Fintech in Retrospect and the Next Frontiers in Financial Services

16 August 2024•

Fintech touches every country, sector, business and individual.

While its roots are debated, fintech’s boom took place in the aftermath of the 2008 Financial Crisis. Since, the sector has consistently demonstrated its high-growth prospects and wide-ranging social and economic impact – convincing us, investors, in its seemingly endless potential.

Fintech Attracts Financing

In just two decades, investors have poured over $800 billion in backing the companies driving the digital financial revolution. From insurance and trading to payments and credit monitoring, the unbundling of financial services has permanently changed the ways in which people are accessing financial products, shifting distribution and consumption from traditional bank branches to quick clicks on our smartphones. At its peak, investments into fintech companies accounted for one-fifth of venture dollars and unicorns created in the United States, according to Silicon Valley Bank.

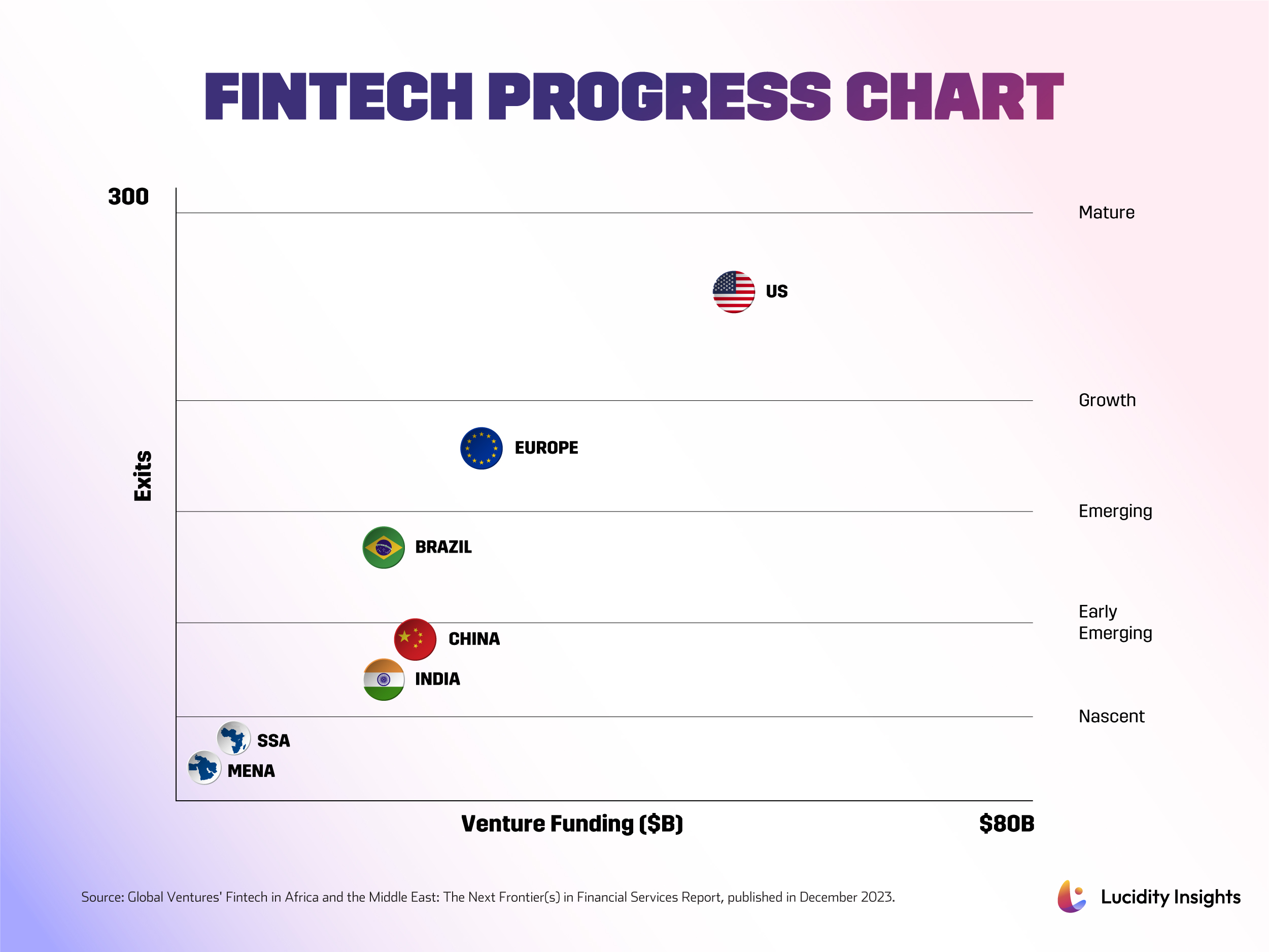

In the last decade, we witnessed a steady shift in the center of gravity of financial innovation. While the US and Europe long stood as centers for disruptive technologies in the world of financial services, frontier markets in Latin America, Asia, Africa, and the Middle East emerged as key players capturing the considerable, yet untapped, opportunity in fintech in their respective markets.

