The Barriers to Fintech and Its Adoption in the Middle East

08 March 2025•

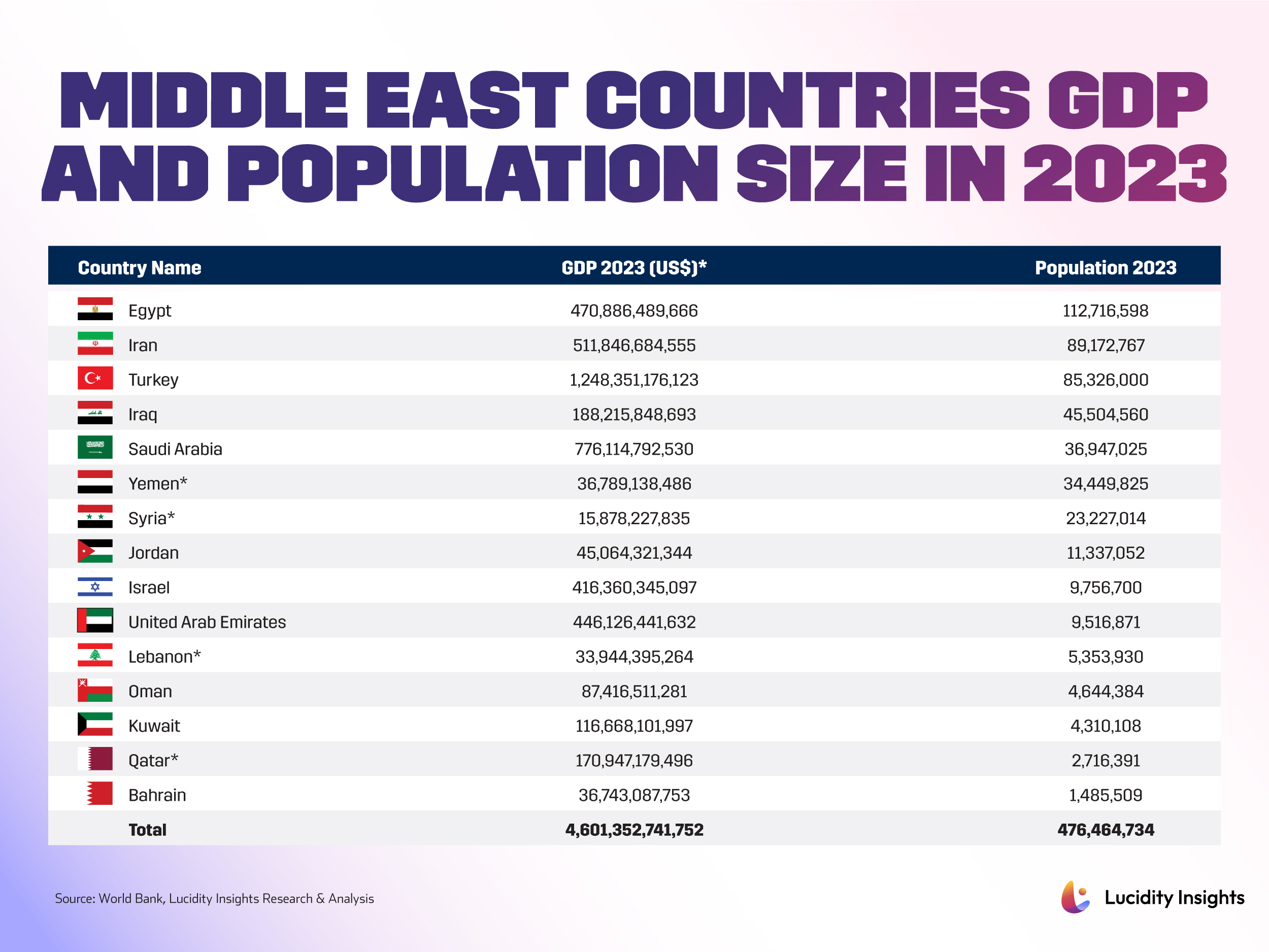

With a population nearing 500 million and projected to exceed 700 million by 2050, the Middle East holds immense potential as a Fintech hub. However, despite the region's key markets—such as Saudi Arabia, the UAE, Egypt, Turkey, and Iran—ranking among the world’s top 50 economies by GDP, significant barriers remain.

