Endure Capital: Pioneering Early-Stage Investments in Egypt and Beyond

18 April 2024•

Endure Capital is an early-stage investment fund headed by entrepreneurs. The company has invested US$ 27 million across 52 startups and has successfully exited from 4, including Careem. Its marquee investments include Careem and Aspect Biosystems.

- Year Established: 2015

- HQ: Cairo, Egypt

- AUM: US$ 85M

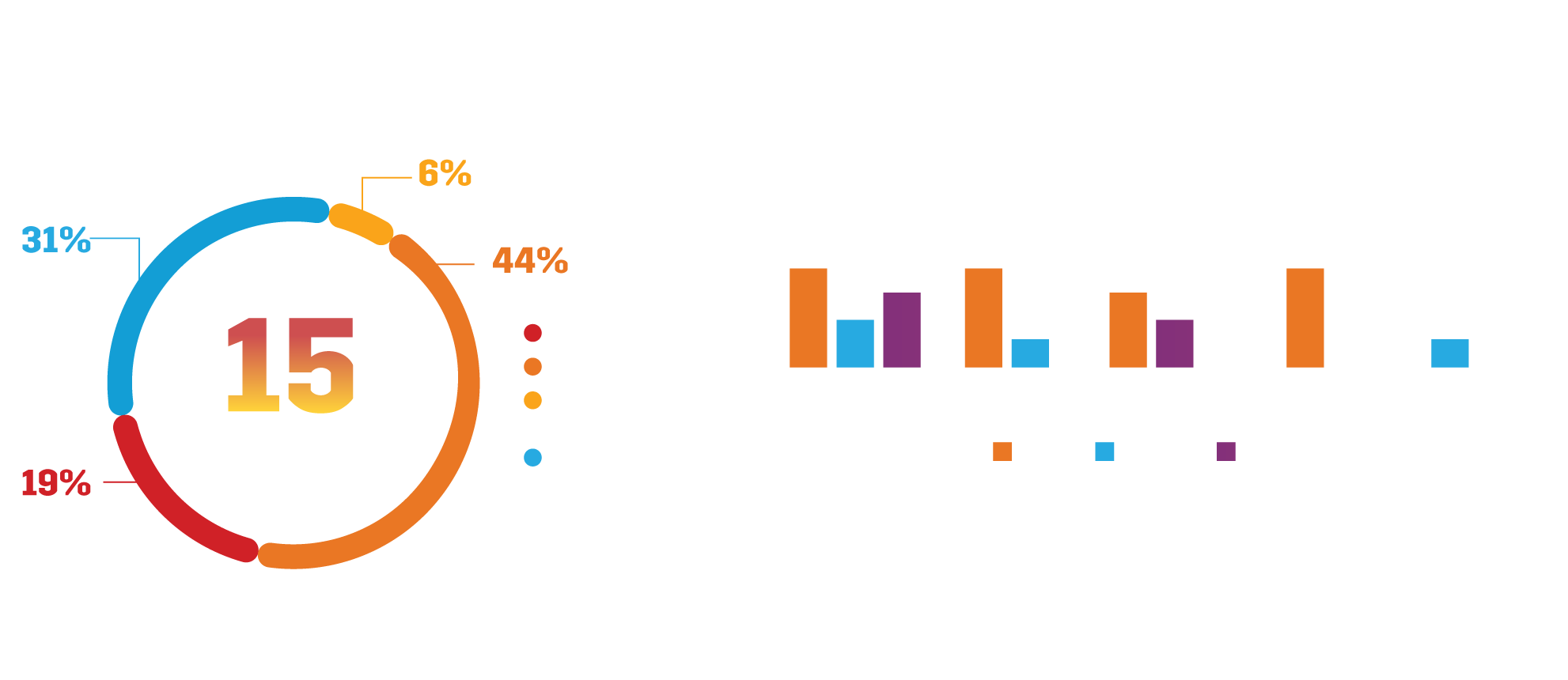

- # of Portfolio Companies: 52

- % of companies in Egypt: 60%

- Avg # of deals per year: 6

- Number of exits: 4

- Funding Stage: Pre-Seed, Seed, Series A and B

- Ticket Size: $1-5 million

- Team Size: 7

- Website: http://www.endurecap.com/

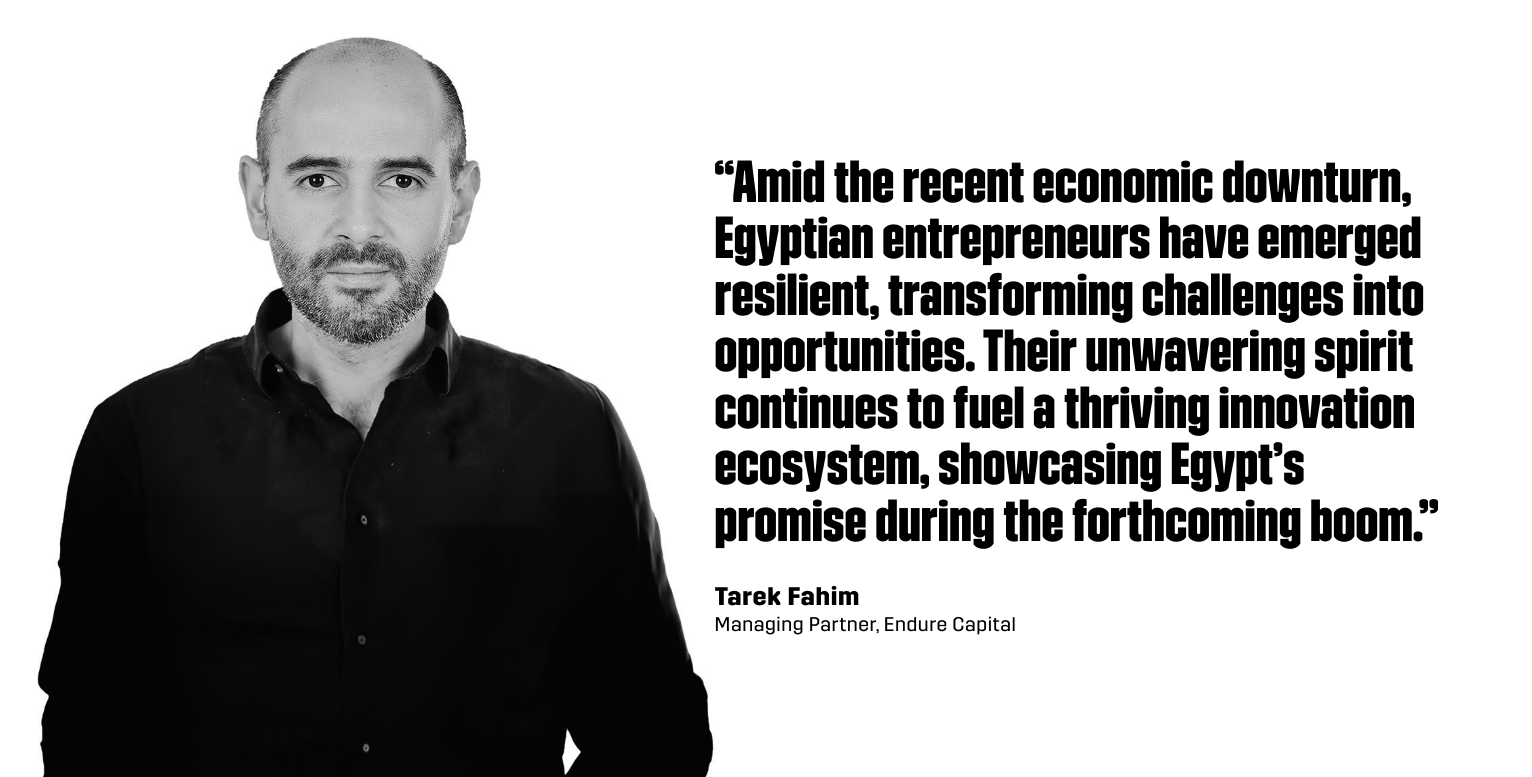

Founded in 2015 by Tarek Fahim, a serial entrepreneur with an eye for transformative potential, Endure Capital is a venture capital firm with roots deeply embedded in the heart of Cairo, now extending its branches across the African continent. Endure Capital’s journey wasn’t just about funding startups; it was about nurturing a culture of relentless innovation and value creation, and Fahim’s ethos quickly positioned Endure as one of Egypt’s most active VC firms.

Endure Capital’s investments span various sectors, including a B2B e-commerce leader, MaxAB (which we cover in our Unicorns and Soonicorns article within this report), and Breadfast, a pioneering grocery delivery startup in Egypt. Its first fund, featuring early bets on companies like Careem, which later saw a $3.1 billion acquisition by Uber, showcased the firm’s knack for identifying winners.

