Flat6Labs: Egypt’s Most Active Tech Investor

09 April 2024•

Flat6Labs is a leading seed and early-stage venture capital firm, currently running the most renowned startup programs in the region. The fund has presence in Cairo, Jeddah, Abu Dhabi, Beirut, Tunis, Manama and Amman and runs multiple theme focused programs.

- Year Established: 2011

- HQ: Giza, Egypt

- AUM: >$95 million

- # of Portfolio Companies: >400

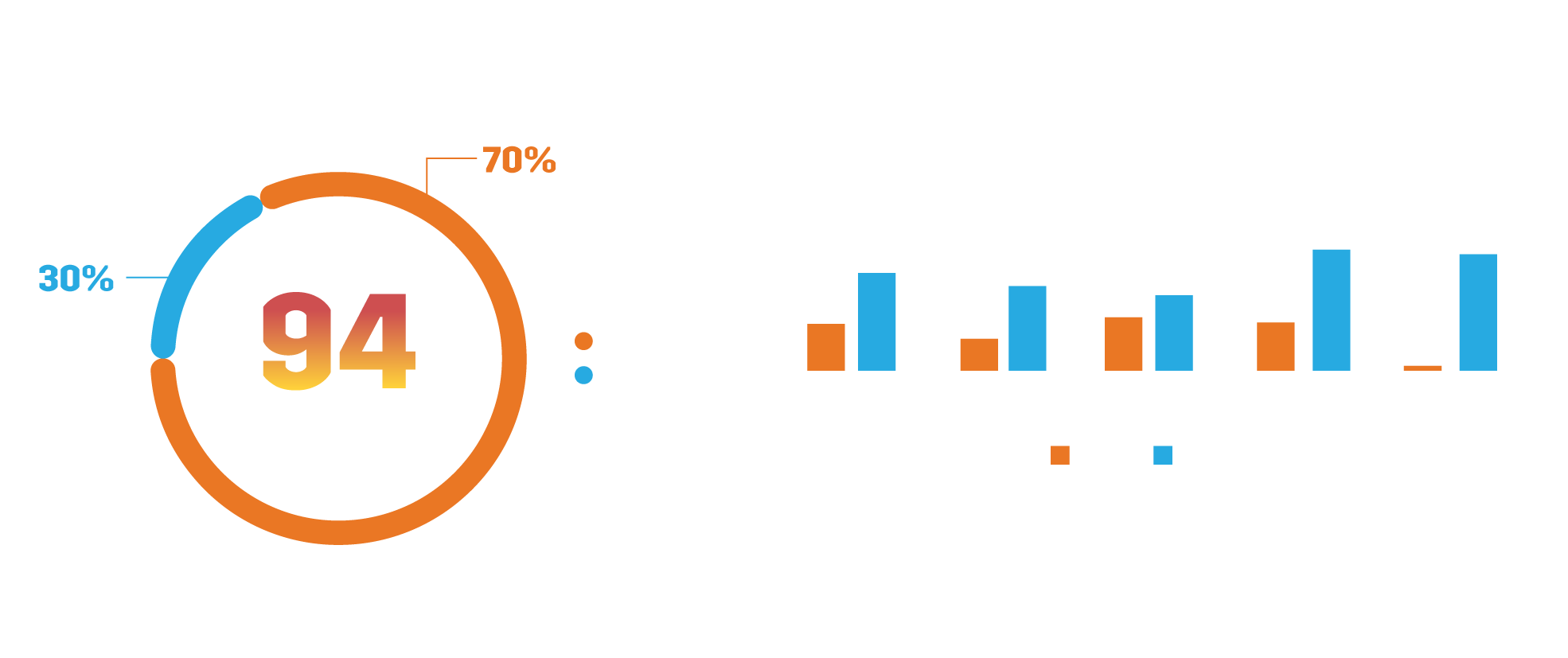

- % of companies in Egypt: ~35%

- Avg # of deals per year: Between 35-50. 2022 witnessed ~75 deals

- Number of exits*: 4 (*as reported on Crunchbase)

