10 Graphs You Need to See About Fintech in the Middle East

19 February 2025•

10 Graphs Explaining Fintech in the Middle East & the World in 2024

Fintechs have been bubbling up the world over, and their strong foothold in the Middle East is no exception. What might come to the surprise of many, is just how strong and diverse the regional Fintech landscape is, how much financing regional players are attracting, how many Fintech unicorns the region is producing, and just how well it measures up against global heavy-weight Fintech nations like the US and the UK. Check out these 10 graphs to put it all into perspective for you.

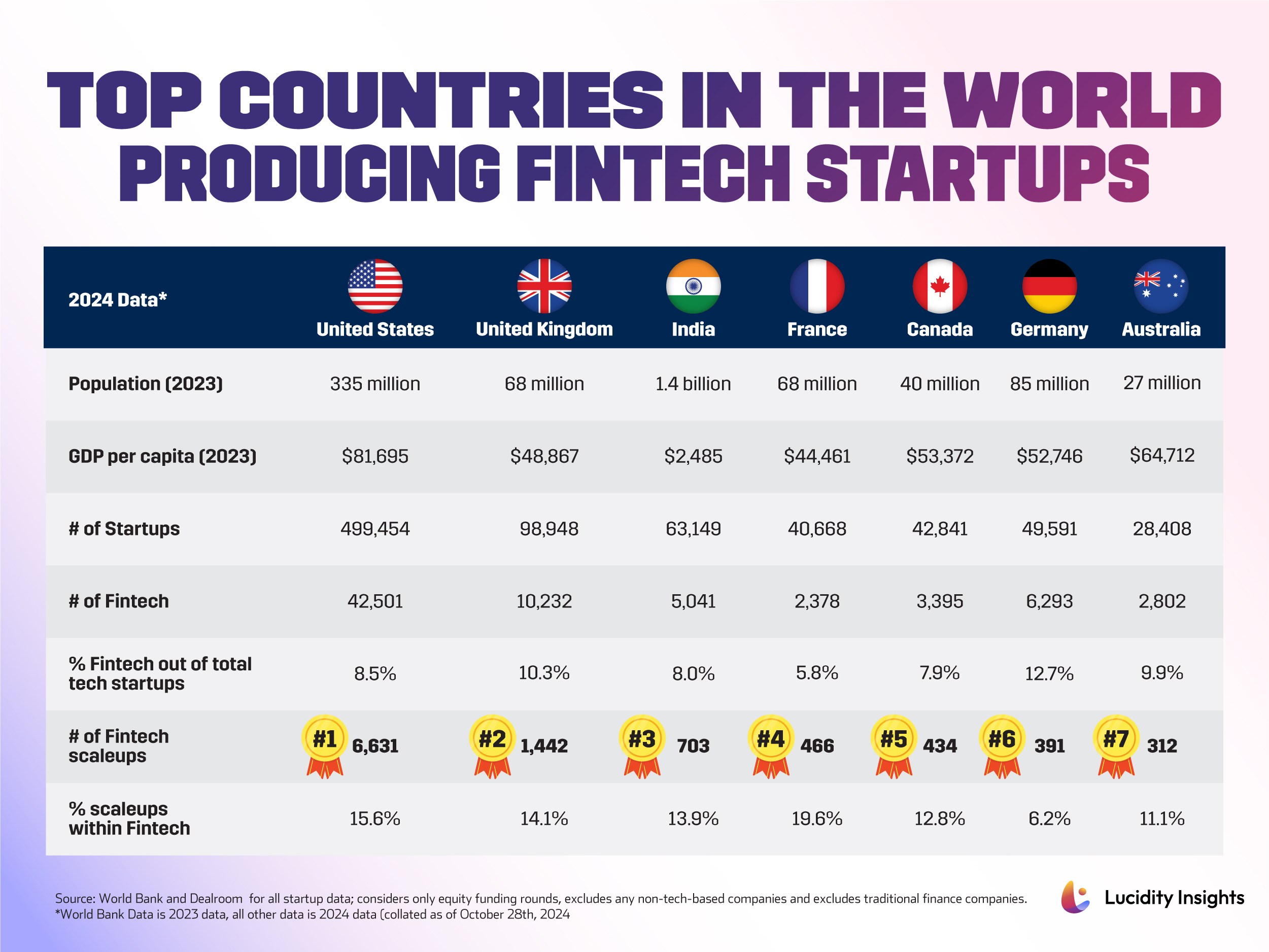

1. Who’s Producing the Majority of the World’s Fintech Startups?

The United States produces the most Fintech startups in the world, with over 42,500 Fintechs calling it home. It’s no surprise though, when you take a look at how many tech startups across all sectors the US produces, which hovers at around half a billion. We must also consider how many people around the world register their tech startups in the US, despite being based elsewhere for regulatory or other reasons.

The second largest producer of startups and home to techpreneurs is the United Kingdom, with nearly 100,000 tech startups, of which over 10,230 are Fintechs. When compared to the US, though, the UK’s 2nd place is just a quarter of the size. When we look at well-funded Fintechs, or scale-ups (which are defined as startups that have successfully raised US $1 million or more), American Fintech scaleups outnumber UK Fintech scallops 5 to 1.

One might make an argument for America’s population of over 335 million people producing more startups than the UK’s nearly 70 million inhabitants, just a question of the baseline population of any ecosystem - but India’s population of 1.4 billion people, lags far behind in 3rd place, with half as many Fintechs as the UK. The infobyte below also indicates GDP per capita to add as a variable - where India lags far behind its counterparts, but still manages to produce significantly more Fintech scale-ups that are well-funded than Germany, Canada, France or Australia.

