Ranking Mena Markets by Size of Fintech Opportunity

03 June 2022•

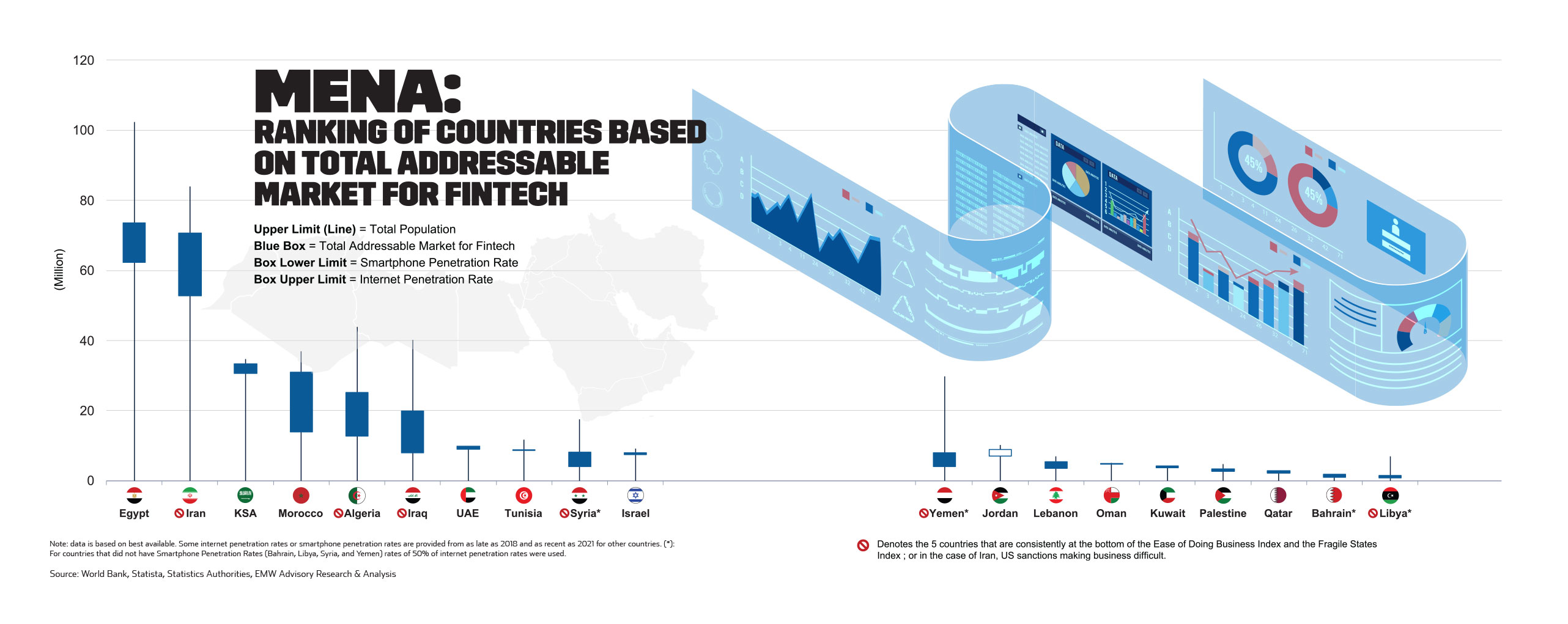

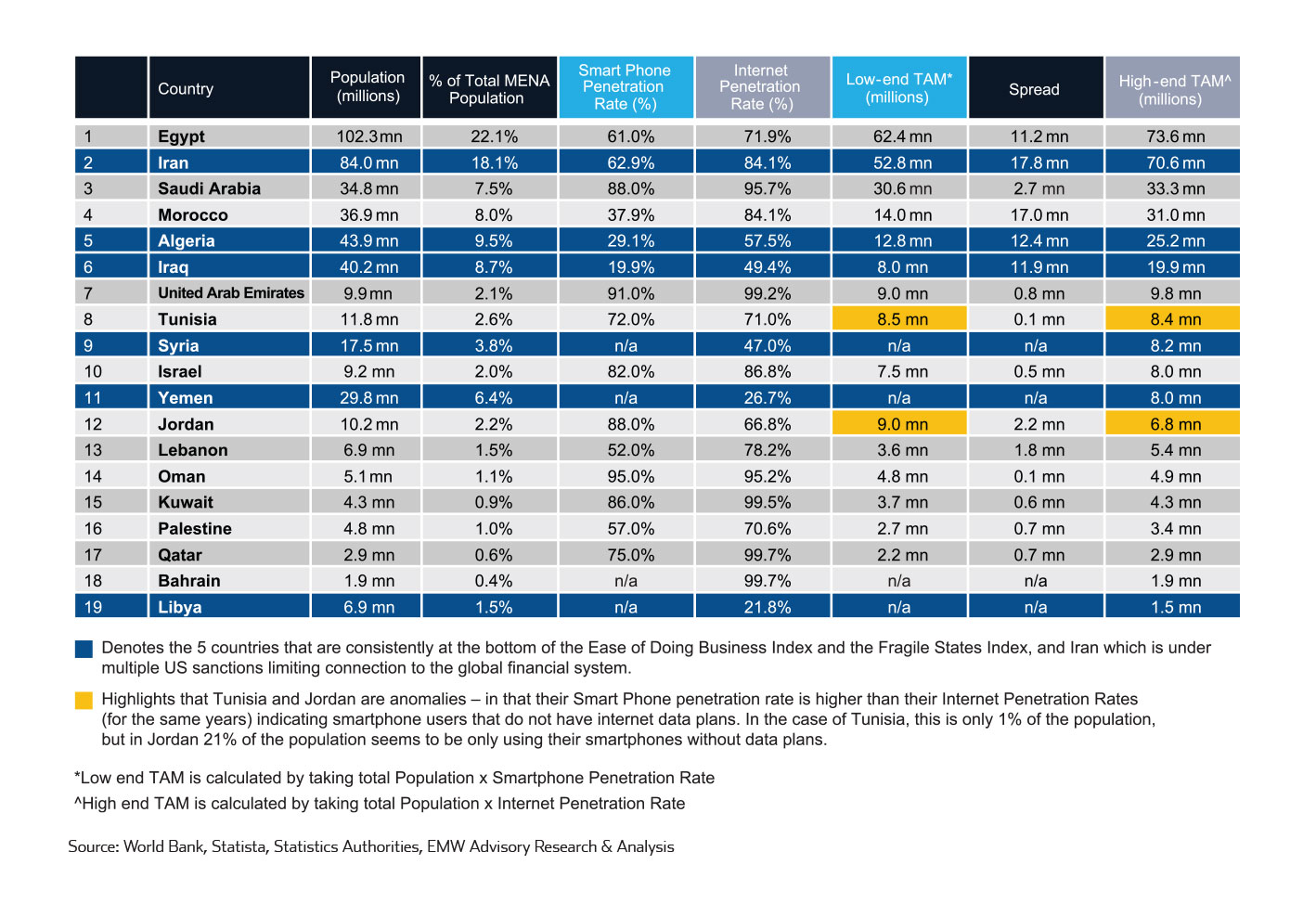

The diagram above illustrates all 19 MENA markets in ranking order of “Size of Fintech Opportunity”, which is in effect, each market’s Total Addressable Market Size for Fintech. In first place is Egypt, which is the most promising and lucrative Fintech market, and in last place is Libya, which is the least attractive Fintech market.

Egypt is the most attractive, as it has between 62 to 72 million potential fintech customers today, out of Egypt’s total 102 million inhabitants. The line indicates the total potential market, which is the total population. The blue box indicates the current Total Addressable Market (TAM). The range of the Total Addressable Market is determined by the smartphone penetration rate (lower limit), and the internet penetration rate (upper limit).

Saudi Arabia is the second most attractive market, as it has between 30.6 million and 33.3 million potential fintech customers, out of Saudi’s 34.8 million inhabitants. The Islamic Republic of Iran would have taken the 2nd place ranking from a Total Addressable Market (TAM) perspective, but ongoing US sanctions against Iran have made banking and finance in Iran challenging, to say the least.

In addition to Iran being siloed out and unplugged from the international finance system, Iran, like Israel, are outliers in the MENA region with regards to operating language; Iran’s primary language is Farsi and Israel’s is Hebrew, while the rest of the MENA market operates on a mix of Arabic and English or French. As such, from the perspective of a global fintech investor or a global fintech entrepreneur looking to create a fintech service that defies borders, and can quickly be transplanted across multiple geographies, Iranian fintechs come with a host of political, commercial and logistical challenges.

