Building the Future: Drivers to Fintech and Its Adoption in the Middle East

07 March 2025•

The Middle East is home to nearly 500 million people, representing about 5.9% of the global population, and is projected to grow to over 700 million by 2050. Despite economic disparities, several countries, including Turkey, Saudi Arabia, Iran, Egypt, and the UAE rank among the top 50 globally by GDP.

This economic strength, coupled with some strong drivers, is creating a fertile ground for Fintech development. As regional governments pursue economic diversification, financial technology is emerging as a key driver for modernization and growth, enabling the Middle East to position itself as a future Fintech hub. Let’s explore what the drivers and barriers are to Fintech adoption and acceleration in the region.

The Drivers of Fintech in the Middle East

1. High Mobile and Internet Penetration

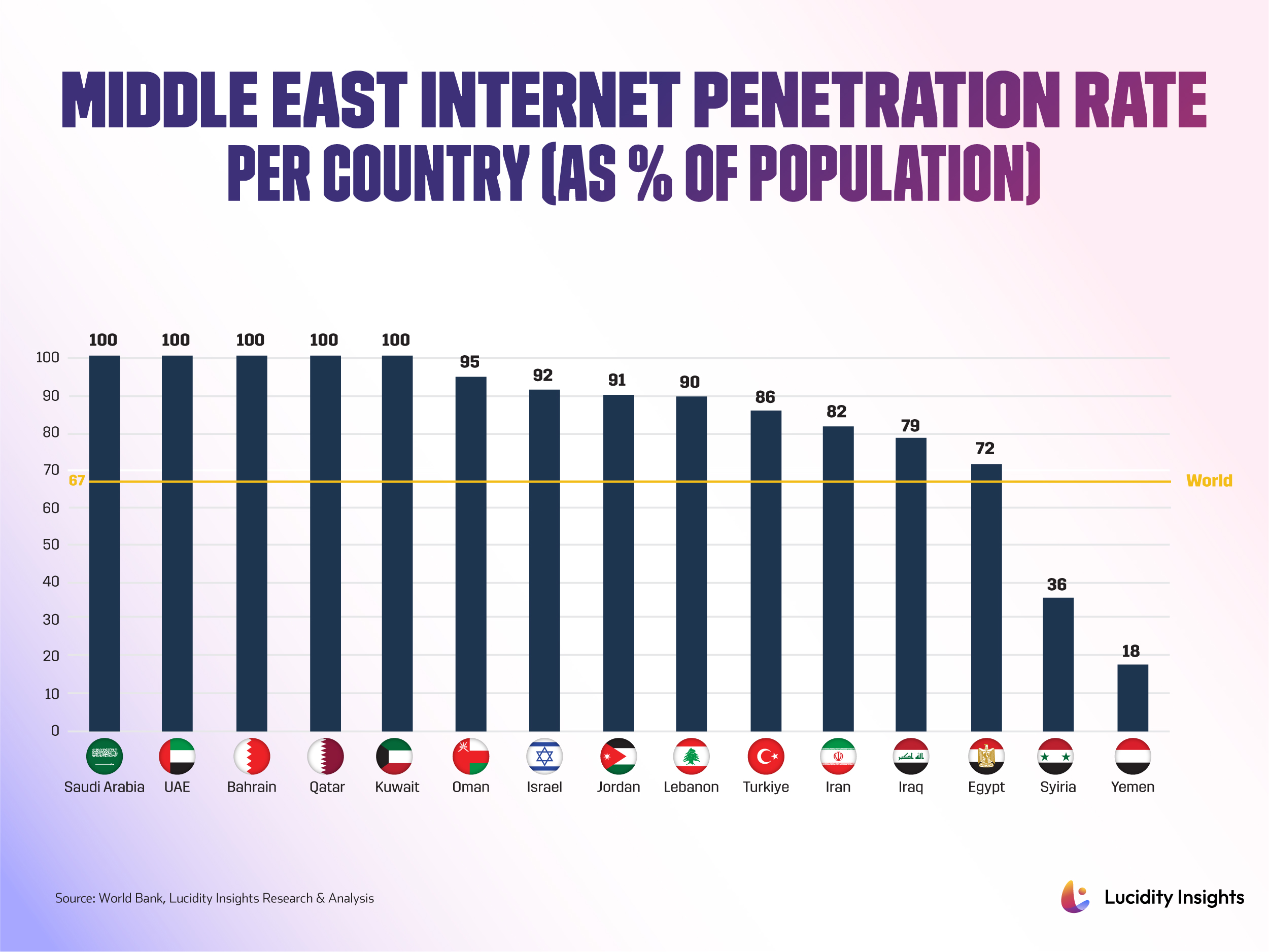

87% of countries in the Middle East have an internet penetration rate superior to the global average with countries like the UAE, Saudi Arabia, Bahrain, Qatar, and Kuwait boasting a 100% penetration rate. Mobile cellular subscriptions as a percentage of the population follows a similar trend with an average above 100% ranging from 58% for Yemen to more than twice the population in the United Arab Emirates. High mobile and internet penetration rates provide a strong foundation for the growth of Fintech, particularly mobile-based financial services such as mobile money and mobile banking.