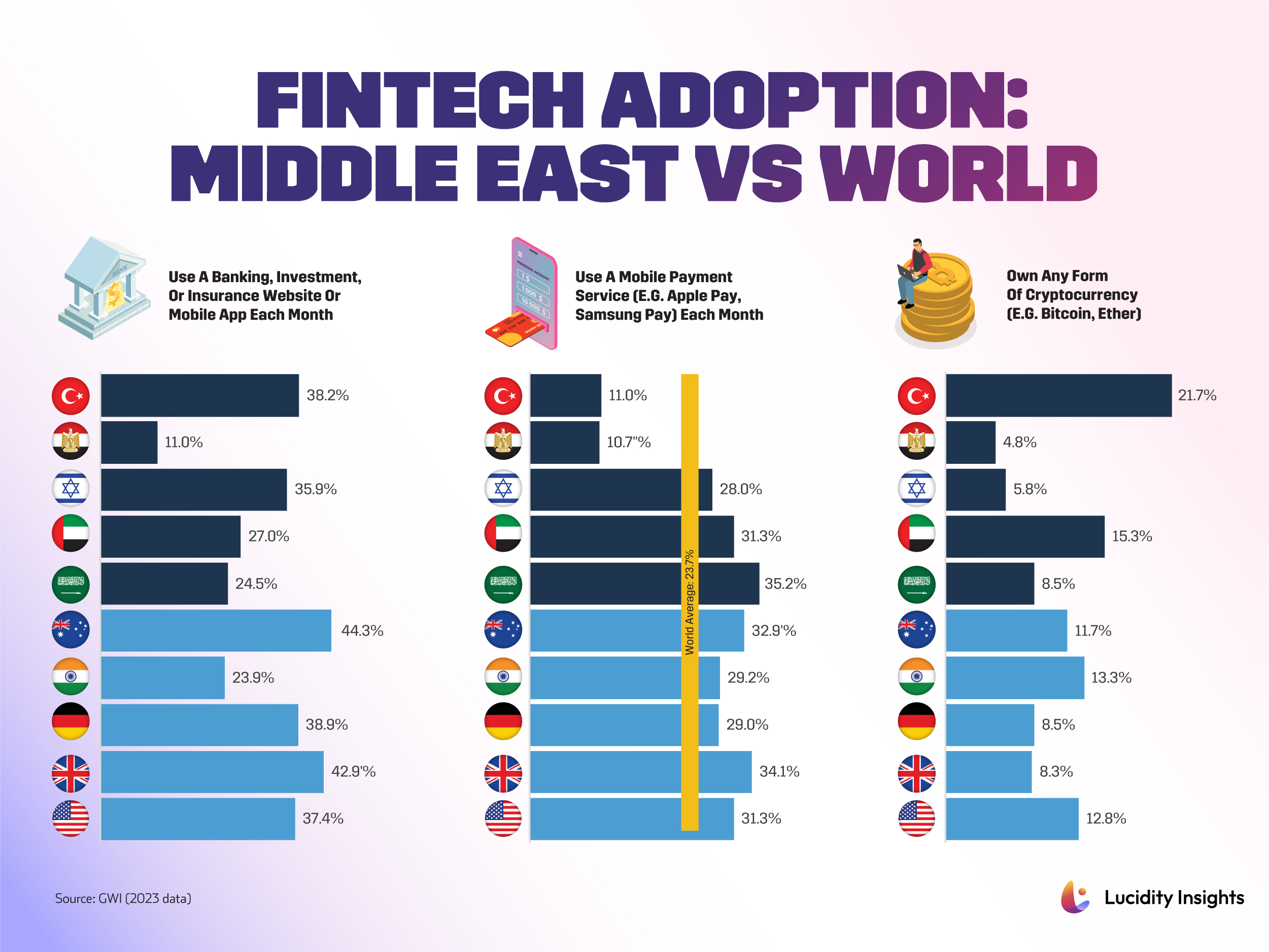

2. Middle East Often Outpaces America in Fintech Adoption

If the United States produces the most Fintechs in the world, one might expect it also to be a country that has high Fintech adoption rates, and it certainly does fall into the top quartile. That said, top Middle Eastern countries like the United Arab Emirates, Saudi Arabia, Turkey and Israel also have high Fintech adoption rates, largely on par with the USA or in many cases, outpacing American adoption.

For example, more Saudi Arabians use mobile payment services than Americans, which have mobile payment adoption rates on par with the United Arab Emirates. More Turkish and UAE residents own cryptocurrency than Americans do. More Turkish and Israeli people use a website or mobile app to do their banking, investment or insurance acquisition than Americans do.

