Lessons from SWVL’s Fall from Grace for the Next Generation of Entrepreneurs

22 April 2024•

Swvl, once hailed as Egypt’s golden startup child and celebrated unicorn, experienced an unfortunate dramatic rise and fall within a few short years. This cautionary tale begins with the company’s ambitious inception and takes a turn with a staggering loss of valuation as well as a series of delisting warnings from NASDAQ.

A Promising Start and Rapid Growth

Founded in 2017, the Cairo-based mass transit and shared mobility services provider quickly gained traction with its innovative business model focused on fixed-route shuttle services bookable via a mobile app. By March 31, 2022, Swvl made a confident debut on Nasdaq at $9.95 per share, boasting a valuation of US $1.5 billion. The listing, following a merger with SPAC Queen’s Gambit Growth Capital, promised a wave of capital inflow and extensive global expansion.

Swvl’s strategy hinged on aggressive expansion as it entered European and South American markets through acquisitions of Shotl (Spain), Viapool (Argentina and Chile), and door2door (Germany). The company’s footprint soon spread over more than 100 cities across 20+ countries, a phase marked by significant revenue growth and optimistic forecasts.

A Series of Missteps and the Downfall

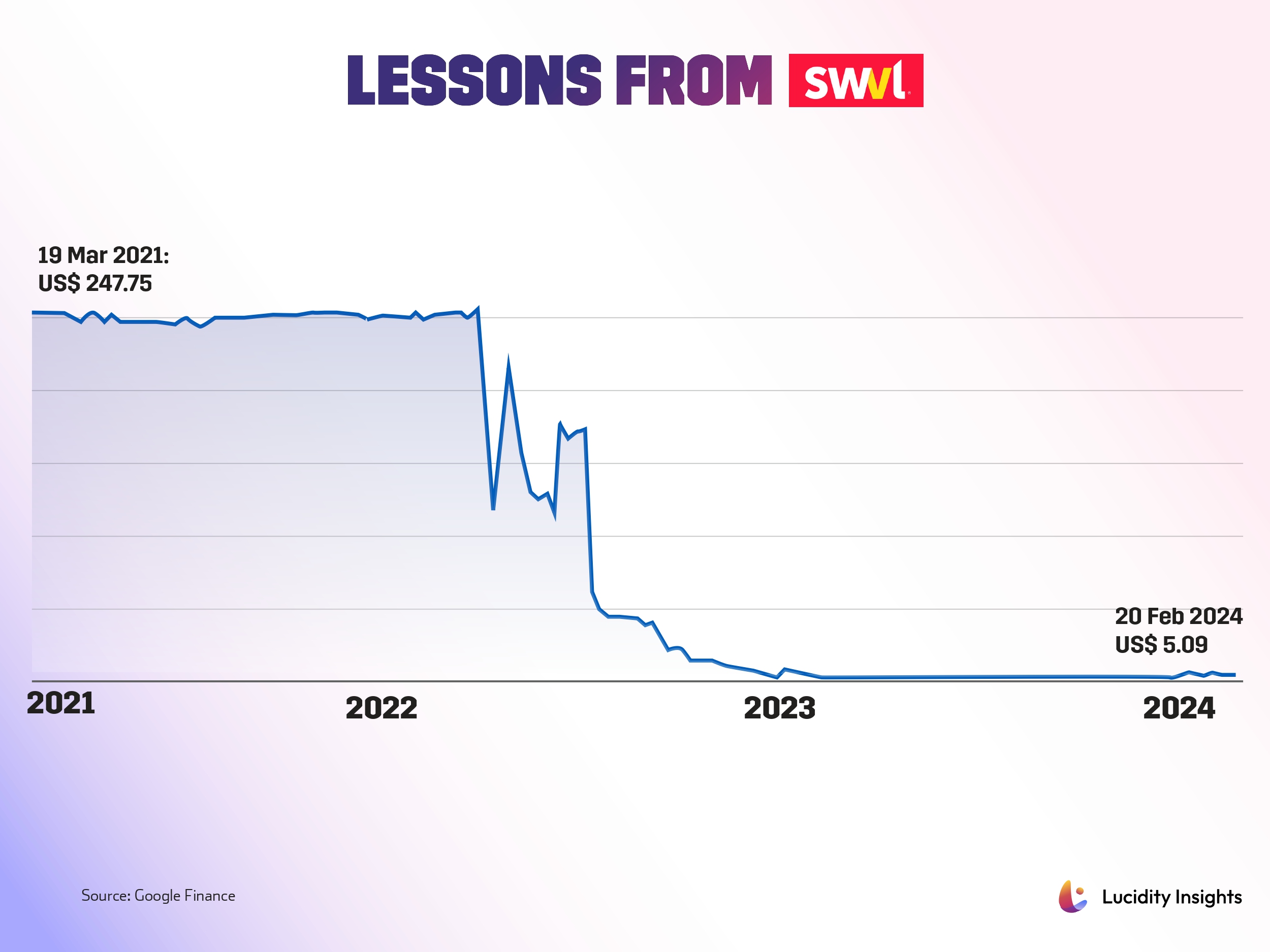

Beneath the surface and unbeknownst to the team, Swvl’s rapid expansion was creating cracks in its foundation. The first signs of trouble emerged with a series of layoffs in 2022 as the company aimed to turn cashflow positive amidst widening losses. Swvl’s share price began to plummet, losing more than 95% of its value by late 2022. External factors compounded Swvl’s struggles further with the global economic downturn, exacerbated by the COVID-19 pandemic and the RussianUkrainian war, which led to soaring energy prices and inflation, significantly impacted the company’s operational costs. This was further exacerbated by the fact that 2022 was a challenging environment for tech companies all over, leading to a broader decline in the NASDAQ during 2022.

By early 2023, Swvl’s situation had worsened with multiple NASDAQ delisting warnings. Its market cap had dwindled to approximately $9 million, a mere fraction of its initial valuation. The company’s stock price had collapsed to about 20 cents, a stark contrast to its IPO price of $10.

Lessons Learned

Swvl embarked on drastic cost-cutting measures to save itself by shuttering operations in certain markets, initiating a cut back on executive pay, layoffs and closing off less profitable routes. Unwinding acquisitions like UK startup Zeelo and Turkish mobility business Volt Lines was inevitable as the company explored strategic alternatives, including corporate sales, mergers, and asset sales.