2. Strong Remittance Markets

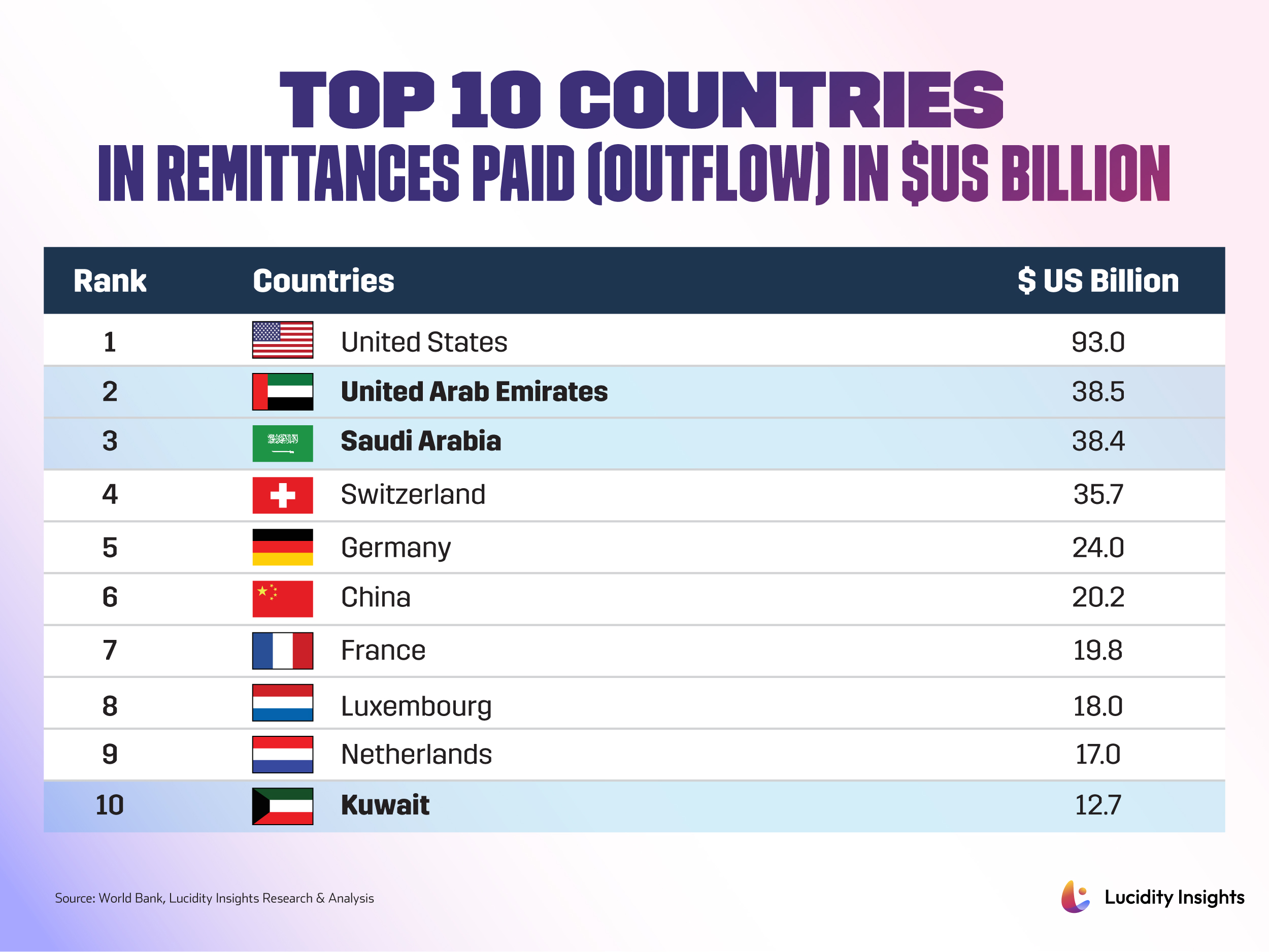

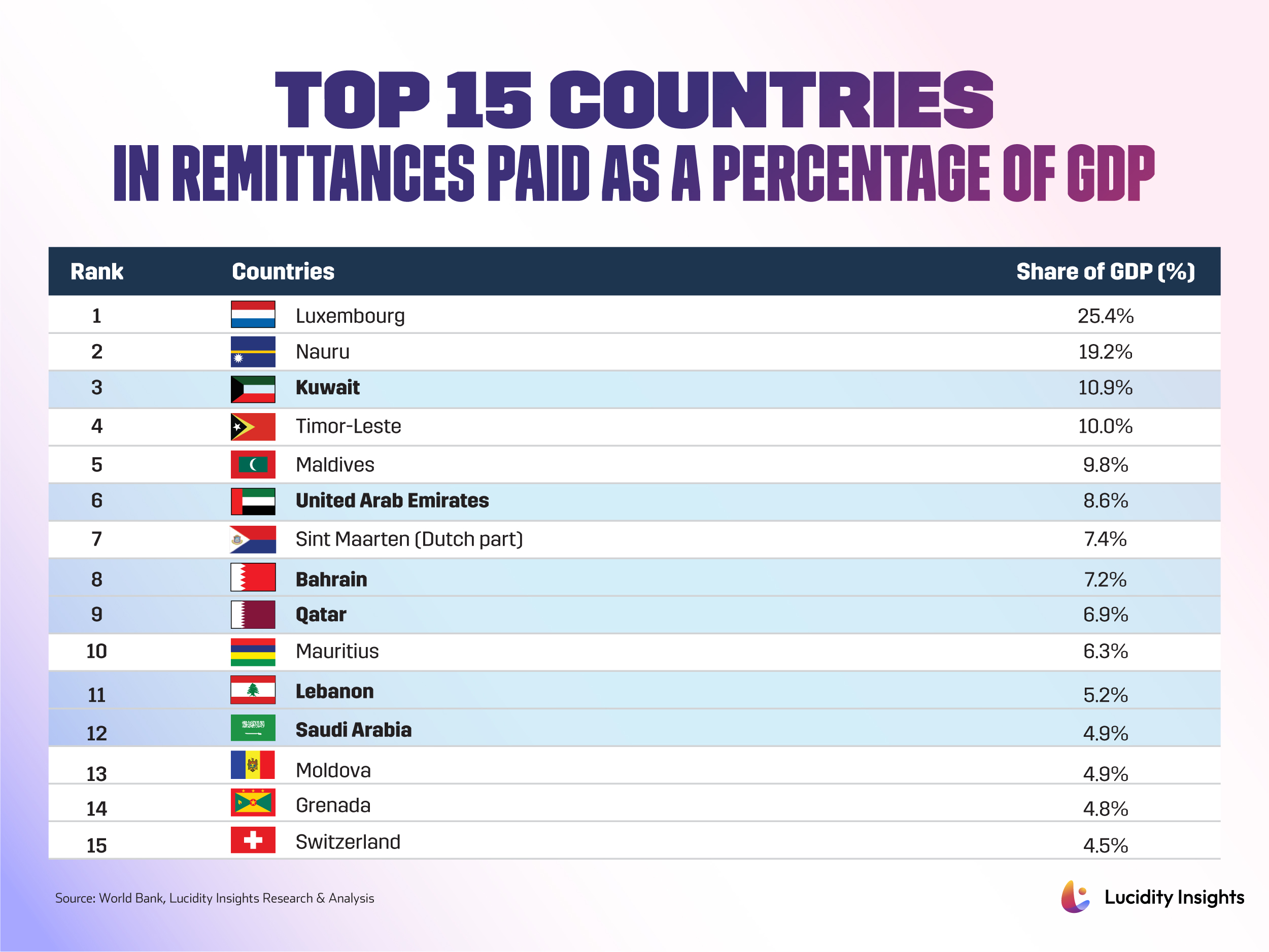

Thanks to significant migration over the past decades, the Middle East is home to some of the world’s largest remittance corridors. Countries like Saudi Arabia, the UAE, and Kuwait are major sources of remittance outflows to South Asia, Africa, and Southeast Asia, consistently ranking in the top 10 globally. Saudi Arabia and the UAE are among the top three, just behind the U.S. Outflows also represent a significant share of GDP, with six Middle Eastern countries in the global top 15, led by Kuwait at 10.87%. Meanwhile, less affluent nations benefit from inflows—Egypt ranks 11th globally by volume, while Palestine and Lebanon rank 14th and 18th by remittances as a percentage of GDP. Fintech innovations such as blockchainbased transfers and mobile platforms are gaining traction by reducing transfer times and costs, further transforming the remittance landscape in the region.