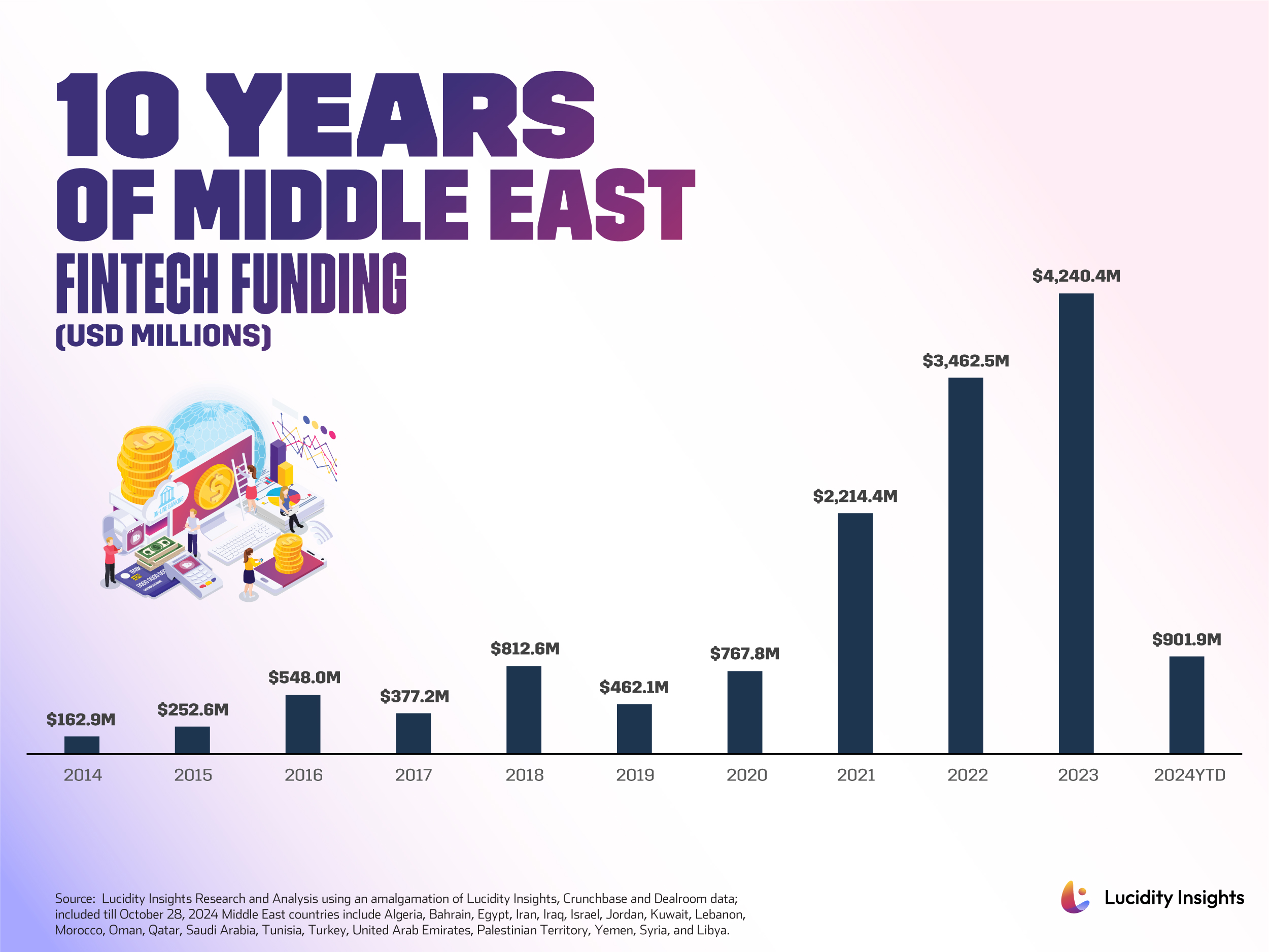

3. Fintech Funding in the Middle East Peaked in 2023 at US $4.2 Billion

Fintech funding peaked in the Middle East in 2023 at US $4.2 billion, before various factors influenced a downturn in 2024 including a global VC Winter which started to take hold in 2023 and continued its icy grip on fundraising purse-strings across the world into 2024. Israel’s War on Gaza has also affected a previously strong tech sector in Israel - which has slowed considerably since the bloodshed began on October 7, 2023.

Israel currently faces an uncertain political and economic future. Though large cybersecurity firms and established incumbents are still attracting US $100 million plus mega-rounds, much of the seed capital has dried up for newer startups trying to establish themselves. Despite the headwinds facing Israel though, in 2024, 7 out of 26 of the Fintechs that raised a US $100 million+ megaround in the MENAPT region were based out of Tel Aviv, which accounts for 27%.

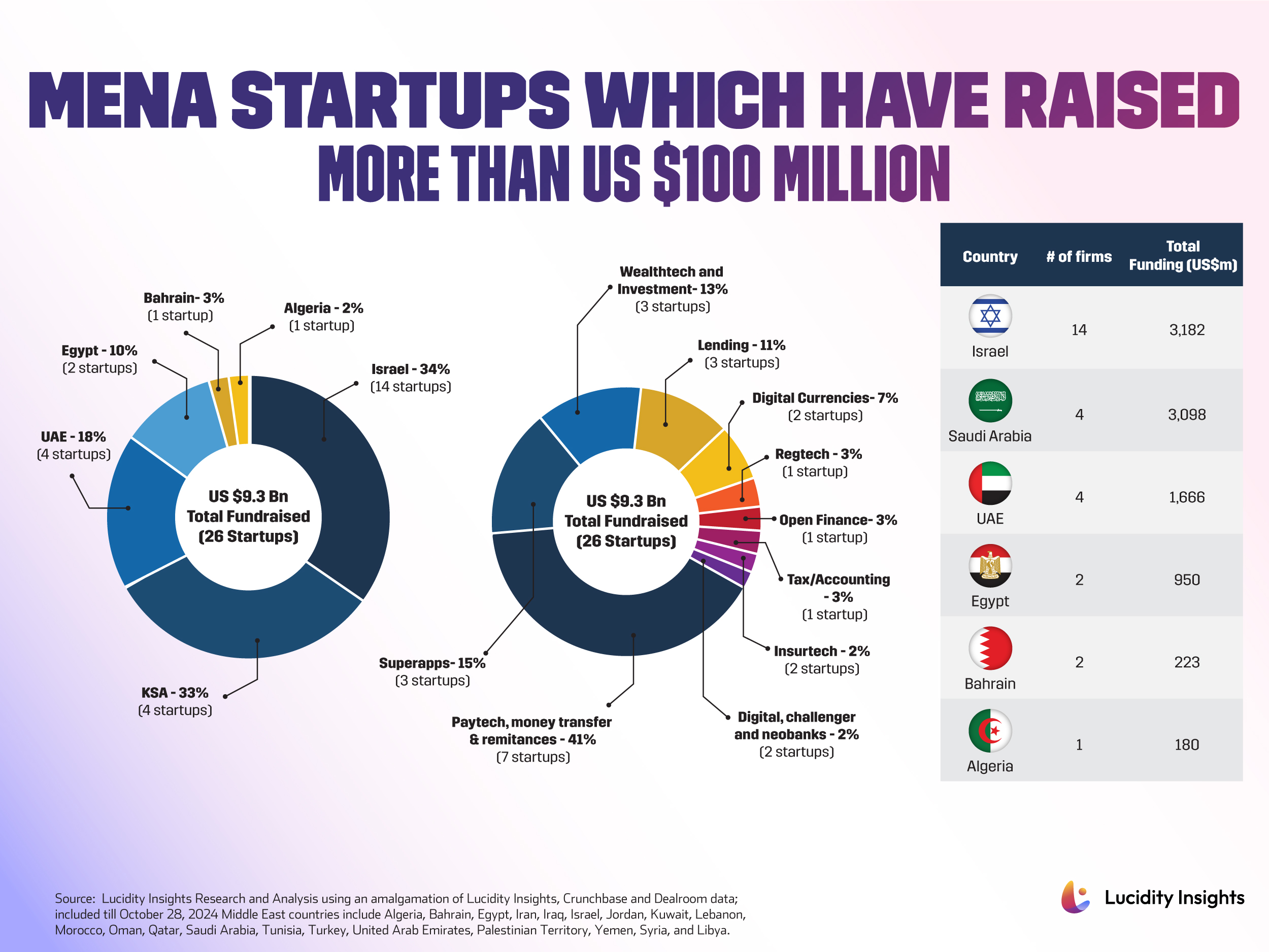

4. MENA: Home to 26 Fintech Soonicorns

There are 26 Fintech soonicorns in MENA, if fundraising US $100 million or more is of any indication. Fourteen out of the 26 soonicorns (27%) are Israel-based, having raised over US $3.1 billion collectively over their lifetime. Four Saudi Arabian Fintechs have also fundraised over US $3 billion collectively, showcasing how valuable Saudi Fintechs are at present, and how much more valuable they are than Israeli or UAE Fintechs (If you’re wondering why this is the case, it’s likely based on simple demographics. The UAE and Israel cater to just over 10 million people, while Saudi Arabia’s population is nearly 4 times that).

