New Report Highlights the Middle East as a New Global Fintech Contender

04 February 2025•

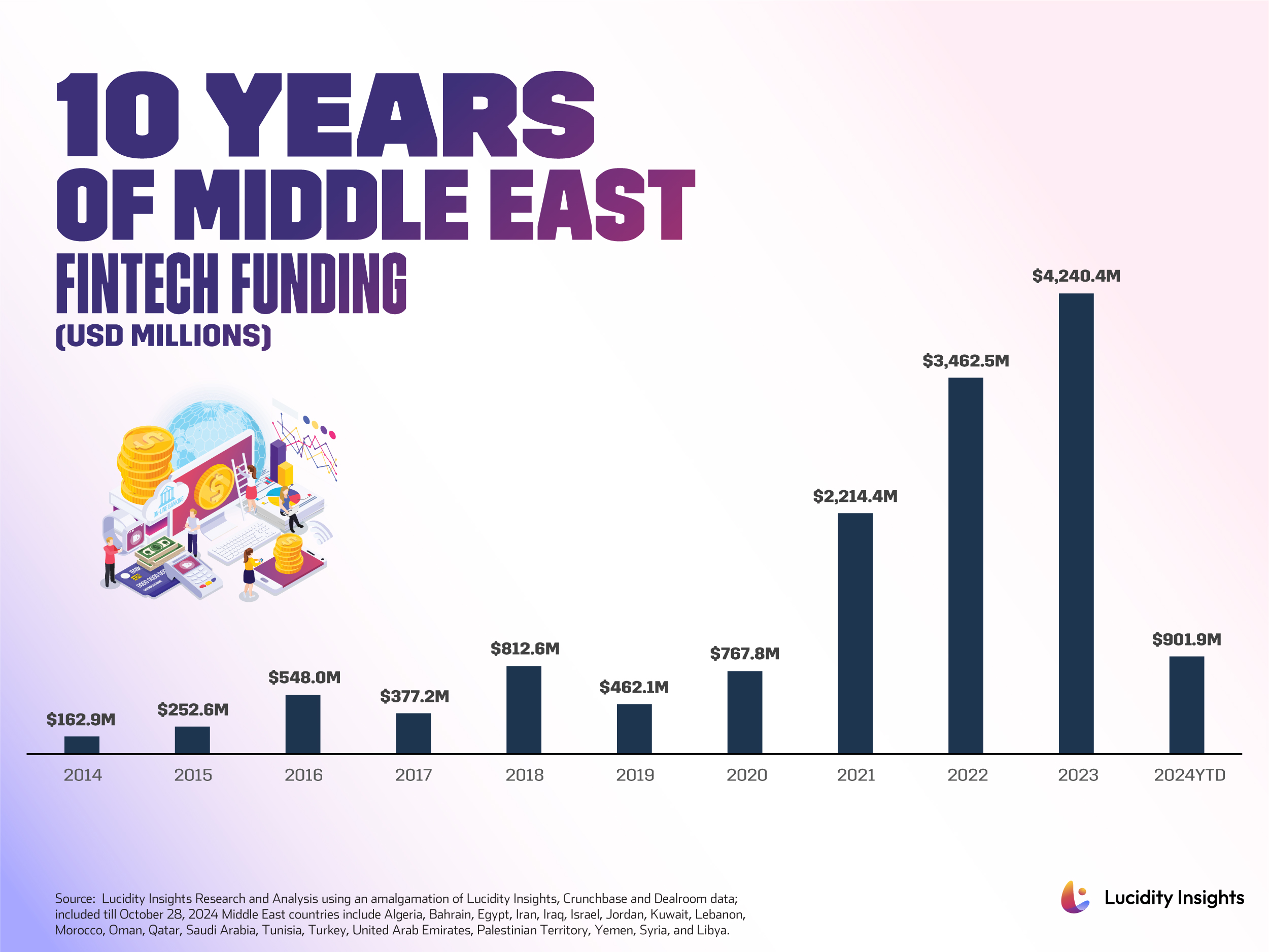

The Middle East’s Fintech sector is on the rise. With over 1,500 Fintech startups, a staggering US $4.2 billion in funding raised in 2023, and 7 IPOs and 30+ M&A exits since 2022, the Middle East region is emerging as a growing region for Fintech innovation and investments. These achievements are no accident—they mark the culmination of a decade of strategic investments, bold entrepreneurial ventures, and supportive government policies.

