The Future of Food Delivery in Saudi Arabia: A Transformative Market on the Rise

20 May 2024•

In an era where convenience reigns supreme, food delivery has emerged as a global phenomenon, reshaping the way we eat and interact with food.

The level of convenience we enjoy today is a relatively new development in the grand scheme of the history of food delivery. DoorDash, the first food delivery app, launched in 2013 in San Francisco, marking the dawn of a new age in food delivery. Before this, companies like Waiter.com pioneered online food-delivery marketplaces as early as 1995, setting the stage for the current wave of app-based services. However, the concept of food delivery dates back to 1763, with the first recorded instance involving cold buckwheat noodle soups in Korea.

Saudi Arabia has rapidly embraced this global trend, and in our latest Special Report "To Your Doorstep: The Future of Food Delivery in Saudi Arabia", we provide an in-depth look at the Kingdom’s rapidly evolving food delivery landscape, highlighting key market trends, growth drivers, and the impressive achievements of local startups. Here's a glimpse into the transformative journey of food delivery in Saudi Arabia, and why this burgeoning market deserves your attention.

A Booming Market: Meal Delivery Dominates, but Grocery Delivery Gains Ground

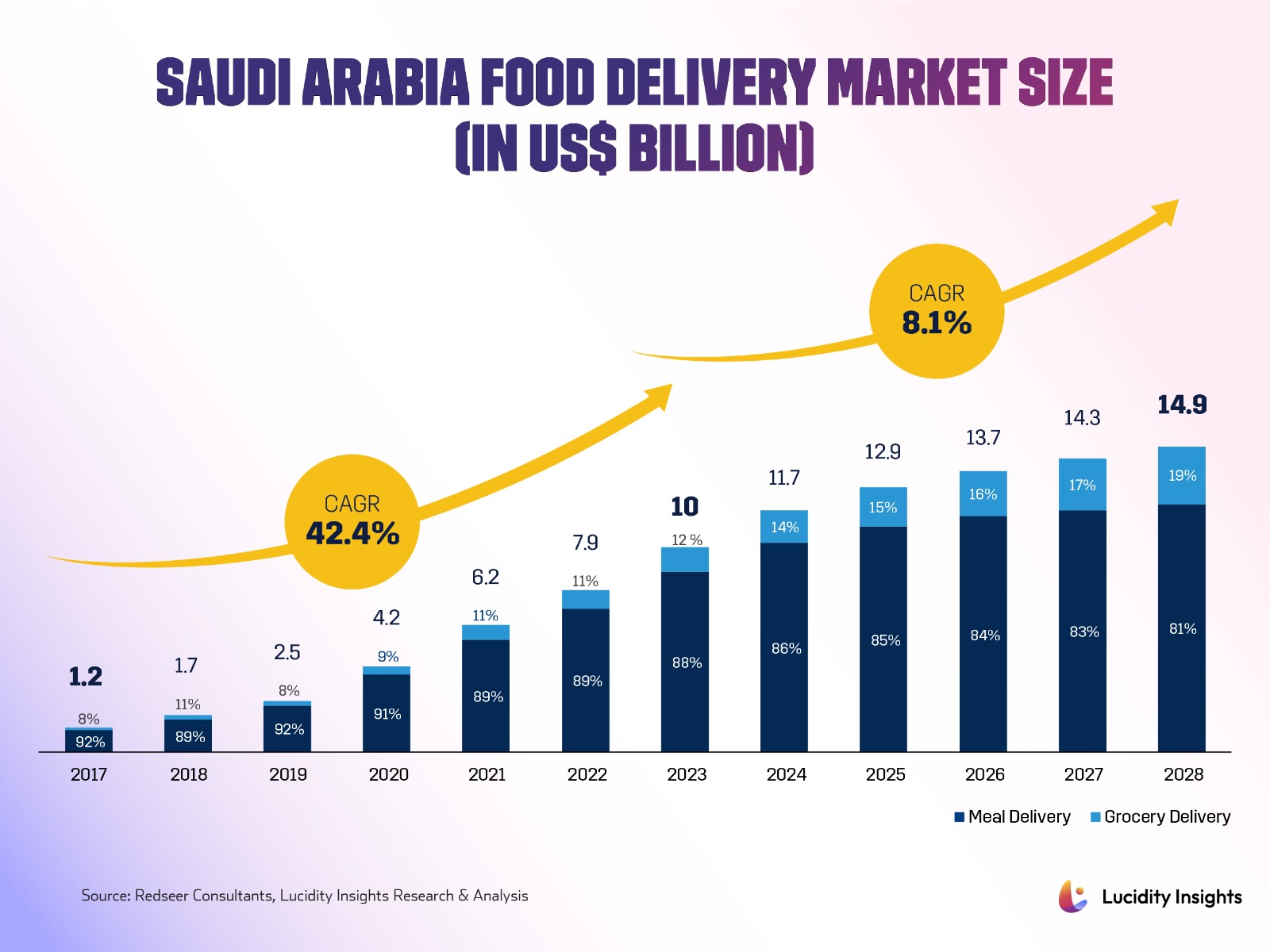

In 2023, the food delivery market in Saudi Arabia was valued at a staggering US $10 billion forecasted to soar to US $14.9 billion by 2028. This growth is largely attributed to the increasing adoption of online food ordering, a trend accelerated by the COVID-19 pandemic and sustained by a tech-savvy, convenience-oriented population.

The Saudi food delivery market is primarily divided into two segments: meal delivery and grocery delivery. As of 2023, meal delivery commands the lion’s share, constituting 88% of the market. This dominance is a testament to the sector's established infrastructure and consumer preference for ready-to-eat restaurant meals delivered to their doorsteps. However, grocery delivery, currently holding a 12% market share, is set to reach 19% by 2028. This shift indicates a broader consumer trend towards online grocery shopping, spurred by the convenience and efficiency offered by delivery platforms like Nana and Ninja.