3. Government Initiatives and Supportive Regulation

Governments across the Middle East, particularly within the Gulf Cooperation Council (GCC), have been instrumental in fostering a robust Fintech ecosystem through proactive policies, regulatory sandboxes, and strategic initiatives. Regulatory sandboxes in hubs like Saudi Arabia, the UAE, Qatar, and Bahrain enable Fintech start-ups to test and refine innovations under controlled conditions. Institutions like Fintech Saudi, the Dubai International Financial Centre (DIFC), Abu Dhabi Global Market (ADGM), and Bahrain Fintech Bay are key facilitators, providing frameworks that encourage experimentation and innovation.

Saudi Arabia’s National Fintech Strategy 2030 exemplifies a long-term commitment to becoming a global Fintech leader, targeting 500 active Fintechs by 2030. Similarly, Dubai’s DIFC Innovation Hub and ADGM in Abu Dhabi stand at the forefront of Fintech innovation by supporting open banking, which is designed to integrate Fintech solutions with existing banking systems, spurring competition and creative solutions.

Cross-border collaboration is also slowly being addressed with the example of the Digital Cooperation Organization (DCO). The DCO was formed in 2020 by countries like Saudi Arabia, Bahrain, Jordan, and Qatar, and aims to enhance digital prosperity and accelerates digital economy growth across the region. In 2022, the DCO launched the Startup Passport initiative, simplifying regional market expansion for entrepreneurs and making cross-border operations more seamless and cost-effective. This initiative serves as a powerful catalyst for scaling Fintech ventures and encouraging cross-border financial innovation across the Middle East.

Together, these initiatives not only facilitate a more conducive environment for Fintech growth but also improve access to international markets and stimulate digital innovation across the region. The combination of regulatory support, cross-border collaboration, and progressive Fintech strategies will continue to drive the rapid adoption of financial technologies in the Middle East.

4. Islamic Finance and Takaful (Islamic Insurance)

With more than 90% of the Middle East’s population being Muslim, Islamic finance holds significant cultural and market importance, providing fertile ground for Fintechs offering Shariah-compliant products such as Takaful (Islamic insurance), loans, and investments. Although it remains a small segment of global finance, Islamic finance is one of the fastest-growing sectors. By 2022, assets in the global Islamic finance industry had surged to US $4.5 trillion, with Islamic banking representing 72% of this. Over the past decade, the sector expanded by 163% and is projected to hit US $6.7 trillion by 2027, driven by rising demand for ethical, Shariah-compliant financial services.

This accelerated growth, coupled with the rising sophistication of Fintech solutions targeting the Muslim demographic, positions Islamic finance as a crucial driver for innovation and growth within the region’s financial sector. Fintech platforms, particularly those offering Takaful and digital Islamic banking solutions, are uniquely positioned to capture this rapidly expanding market by leveraging the regulatory frameworks and cultural demands shaping the Middle East.

5. Economic Diversification and Vision Plans

Economic diversification plans across the region are driving Fintech adoption. These initiatives aim to reduce dependence on oil revenues and build a knowledge-based economy, with Fintech often playing a key role in this transformation. Countries are investing heavily in digital infrastructure, talent development, and innovation hubs, making Fintech a cornerstone of their future economies.

For examples, in Saudi Arabia, Vision 2030 positions Fintech as a pivotal sector to help modernize the economy and drive job creation. Through initiatives like Fintech Saudi, the country provides support for startups, nurtures partnerships, and fosters a culture of financial innovation, aligning with the broader goals of Vision 2030 to strengthen Saudi Arabia’s position as a regional tech and finance leader.

Dubai’s D33 Economic Agenda underscores the emirate’s commitment to becoming a top global economic hub by 2033, with Fintech as a critical component. Initiatives such as the Dubai International Financial Centre (DIFC) Innovation Hub and the Dubai Cashless Strategy provide infrastructure and support for Fintech growth, reinforcing Dubai’s role as a nexus for digital finance in the region.

Similarly, Bahrain’s Economic Vision 2030 has seen the development of Bahrain Fintech Bay, a hub dedicated to nurturing the Fintech ecosystem by offering incubation, co-working spaces, and networking opportunities with investors and financial institutions. This initiative aims to position Bahrain as a Fintech innovation center in the Gulf.

In Qatar’s National Vision 2030, Fintech is a cornerstone in creating a diversified, knowledge-driven economy. The Qatar Financial Centre (QFC) and Qatar Fintech Hub by Qatar Development Bank actively supports Fintech ventures by providing a favourable regulatory environment and encouraging innovation and investment in the sector.

Together, these national agendas emphasize the region’s dedication to embedding Fintech as a core driver of economic diversification, signaling its strategic importance in shaping the Middle East’s future economy.

Next Read: The Barriers to Fintech and Its Adoption in the Middle East

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)