The Complete History and Evolution of Food Delivery in Saudi Arabia

04 June 2024•

The Story of Food Delivery in KSA

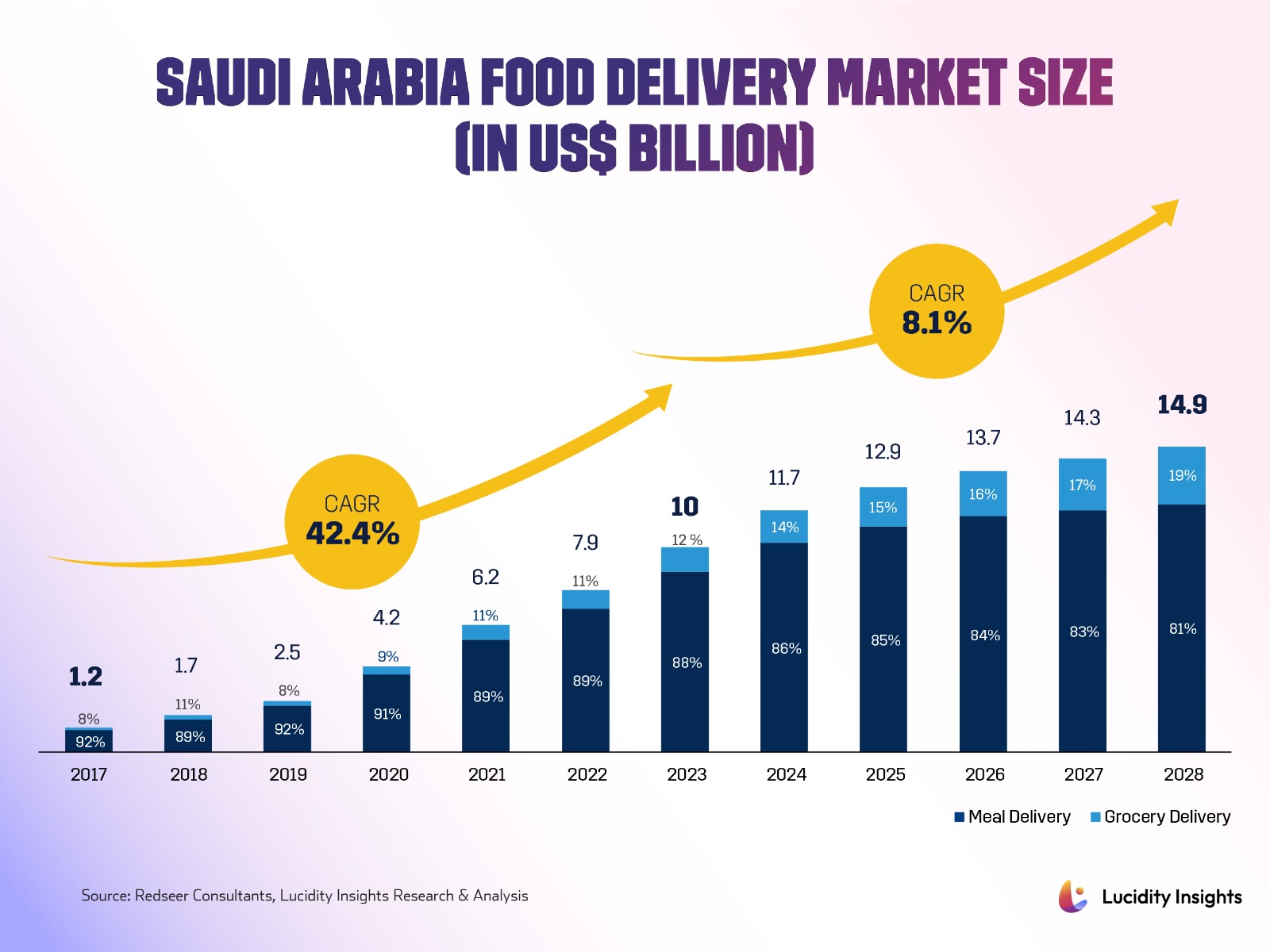

Saudi Arabia’s food delivery sector, poised to grow from $10 billion in 2023 to $14.9 billion by 2028, illustrates a vibrant market experiencing notable expansion in its two segments: meal and grocery delivery. Although meal delivery currently dominates, grocery delivery is swiftly gaining ground, showcasing shifting consumer preferences and the emergence of compelling service offerings. With the highest average revenue per user (ARPU) in the MENA region’s meal delivery market, surpassing $600, the Kingdom has remarkable consumer spending on food delivered to their doorstep.