Swvl’s story is a sobering reminder of the risks associated with rapid expansion and overreliance on volatile markets. The company’s initial success, driven by a unique business model and an aggressive growth strategy couldn’t shield it from the harsh realities of an economic downturn and operational challenges.

Every cloud has a silver lining though, and Swvl’s trajectory provides valuable insights for the Egyptian startup ecosystem. Growth must be both managed and sustainable, as rapid expansion can lead to operational and financial strain if not backed by a solid foundation and a clear path to profitability. This is particularly relevant in emerging markets like Egypt, where the excitement of quick success must be balanced with long-term strategic planning Swvl’s expansion attempts beyond Egypt into global markets offers insights into the challenges and opportunities faced by any startup looking to go global.

Swvl’s biggest successes were in markets where it had a deep understanding, like Egypt, thus highlighting the importance of local market knowledge and innovation tailored to local needs. Swvl’s journey through public markets, marked by volatile share price movements and regulatory challenges, illustrates the scrutiny and pressures of being a publicly traded entity. Swvl’s experience also underscores the need for financial prudence and adaptability in business strategy as managing finances wisely, particularly for startups aiming for rapid growth or public listing, is crucial.

Looking Ahead

Not all is lost, however, as there have been signs of a promising turnaround as Swvl moves into 2024. Its valuation currently stands at US$ 40 million and according to Chief Financial Officer, Youssef Salem, the company met its operational targets for 2023 following its decision to focus on key markets and its transition to a B2B model, a more strategic and sustainable approach to business.

Of course the journey ahead remains challenging, and Swvl is learning from its late losses to manage its costs effectively, innovate in its technology offerings, and navigate the complexities of operating in diverse markets. The company is currently rehiring previously laid-off employees as well as carefully expanding in various markets, particularly Saudi Arabia. Things are finally looking up at Swvl as this recent profitability marks a significant milestone going into the new year!

Next Read: Egyptian Unicorns & Success Stories

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)