Understanding the MENA Region from a Fintech Perspective

03 June 2022•

Variations in the MENA Landscape

When we look at the Middle East and North Africa (MENA) region in particular, we find the same trends that are reported globally: a decline in cash usage, and an increase in fintech adoption; but the results vary significantly from country to country.

The 19 markets in the MENA region spans great variations, including some of the world’s wealthiest countries alongside the world’s poorest countries. MENA also has some of the world’s most connected (with regards to internet connectivity) as well as some of the most disconnected and disenfranchised countries in the world, as the following illustrations and graphs in this section will show.

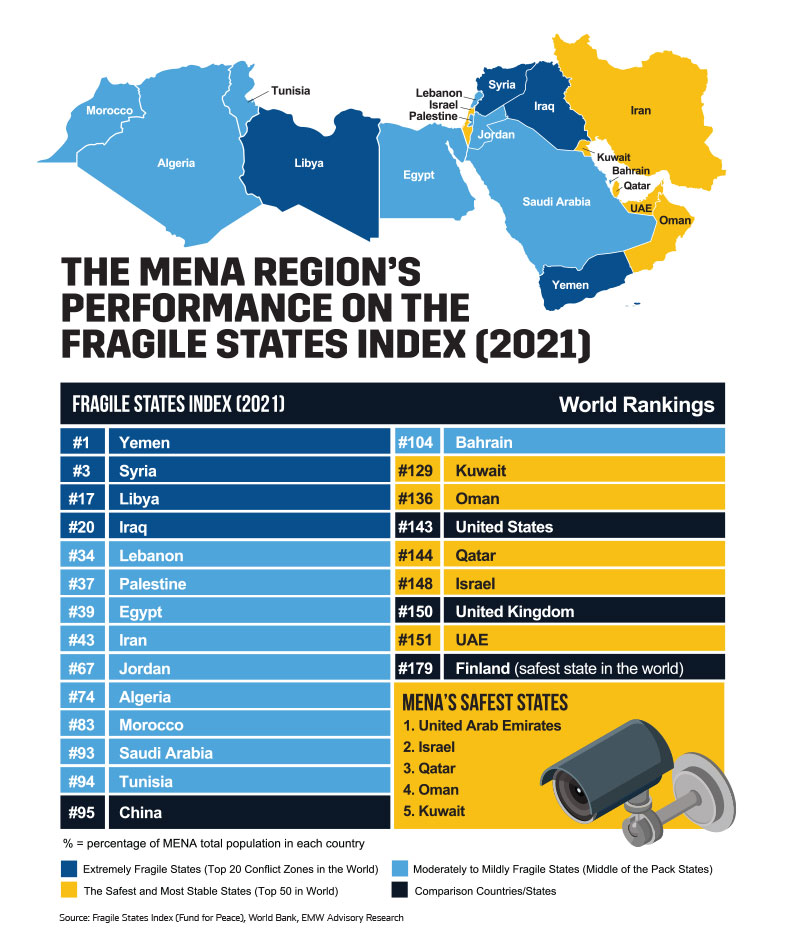

If we take a look at the Fragile States Index, 4 MENA markets are in the ‘World’s Top 20 Most Fragile States’ list (Yemen, Syria, Libya, and Iraq), while simultaneously 5 MENA markets are in the “World’s Top 50 Most Stable (Least Fragile) States’ list (UAE, Israel, Qatar, Oman, and Kuwait). An argument can be made that the most fragile states in the world might need fintech more than others, to reach a large unbanked population - and perhaps will be fintech hotbeds one day. The objective of this section of the report is to provide a bird’s-eye view of all 19 countries in MENA, from the perspective of a fintech entrepreneur or investor, and quickly identify the top markets to watch for fintech activity and fintech potential.

