Geidea: Driving Saudi Arabia’s Cashless Revolution in Support of Vision 2030

13 March 2025•

Though there were several Fintech players active in the Saudi Market prior to 2016, activities were largely unregulated and unsupported by a wider economic infrastructure. Upon the unveiling of the Saudi Vision 2030, several organizations and initiatives were birthed specifically to support the cultivation of the Fintech industry, including the launch of SAMA’s Regulatory Sandbox and CMA’s Fintech Lab, the establishment of Fintech Saudi, a government-backed organization directly mandated to monitor and actively support the development of the Fintech sector.

The Fintech ecosystem has grown rapidly. A cornerstone of this transformation is the country’s shift toward a cashless society, with noncash transactions taking center stage in the modernization of the economy. Among the players shaping this new financial landscape is Geidea, a Saudi-founded Fintech company that has expanded its reach and influence over the past 15 years. Established in 2008, Geidea began with a mission to democratize payment technology and empower businesses, particularly small and medium enterprises (SMEs). Today, it stands as one of the leading Fintech companies in the Kingdom, playing a pivotal role in the broader push for financial inclusion and digital transformation.

Vision 2030 and the goal for a cashless society

Saudi Arabia’s Vision 2030 outlines an ambitious blueprint for economic diversification and modernization, with technology and financial inclusion playing key roles. A central pillar of this transformation is the transition to a cashless society, designed to increase efficiency, enhance transparency, and drive economic activity through digital payments.