Lucidity Insights' latest special report in partnership with SAP, titled "The State of Fintech in the Middle East," deep dives into this remarkable transformation. Discover the key players, emerging trends, and market forces shaping the future of finance in the MENAT (Middle East, North Africa, and Turkey).

A Decade of Fintech Growth and Momentum

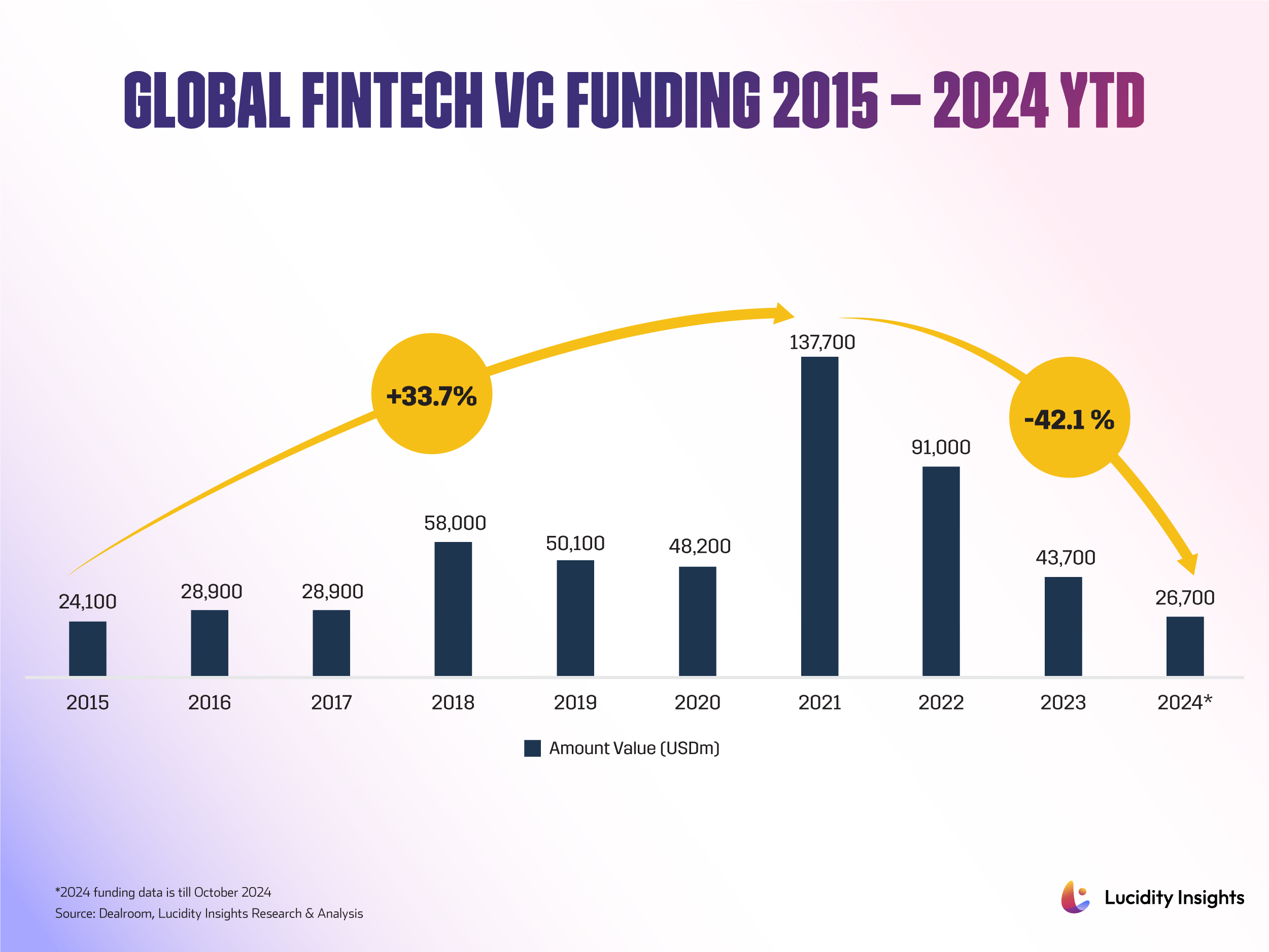

Globally, Fintech has dominated venture capital flows, attracting over US $500 billion in funding since 2015. While global Fintech funding peaked in 2021 at US $137.7 billion, the Middle East’s trajectory has been more consistent, culminating in a record US $4.2 billion in 2023, even amid global market cooling.

This sustained growth has fueled the rise of standout startups such as Tabby, a UAE-born BNPL unicorn now valued at US $1.5 billion, and Tamara in Saudi Arabia. Other regional leaders, including MNT-Halan, continue to attract significant investor interest, with funding trends pointing to a bright future for the ecosystem.

Unicorns in the Making

While global Fintech giants like Stripe, Revolut, and Nubank dominate valuations, the Middle East is building its own unicorn pipeline. Startups like Geidea, Midas, PayTabs, and Sarwa are on the brink of unicorn status, joining the ranks of Tabby and Tamara.

