Nclude: Driving Egypt's Digital Transformation Through Fintech Innovation and Financial Inclusion

22 April 2024•

Nclude is an investment firm headquartered in Egypt that focuses on fintech innovation and financial inclusion. Building a financial technology stack to support and accelerate Egypt’s transformation into a digital and financially inclusive economy and position Egypt as the Fintech Innovation Hub across MEA.

- Year Established: 2022

- HQ: Cairo, Egypt

- AUM: N/A

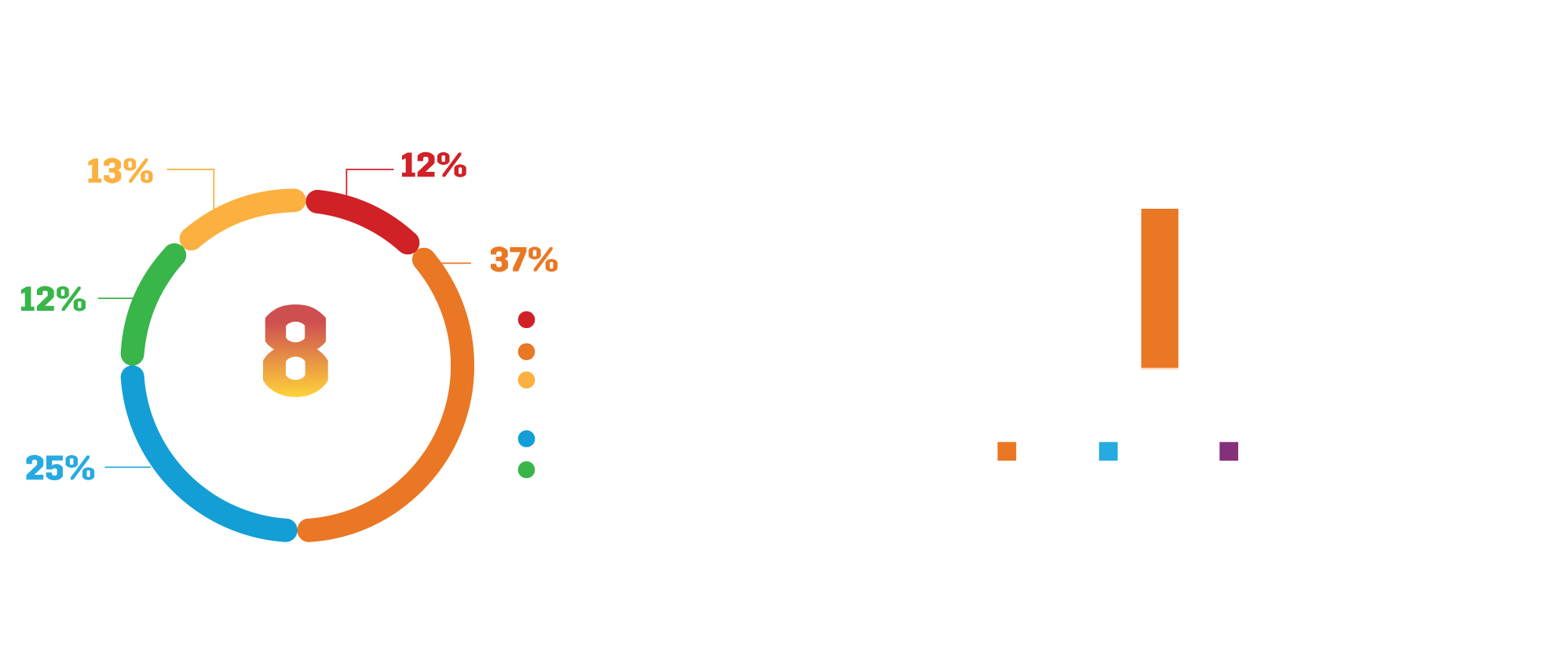

- # of Portfolio Companies: 8

- % of companies in Egypt: 100%

- Total # of deals: 8

- Avg # of deals per year: ~5

- Number of exits: -

- Funding Stage: Seed and Early Stage

- Ticket Size: Between $500K and $5M

- Team Size: 7

- Website: https://nclude.com/

Nclude is a specialty fund, focused on financial inclusion and founded most recently in 2022. It is an investment firm, headquartered in Cairo, that is focused on building a financial technology stack to support and accelerate Egypt’s transformation into a digital and financially inclusive economy and position Egypt as the predominant Fintech Innovation Hub across the Middle East & Africa.

Nclude is a specialty fund, focused on financial inclusion and founded most recently in 2022. It is an investment firm, headquartered in Cairo, that is focused on building a financial technology stack to support and accelerate Egypt’s transformation into a digital and financially inclusive economy and position Egypt as the predominant Fintech Innovation Hub across the Middle East & Africa.

This fund was originally managed by Global Ventures, and was spun out to become its own standalone entity, due to the size and scale of the mission requiring its own team based in Egypt. The fund has been backed by Banque Misr, National Bank of Egypt, and Banque du Caire, with Banque Misr leading the US$ 105 million raised for its first fund, while the other two banks were strategic follow-on investors. Mr. Basil Moftah, Founding GP at Nclude told us that Nclude acts as a platform for various fintechs to come together, and build its own fintech ecosystem. He went on to say, “the Fund considers investments in startups that can work with each other, to support each other and collaborate to build a strong multilayered tech stack for the Egyptian fintech ecosystem at large.”

Nclude Team (Left to Right): Omar ElKholy, Abdo Edris, Basil Month, Salma Farouk, Yomon AlMallah, Rana Abdel Latif

Key investments include startups across fintech such as Paymob, Khazna, Lucky and FlapKap to investments in proptech, healthtech, foodtech and agritech. One example of operational synergies is OneOrder’s use of Paymob’s tools to offer supply chain financing to its customers. All investments were made in 2022, with 2023 being a ‘slow year’ due to Egypt’s recent economic challenges which include a burdening debt and rising interest rates making cost of financing a lot more expensive. Basil added, “we all know that technology is the ultimate leveler of society, however the current scenario is extremely challenging post the Ukraine-Russia war as inflation has touched 35%, doubling food prices and everything has rocketed.”

Given the challenges, Basil is confident that Egypt still poses numerous advantages with its young digitally savvy population which provide a huge opportunity for startups focused on the consumers and SME sector. Commenting on the current climate, Basil says, “well there’s one consistent trait among Egyptian entrepreneurs, and that’s their resilience.” Nclude offers startups and entrepreneurs tools such as access to capital, advisors, talent and other support including administrative and technology to benefit from.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)