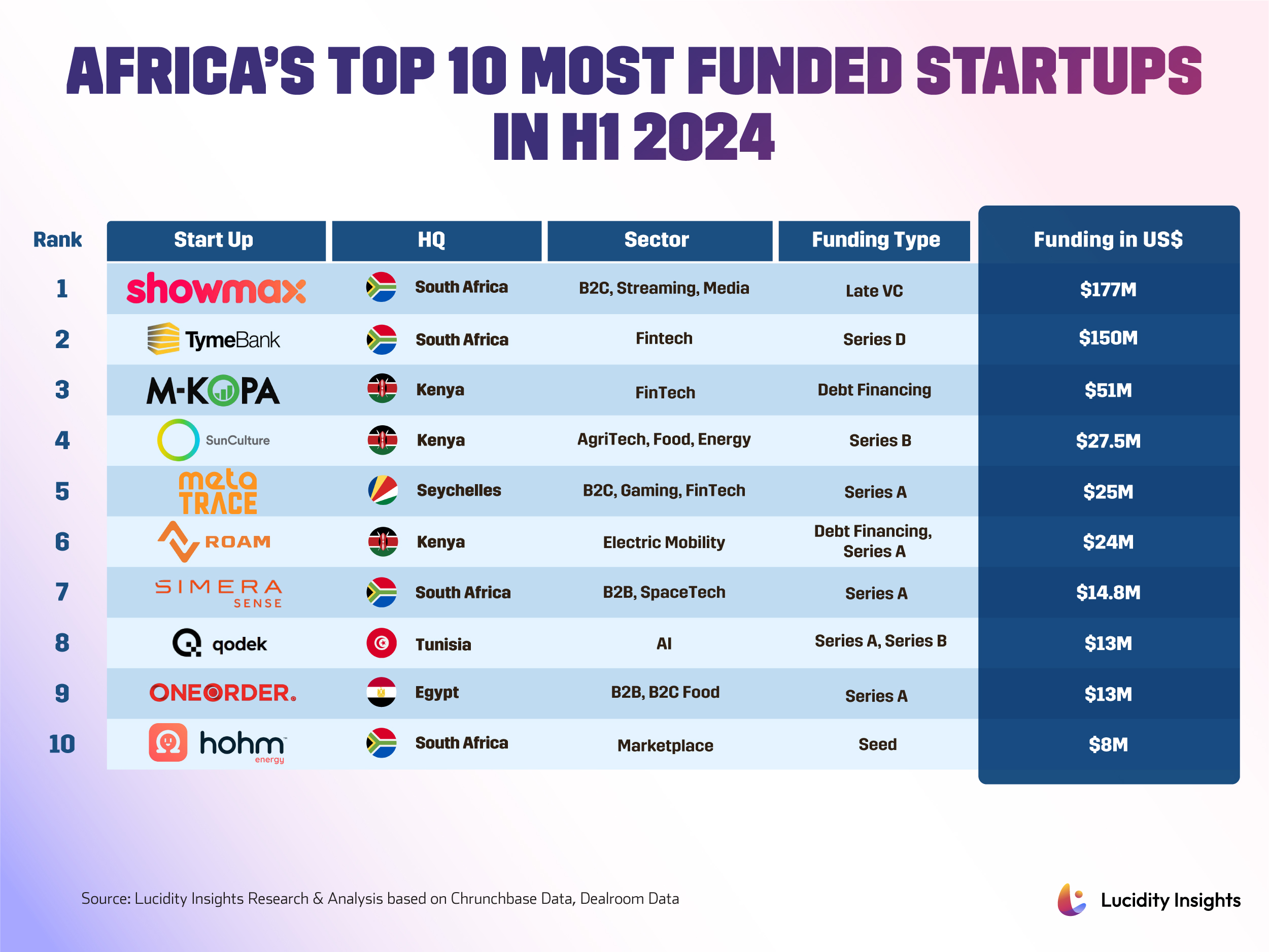

The Top 10 Most Funded Startups in Africa for H1 2024

24 September 2024•

As one of the world's most multicultural and economically diverse continents, Africa has witnessed a dynamic transformation in its startup landscape as of late with some growing interest. The first half of 2024 saw funding activities across various industries, underscoring the continent’s growing role. Investor interest is particularly strong in FinTech, media, and sustainable solutions like energy and agricultural technologies, sectors which align with global trends emphasizing sustainability and digital transformation. South Africa and Kenya are leading the charts, as mature ecosystems conducive to startup growth and attractive to international investors.

