide more accessible and affordable healthcare solutions across Tanzania.

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)