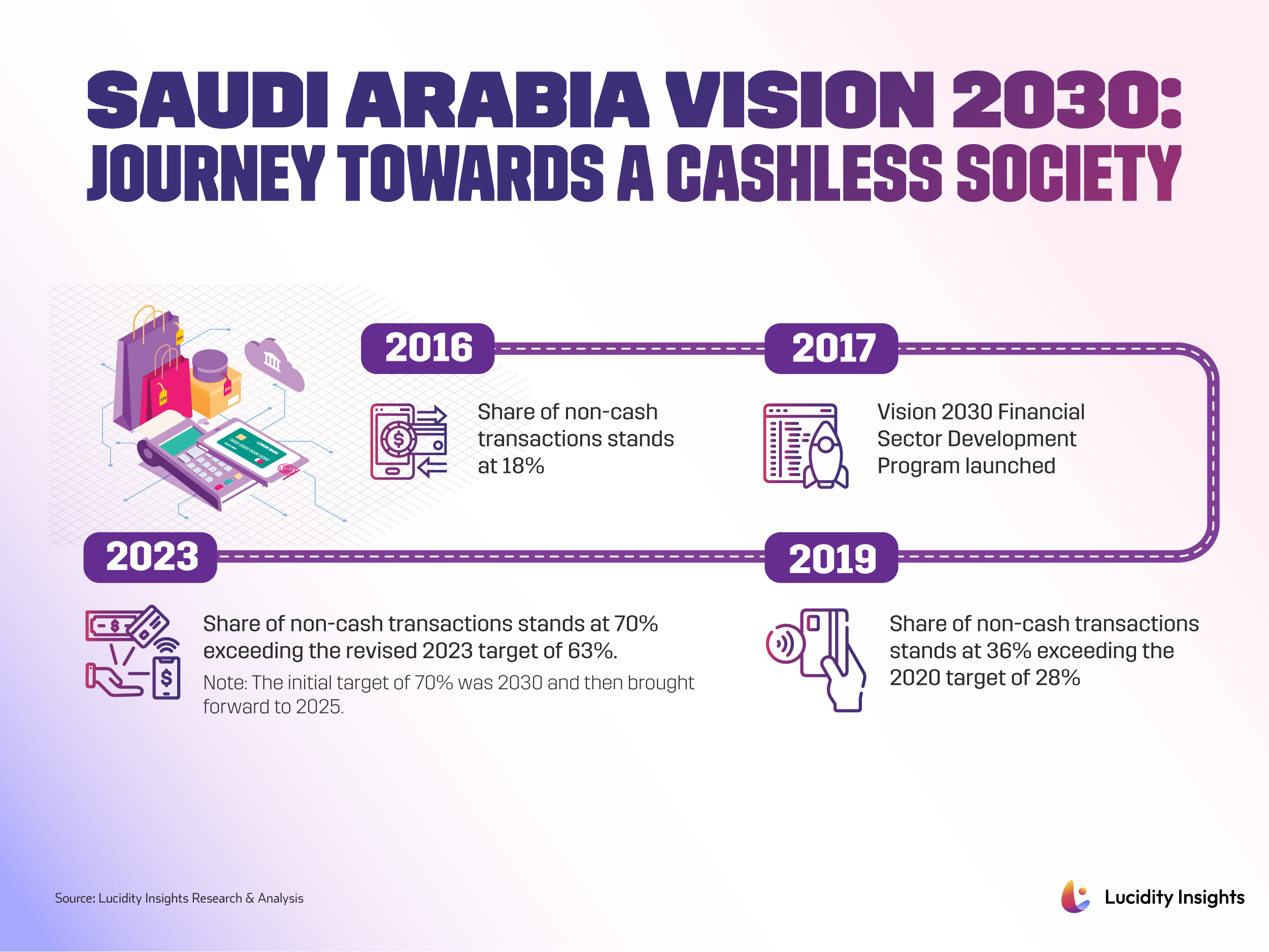

In 2016, cash dominated Saudi Arabia’s economy, with only 18% of all transactions conducted electronically. Recognizing the need to modernize, the Saudi government set progressive goals to increase the share of noncash transactions. By 2019, noncash payments had doubled to 36%, reflecting the impact of early regulatory initiatives and the growing adoption of digital payment technologies. The pace of growth accelerated significantly in subsequent years, and by 2023, Saudi Arabia not only surpassed its interim target of 63% but also achieved its 2030 goal of 70% non-cash transactions—seven years ahead of schedule.

