Investors Remain Bullish on Egypt’s Startup Ecosystem, Despite Falling on Hard Times in 2023

19 March 2024•

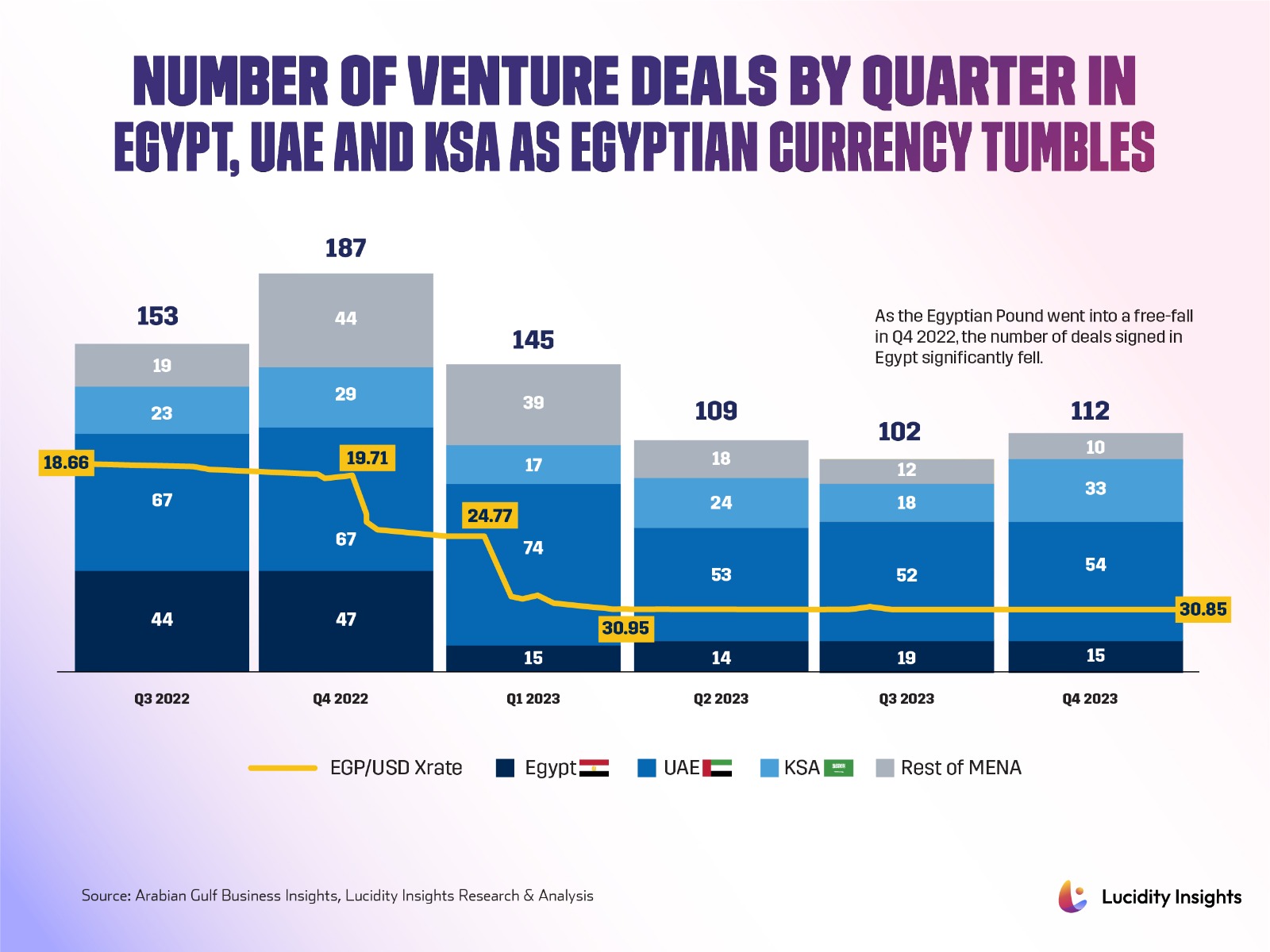

After several years of fast-paced growth and a stand-out performance year in 2022 in terms of startup fundraising and deal flow, Egypt’s startup ecosystem hit multiple speed bumps in 2023. The global VC winter had something to do with it, but run-away inflation and plummeting currency valuations compounded challenges for investors and startups alike. Still, and perhaps due to the current macroeconomic climate, many investors remain bullish about investing in the sector in 2024.

