Tabby, the First Independent Fintech Unicorn in the Middle East

04 March 2025•

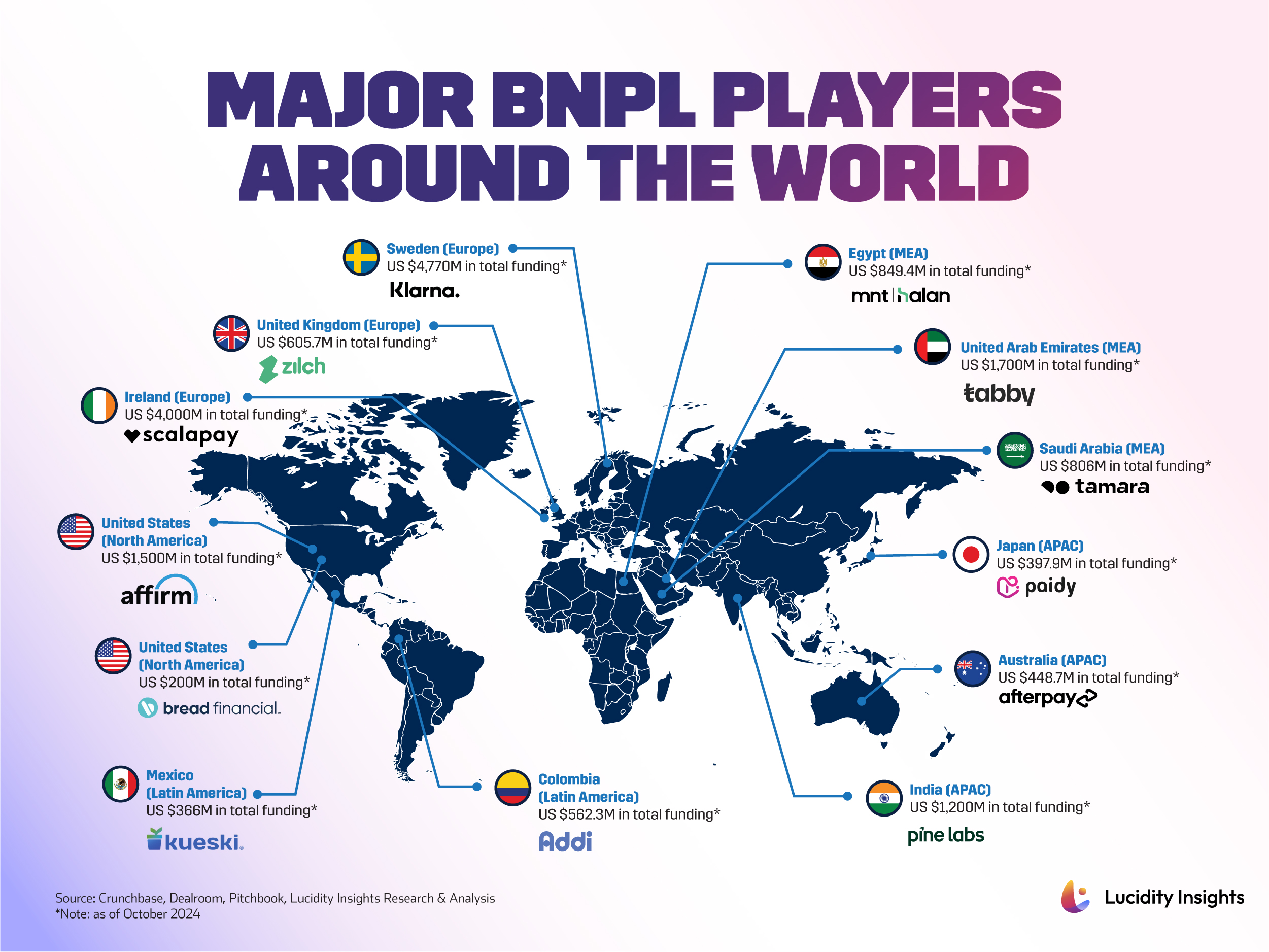

In today’s increasingly tech savvy world, financial solutions must evolve at the pace of consumer needs and Buy Now, Pay Later (BNPL) services have carved a niche, becoming a popular financial model globally due to their flexibility, accessibility, and user-friendliness. These systems address the growing demand for more adaptive financial products that cater to the modern consumer’s desire for immediate gratification while managing budget constraints. They allow shoppers to defer payments without incurring the high costs typically associated with traditional credit options, effectively solving the problem of accessibility to goods with manageable payment solutions.

Since the pandemic, consumer behavior worldwide has undergone a profound shift toward online shopping and digital payment solutions. This change has spurred rapid growth in the popularity of BNPL services, which provide consumers with flexible payment options. The market is experiencing explosive growth, with its global valuation rising from US $156.58 billion in 2023 to an expected $232.23 billion in 2024 — reflecting a CAGR of 48.3%. This surge is fueled by the rapid expansion of e-commerce, rising demand for flexible payment options, and the growing adoption of digital wallets and mobile payments.