Saudi Arabia Vision 2030: Journey Towards a Cashless Society

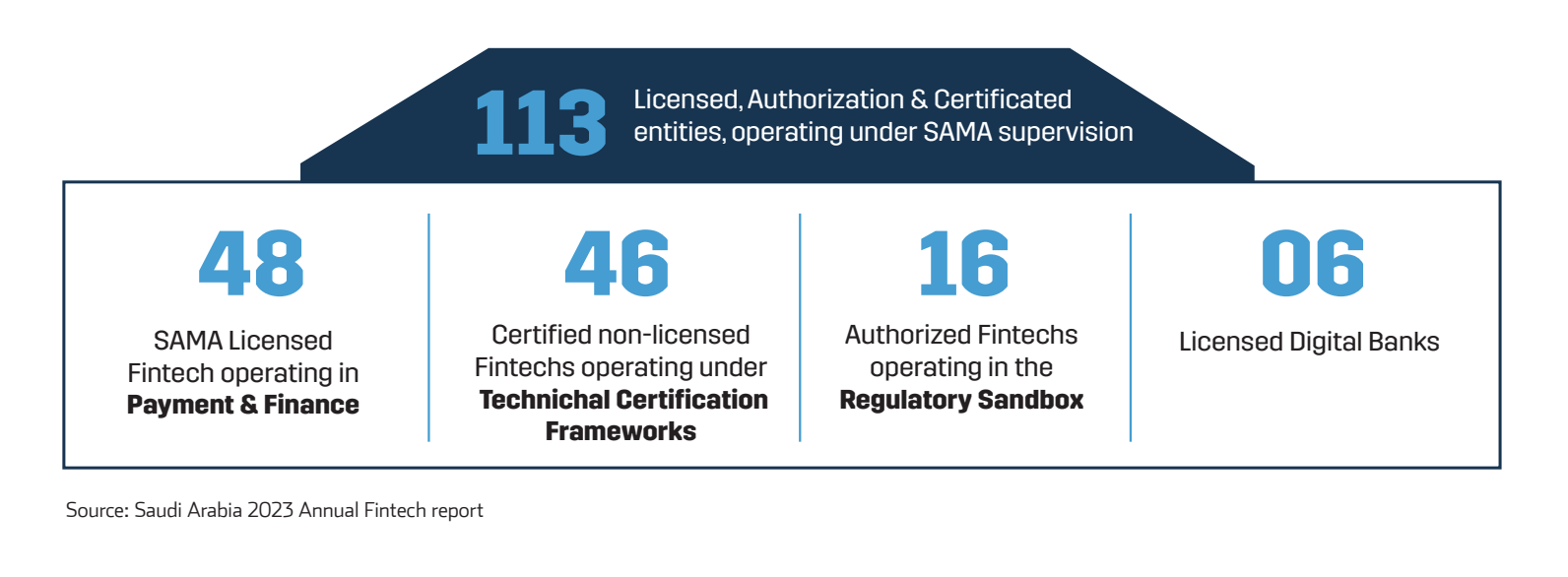

The Fintech sector has been instrumental in Saudi Arabia’s cashless journey. According to the 2023 Annual Fintech Report, the country is home to 216 operational Fintech companies, representing a vibrant ecosystem that supports the Kingdom’s financial transformation through, for example, infrastructure development. Notably, 33.3% of these Fintechs specialize in payments, underscoring the critical importance of digital transaction technologies.

Under the supervision of the Saudi Central Bank (SAMA), 113 Fintech companies are officially licensed, with 48 operating in payments and finance. This regulatory framework ensures the stability and scalability of the Fintech sector, while encouraging innovation to meet the needs of consumers and businesses that have sifted dramatically. Everyone remembers the COVID-19 pandemic and how it accelerated digital payment adoption across the Kingdom.

Geidea’s Story

Abdullah Faisal Al Othman, Founder & Chairman of Geidea

In 2008, Abdullah Al-Othman identified a significant gap in the Saudi market: merchants, particularly SMEs, lacked access to affordable and intuitive payment solutions. Recognizing the impending digital revolution, Al-Othman established Geidea to democratize payment technologies, aiming to empower SMEs and foster financial inclusion. The company’s name, derived from the Arabic word for “idea,” reflects its commitment to innovative problem-solving.