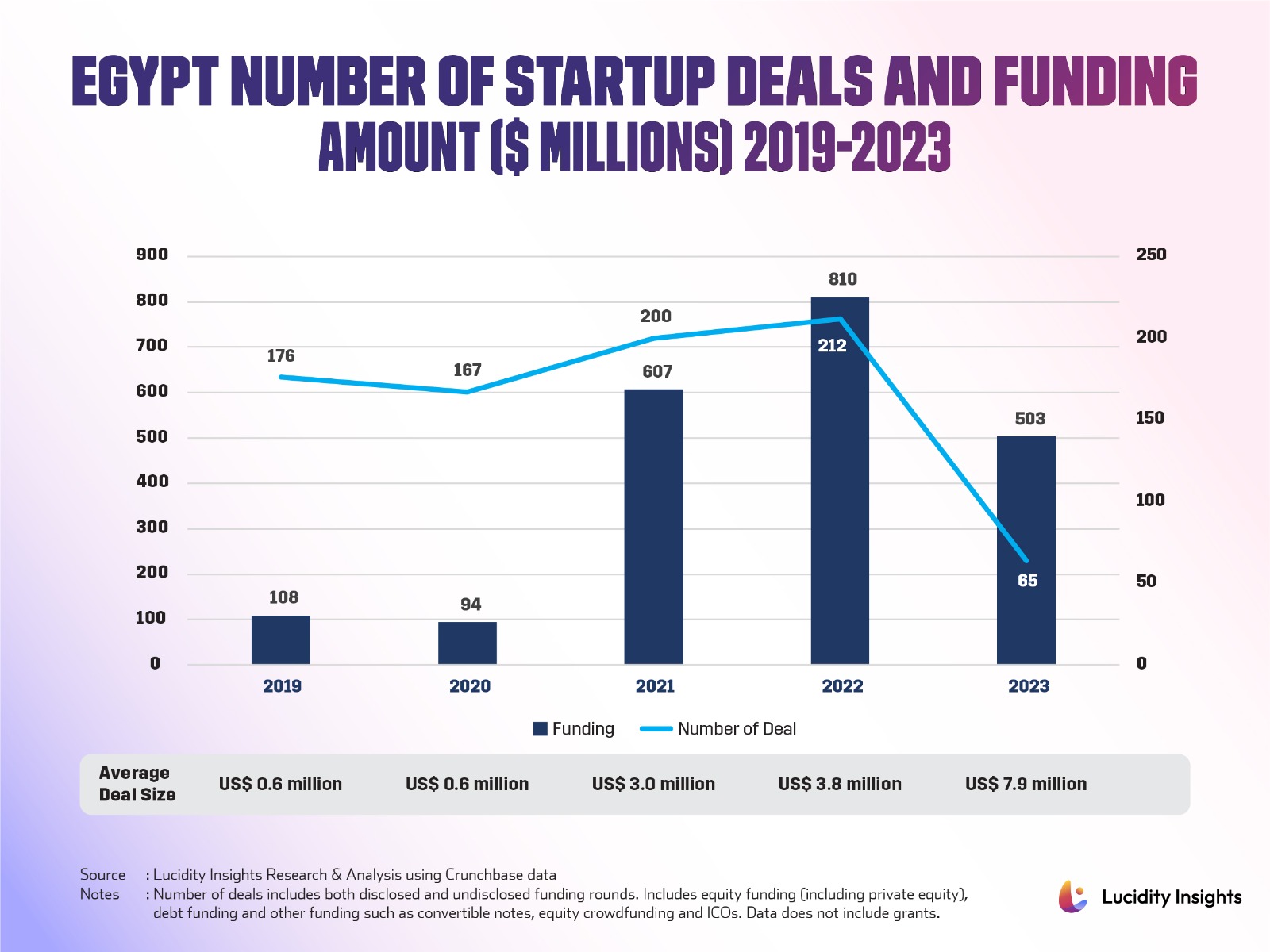

This month, Lucidity Insights partnered with Entrepreneur Middle East to publish a comprehensive Special Report, looking at Egypt’s startup and investor ecosystem titled, “Investing in Egypt’s Startup Ecosystem in 2024”. The special report looks at Egypt’s six to eight fold growth in startup funding, from averaging $100 million in annual funding in 2019-2020 and jumping to US $607 million in funding in 2021 to finally hitting an all-time high of US $810 million in 2022. The special report also details some of the challenges the ecosystem has faced in 2023, not just in terms of feeling the pinch of the global VC winter, but of run-away inflation and currency devaluation woes.