Four Fintech startups based in the United Arab Emirates have collectively raised over US $1.67 billion as well. There are also startups from Egypt, Bahrain, and Algeria on the list, with Fintechs in payments raising the most capital, at 41% of US $9.3 billion collectively raised by these 26 regional soonicorns. Superapps, wealth and investment startups, and lending startups are the top Fintech sub-sectors that have collectively raised the most funding out of the soonicorn pool, coming in behind startups in the paytech, money transfer and remittances space.

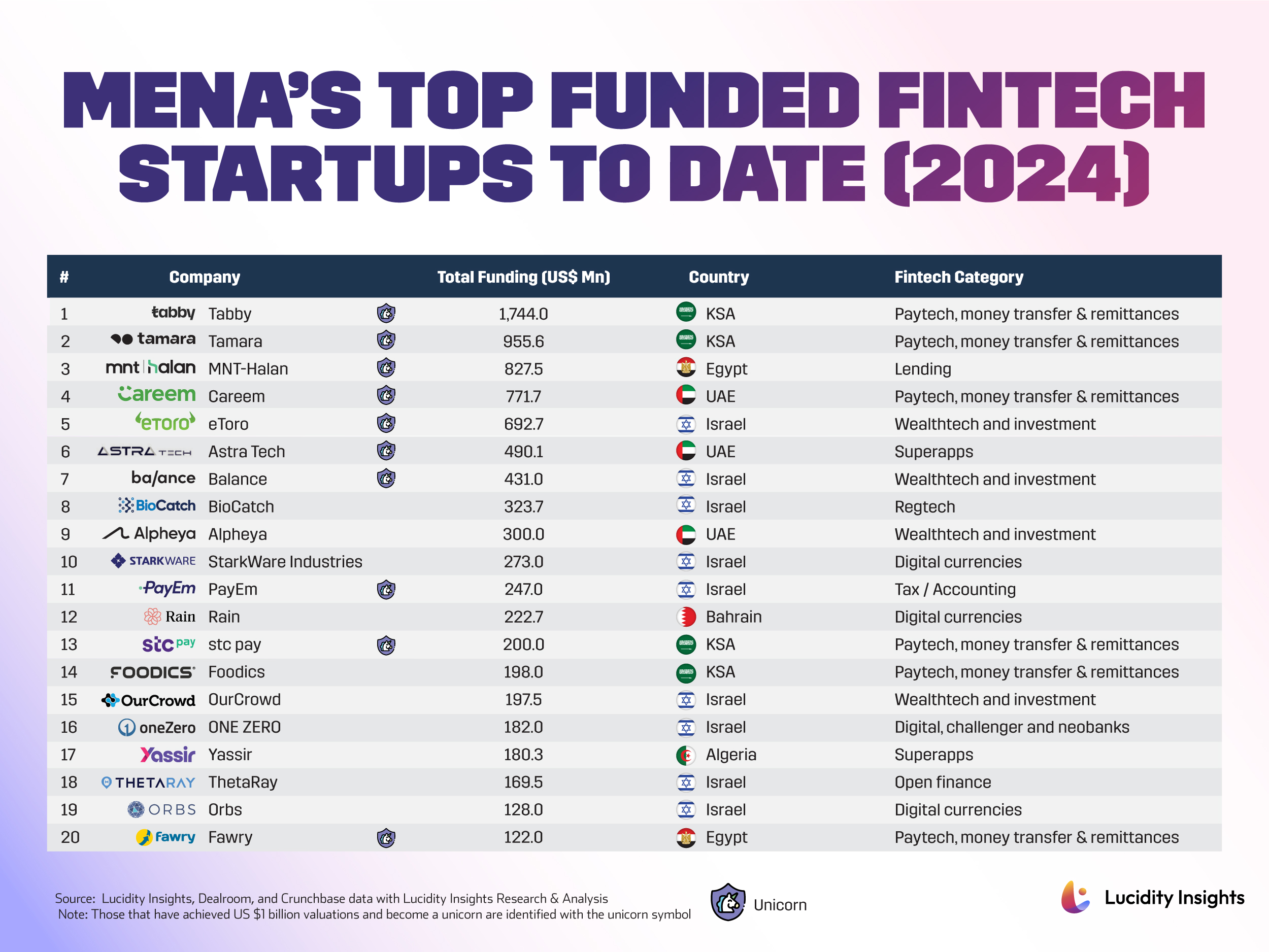

5. Here are MENA’s Most Funded Fintech Startups of All Time (2024)

The Top 20 most funded Fintechs in MENA span quite the fundraising range from Egypt’s Fawry raising US $122 million before IPO-ing in 2019, to the UAE-born, KSA-based, Tabby, who has raised over US $1.7 billion thus far and is rumoured to be preparing for its own IPO. Both are valued at over US $1 billion, but have raised starkly different figures to get to that coveted inner circle of Middle Eastern born unicorns.

There are also some cross-over Fintechs on this list, such as Careem, which was considered a mobility player, before it moved into remittances and wallets to become a regional SuperApp play. Foodics has traditionally been considered more of a foodtech or restaurant SaaS play, though its restaurant financing product has helped it venture more concretely into the Fintech space. Many of the region’s unicorns are on this list, and the rest we should keep a close eye on, as the next big unicorn is likely on this list too.

Also Read:

