The Barriers to Egypt Becoming the Next Big Tech Hub

12 April 2024•

The Barriers to Egypt’s Startup Ecosystem Growth

While there are multiple benefits, Egypt also poses some challenges to startup founders and entrepreneurs. Access to finance is crucial to the development and growth of any economy, as it plays a vital role in facilitating enterprise growth.

Startup founders say that access to capital in Egypt is tough. Though a quick tally might show there are over 50 incubators, accelerators and venture capital funds in Egypt facilitating access to capital for startups, the truth of the matter is the top 10 venture capitalists in the country are conducting 5 or less deals per year, on average.

Though some accelerators are able to support 20 startups per year, that is simply not the norm. Overall, the investor ecosystem is still quite small and nascent. Speaking to investors in Egypt, it is also common knowledge that Egypt is also home to many zombie firms that are simply inactive. For this reason, we are excited to profile some of the most active investors in Egypt in this report.

Besides Egypt’s local VC ecosystem being somewhat limited, many startups and investors have told us that Egypt and North Africa often gets the short-end of the stick when it comes to global investments; they claim that most European capital goes to Sub-Saharan Africa - which doesn’t include North Africa. And most Middle Eastern funding goes primarily to the GCC markets, before making it down to Egypt.

Thus, Egyptian founders say they get the “left-overs” of capital not absorbed by Saudi and UAE startups - making access to capital that much more competitive.

Add to that the current run-away inflation, the complex and uncertain regulatory environment, and scarcity of debt-financing in the country - and you see why Egyptian entrepreneurs are both frustrated, and are also often referred to as the most resilient entrepreneurs in the region.