Egypt’s Entrepreneurial Potential

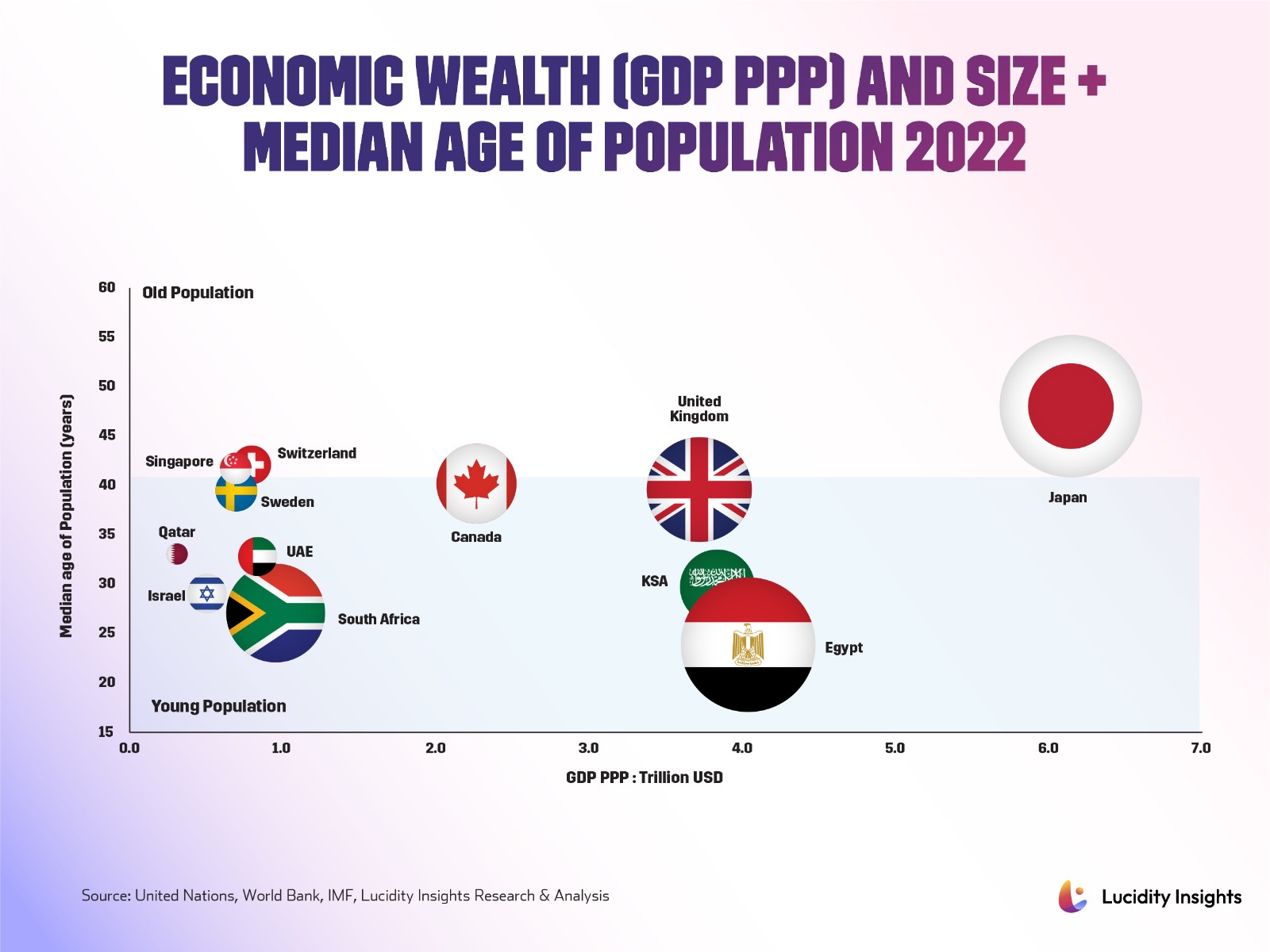

When you look at Egypt from a startup founder or investor viewpoint, it’s easy to see the potential. Egypt is MENA’s most populous country, Africa’s 3rd most populous market, and the world’s 15th most populous nation, being home to over 110 million inhabitants. And unlike many other African countries that have sometimes hundreds of languages spoken within its borders, Egypt is a homogenous country in terms of language and communication; this of course makes it easier for startups and developers to bring their products to market here.

Egypt’s population is also amongst some of the youngest and most digitally savvy in the world; 76% of Egyptians are under the age of 40, and 95% are smart phone owners, making the country ripe for consumer-tech startups looking to gain users. Literacy rates are high, internet penetration is amongst the highest in Africa at 70% (for comparison, China’s internet penetration rate is 76%), and the country produces over 500,000 graduates each year, 40% of which graduate from STEM fields.

The Egyptian government is also backing entrepreneurship. You don’t need to dig too far to understand why. Micro, small and medium enterprises (MSMEs) contribute over 40% to Egypt’s economy and account for over 75% of the country’s total employment. Egypt’s Vision 2030 is looking to diversify its economy beyond tourism, and technology and entrepreneurship is just one means of achieving its objectives.