Let's take a closer look at the top 10 most funded startups in Africa for H1 2024.

Infobyte: The Top 10 Most Funded African Startups in H1 2024

1. Showmax | B2C, Streaming, Media (South Africa) | US $177 Million Late VC

Launched in 2015 by Africa’s leading pay TV operator, MultiChoice Group, Showmax is an online subscription video on demand service based in South Africa. The platform focuses on local content and partnerships with mobile telcos to enhance accessibility and offer a diverse range of content, including African Originals, international series, movies, and live sports such as Premier League matches. By 2023, Showmax had expanded into 44 countries in Sub-Saharan Africa and over 30 international markets across the globe.

In February 2024, Showmax received US $177 million in a late VC funding round from MultiChoice Group and U.S. media powerhouse Comcast’s NBCUniversal Media. The investment is dedicated to strengthening Showmax's position in the highly competitive streaming landscape, where global players compete for the African audience's viewership, with Showmax broadening its content strategy by not only featuring international content from NBCUniversal and Sky but also launching original local programming.

2. TymeBank | FinTech (South Africa) | US $150 Million Series D

Originally developed as part of a Deloitte Consulting project funded by MTN Group, TymeBank became a stand-alone business in June 2012 and has acquired over 8.5 million new customers since 2019. TymeBank offers basic transactional banking services through its Android banking app, internet banking site, and a national network of self-service kiosks hosted in partnership with retail chains like Pick n Pay and Boxer. TymeBank achieved profitability in December 2023 with over 1,000 kiosks and 15,000 retail points nationwide.

In June 2024, TymeBank secured US $150 million in Series D funding bringing it to a pre–unicorn valuation of US $965 million. The new funds are designated to facilitate the company's expansion into the Philippine and Vietnamese markets while helping TymeBank scale operations in preparation for an upcoming IPO.

3. M-KOPA | FinTech (Kenya) | US $51 Million Venture Debt Financing

Founded by Nick Hughes, Chad Larson, and Jesse Moore in 2011, M-KOPA is an African connected asset financing platform that empowers underbanked customers by combining digital micropayments with GSM connectivity to make life-enhancing assets accessible. M-KOPA provides a connected financing platform that enables access to solar lighting systems, televisions, fridges, smartphones, and financial services. By 2023, M-KOPA had expanded its services to Nigeria, Ghana, Uganda, and South Africa, deploying US $1 billion in products and credit to over 3 million customers.

In 2024, M-KOPA raised US $51 million in Debt Financing led by the U.S. International Development Finance Corp, bringing its total funds raised to US $590.2 million. The new financing is dedicated to delivering sustainable energy solutions while accelerating M-KOPA's expansion plans in the South African market.

4. SunCulture | AgriTech, Food, Energy (Kenya) | US $27.5 Million Series B

Founded in 2013 by Samir Ibrahim and Charles Nichols, SunCulture provides solar-powered irrigation, lighting, and mobile charging solutions to over 50% of smallholder farmers across Kenya, Ethiopia, Uganda, Zambia, Senegal, Togo, and Ivory Coast. SunCultures AgroSolar Irrigation Kit combines solar water pumping technology with high-efficiency drip irrigation, helping farmers increase their crop yields by up to 300% while reducing water usage by 80%.

In April 2024, SunCulture secured US $27.5 million in a Series B funding round led by InfraCo Africa. This funding supports the company's expansion and the creation of new products designed to empower farmers as SunCulture aims to boost productivity while providing them with the necessary resources to cope with climatic difficulties.

5. MetaTrace | B2C, Gaming, FinTech (Seychelles) | US $25 Million Series A

Founded by Bogdan Evtushenko in 2022, MetaTrace is a GameFi platform that offers unique metaverse gaming experiences with real-world maps, allowing users to search for reward boxes hidden around the world. The MetaTrace platform also features NFT collectibles and cryptocurrency tokens, enabling users to move in sync with real-life movements and grow virtual pets. Its TRC token debuted in 2023, and a 400% increase maintained its leading position in the market.

In February 2024, MetaTrace raised US $25 million Series A funding, bringing the company to a valuation of US $296 million. The funds are being used to strengthen MetaTrace's position as a leader in the global GameFi industry, expand operations, implement marketing strategies across all continents, and enter new exchange platforms.