By 2028, the BNPL market is forecast to reach $1.015 trillion, driven by the integration of BNPL services in physical retail, cross-border e-commerce, and the rise of embedded finance models. In the Middle East, the BNPL market is poised for significant expansion as regional dynamics create fertile ground for growth. Key factors driving this momentum include a youthful, tech-savvy population, high internet and mobile penetration, and a rapidly expanding e-commerce sector. BNPL services are resonating with Middle Eastern consumers, offering a way to better manage cash flow while enabling immediate access to products and services. For businesses, BNPL solutions have proven to boost customer engagement, drive higher conversion rates, and support long-term revenue growth.

As the demand for BNPL services soars in the Middle East, Tabby has emerged as a pioneering force in the industry. Positioned at the intersection of financial innovation and consumer convenience, Tabby has strategically expanded its footprint to align with this regional momentum, ultimately becoming the first independent Fintech unicorn in the Middle East.

From Founding Vision to Unicorn Valuation

Founded in 2019 by Hosam Arab and Daniil Barkalov, Tabby emerged in Dubai with a mission to transform the retail and consumer finance landscape in the Middle East through accessible BNPL solutions. Hosam Arab, previously the CEO of Namshi, one of the region’s most successful online fashion retailers, brought to Tabby his deep experience in e-commerce and an understanding of Middle Eastern consumers. His cofounder, Daniil Barkalov, leveraged his background in scaling technology at Careem, the region’s ride-hailing leader, where he gained critical insights into building platforms that support rapid growth. Together, they saw a unique opportunity to bridge gaps in financial services and introduce flexible, customer-centered payment options across the MENA region.

Tabby Co-Founders: Hosam Arab and Daniil Barkalov

Tabby hit the ground running by securing its first seed funding of US $2 million from Global Founders Capital. This initial capital laid the groundwork for building its proprietary technology and assembling a team to execute its ambitious plans.

By 2020, Tabby raised an additional US $7 million in a seed round led by Raed Ventures, followed by a US $23 million Series A led by Arbor Ventures and Mubadala. These rounds enabled Tabby to scale its operations and roll out its BNPL platform beyond Dubai to cover the UAE and Saudi Arabia—two of the region’s largest and most dynamic retail markets. This early expansion cemented Tabby’s position as a key player in the MENA region, empowering millions of consumers to shop with greater flexibility.

A cornerstone of Tabby’s strategy has been forging partnerships with toptier retailers. By mid-2021, Tabby had onboarded more than 2,000 brands, including global names like IKEA, SHEIN, and Adidas, allowing it to cater to diverse consumer needs. The company’s ability to secure these partnerships drove rapid growth, with active users surpassing 400,000 by July 2021. Its Series B funding later that year, led by STV and Global Founders Capital, valued the company at US $300 million and provided the resources needed to scale further.

Tabby’s growth accelerated in 2022 as the company extended its Series B funding to US $54 million and secured US $150 million in debt financing. By August, Tabby had over 4,000 retail partners and 2 million active users. Revenue for the first half of 2022 grew tenfold compared to the previous year.

By May 2023, Tabby had expanded its retailer network to over 15,000 brands and grown its user base to more than 4 million active shoppers. With US $350 million in debt financing and US $58 million raised in a Series C led by Peak XV Partners and STV, the company achieved annualized transaction volumes of US $6 billion. By October 2023, Tabby reported over 10 million users and 30,000 retailer partnerships, solidifying its status as a leader in the Middle East’s BNPL sector.

The pinnacle of Tabby’s journey came in November 2023, when the company closed a US $250 million Series D funding round led by Wellington Management, bringing its valuation to US $1.5 billion and officially joining the unicorn club. Shortly after, Tabby relocated its headquarters to Saudi Arabia, positioning itself at the heart of the region’s most dynamic economy in preparation for its anticipated IPO on the Saudi Arabian Exchange (Tadawul). CEO Hosam Arab described this as “the next logical step” for the company, citing the Kingdom’s strong growth potential and alignment with Tabby’s long-term objectives.

The relocation underscores Saudi Arabia’s central role in Tabby’s strategy, as the Kingdom’s tech-savvy population, dynamic retail sector, and economic reforms under Vision 2030 create fertile ground for innovation and expansion.

In September 2024, Tabby made a strategic acquisition of Tweeq, a Saudi-based digital wallet licensed by the Saudi Central Bank (SAMA). This acquisition marked a shift beyond BNPL, integrating digital banking capabilities to offer more comprehensive financial solutions.

Tweeq’s digital spending account aligns with Saudi Arabia’s National Fintech Strategy and Vision 2030, which aim to drive financial inclusion and promote a cashless economy.

By late 2024, Tabby’s user base has grown to over 14 million, with a network of more than 40,000 retailers and small businesses. As Tabby prepares for its IPO, it stands as one of the Middle East’s most prominent Fintech success stories, poised to reshape the region’s financial landscape while contributing meaningfully to Saudi Arabia’s ambitious Vision 2030 goals.