- Funding Stage: Mainly in pre-seed and seed stage of funding

- Ticket Size: US$ 50K up to US$ 500K

- Team Size: ~70 (~40 in Egypt)

- Website: https://www.flat6labs.com/

As one of the first seed and early stage VC firms in MENA, Flat6Labs has been instrumental in empowering thousands of entrepreneurs with daring ambitions, fundamentally nurturing the startup culture across the region. Launched in 2011, at Cairo, by Sawari Ventures, the firm was founded by Ahmed El Alfi and Hany Al Sonbaty, both founders of Sawari Ventures and previously experienced at EFG Hermes Private Equity. Since its establishment, Flat6Labs has expanded its reach across the region, managing various seed funds with total assets under management (AUM) exceeding US $95 million. With investments from over 25 leading institutions, the firm has cemented its status as a market leader. Flat6Labs has nurtured over 400 startups to date, with seed funding ranging from $50K to up tp $500K, and at least 90% of their startups have gone on to raise $162 million more since 2017.

As one of the first seed and early stage VC firms in MENA, Flat6Labs has been instrumental in empowering thousands of entrepreneurs with daring ambitions, fundamentally nurturing the startup culture across the region. Launched in 2011, at Cairo, by Sawari Ventures, the firm was founded by Ahmed El Alfi and Hany Al Sonbaty, both founders of Sawari Ventures and previously experienced at EFG Hermes Private Equity. Since its establishment, Flat6Labs has expanded its reach across the region, managing various seed funds with total assets under management (AUM) exceeding US $95 million. With investments from over 25 leading institutions, the firm has cemented its status as a market leader. Flat6Labs has nurtured over 400 startups to date, with seed funding ranging from $50K to up tp $500K, and at least 90% of their startups have gone on to raise $162 million more since 2017.

Related: Sawari Ventures: Pioneering VC Investments in Egypt's Tech Ecosystem

Flat6Labs’ success extends past local borders through strategic partnerships like the IFC’s Startup Catalyst program, which has invested in 19 funds across 24 countries since 2016. This partnership has significantly addressed funding gaps in emerging VC ecosystems, supporting over 2,800 entrepreneurs, where women represent 1 in 4 of their labor force, demonstrating a strong commitment to gender diversity and inclusivity in the entrepreneurial sector. “IFC was the first major fund to invest in seed stage funds and support the startup ecosystems in MENA,” says Dina elShenoufy, Partner and Chief Investment Officer at Flat6Labs. “IFC had the foresight to see what we were trying to achieve and was a huge validation that we catalyzed to help us close on additional funding as our portfolio strengthened.”

2023 has been a landmark year for Flat6Labs, marked by significant expansions and innovative initiatives such as their SAR 75 million (US $20 million) Startup Seed Fund in Saudi Arabia; the fund aims to bolster early stage tech startups, with the potential to create over 6,000 jobs in the private sector. The “Makers” ConTech Accelerator Program, a collaboration with SIAC and Dar Al-Handasah, was initiated to support construction-focused startups get access to funding. Their StartMashreq Growth Track program featured 24 companies which have generated $20.8 million in revenue and created 700 jobs in various sectors across Jordan, Lebanon, and Iraq.

Venturing beyond MENA, Flat6Labs announced a $95 million Africa Seed Fund, investing in diverse sectors like fintech and healthtech, targeting key African markets. This strategic growth continued with the appointment of Christine Namara as Partner for their Africa Seed Fund, leveraging her extensive experience in private equity and venture capital to strengthen Flat6Labs’ footprint in the African startup ecosystem.

Throughout its journey, Flat6Labs has not only been a catalyst for startup growth but also a harbinger of hope and innovation in emerging markets in MENA. By empowering entrepreneurs and connecting them with essential resources and opportunities, Flat6Labs is driving economic growth while nurturing the dreams and ambitions of countless individuals across the region and beyond.

Visit Flat6Labs’ Investor Page here

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

Read more in the Special Report, ‘Investing in Egypt’s Startup Ecosystem’.

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)