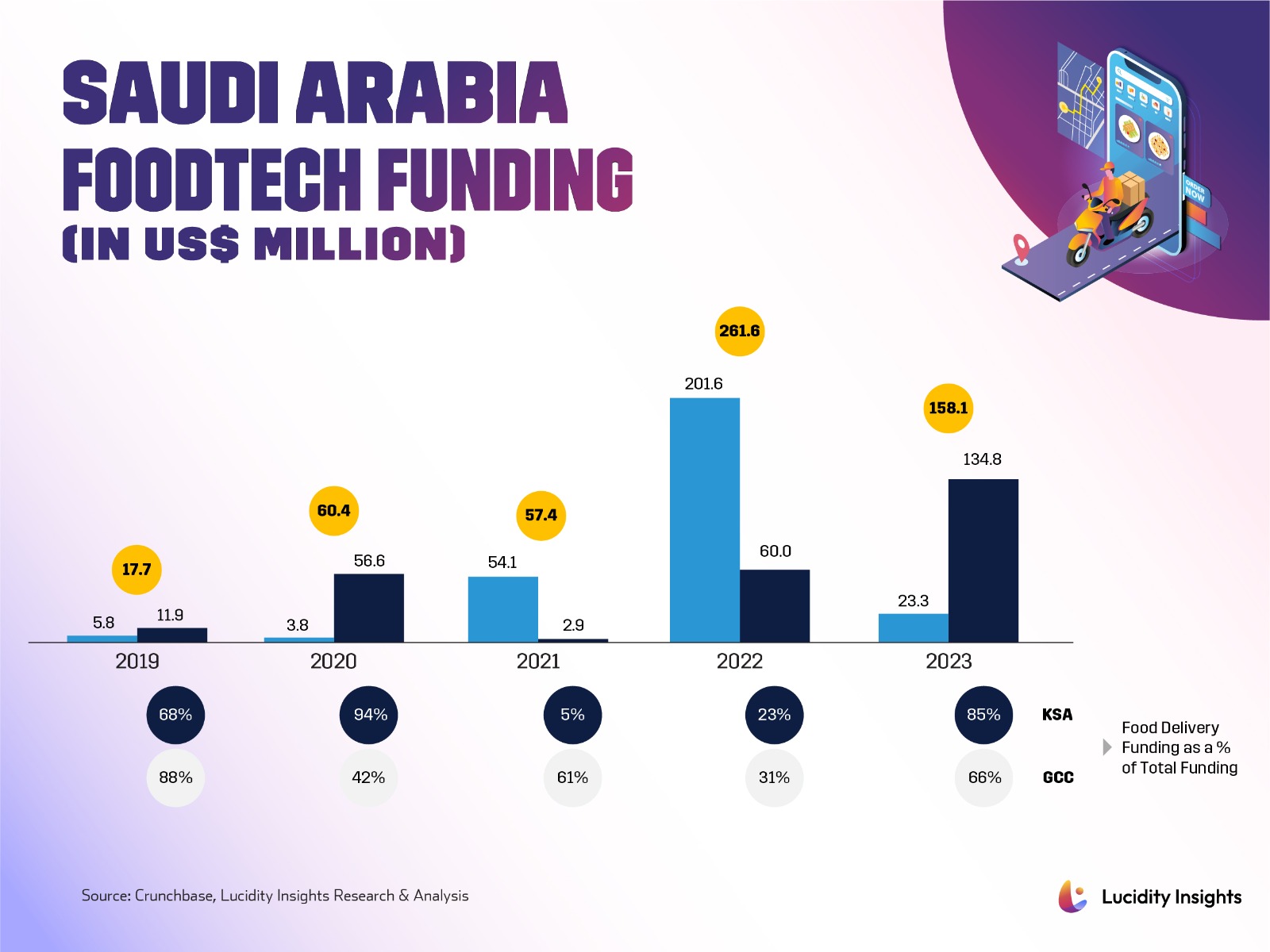

In the past five years since 2019, Saudi foodtech startups have attracted over $555 million in funding; food delivery startups have snapped up 48% of that total funding ($266 million), indicating just how integral the food delivery sector is to Saudi’s foodtech startup ecosystem.

Key Players: A Story of Innovation and Success

The report delves into the success stories of major Saudi startups, each playing a role in shaping the food delivery landscape:

HungerStation, the first online food-ordering platform in the Kingdom, has grown exponentially since its inception in 2012. With over 300 million orders fulfilled and a presence in more than 100 cities, HungerStation's journey is a testament to the rapid digital transformation within the Kingdom.

Jahez has rapidly expanded its market reach, doubling the number of cities covered over the past three years and now reaching 100 cities. Its successful IPO in 2022, which raised $430 million, highlights investor confidence and the robust growth potential of the sector.

Nana, the leading grocery delivery startup, is the most dominant player in terms of funds raised, after raising $212 million across several rounds. Nana’s latest $133 million Series C round in 2023 showcases continued investor confidence in the grocery delivery sector at large.

Calo, specializing in personalized nutrition and wellness, has made significant strides in the ready-to-eat meal delivery market. By offering tailored meal plans that cater to individual dietary needs and fitness goals, Calo has carved out a unique niche, appealing to health-conscious consumers across the region.

MrSool, an on-demand delivery network, stands out for its versatility, allowing users to place orders for any products from various stores and restaurants. This flexibility has propelled MrSool to become a super app contender, further diversifying the food delivery landscape in Saudi Arabia.

These success stories of HungerStation, Jahez, Nana, Calo, and MrSool collectively highlight the innovation and rapid growth in Saudi Arabia’s food delivery market. As startups continue to innovate and expand their service and product offerings, the market is poised to offer even greater convenience, variety, and quality to consumers.

Whether you are looking to understand market dynamics or gain insights into the success stories of leading startups, this report is your comprehensive guide to the future of food delivery in Saudi Arabia. To read more about the history of food delivery and to deep dive into KSA’s food delivery market today, download and read the Special Report click here.

%2Fuploads%2Fsaudi-food-delivery%2Fcover21.jpg&w=3840&q=75)