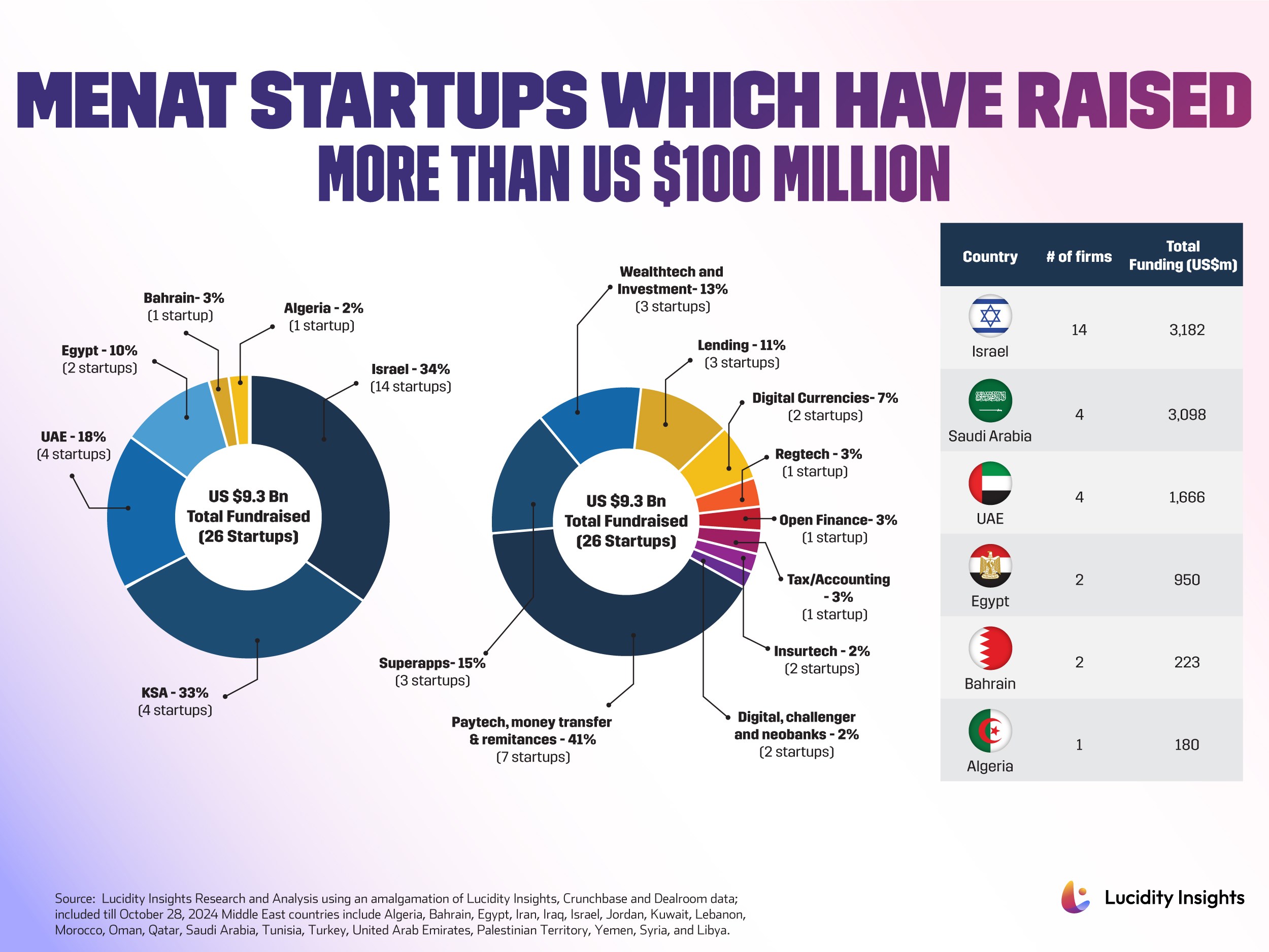

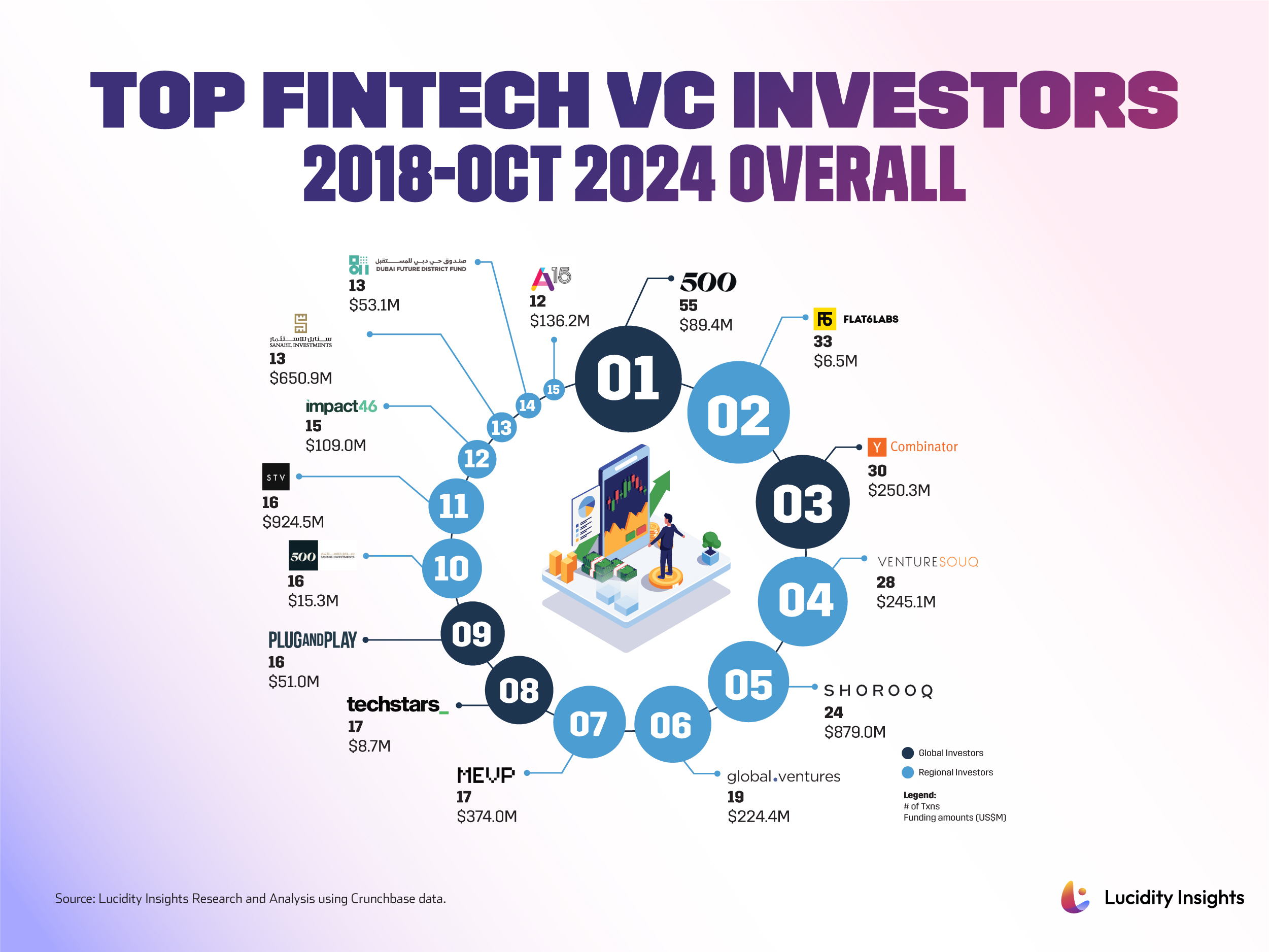

According to the Lucidity Insights’ report, 26 MENA-based Fintechs have already raised over US $100 million, signaling a robust pipeline of future unicorns. Notably, STV, a leading growth-stage Venture Capital fund based in Saudi Arabia, has invested US $924 million across 16 Fintechs since 2018, showcasing the region’s growing investor confidence.

Even global players are taking notice: Y-Combinator has invested in 30 Fintechs across the region, pouring in over US $250 million collectively in the last six years. This influx of capital underscores the region’s rising prominence on the global Fintech stage.