Regulatory fragmentation hampers cross-border collaboration, while a shortage of skilled tech talent stifles innovation. Limited access to early-stage capital further constrains startup growth. These challenges persist even as high mobile and internet penetration, strong remittance flows, and government-led initiatives lay the groundwork for rapid Fintech adoption. Addressing these obstacles is crucial to unlocking the full potential of the Middle East’s Fintech landscape.

Previously: The Drivers to Fintech and Its Adoption in the Middle East

1. Regulatory Fragmentation

One of the most significant barriers facing Fintech in the Middle East is the fragmented regulatory environment, which complicates cross-border expansion for companies across the region. Each country maintains distinct regulatory frameworks, making it difficult for Fintech companies to offer uniform services across multiple markets. This lack of harmonization leads to costly and time-consuming processes, with many Fintech startups reporting that navigating cross-border regulatory approvals can take over a year.

To illustrate the impact, consider a Fintech firm aiming to access the 9.5 million people in the UAE or the nearly 37 million people in Saudi Arabia. Despite both being members of the GCC, a Fintech licensed in Saudi Arabia would still need to undergo a separate licensing process in the UAE to reach that consumer base. For smaller markets like Qatar and Bahrain, this repeated licensing requirement further strains smaller Fintech firms, which often lack the financial resources to register in multiple jurisdictions. For instance, in markets like Kuwait (4.3 million people) or Oman (4.6 million people), the process of regulatory compliance may outweigh the potential market benefits for newer entrants.

A streamlined approach, like Europe’s “passporting” model, could significantly boost Fintech’s growth across the region by enabling companies to operate freely across multiple GCC countries. Although the Digital Cooperation Organization, founded by countries such as Saudi Arabia, Bahrain, and Jordan, aims to improve regional digital integration, more concrete regulatory alignment is necessary to facilitate Fintech expansion and competition.

The fragmented landscape not only poses a challenge to Fintech startups but also limits the total addressable market (TAM) for digital financial services in each country, slowing down the region’s overall Fintech adoption and innovation potential.

2. Talent Shortage

Another challenge is the significant talent shortage, particularly in advanced technical roles. While the sector is expanding rapidly, the region lacks a sufficient supply of specialized professionals in critical areas like cloud computing, APIs, blockchain, and cybersecurity. This gap is particularly acute in GCC countries like Saudi Arabia, Qatar, and Kuwait, where 75% of employees in Kuwait and 60% in Qatar report a lack of specialized skills. The region is making some strides, with Saudi Arabia and the UAE investing in large-scale educational programs to address the shortage. Saudi Arabia’s US $1.2 billion initiative, aimed at improving digital skills for 100,000 youth by 2030, and the UAE’s National Program for Coders, offering Golden Visas to skilled professionals, reflect efforts to address this talent gap.

However, competition for tech talent is fierce, driving up costs for recruiting skilled engineers and programmers. Firms in the Middle East are now paying more to attract talent than in established tech hubs like London or Singapore, making it difficult for startups to compete. Only 6% of the GCC workforce is employed in technology-related jobs, far below what is needed to support the sector’s growth, leaving firms struggling to find qualified candidates locally.

Government-mandated localization policies, particularly in Saudi Arabia, add another layer of pressure, as firms are tasked with training domestic talent to assume leadership roles. This places additional strain on businesses, which must balance local hiring requirements with the urgent need for expertise.

Lastly, the low representation of women in leadership roles within Fintech remains a challenge, as only 9% of MENA startups have a woman on their executive team, far below global benchmarks. This gender imbalance poses a challenge, as global studies link gender-diverse leadership teams with higher profitability and better innovation outcomes.

3. Limited Access to Capital

Fintech startups in the Middle East also have significant challenges due to limited access to capital hindering their growth and scalability. Despite the economic prosperity in the GCC, VC investment remains small. Saudi Arabia holds only 0.08% of global VC funding, far below its 0.9% share of global GDP. This disparity highlights a lack of sufficient private investment compared to other global financial hubs.