Infobyte: Saudi Arabia Food Delivery Market Size

Infobyte: Saudi Arabia Food Delivery Market Size

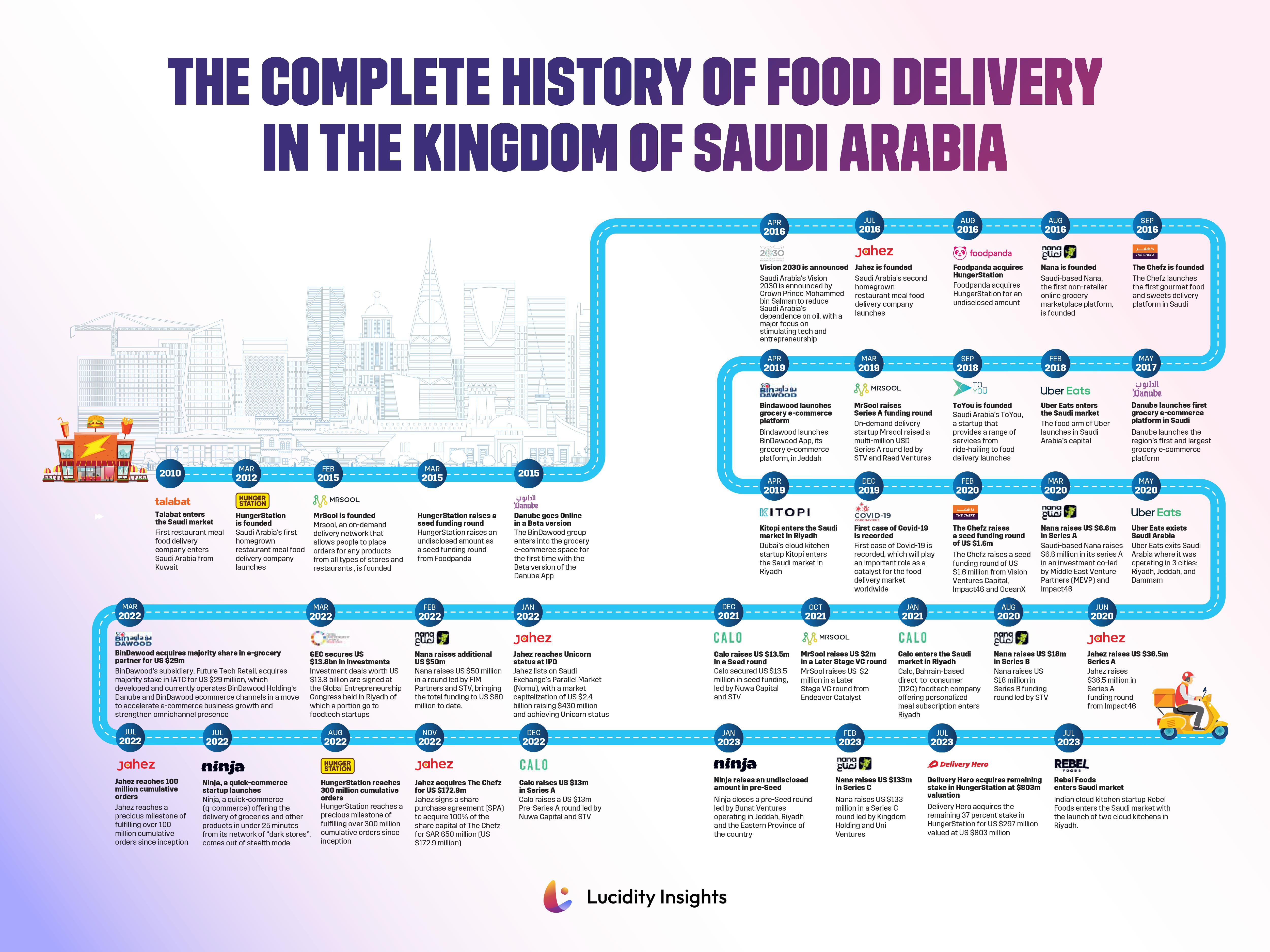

The Complete History of Food Delivery in the Kingdom of Saudi Arabia

2010

- Talabat enters the Saudi market: First restaurant meal food delivery company enters Saudi Arabia from Kuwait.

2012

- March 2012 – HungerStation is founded: Saudi Arabia's first homegrown restaurant meal food delivery company launches.

2015

- February 2015 – MrSool is founded: Mrsool, an on-demand delivery network that allows people to place orders for any products from all types of stores and restaurants , is founded.

Related: Mrsool’s Journey from eCommerce to Super App Contender

- March 2015 – HungerStation raises a seed funding round: HungerStation raises an undisclosed amount as a seed funding round from Foodpanda

- Danube goes Online in a Beta version: The BinDawood group enters into the grocery e-commerce space for the first time with the Beta version of the Danube App.

2016

- April 2016 – Vision 2030 is announced: Saudi Arabia's Vision 2030 is announced by Crown Prince Mohammed bin Salman to reduce Saudi Arabia's dependence on oil, with a major focus on stimulating tech and entrepreneurship.

- July 2016 – Jahez is founded: Saudi Arabia's second homegrown restaurant meal food delivery company launches

- August 2016 – Foodpanda acquires HungerStation: Foodpanda acquires HungerStation for an undisclosed amount.

- September 2016 – The Chefz is founded: The Chefz launches the first gourmet food and sweets delivery platform in Saudi.

2017

- Danube launches first grocery e-commerce platform in Saudi: Danube launches the region’s first and largest grocery e-commerce platform.

2018

- February 2018 – Uber Eats enters the Saudi market: The food arm of Uber launches in Saudi Arabia’s capital.