- Tabby, the First Independent Fintech Unicorn in the Middle East

- Fawry: Egypt’s Leading E-payments Player, and First Fintech IPO Success Story

- Foodics: The Region’s Most Prominent Foodtech-Meets-Fintech Player

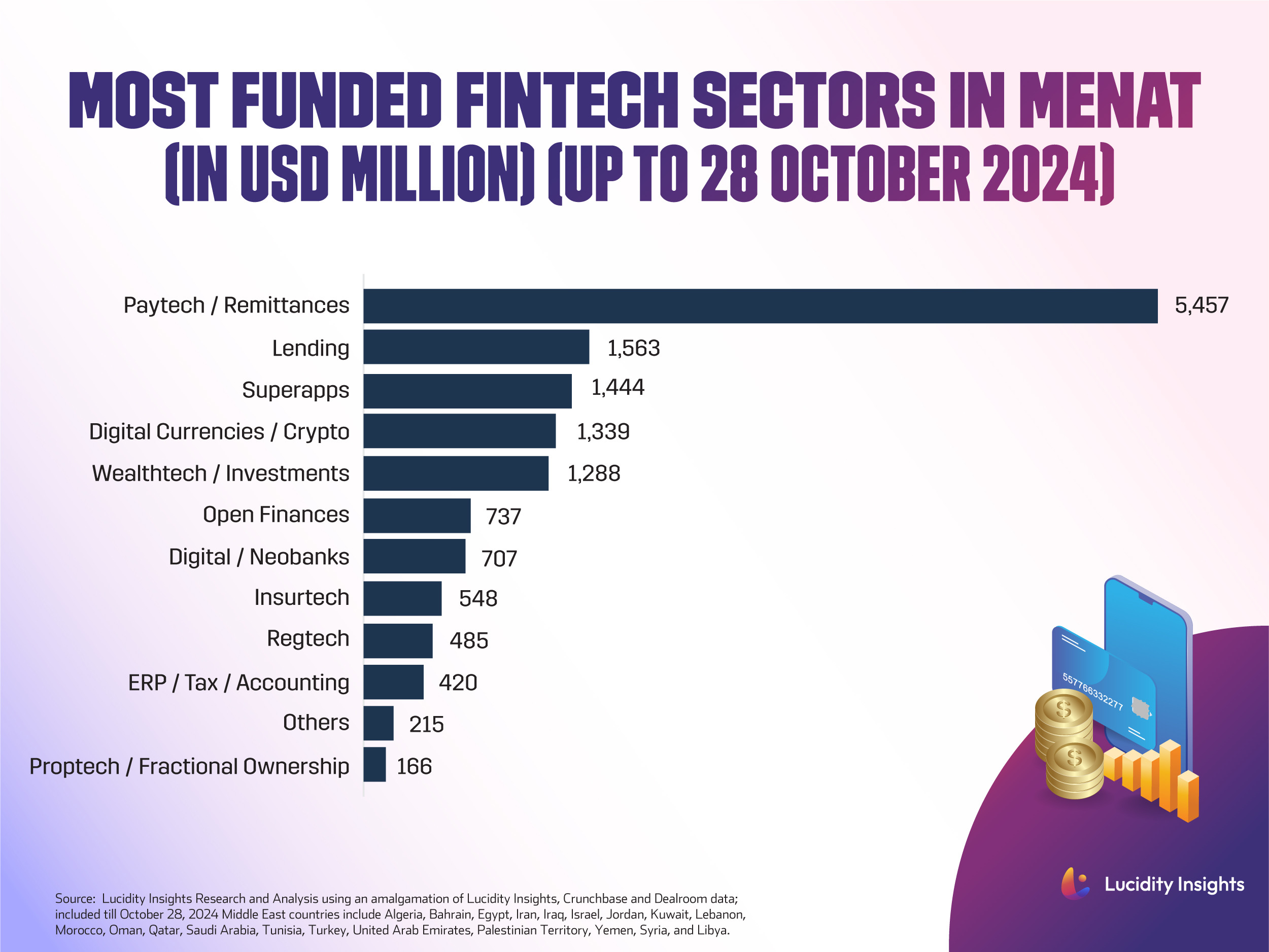

6. Most Funded Fintech Sector in MENAT to Date

As is the case in most parts of the world, Paytech, or tech startups in the payments and remittances space have been most largely funded in the MENAT region, accumulating over US $5.4 billion in funding over the last 20+ years since Fintechs began entering the Middle East scene. But as the region’s startups are getting more advanced, fundraising figures are fast catching up, with Lending, SuperApps and Digital Asset or Crypto and Wealthtech startups fundraising and attracting large swaths of capital too.