Interestingly, the top 5 markets remain consistent regardless of using smartphone or internet penetration rates: Egypt, Iran, Saudi Arabia, Morocco and Algeria – which consistently come up with the largest consumer populations for fintech adoption. The graph also highlights the 5 markets which consistently come up as the most difficult markets to do business in and have the most fragile states – Yemen, Libya, Syria, Iraq and Algeria – which can and should also feed into conversations between go-to-market implementers, growth analysts, investors and fintech entrepreneurs. For the purposes of this report. Thus, these countries that have ranked lowest in the world for ease of doing business have been removed from the ranking.

When Anomalies tell a story

There are also a few anomalies found in the data that tell an interesting story. There is an inverse set of data presenting in #8 Tunisia and #12 Jordan. In both of these markets, Tunisia and Jordan, there are more individuals with a smartphone than with access to the internet.

In the case of Tunisia, this is only a 1% difference, which means that 1% of the population own smartphones without data plans. In Jordan’s case, this is significantly more pronounced, where 21% of the country’s population has a smartphone and does not have a data plan associated with their smartphones. In both cases, it may mean that more individuals are finding ways to access the internet on a part-time basis. The largest differential spread in the data between the Smartphone Penetration Rate and the Internet Penetration Rate is found in Morocco, with a 46.2% difference (38% smartphone penetration vs 84% internet penetration), followed by Iraq (30% difference), Algeria (28% difference), and Lebanon (26% difference).

%2Fuploads%2Fmena-fintech%2Fcover4.jpg&w=3840&q=75)