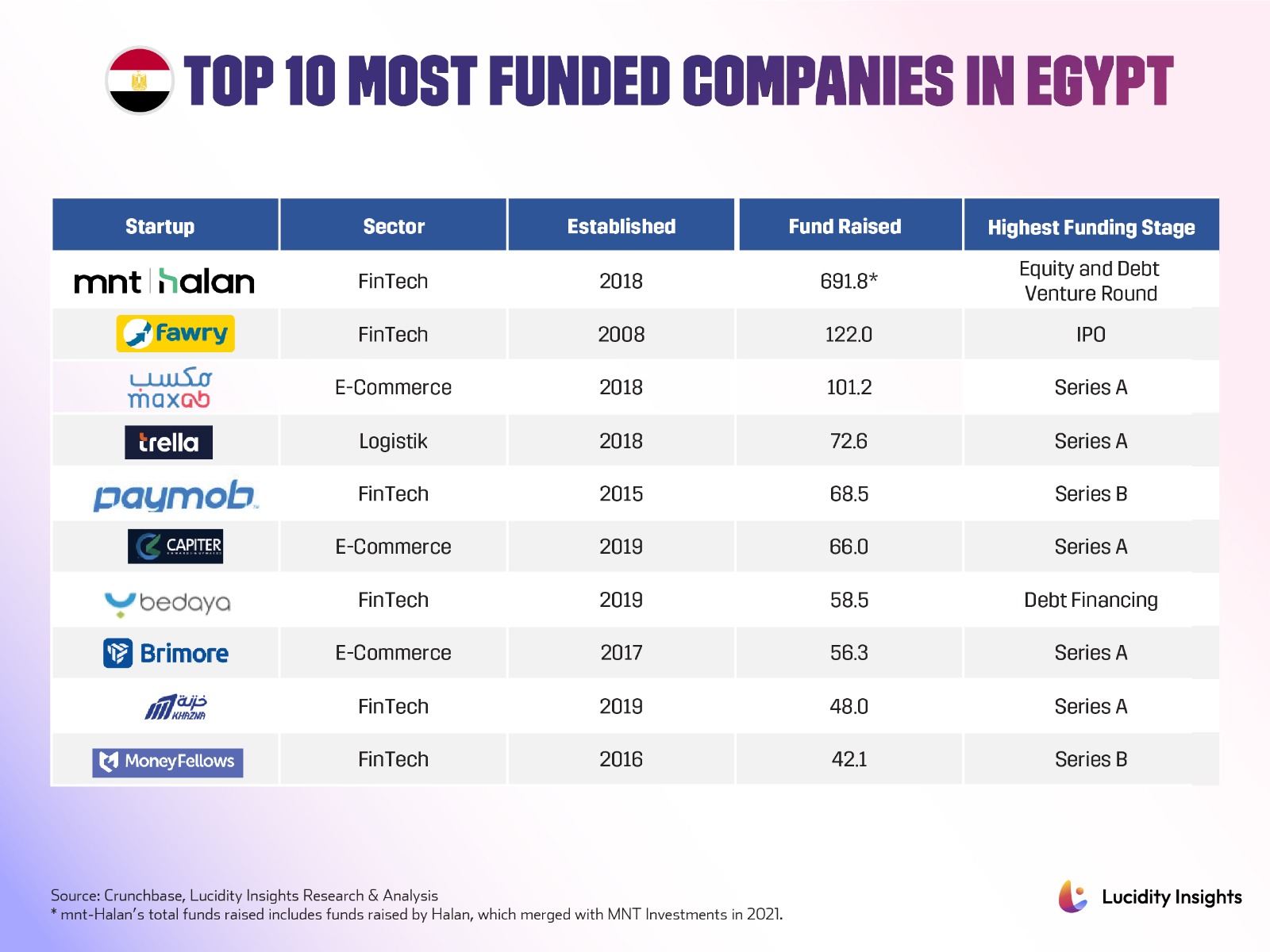

Egypt also consistently ranks among the top three startup ecosystems in terms of both VC funding and deals in both the MENA region (excluding Israel and Turkey) behind the United Arab Emirates and Saudi Arabia; and also top three in Africa, alongside Nigeria and South Africa. Even though Egypt has hit on hard times in 2023, it maintains this position, highlighting the resiliency of the tech ecosystem. It is also a top 20 startup ecosystem globally, in terms of affordable talent with blue-chip experience. The Special Report also highlights the growth of average round sizes in Egypt, and the dominance of the fintech sector, followed by e-Commerce, healthtech and edtech.

The special report also profiles Egypt’s home-grown unicorns, MNT-Halan and Fawry, and details the cautionary tale of Swvl, a unicorn that successfully IPO’d on NASDAQ in 2022, only to lose 95% of its valuation when it grew too fast in challenging times. It maps out the most funded startups in Egypt’s startup ecosystem, and highlights some soonicorns such as MaxAB and Valu.

Egypt’s Startup Ecosystem Challenges

Though Egypt seems to have all the building blocks and primary ingredients for a flourishing startup ecosystem, it is not without its challenges. 85% of the country’s population is traditionally unbanked, without any formal access to financial services such as loans from traditional banking institutions. Instead, much of the country’s population have turned to digital and mobile wallets and other fintech solutions - which has dramatically lowered that unbanked number to a third of the Egyptian population. Perhaps this is why some of the country’s most prolific tech startups have been born from the fintech space in the past decade.