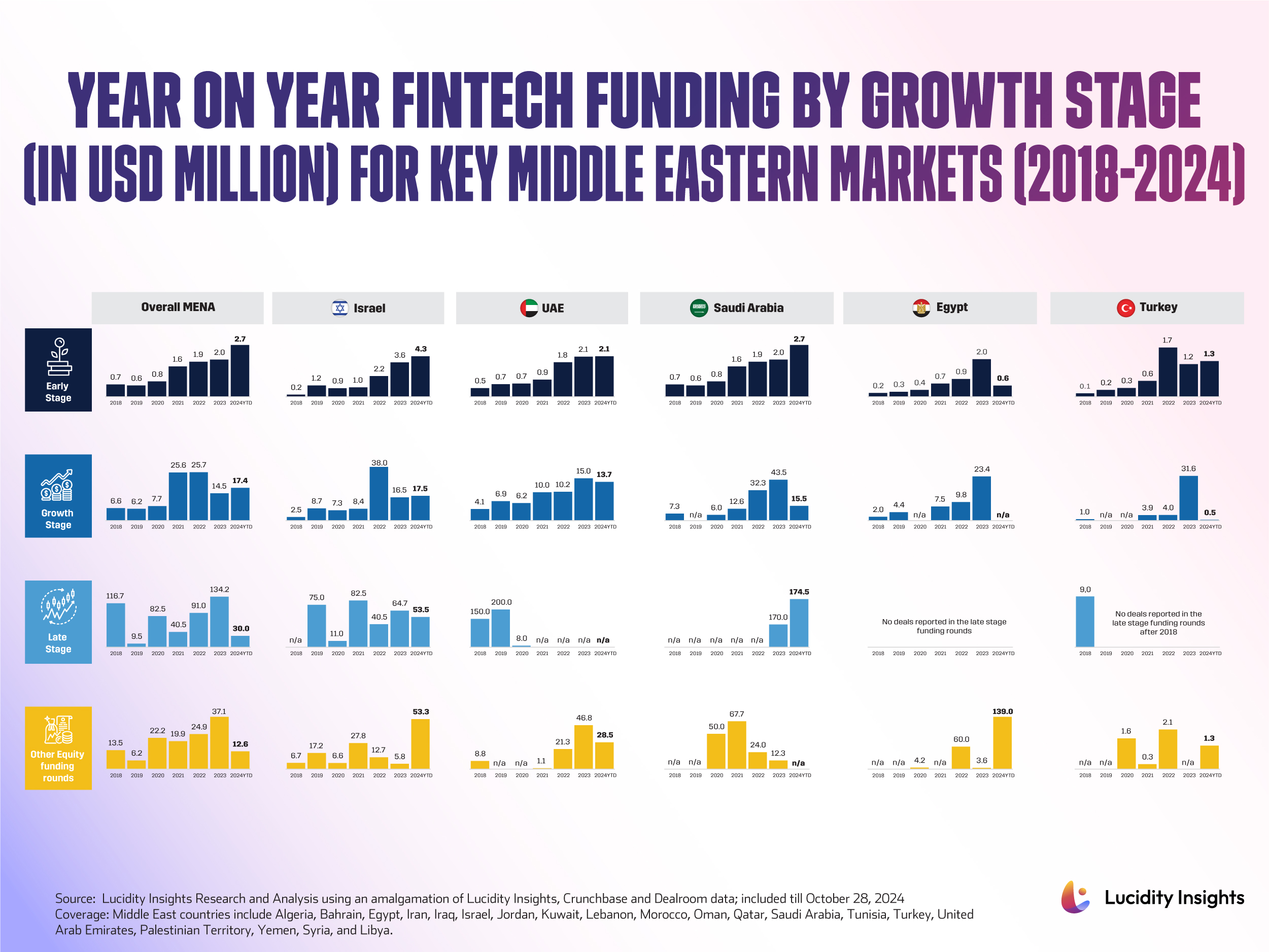

7. MENA Macro VC Investment Trend by Startup Growth Stage and Country (2018-2024 YTD)

This would be considered the ‘Data Dump Goldmine' that helps us understand the maturity of different Fintech markets, and key trends across the highest performing Middle East markets over the past six to seven years. It tells us that in early stage Fintechs, average funding deal sizes have increased over time across all key markets in the Middle East. For growth stage funding rounds, different countries have peaked deal sizes at different times - but most saw 2023 as a highlight year.

Late stage investments vary across the board, as Israel has an older, more developed sector, while some key UAE-based later-stage Fintechs have opted to move headquarters to KSA to attract financing and seek out IPO exits. Egypt and Turkey seem to be in too early its startup ecosystem development to have any late stage Fintech funding rounds, showing us that every country has a different definition to “nascent stage”.

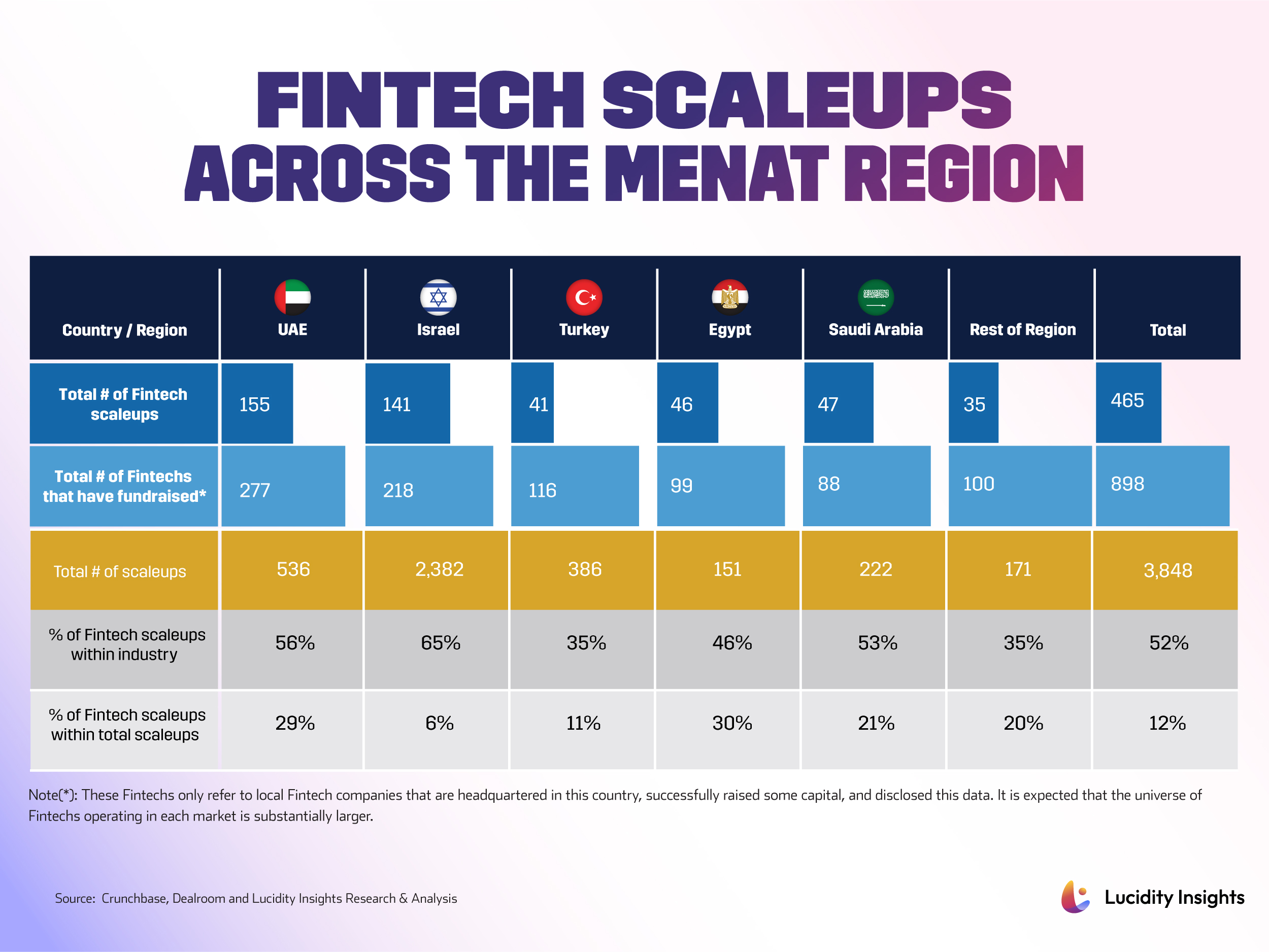

8. UAE is home to the Most Fintech Scaleups in the Middle East

The UAE is home to the most Fintech scaleups at 155 that have raised over US $1 million or more. That’s more Fintech scaleups than Israel, which is quite the feat - as Israel is known to be a Fintech and cybersecurity powerhouse - not just in the region, but across the World. Of course quality is more important than quantity, but as many Fintechs around the world (including Israeli Fintechs) move headquarters to Dubai, there is something brewing there.

But it’s not a landslide victory for the UAE Fintech scene; Israel follows close behind at 141, then Turkey, Egypt, and Saudi Arabia follow in the distance, rounding out the top 5 markets producing Fintechs that have been backed by substantial investor cash - with 41, 46 and 47 Fintech scaleups each, respectively. The UAE’s ease of doing business, English business language, globalized and international workforce, and transparent financial regulatory infrastructure is likely key reasons as to why it’s home to more successfully fundraised Fintech startups than any other country in the region.