6. Roam Electric | Electric Mobility (Kenya) | US $14 Million Series A

Founded in 2017 by Filip Lövström and Mikael Gånge, Roam Electric is a tech-driven electric mobility company focused on sustainable transport solutions. Roam designs and develops electric motorcycles and electric buses tailored for the African market. Its flagship products include the Roam Air, an electric motorcycle, and the Roam Transit, an electric bus, as well as supporting infrastructure, fleet management software, and after-sales services.

In 2024, Roam raised a total of US $24 million in funding, consisting of US $14 million in a Series A equity investment led by Equator Africa, as well as US $10 million in debt commitment from the US government’s Development Finance Corporation (DFC), bringing its total funding amount to US $31.5 million. The funding came as Roam doubled down on the assembly of its Move bus model, launched last year, with the goal to increase and get stability in terms of production to meet demand this year. Roam aims to reach a production rate of 1,000 motorcycles a month to start filling the market with the relevant number of motorcycles.

7. Simera Sense | B2B, SpaceTech (South Africa) | US $14.8 Million Series A

Established within the Simera Group by Charles Black in 2017, Simera Sense specializes in optical payload solutions for the nanosatellite Earth Observation industry. Simera Sense produces end-to-end optical payload solutions for CubeSats, micro-, and small satellites, and high-resolution cameras such as the xScape50, xScape100, and xScape200, which are designed for various Earth observation applications.

In March 2024, Simera Sense raised US $14.8 million in Series A funding from investors NewSpace Capital and Knife Capital. Simera Sense is using the investment to respond to rising client demand and expand its current teams and capacity, with additional production sites planned in Europe to fast-track the development of higher-resolution and SWIR camera products.

8. Qodek | Artificial Intelligence (Tunisia) | US $13 Million Series A & B

Founded in 2023 by Skander Nabli, Qodek is a young Franco-Tunisian startup using AI for sales and marketing automation in the French and German markets. Its services include web scraping, CRM enhancement, market analysis and mapping, data analytics, and custom integration development.

In 2024, Qodek raised US $5 million in Series A funding followed by US $8 million in Series B funding, bringing their total funding amount to US $14 million. The investments aim to support Qodek's growth and expansion as well as the development of its products and services while expanding its team and strengthening its market presence.

9. OneOrder | Food delivery, Supply Chain Tech (Egypt) | US $12.8 Million Series A

Founded in 2022 by Tamer Amer and Karim Maurice, OneOrder is a logistics tech startup optimizing the supply chain for the food and beverage industry through its digital platform that connects restaurants directly with suppliers, offering a streamlined process for sourcing supplies at competitive prices. Its services include fresh produce, custom cuts of meat, high-quality seafood, and imported foods, and the platform also features embedded financing options and a mobile app for order management.

In 2024, OneOrder raised US $16 million in debt financing and Series A funding led by Delivery Hero Ventures. The investments are dedicated to revolutionizing the hotel, restaurant, and catering (HoReCa) supply chains across Africa and beyond as OneOrder expands into the GCC region, beginning with the UAE.

10. Hohm Energy | Marketplace (South Africa) | US $8 Million Seed round

Founded in 2021 by Tim Ohlsen and Emir Gluhbegovic, Hohm Energy (a subsidiary of Spark Energy) is driving the adoption of rooftop solar energy across South Africa through its innovative marketplace. This platform connects customers with accredited solar providers, product suppliers, and financiers, streamlining the entire solar installation process—from proposal generation to installation and ongoing maintenance. Hohm Energy offers comprehensive solutions for residential, commercial, and industrial solar energy needs.

In February 2024, Hohm Energy secured US $8 million in a seed round led by E3 Capital and 4DX Ventures, marking the largest seed round ever raised by a South African tech startup. This brought the company’s total funding to US $10.6 million. The funds were intended to support Hohm Energy’s expansion plans, technological advancements, product innovation, and skill development for solar installers.

However, in September 2024, Hohm Energy filed for voluntary liquidation with the Companies and Intellectual Property Commission (CIPC), an agency under South Africa’s Department of Trade, Industry, and Competition. The company ceased trading in August 2024, citing cash flow issues and an inability to service existing debts as demand weakened, partly due to improvements in South Africa’s grid electricity supply.

Takeaway

While the funding landscape for African startups in the first half of 2024 may be small in comparison to the broader MEA region, investments in African startups in sectors like FinTech and sustainable technologies underscore the continent's ability to leverage digital transformation and innovative solutions to address unique local opportunities and challenges. South Africa and Kenya, in particular, have demonstrated the importance of having a supportive ecosystem that nurtures startup growth and attracts international capital, setting a standard for others in the region.

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)