Worldwide Fintech Adoption

China, India, and Brazil have become stand-out fintech markets with billions of dollars invested in local start-ups, and several unicorns to their name, such as Nubank, Ant and Razorpay, to name a few. Sharing similar tailwinds, the Middle East and Africa (MEA) are on a similar trajectory, with a dynamic population, sizable latent demand for financial services and supportive regulators. Investors are also increasingly engaged. Over the last 5 years, fintech consistently attracted the lion’s share of all venture funding, with almost $6 billion invested in over 1181 start-ups across the region. Many of them have proved the success potential of MEA’s fintech landscape: Fawry’s $1.8 billion IPO; Tabby’s $200 million Series D and $1.5 billion valuation; Paystack’s acquisition by Stripe for $200 million; Flutterwave’s $170 million Series C.

Source: Fintech in Africa and the Middle East: The Next Frontier(s) of Financial Services

Fintech in the Middle East & North Africa

Since 2018, we have witnessed the gradual integration of technology into the region’s financial services sector, and supported entrepreneurs harnessing these technologies to build products that cater to the needs of millions of businesses, individuals, and households across MEA. When we first ventured into the space, our belief was that fintech would serve as a gateway to a more inclusive and tech-enabled financial services industry, that empowers a wide range of industries, from mobility to energy and commerce.

Did it fulfill its mandate? The longer answer would be it is a long-winded and nuanced process whose foundations have been laid out in the first wave of fintech innovation. MEA is a heterogenous region. The maturity of financial infrastructure and levels of digital penetration vary significantly from one country to the other. In the Gulf, where banking is more robust, financial technology aimed to offer new ways of consuming and distributing financial services that stood in contrast to the time-consuming and cumbersome legacy models. This unlocked a host of complementary and embedded offerings, from buy-now-pay-later and wealth management to earned wage access and early banking-as-a-service models.

Fintech Progress in Sub-Saharan Africa

In Sub-Saharan Africa (SSA), where infrastructure is still lacking, the first step for fintech was to create the digital layer from which the rest of the ecosystem can build on, starting with payments orchestration, and then leveraging customer relationships and data to extend and tailor offerings. It was about creating the infrastructure to start servicing customers who have traditionally been excluded altogether. In parallel, SSA countries also experienced a trend toward verticalizing fintech offerings within industries to drive uptake, but also address sector pain points more holistically. This took the form of agri-fintech plays, vehicle financing solutions in mobility or embedded fintech products that spread the cost of decentralized solar systems.

What’s Next for Fintech?

Whether globally or regionally, the fintech industry is still scratching the surface of its potential. Despite the level of activity in the last few decades, the sector still only represents less than 2% of annual financial services revenues worldwide. In MENA, fintech’s share of financial services revenue stands at 1%. In Africa, its penetration reaches 3% to 5%. These statistics lead us to believe that the opportunity remains strong, with experts expecting it to be particularly sizable in emerging markets.

Building on the developments of the last wave of fintech innovation, several trends are pointing us to the next. We expect that there will be a continued drive toward business and financial inclusion, with a specific focus on financial solutions that serve the millions of small-to-medium businesses across MEA. Consumers’ pursuit of real-time, seamless, and experiential financial products will continue to define the next generation of banking, lending, and payment products. The relationship between incumbents, regulators and fintech companies will grow to be increasingly synergistic as new forms of collaboration take root, manifested in rising consolidation, the emergence of B2B2X models and the advent of licensed BaaS. The next decade of decade will focus more intentionally on security and fraud prevention to gain customer and regulator trust. Each of these is underpinned by advancements in key technologies, such as generative artificial intelligence (AI), application programming interfaces (APIs), robotic process automation (RPA), distributed ledger and blockchain. As these trends converge, the next iteration of fintech will go beyond access to become more secure, coactive, and convenient.

What about the wave after next?

So far, fintech has mostly focused on the payments, remittances, and lending verticals, and predominantly in retail use cases. Significant white spaces exist in enterprise fintech that are more meaningfully being served in more mature economies and receiving significant investor backing. Especially poignant is the growing innovation in capital markets – a vertical that has attracted over $3.9 billion in venture funding as of Q3 2023, according to Pitchbook data. In a climate of volatile commodity prices, slowing economic growth and market unpredictability, solutions that help reduce structural costs and simplify architecture grow in relevance as capital markets and investment banking firms seek to optimize their return-on-equity (ROE). At the same time, tokenization is orchestrating a profound transformation in how tangible assets transcend into the digital domain and the newfound liquidity that ensues, revolutionizing how investors and businesses interact with assets.

Today, innovation in capital markets is imperative, especially in emerging markets. Capital markets are the essential infrastructure for economic growth and development, providing a way for businesses to raise capital, investors to access opportunities and financial institutions to remain competitive.

Despite the uncertainty surrounding public and private markets today, the fintech venture opportunity has never been stronger, especially in our markets. As a firm, it is a space we are familiar with, and immensely bullish about. Our thesis continues to evolve as the industry undergoes waves of changes and disruption. But, it remains underpinned by a sustained interest driven by its robust fundamentals, favorable tailwinds and the opportunity to enable widespread socio-economic impact.