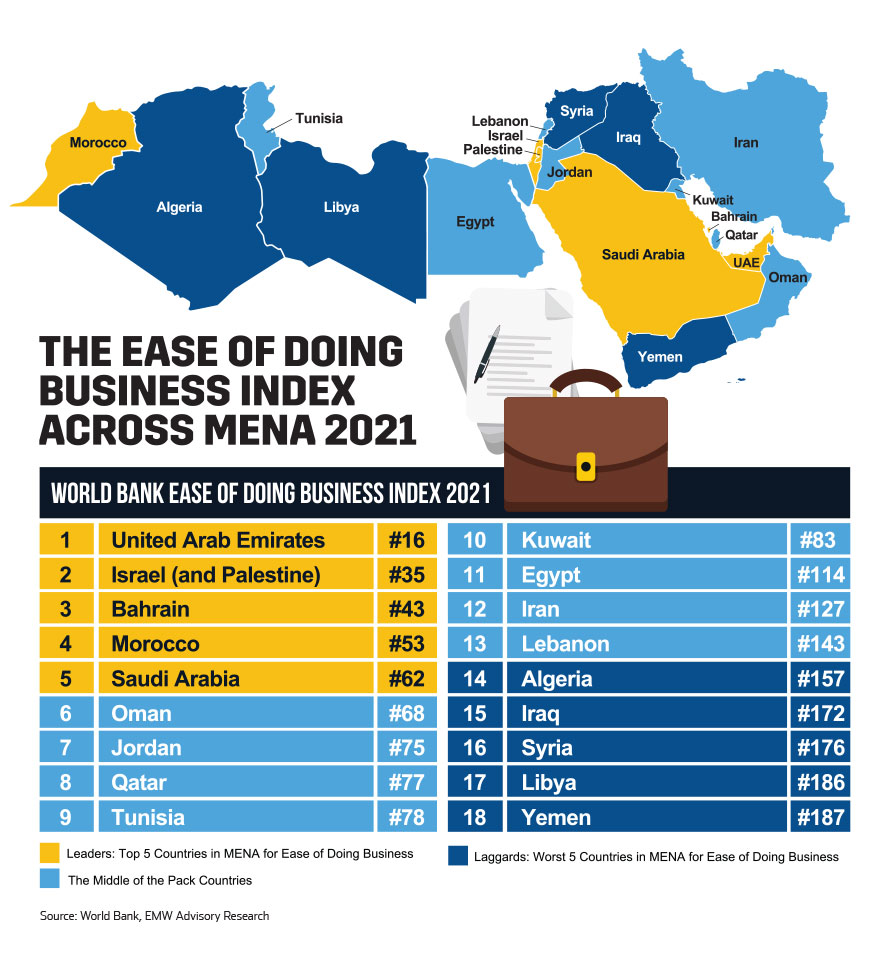

When we look at the World Bank’s Ease of Doing Business Index, we get a similar spread in leader and laggard countries to the Fragile States Index. The United Arab Emirates again leads the region, ranking 16th in the entire world for ease of doing business; Israel follows suit, just as in the fragility index. Unsurprisingly, Yemen, Libya, Syria and Iraq all round out the laggards marking countries that are some of the most difficult countries to conduct business in, in the world.