Run-Away Inflation

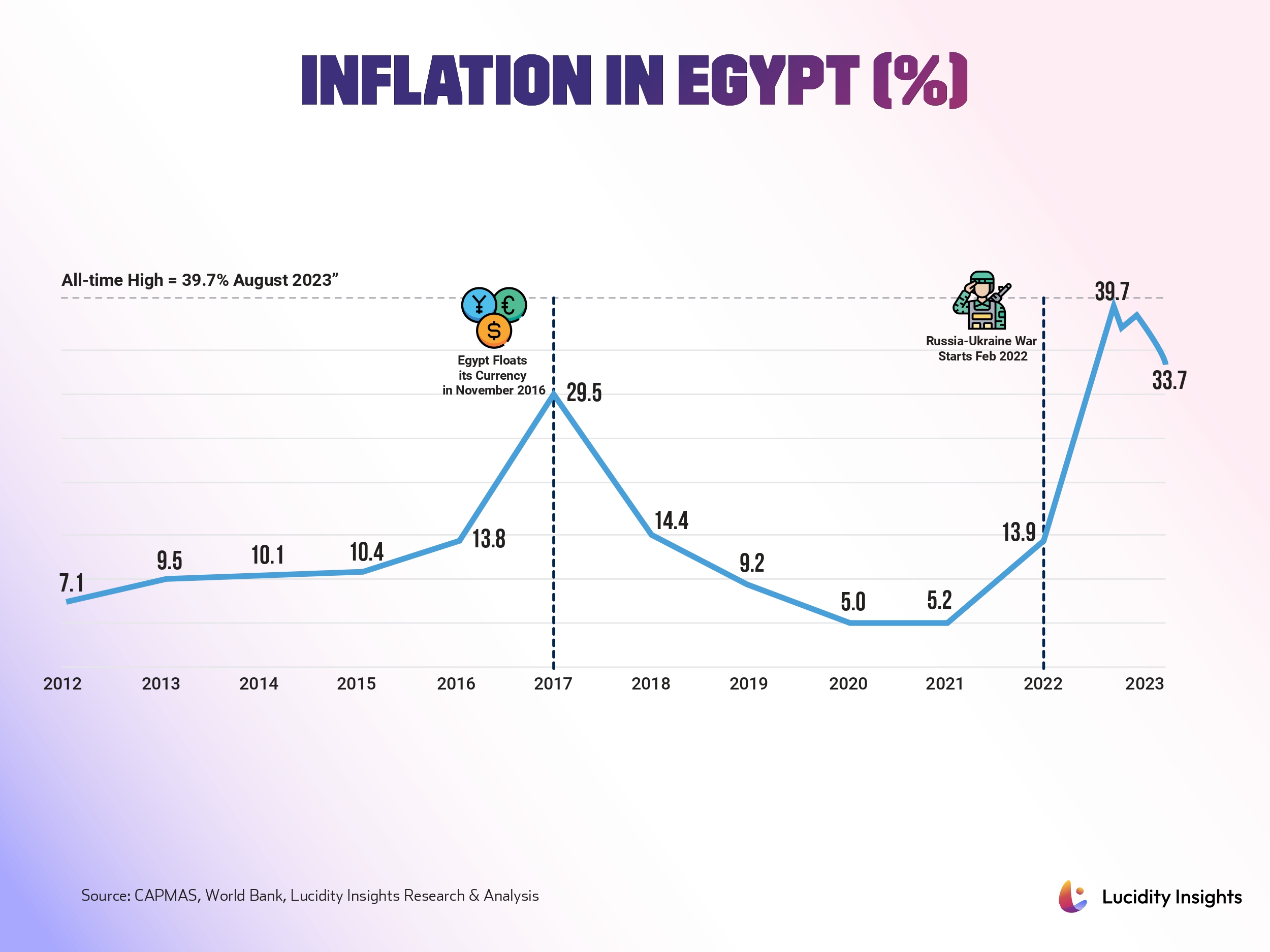

Inflation in Egypt was under control for many years after the currency was floated in 2016, however things took a turn for the worst in early 2022. Egypt has been experiencing runaway inflation since then, which was further exacerbated when the Russia-Ukraine war started. The war brought food security concerns and further unsettled global markets.

As a nation relying on fuel and food imports, the war in Ukraine – a country that was termed ‘the bread-basket’ for many nations, including Egypt – spelled trouble for Egypt.

Egypt has been doing its best to manage the situation, but having taken place after the pandemic under the backdrop of a depressed global economy has led economists to declare an economic crisis. This further destabilized exchange rates and has negatively impacted investor confidence. That said, inflation seems to have peaked, and saw a much-welcome drop to 29.8% in January 2024, compared to 33.7% in December 2023.