According to a report by Strategy&, sovereign wealth funds (SWFs) like the UAE’s Mubadala and Saudi Arabia’s Public Investment Fund (PIF) are the primary drivers of Fintech funding in the region. However, this reliance on public funding leaves gaps, particularly in early-stage investment, where private venture capital is essential for fostering innovation and growth. While efforts such as the Middle East Venture Capital Association, launched in 2018, aim to address these challenges, progress has been slow, and many Fintech startups struggle to secure the early capital needed to scale. While there have been increases in funding, the depth of the investment pool remains shallow, particularly in comparison to mature Fintech ecosystems in Europe or North America.

One of the other challenges limiting investor appetite is the lack of exit options. Middle Eastern IPO and M&A markets remain underdeveloped in comparison to other major markets, which discourages investment, especially in early-stage ventures. Investors often have limited pathways to liquidate their holdings, hindering the recycling of capital back into the ecosystem.

In conclusion, the Middle East Fintech sector requires greater private-sector participation, deeper early-stage investment pools, and more developed capital markets to support its growing innovation landscape. Without addressing these barriers, Fintechs in the region will struggle to scale and achieve their potential in the global financial ecosystem.

4. Infrastructure Gaps and Financial Exclusion

Despite impressive mobile and internet penetration rates in the GCC countries, parts of the Middle East face significant infrastructure challenges that hinder Fintech adoption. Countries like Lebanon, Syria, and Yemen continue to struggle with unreliable internet connections, frequent power outages, and an overall underdeveloped digital ecosystem. These limitations create barriers to financial inclusion, especially in rural areas where access to digital services is crucial but unavailable.

Moreover, a crucial infrastructure gap in the region is the lack of robust credit bureau systems, which are vital for assessing creditworthiness. Credit coverage in many Middle Eastern countries is inadequate, with private credit bureaus covering just over 20% of adults across the broader region. While Israel and several GCC countries have relatively high credit bureau coverage (with some surpassing 50- 60%), other nations like Lebanon and Jordan lag significantly behind. This gap makes it challenging for financial institutions to evaluate potential borrowers, particularly small and medium-sized enterprises (SMEs), and restricts access to credit for individuals and businesses alike.

For individuals, this lack of infrastructure exacerbates financial exclusion. Countries like Egypt, where nearly two-thirds of the population remains unbanked, illustrate the difficulty of reaching rural or underserved communities. Similarly, the high number of unbanked individuals in Lebanon, Palestine, and Jordan highlights the need for better financial infrastructure and systems, such as mobile banking and Fintech solutions, that can address these challenges.

SMEs face even greater barriers. Although they play a vital role in the economies of countries like Saudi Arabia and Egypt, SMEs often lack access to formal credit systems, relying instead on informal or costly financing options. The absence of comprehensive credit bureaus compounds these difficulties, limiting their ability to secure loans and expand operations. In Saudi Arabia, for instance, SMEs receive only about 2% of total bank lending, one of the lowest rates globally, highlighting the urgent need for improved infrastructure to assess and serve smaller businesses.

While Fintech offers promising solutions to these challenges, infrastructure gaps in broadband access, credit data, and digital systems need to be addressed to unlock the full potential of financial inclusion in the Middle East. Without these critical upgrades, the region risks leaving large portions of the population and business community underserved, unable to participate fully in the financial system.

5. Data Sovereignty and Localization Laws

Data sovereignty laws requiring that data be stored locally add another layer of complexity for Fintech firms seeking to scale. Countries like Saudi Arabia and the UAE have stringent regulations on data localization, which can be costly and burdensome for international Fintech companies. These laws can also restrict cross-border data flow, further complicating the scaling of Fintech services across multiple jurisdictions.

Conclusion

The Middle East is a region of immense potential for Fintech growth, driven by its high mobile penetration, government support, and economic diversification efforts. However, challenges such as regulatory fragmentation, talent shortages, limited access to capital, and infrastructure gaps continue to hinder widespread Fintech adoption. Addressing these barriers requires coordinated efforts from governments, the private sector, and international investors. By fostering a more unified regulatory environment and investing in talent and infrastructure, the Middle East can unlock the full potential of its Fintech sector and cement its position as a global Fintech hub.

Explore the transformative trends shaping the Middle East's Fintech sector. Read or download your copy of "The State of Fintech in the Middle East" now.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)