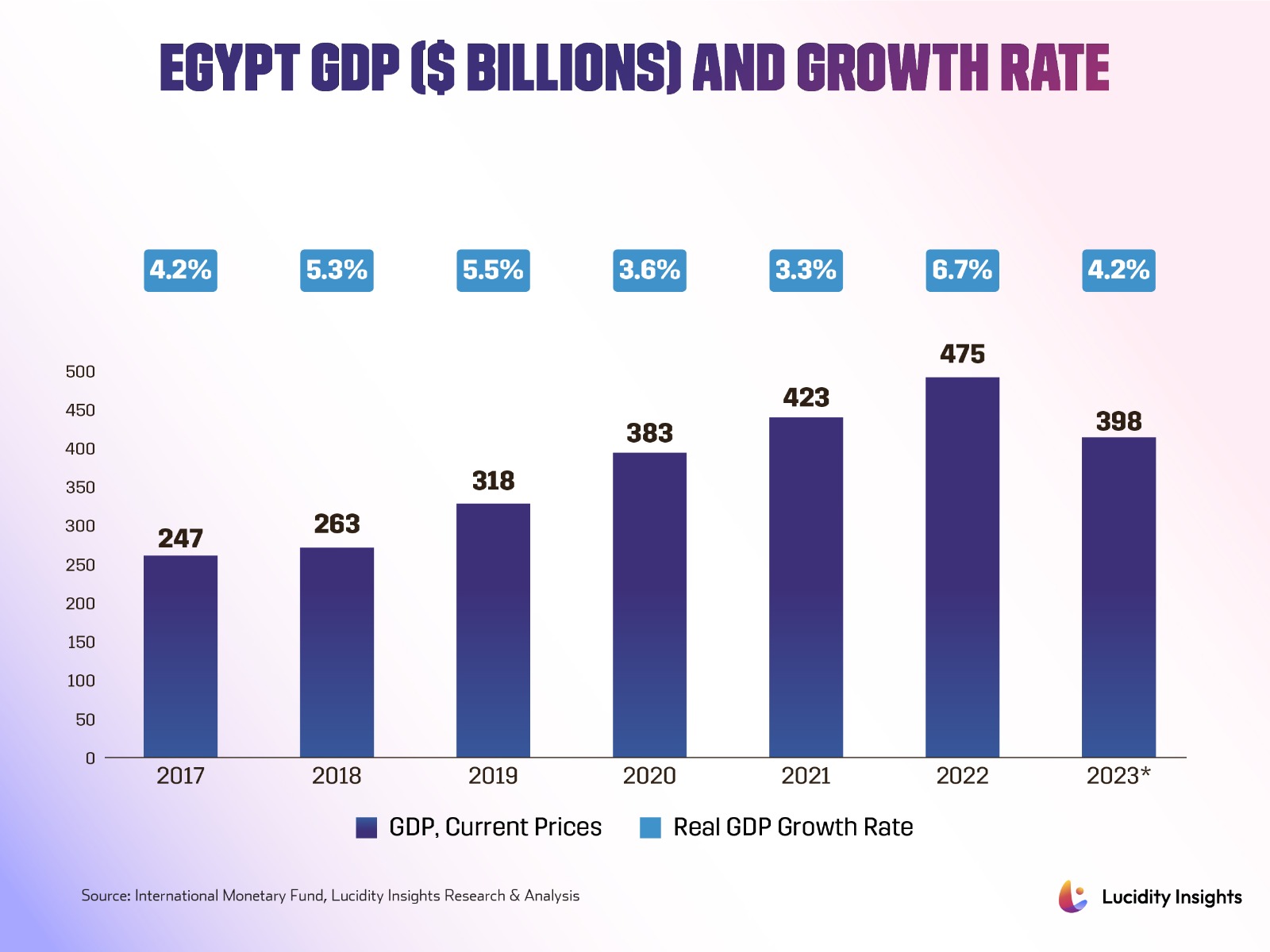

Egypt’s economy was booming from 2017-2022, with Egypt’s GDP (at current prices) growing at 11% CAGR. This was a major success for Egypt, which saw growth despite the Covid-19 pandemic shutting the world down and limiting tourism revenues. But the country’s economy fell on hard times suddenly in 2023. After years of double-digit growth, the Egyptian economy shrunk by 16% in the past year. Inflation hit an all time high of 41%, before starting its gradual correction. In January 2024, inflation still stood at 29.8%. All of these economic pressures have meant that the currency which was successfully free-floating for the past 7 years has been in free-fall for the past year, losing half of its value since April 2022.

This has been hard to swallow, particularly for startups who had previously closed fundraising rounds and received a valuation. Today, that valuation has halved just due to the currency devaluation. Any revenue they receive today has half of the purchasing power it had 18 months ago. It is a long, uphill battle – and one they will have to win, with little access to capital. Some are aggressively expanding into new markets. Others are relocating entirely.

When we spoke to the top investors from across the region and in Egypt, one thing is certain; Egypt’s startup ecosystem may be going through short-term difficulties, but it also presents lucrative opportunities. The special report details investor viewpoints on how startups are getting cash efficient, and these challenging times are driving innovative pivots. Egypt boasts some of the best tech talent across the Middle East and Africa, and investors say there are major opportunities that are heavily discounted today. We spoke to twelve of the most active investors in the country over the past five years, and profiled them, from Flat6Labs, Falak Startups, Algebra Ventures, A15, Sawari Ventures, Global Ventures, 4DX, Disruptech, Endure Capital and Foundation Ventures. We also spoke to sector-specific fund, Nclude, and the International Finance Corporation for their take on Egypt’s ecosystem today.

Though early and late stage startups may have to go through down-rounds, new startups fundraising for the first time may find themselves surprised at how bullish local investors are on the Egyptian startup ecosystem. The current situation will only shed the undisciplined businesses, and stars are likely to be born.

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)