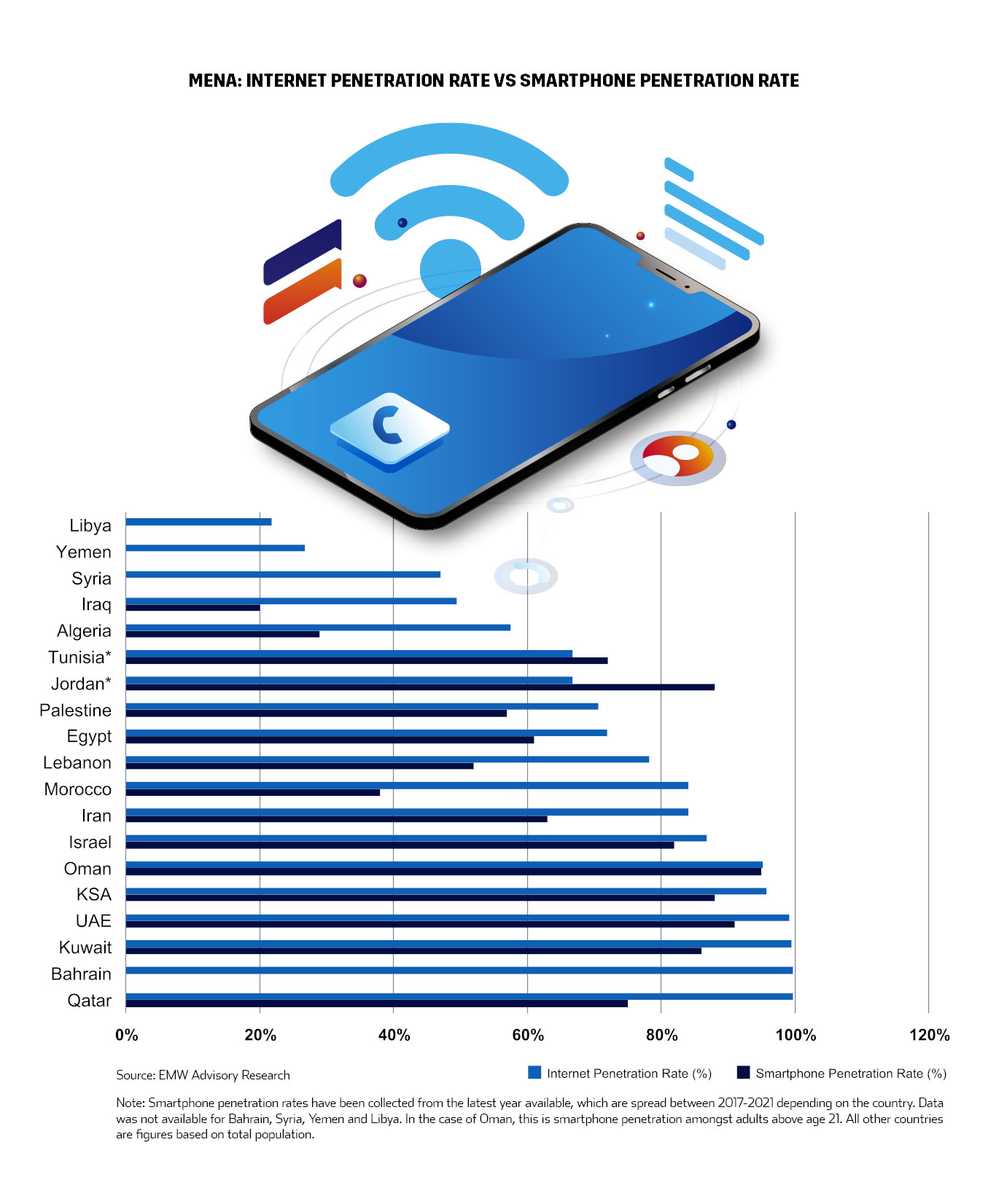

Though many global fintechs may look at fragility of states or the World Bank’s “ease of doing business” index to determine which markets to expand into or avoid, these indices are not necessarily strong barometers of whether or not these countries are ripe for fintech to take hold of in or not. Ranking markets in terms of potential really comes down to identifying as best as possible, the Total Addressable Market (TAM) for fintechs in terms of potential users to onboard and acquire. This requires fintechs and investors to understand demographics of each market; namely, the number of total consumers that have access to the internet, and more so, smartphones, in any given market. Thus, the three most important data driven indicators become (a) total population size, (b) internet penetration rate, and (c) smartphone penetration rate amongst each population.