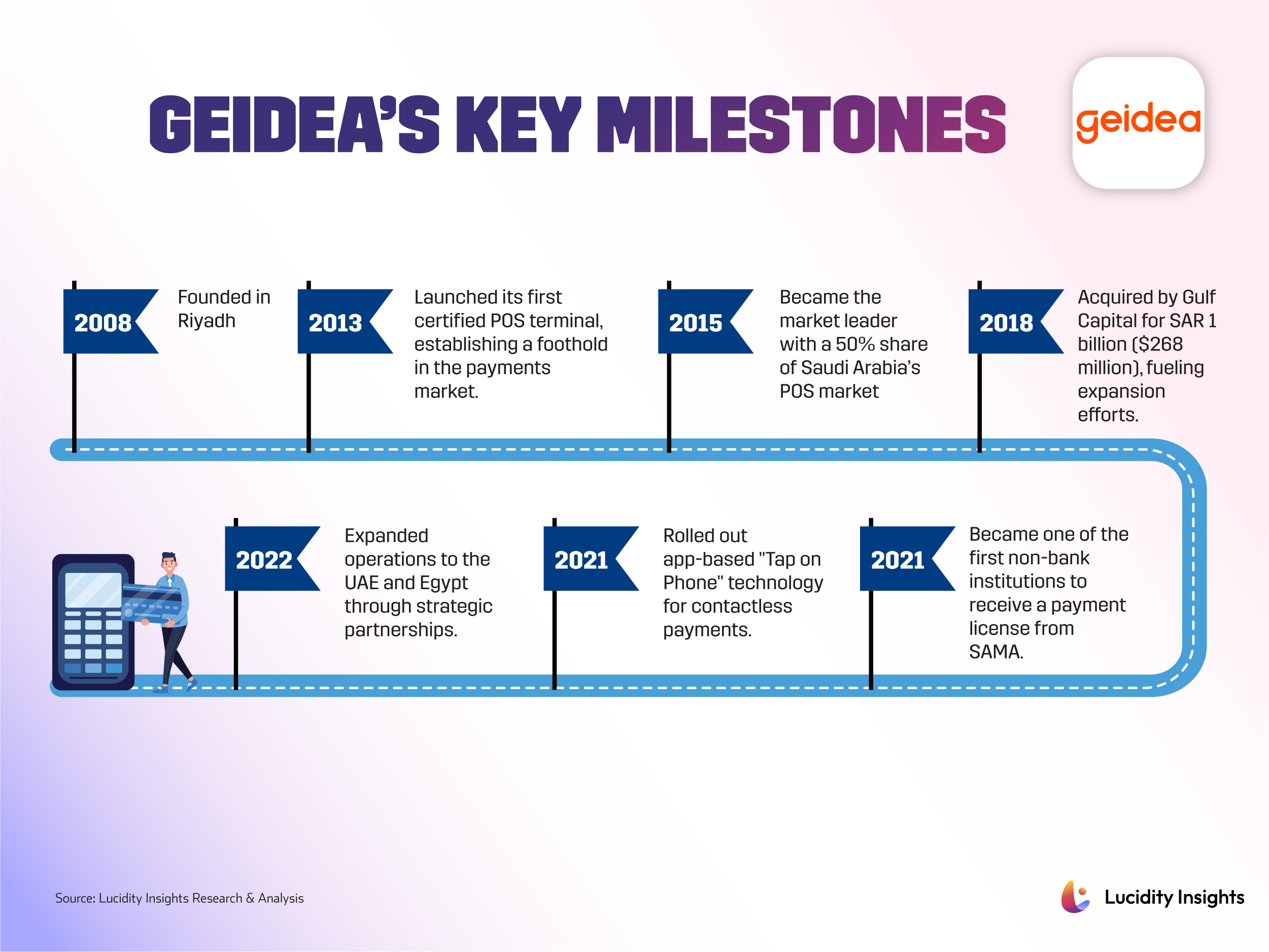

Geidea’s mission has been to serve as an enabler for the business environment, reducing the time and costs associated with setting up businesses for small merchants. By leveraging emerging digital technologies, Geidea sought to enhance customer experiences and integrate SMEs into the high-tech ecosystem. Geidea’s early focus was on developing and deploying point-of-sale (POS) systems tailored to the needs of the local market. The company’s first product launched in 2011, but it wasn’t until 2013 when they launched their first certified POS terminal. Within two years, Geidea had captured 50% of Saudi Arabia’s POS market share, becoming a leading provider of payment solutions in the Kingdom.

In 2018, Gulf Capital’s acquisition of Geidea for SAR 1 billion (US $268 million) provided the financial impetus for the company’s expansion. This investment facilitated the enhancement of Geidea’s product offerings and supported its expansion plans. The transaction came just days after the launch of SAMA’s regulatory sandbox designed to foster innovation in the financial sector by providing a controlled environment for Fintech companies and financial institutions to test and develop new products and services.

In March 2021, Geidea, alongside STC Pay, became one of the first non-bank financial institutions to obtain a payment license from SAMA. This authorization enabled Geidea to process payments directly, eliminating the need for traditional banking intermediaries and allowing the company to offer comprehensive payment solutions. In the same year, Geidea became the first in the region to develop an app-based contactless “tap on phone” solution empowering SMEs with a simple way to process customer payments, without a separate payment (POS) terminal or connection.

Building on the momentum of their mobile solution, Geidea formed strategic partnerships with global payment leaders Mastercard and Visa, as well as with the Saudi British Bank (SABB). These collaborations have been instrumental in scaling Geidea’s technologies across the region and expanding its reach in key markets. In 2022, Geidea extended its services to Egypt and the UAE, targeting markets with burgeoning digital economies and substantial SME sectors. Partnerships with institutions like Banque Misr in Egypt and Magnati in the UAE facilitated the localization of Geidea’s offerings.

Also Read: Geidea Brings SoftPos Service to Egypt After Success in Saudi Arabia and UAE

Geidea’s integration into national systems, such as the National Payments System (MADA), and its participation in SAMA initiatives like QR-code payment standards, further solidified its position within Saudi Arabia’s Fintech ecosystem.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)