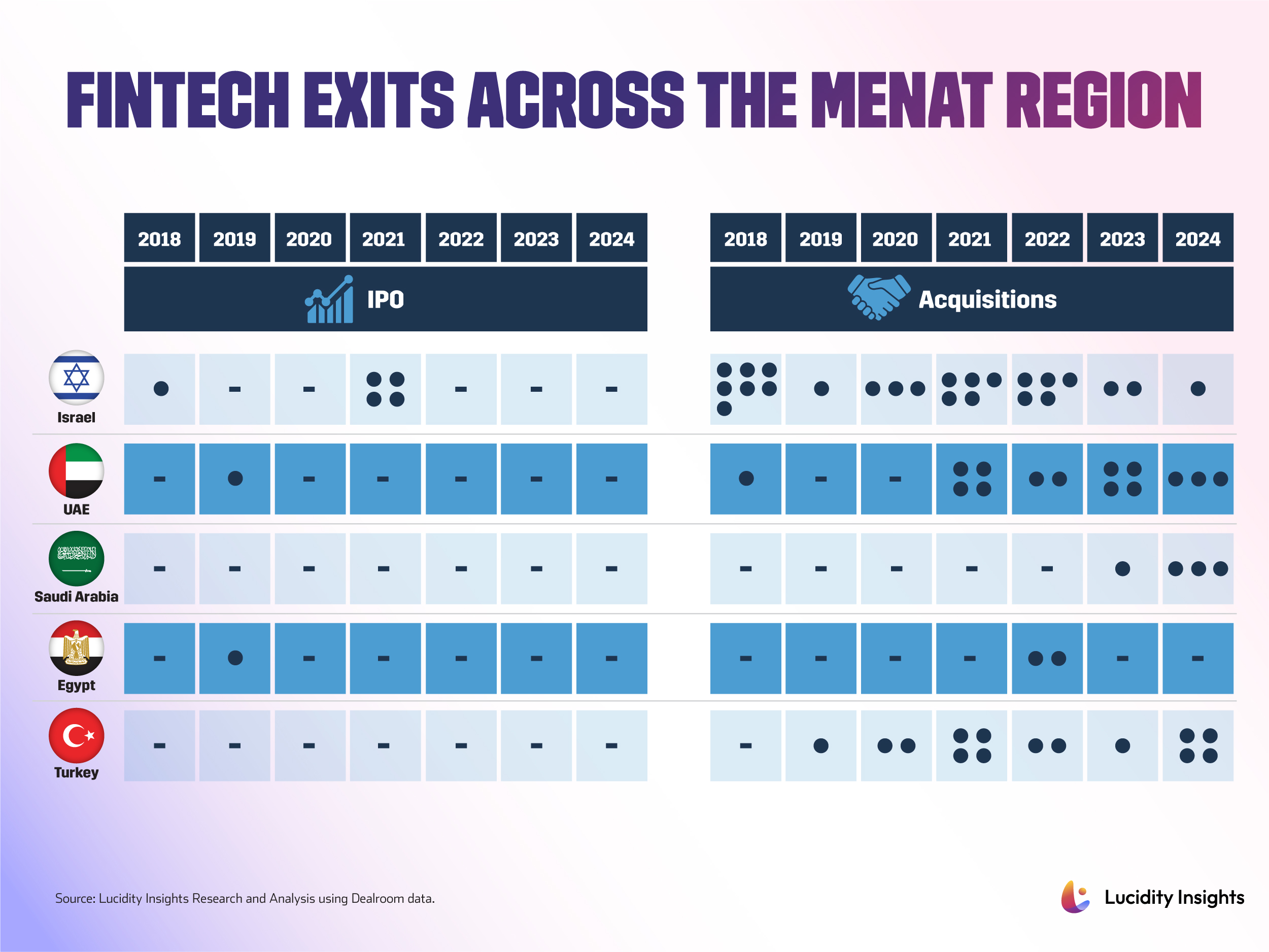

9. 66 Fintech Exits in the past 6 Years

There have been 66 exits in the Middle East and Turkey Fintech space over the past 6 years, of which only 7 were IPOs. Acquisitions and Buyouts is the main off-ramp for startups in the region, of which Israel has had the most exit success, with 29 exits since 2018; rounding out the top 3 markets is the UAE and Turkey, which had 15 exits and 14 exits, respectively. Israel, UAE, and Egypt are the only markets that have had Fintech startups successfully IPO over the years.