Key Investment Sectors

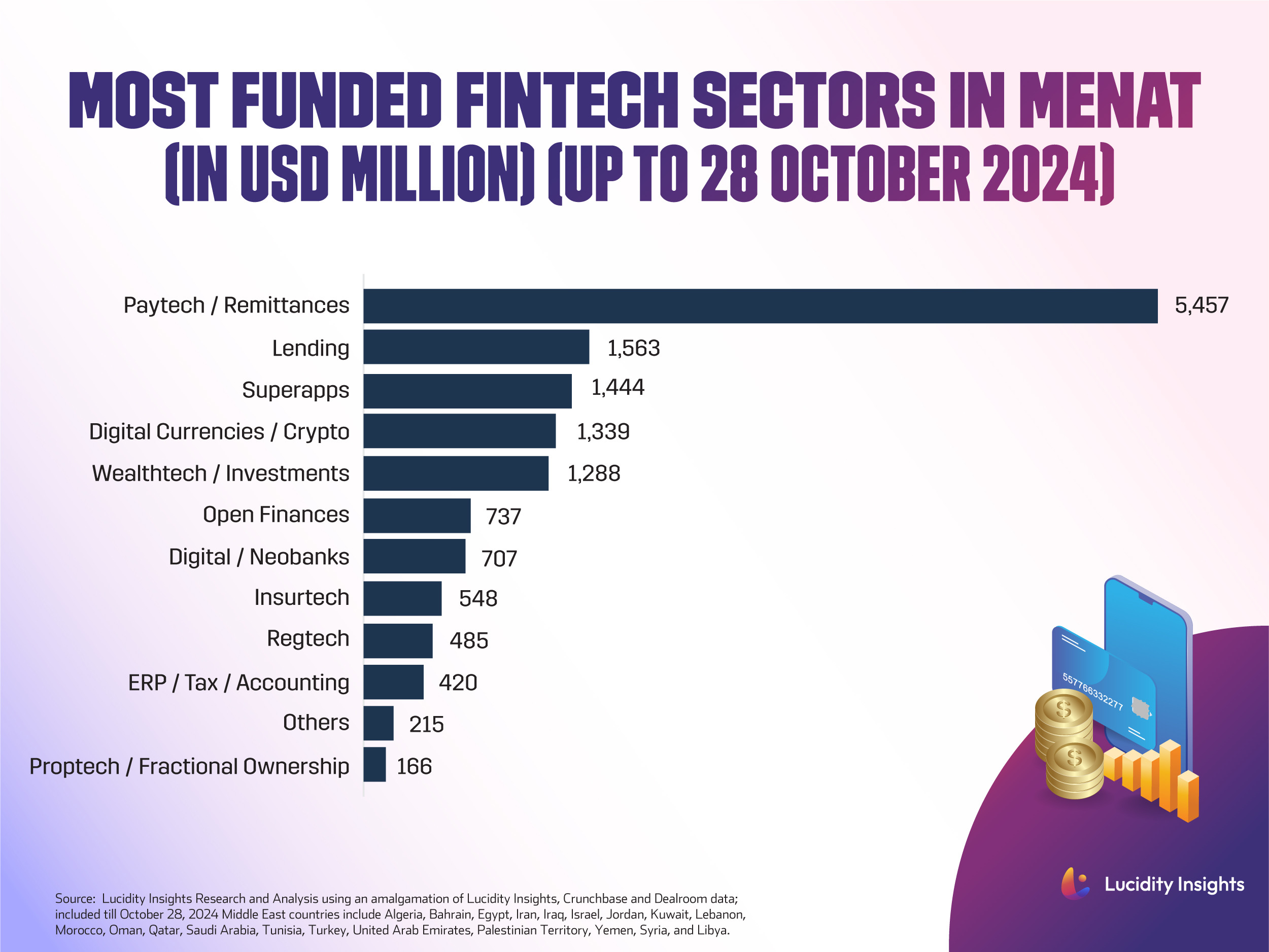

As in most parts of the world, paytech—startups specializing in payments and remittances—has and continues to lead the way, attracting over US $5.4 billion in funding over the past two decades. However, the region is now seeing rapid growth in other Fintech verticals, including:

- Lending: Companies like Tabby and Tamara are reshaping consumer finance through innovative credit models like Buy-Now-Pay-Later (BNPL) offerings.

- Superapps: Multifunctional platforms are gaining traction, combining payments, wealth management, and e-commerce.

- Crypto and WealthTech: Startups like Sarwa are catering to a younger, tech-savvy population, democratizing investment and crypto adoption.

This diversification reflects the ecosystem’s maturity, with startups moving beyond payments to address more complex financial needs.

What Lies Ahead?

The Middle East’s Fintech sector is entering a pivotal phase, with 2025 set to be a defining year for the region. Key trends such as AI-driven financial solutions, open banking, and embedded finance are poised to reshape the financial landscape, unlocking new opportunities for both startups and investors.

AI will continue to drive hyper-personalized financial solutions, enabling Fintechs to anticipate customer needs, streamline compliance workflows, and deliver faster, smarter services. At the same time, open banking frameworks in Saudi Arabia and the UAE will foster greater financial interoperability, empowering startups to integrate seamlessly with traditional banks and innovate at scale.

Emerging verticals such as trade finance, wealthtech, and insurance are expected to become hotbeds of Fintech-driven innovation. These sectors, historically underserved in the region, now offer immense potential for startups to tackle inefficiencies, enhance accessibility, and drive economic growth.

As Said Murad, Senior Partner at Global Ventures, puts it, "With a dynamic population and supportive regulatory environments, the Middle East promises to become a hub for Fintech innovation, mirroring successes in markets like China, India, and Brazil."

Additionally, the region’s second-generation founders—entrepreneurs building companies based on pain points they experienced firsthand—are bringing deeper insights and global expertise to the table. Their ventures are positioning the Middle East not just as a participant in the global Fintech revolution but as an active shaper of its future.

As Rabih Khoury, Managing Partner at MEVP, emphasizes, "2025 will be the year of Fintech." The convergence of technological innovation, regulatory support, and entrepreneurial talent ensures that the Middle East is well-equipped to tackle its most pressing financial challenges while setting a benchmark for Fintech ecosystems worldwide.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)