Rising Debts & Poor Credit Ratings

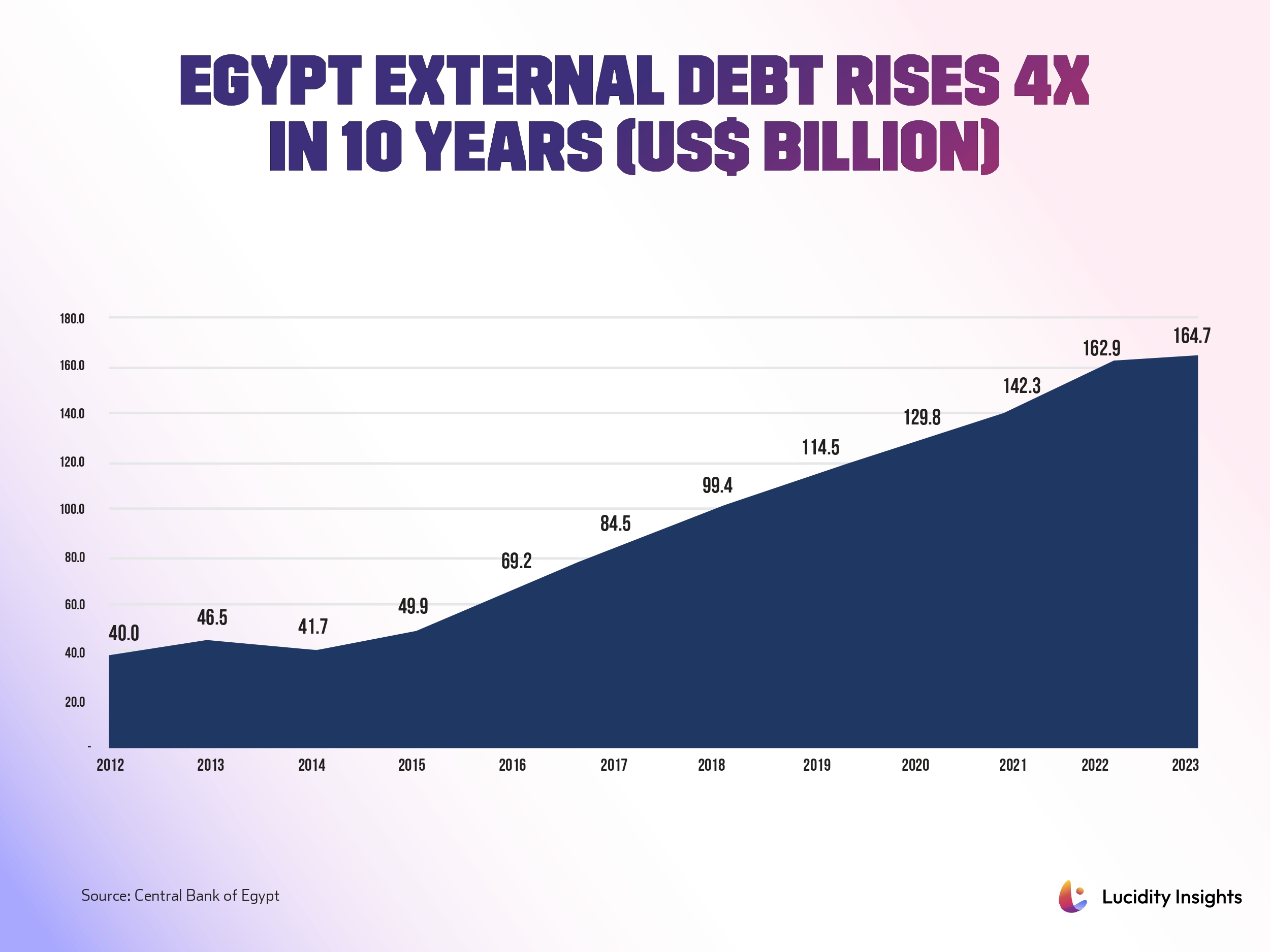

Egypt has been dependent on bailouts in recent years, from both oil-rich Gulf allies and the International Monetary Fund. This is reflected in the country’s rising external debt in the past decade from US$ 40 billion to over US$ 160 billion earlier this year. The external debt to GDP ratio is at ~40%, which is high, but still manageable, according to the International Monetary Fund.

While the external debt has increased through the past decade, Egypt is expected to pay US$ 32.7 billion in debt service in 2024. With Egypt addressing its debt obligations, it aims to create a favorable environment for economic growth, attract foreign investment, and strengthen its overall fiscal resilience. However, debt affordability is worsening as Egypt’s credit rating has shifted from B3 to Caa1, in October 2023.

Fitch Ratings, which just recently downgraded Egypt’s Long-Term Foreign-Currency Issuer Default Rating from B to B-, stated that “the impact of persistent high inflation (expected to average 33% in FY24) on living standards will be sizable and hard to reverse, despite the government’s efforts to address it.” While the government agreed with private producers and retailers to cut prices on staple foods in October 2023, the move has not yet been successful.

A Complex Tax & Regulatory Landscape

The tax and regulatory environment remains more complex than in other countries within the region. The country has different forms of taxation, such as income tax, value added tax, corporate tax, property tax and others, each with its own set of rules, rates and filing requirements.

The country’s labour laws and its social security system are also complicated, and dealings with the administrative authorities are further hampered by the fact that Arabic is the sole language used in official government portals for tax, social insurance, customs and the commercial register.

While Egypt has improved in terms of ease of doing business, it’s still ranked above 100, having a score of 60.1 in 2020, an improvement from 54.4 in 2016.

Geopolitical Concerns

Over and above, there is an increased geopolitical security risk in the MENA region as a whole, but also particularly for Egypt as the nation shares a border with Israel and Gaza, and is situated next-door to the Israel-Hamas conflict. With the Israel-Hamas war, there is an uneasiness amongst investors in the region and outside the region, with the worry that destabilization will spread beyond Israel’s borders.

Attacks by Yemen’s Houthi militants on ships in the Red Sea are also disrupting maritime trade through the Suez Canal, thought to be incited because of the conflict in Gaza. As a neighbor to the ongoing conflict, dealing with its own national economic crisis, geopolitical tensions can only add cumbersome weight on the shoulders of investors looking at Egypt.

Next Read: Egypt’s Resilient Tech Ecosystem: 10 Graphs You need to see to understand Egypt’s Startup Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)