By September 2022, Endure had announced the first close of its $50 million fund, Endure 21, with a keen focus on impact-driven early-stage startups in Africa, and a selective eye for growth-stage startups globally. Notable investors in Endure 21 include British International Investment (BII) and Egypt’s Micro, Small, and Medium Enterprise Development Agency (MSMEDA), underscoring a blend of international and local confidence in Endure’s vision.

Furthermore, Endure is expanding in North America and Saudi Arabia. It recently announced the Arak Fund, a US$ 200 million fund, established in partnership with Saudi Arabia-based Awaed Capital. The Arak Fund will focus on areas such as space technology, biotechnology, electricity, smart logistic services, semiconductors, AI infrastructure, and others.

Endure’s sector-agnostic approach allows for a diversified portfolio, investing in startups across various industries, thus fostering a rich ecosystem of innovation. From technology, healthcare, and fintech to foodtech, Endure’s portfolio is a kaleidoscope of entrepreneurial spirit, and this philosophy extends beyond mere financial investment.

The firm is known for its “Endure... Pay it Forward” initiative, where they work closely with portfolio founders to mentor aspiring entrepreneurs. This approach exemplifies their commitment to long-term support and investment in diversified startups throughout their lifecycle. As they continue to write new chapters in their journey, Endure Capital remains a symbol of strategy and possibility for aspiring entrepreneurs far and wide.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

Read more in the Special Report, ‘Investing in Egypt’s Startup Ecosystem’.

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)