Empowering Innovation: Falak Startups Catalyzing Egypt's Tech Scene

10 April 2024•

Powered by the Egyptian Ministry of International Cooperation’s VC arm, Egypt Ventures, Falak Startups invests in seed stage tech startups. The firm is industry agnostic, however has an additional focused track that specializes in Financial Technology powered by EFG Hermes.

- Year Established: 2018

- HQ: Cairo, Egypt

- AUM: N/A

- # of Portfolio Companies: >60

- % of companies in Egypt: ~85%

- Avg # of deals per year: 5-10

- Number of exits*: 1 (*as reported on Crunchbase)

- Funding Stage: Pre-Seed, Seed, Series A

- Ticket Size: up to 2,000,000 EGP (~US$ 65,000)

- Website: http://www.falakstartups.com/

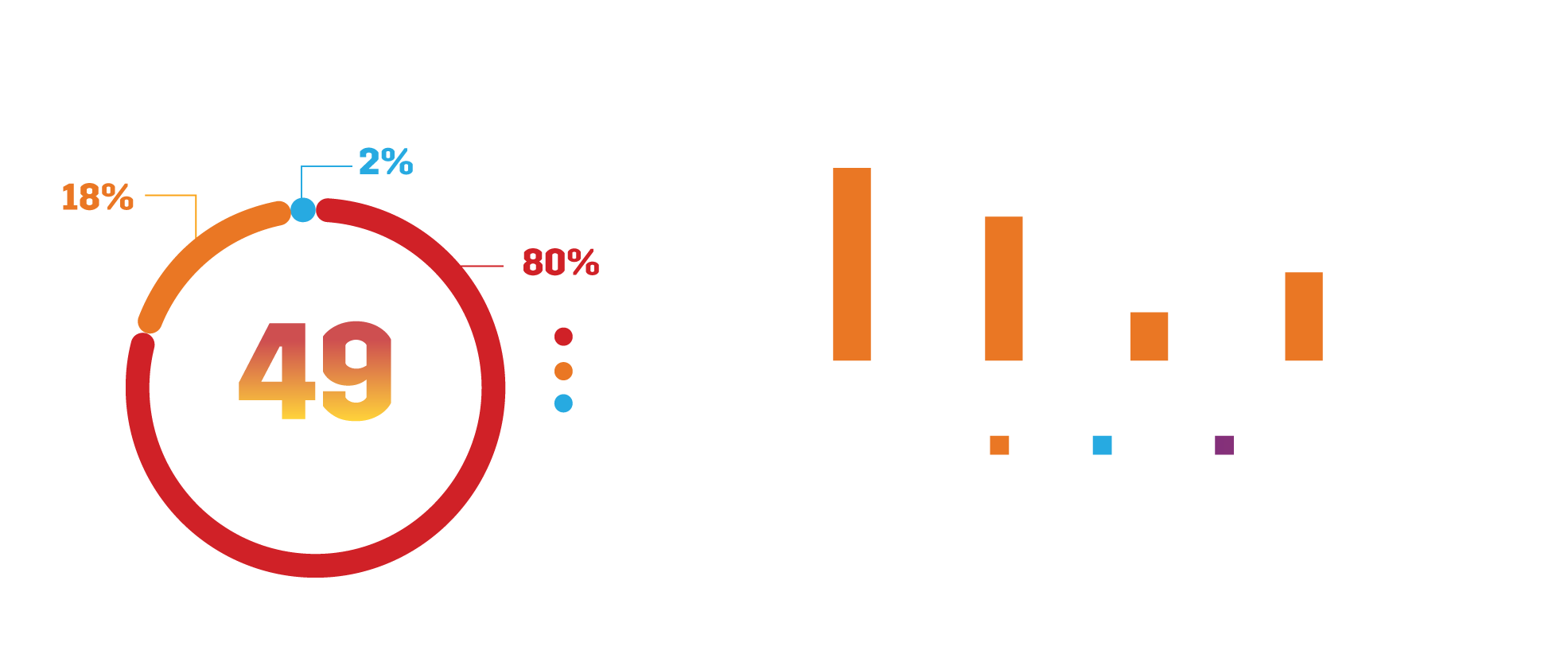

Established in 2018 in the vibrant heart of Cairo, Falak Startups established itself in the second wave of VC firms and accelerators establishing themselves in Egypt. Falak Startups is a startup accelerator that has supported over 60 startups to date (considering investments via both General track and Fintech track), leading with a narrative of innovation, transformation, and empowerment. Falak Startups began as the brainchild of the Egyptian Ministry of International Cooperation and Egypt Ventures with a mission to discover and nurture seed-stage tech startup founders, helping them flourish in a rapidly evolving entrepreneurial environment. Falak Startups’ founders envisioned revolutionizing the startup scene with a keen focus on diversity and inclusion.

Falak Startups provides a comprehensive suite of services including workspace, mentorship, and business development, essential for nurturing startups from infancy to maturity. The firm has a penchant for investing in startups in e–commerce and logistics, as well as healthtech, cleantech, and agtech. Their industryagnostic approach, however, opens doors for any and all other sectors, ensuring a diverse and vibrant entrepreneurial ecosystem.

Falak Startups has two tracks, one of which is a General track, which is industry agnostic and another is the Fintech track, which is powered by EFG Hermes Finance, under EFG EV Fintech. The accelerator identifies promising fintech startups by investing up to EGP 1 million (~US$ 32K) in exchange for up to 10% equity. Similar to Falak Startups, the EFG EV Fintech accelerator has two cohorts where the company invests in up to 5 startups in each cohort. In addition to the accelerator, EFG EV Fintech also invests, up to EGP 5 million (~US$ 160K) in post-seed and early-stage startups with bridge financing to reach the next stage of funding.

The firm also provides opportunities for ease of expansion to the larger MENA region, through a partnership with 11 other startup accelerators and incubators. The eleven other accelerators include Enara Ventures and EFG-EV Fintech from Egypt, Womena from UAE, Oasis500 from Jordan, Badir from Saudi, La Factory from Morocco, Tec.ly from Libya, Gaza Sky Geeks from Palestine, Level 1 from Tunisia, IncubMe from Algeria and Brilliant Lab with operations in Kuwait and Bahrain.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

Read more in the Special Report, ‘Investing in Egypt’s Startup Ecosystem’.

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)