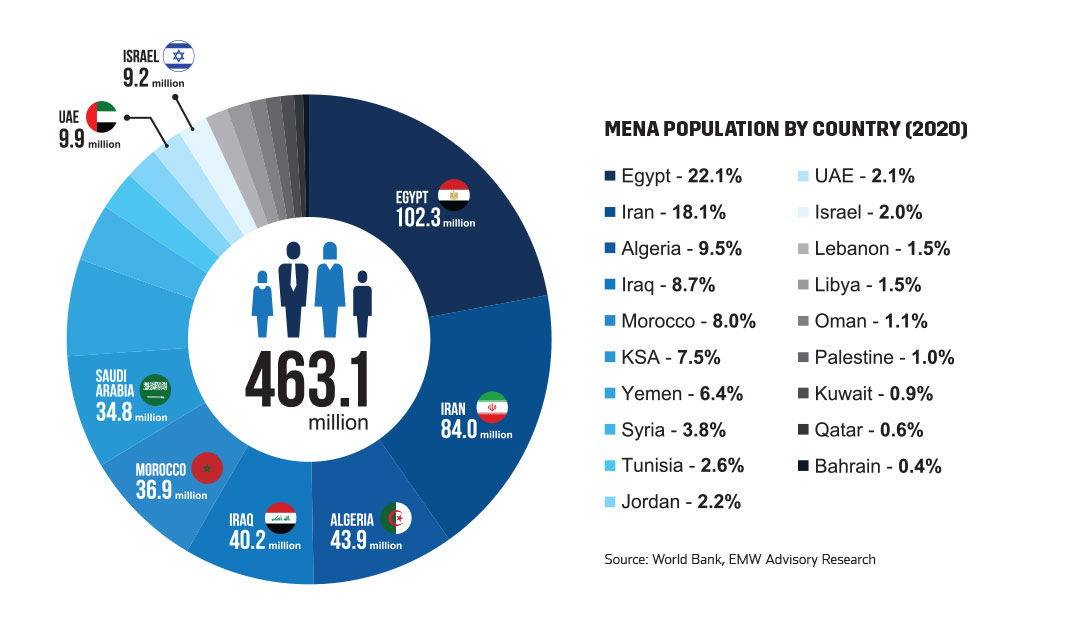

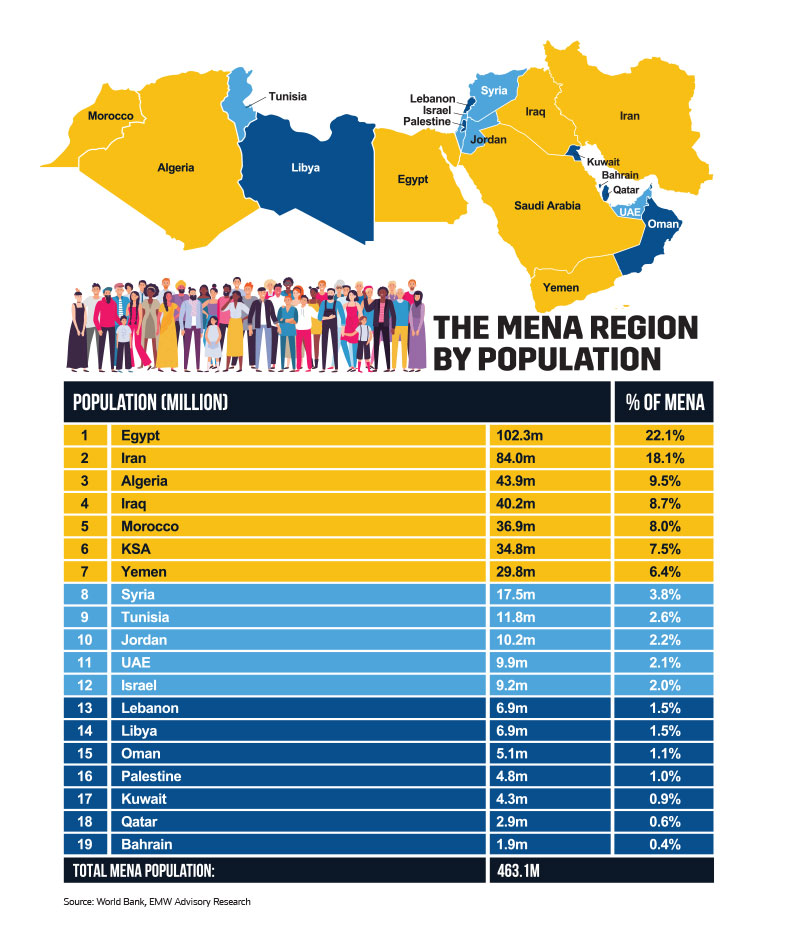

Population

Let’s start with Population Size. With regards to Population, the bigger the better. We see here that over 66% of the over 463 million inhabitants in the Middle East and North Africa region reside in the top 5 most populous countries which are: Egypt, the Republic of Iran, Algeria, Iraq and Morocco. Egypt is the 14th most populous country in the world with over 103 million inhabitants, with a young population (median age 24.6 years old). But large populations don’t mean much to the world of fintech, unless the majority of the population is connected to the internet. In contrast, countries such as Israel and the United Arab Emirates have small populations sizes of 9.2 and 9.9 million respectively, but with the majority of these countries having access to the internet and smartphones make them fast-adoption markets.