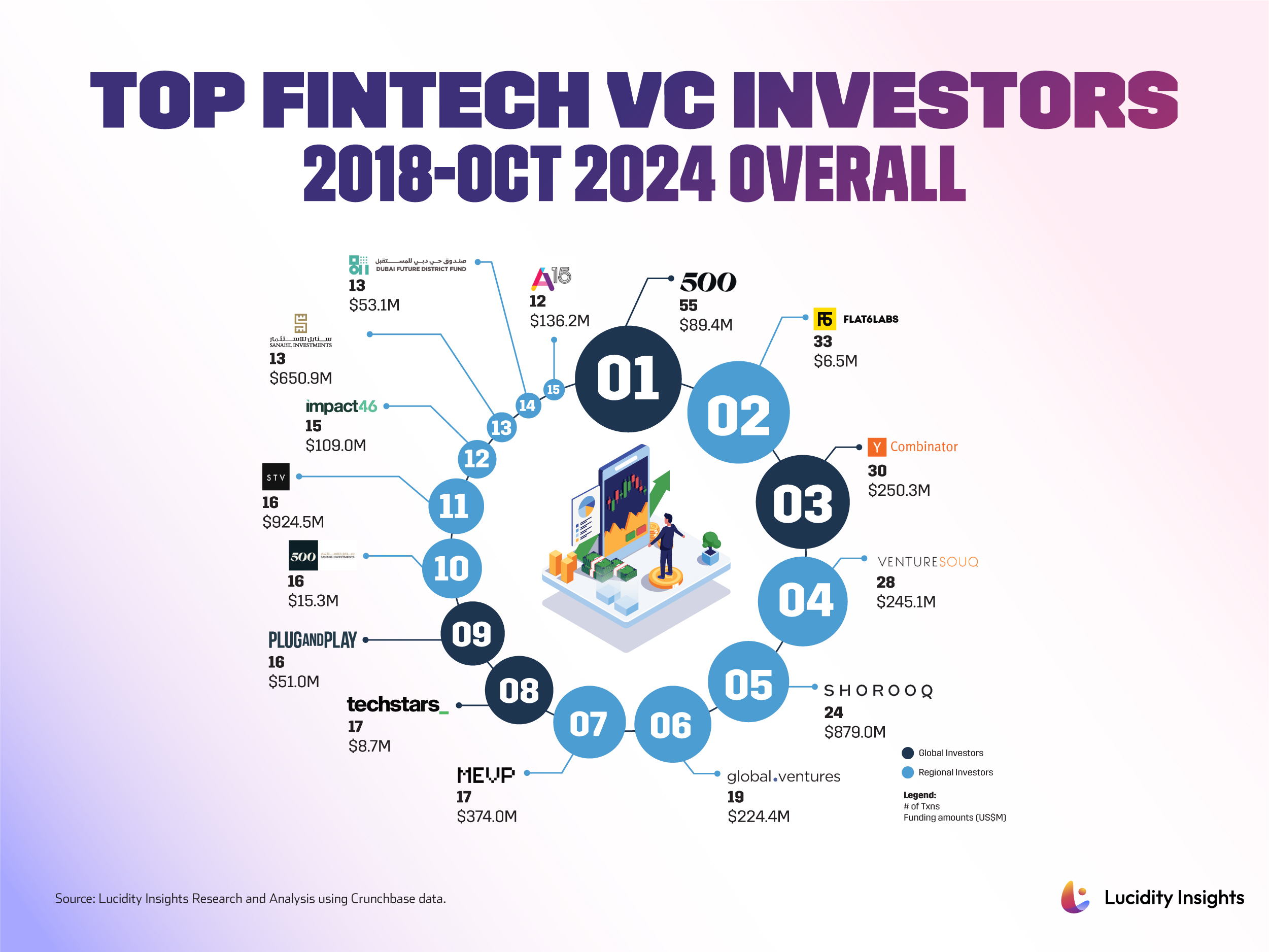

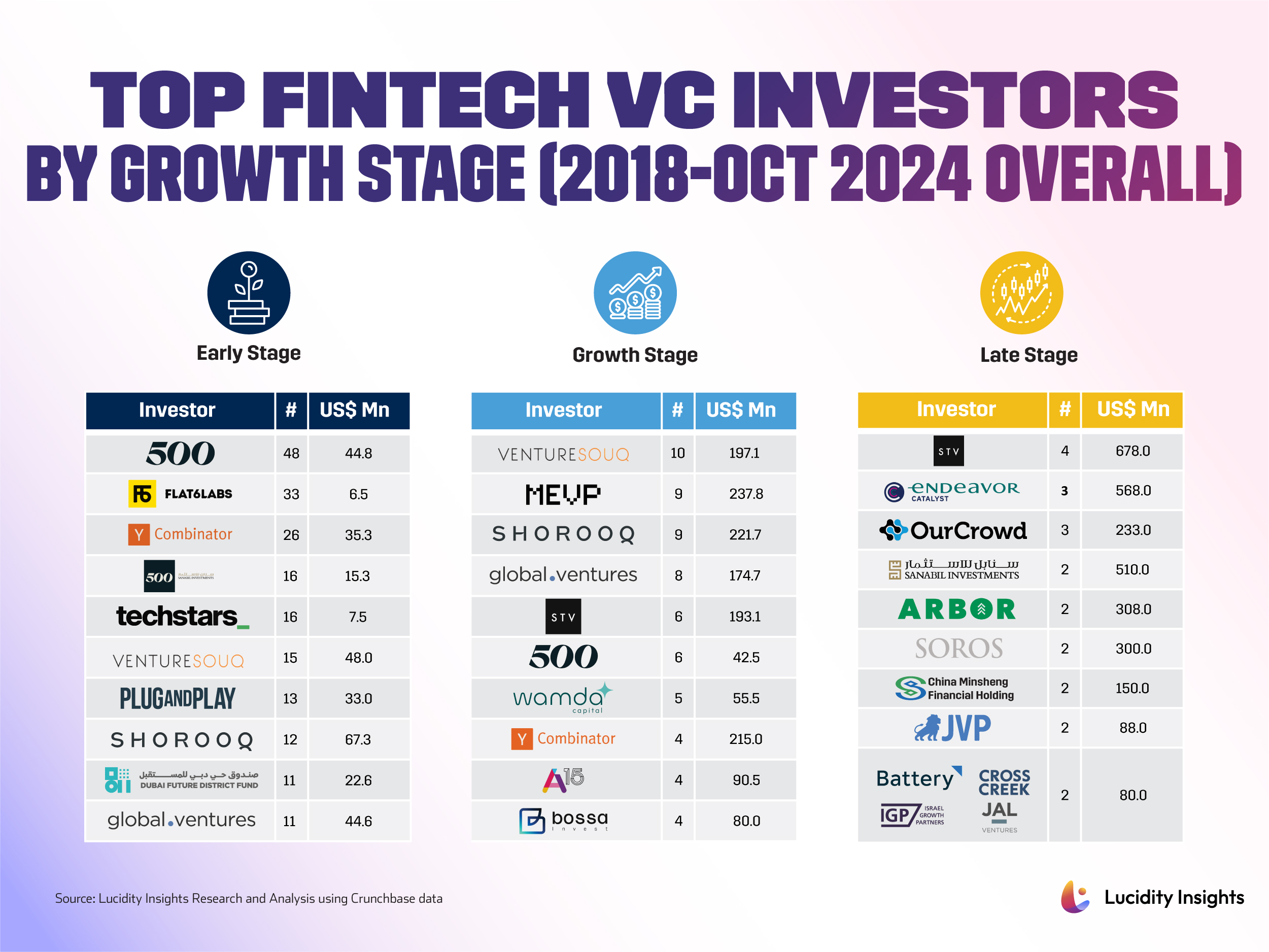

10. Top Fintech Investors in MENAT

The region is rich in Fintech investors, whether they are incubators and accelerators or venture capitalist players investing in the Middle East, Africa and Turkey’s Fintech scene from here or abroad. Of course, incubators and accelerators that have set themselves up regionally - players like 500 Global, Techstars, Plug and Play, and Flat6Labs tend to have higher investment numbers by the nature of their structure, and the volume of startups going through their programs annually. Even Silicon Valley’s Y-Combinator has made 30 investments in Middle East Fintechs amounting to over US $250 million collectively over the past 6+ years.

When we look at all investments made from 2018 to Q3 2024, the heaviest hitter for regional Fintech investments is STV out of Saudi Arabia, who has invested over US $924 million across 16 regional Fintechs; this comes as no surprise, as STV is one of the few later stage investors in the region, investing only in startups that are at the Series B stages or higher which always has larger ticket sizes.

Abu Dhabi’s Shorooq Partners follows close behind STV with US $879 million invested across 24 regional Fintechs largely across Seed to Series A cheques. Dubai’s MEVP falls in a distant 3rd place, when you look at investment amounts at US $374 million across 17 Fintech deals, as a largely growth stage investor in the Series A category.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)