Also Read: Tabby Raises $160M in Series E, Expands Digital Payments & Prepares for IPO

What does the future hold for Tabby?

With a planned IPO on the Saudi stock exchange, Tabby is set to become one of the few Fintechs in the region to go public locally. Going public will provide Tabby with access to new capital, enabling it to scale operations, fuel product innovation, and attract institutional investors seeking exposure to the Middle East’s booming Fintech sector.

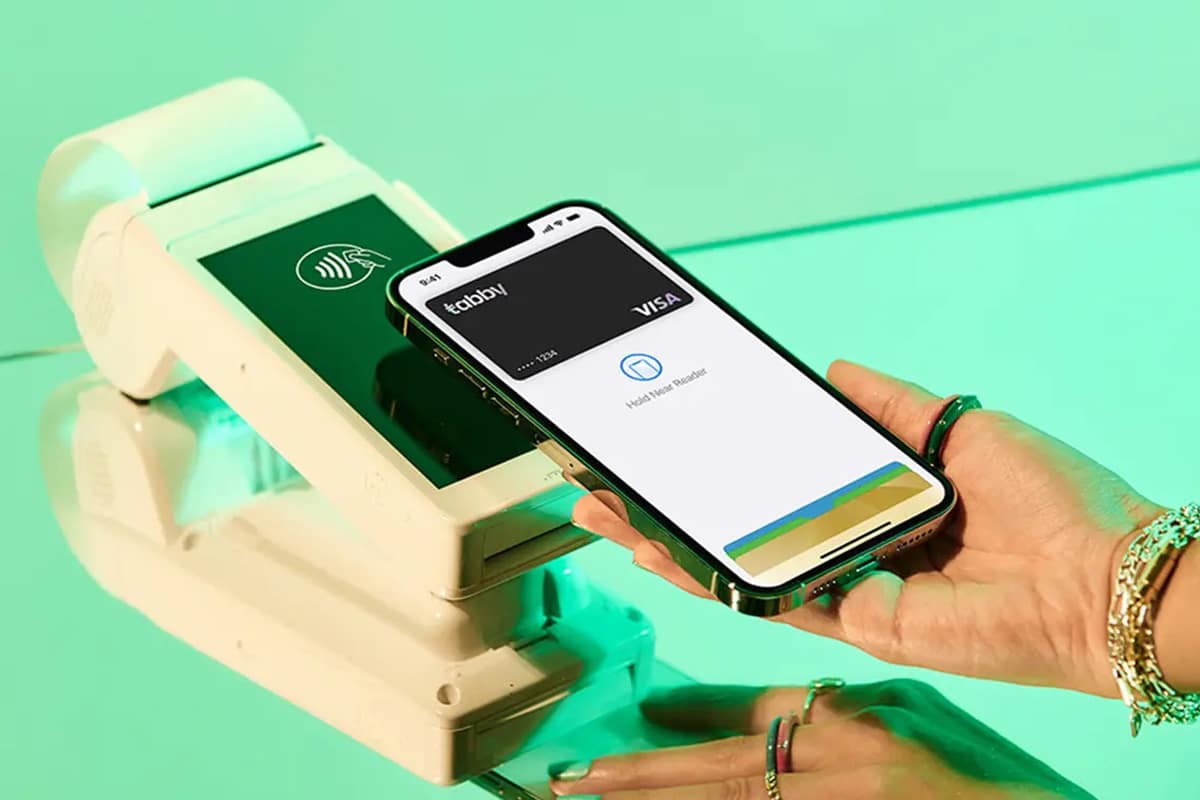

But Tabby's ambitions are extending far beyond its roots in BNPL services. The company is on a mission to become a multi-faceted financial services platform. Key to this strategy are recent acquisitions and new product offerings such as the Tabby Card for in-store purchases and the Tabby Shop digital shopping assistant. These initiatives demonstrate Tabby's drive toward creating a seamless, omnichannel payment experience. As the region embraces embedded finance, Tabby is well-positioned to integrate its services into broader shopping and financial experiences, offering consumers more personalized payment options and frictionless purchasing journeys. Over time, this strategic expansion could even position Tabby as a contender in the emerging "superapp" space, where a single platform offers users a suite of financial, shopping, and lifestyle services.

By embedding itself into essential consumer spending habits and diversifying its product offerings, Tabby is redefining its role in the Middle East’s financial services ecosystem. The company’s efforts to expand its range of services, enhance customer engagement, and solidify its market leadership are paving the way for sustained growth. As Tabby prepares for its IPO and continues its transformation into a multi-service financial platform, it is clear that the company’s influence will extend far beyond BNPL. With a growing customer base, diversified revenue streams, and a foothold in Saudi Arabia’s rapidly growing Fintech market, Tabby is poised to lead the next wave of financial innovation in the Middle East.

Explore the transformative trends shaping the Middle East's Fintech sector. Read or download your copy of "The State of Fintech in the Middle East" now.

%2Fuploads%2Ffintech-sap-2025%2Fcover.jpg&w=3840&q=75)