Internet Connectivity and Smartphone Penetration

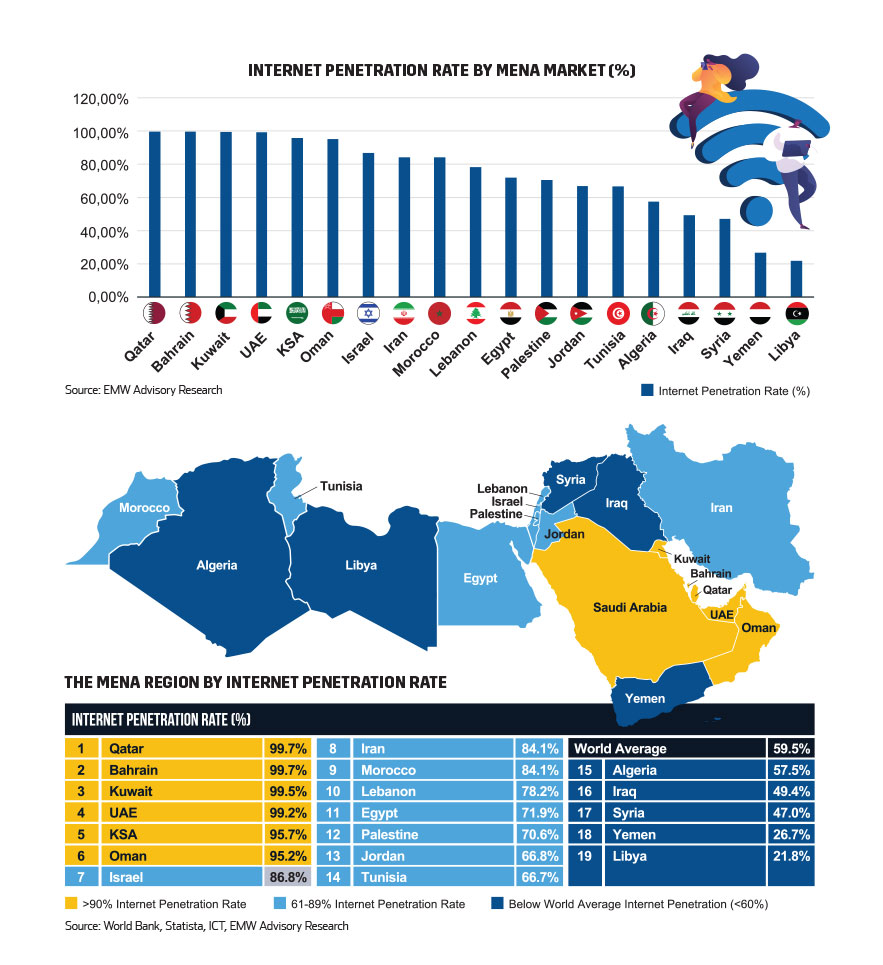

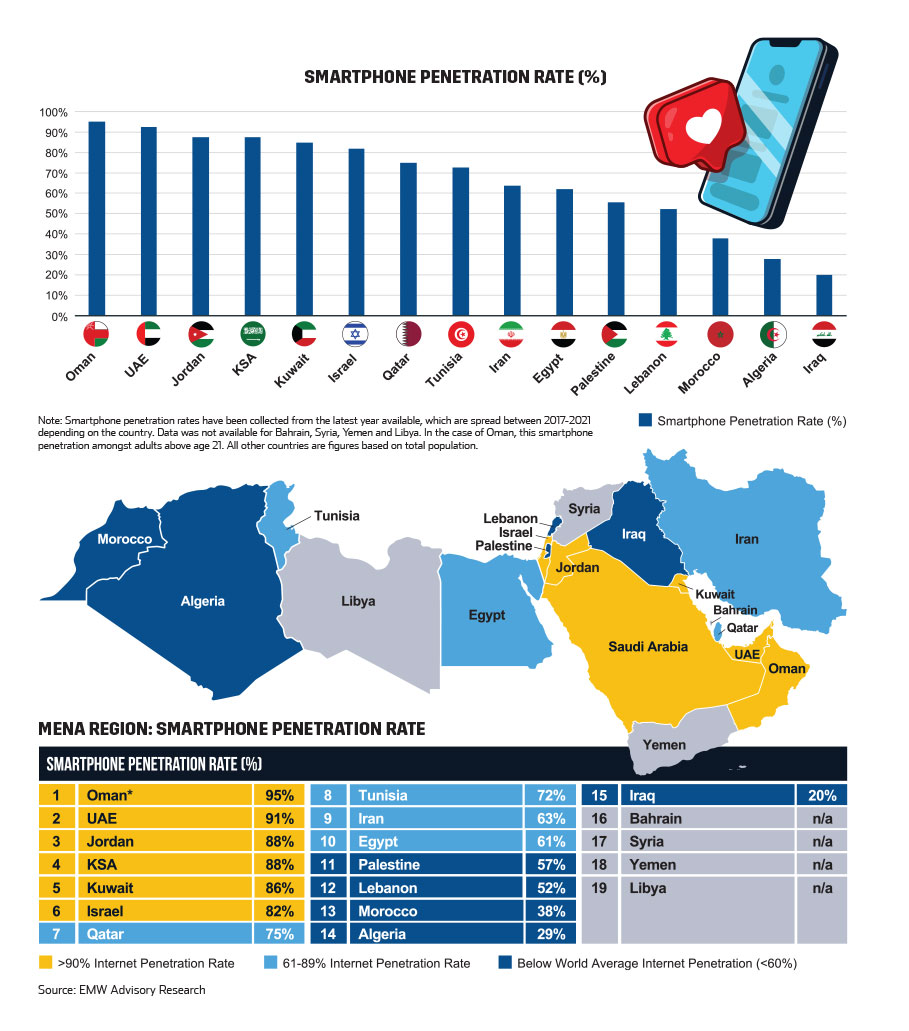

All GCC countries have over 90% internet penetration rates; and Qatar, Kuwait, Bahrain and the United Arab Emirates all have internet penetration rates above 99%. This is remarkable, meaning that nearly every person in each of these countries has access to the internet. For comparison, both the United States and the United Kingdom have lower internet penetration rates at 90.8% and 94.6% respectively. Five countries fell below the world average internet penetration rate of 59.5%: namely, Algeria, Iraq, Syria, Yemen and Libya.

Smartphone penetration rates were not available for every country, but data shows that Oman and the UAE boast smartphone penetration rates above 90% (among populations 21 years and older), and Jordan, Saudi Arabia, Kuwait and Israel have smartphone penetration rates above 80%. Smartphone penetration is especially critical, as more and more fintech applications spanning digital payments to insurtech are browsed and purchased on mobile devices around the world.

Other Data Points for Consideration

“What about banking penetration rate?” you might ask; preliminary data from emerging markets show us that the rate at which individuals of any given market utilize traditional banking services do not necessarily help us understand whether or not consumers in that market might use fintech services. Egypt is a burgeoning Fintech market in its nascent ages, that proves that banking indicators have no place to determine fintech attractiveness; approximately 80% of Egypt’s 100 million+ inhabitants are officially unbanked4, meaning over 80 million people living in Egypt do not have an active bank account open at a banking institution. In fact, many are wary of and mistrustful towards banks, but have shown interest in fintech products and services. Thus, Fintech is seemingly leapfrogging traditional financial institutions in Egypt, giving Egyptians access to digital capital, where they had only used cash up until now. Spotlight case studies of Egyptian fintech start-ups illustrate this further, later in this report.

The same can be said of credit card penetration. Generally speaking, countries with higher GDPs tend to have larger rates of credit card adoption – but that trend seems to be bucked in the MENA region. Saudi Arabia, one of world’s 20 most wealthy nations only has 33% of the population adopting credit cards. Some analysts state religious reasons as a potential barrier to credit card adoption in the region, due to the payment of interest being frowned upon in Islam. To counter this, many local and regional banks have been offering a wider range of Sharia-compliant credit cards in recent years. With approximately 325 Muslims living in the MENA region, equating to roughly 70% of the region’s population, this reality also negates the impact of the credit card penetration data point.

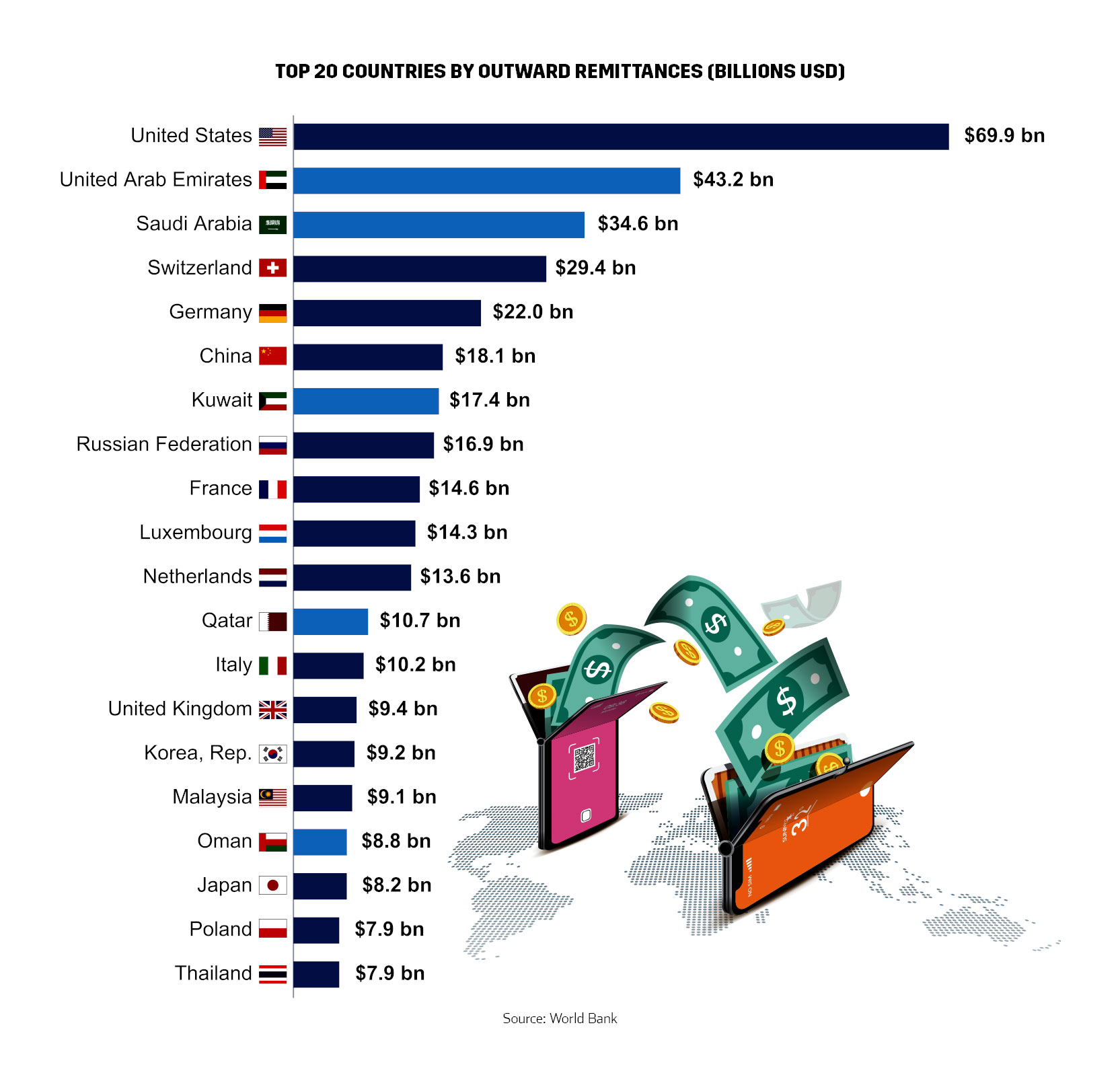

Fintech Entrepreneurs, especially in the remittance space, might be interested to know that the MENA region is a hotbed for international remittances, particularly from the region’s wealthiest economies. Five MENA countries, all GCC states, are in the “Top 20 Countries for Outward Remittances” list. The United Arab Emirates is 2nd in the world (United States ranking #1 in the world), having sent out US$43.2 billion dollars out of the country in 2020. Saudi Arabia follows behind the UAE in 3rd place, with US$34.6 billion dollars in remittances in the same year.

%2Fuploads%2Fmena-fintech%2Fcover4.jpg&w=3840&q=75)