- September 2018 – ToYou is founded: Saudi Arabia’s ToYou, a startup that provides a range of services from ride-hailing to food delivery launches.

2019

- March 2019 – MrSool raises Series A funding round: On-demand delivery startup Mrsool raised a multi-million USD Series A round led by STV and Raed Ventures.

- April 2019 – Bindawood launches grocery e-commerce platform: Bindawood launches BinDawood App, its grocery e-commerce platform, in Jeddah.

- June 2019 – First case of Covid-19 is recorded: First case of Covid-19 is recorded, which will play an important role as a catalyst for the food delivery market worldwide

2020

- February 2020 – The Chefz raises a seed funding round of US $1.6m: The Chefz raises a seed funding round of US $1.6 million from Vision Ventures Capital, Impact46 and OceanX.

- March 2020 – Nana raises US $6.6m in Series A: Saudi-based Nana raises $6.6 million in its series A in an investment co-led by Middle East Venture Partners (MEVP) and Impact46.

- May 2020 – Uber Eats exits Saudi Arabia: Uber Eats exits Saudi Arabia where it was operating in 3 cities: Riyadh, Jeddah, and Dammam.

- June 2020 – Jahez raises US $36.5m Series A: Jahez raises $36.5 million in Series A funding round from Impact46.

- August 2020 – Nana raises US $18m in Series B: Nana raises US $18 million in Series B funding round led by STV.

2021

- January 2021 – Calo enters the Saudi market in Riyadh: Calo, Bahrain-based direct-to-consumer (D2C) foodtech company offering personalized meal subscription enters Riyadh.

Related: Calo: Pioneering Personalized Nutrition and Wellness in MENA

- October 2021 – MrSool raises US $2m in a Later Stage VC round: MrSool raises US $2 million in a Later Stage VC round from Endeavor Catalyst.

- December 2021 – Calo raises US $13.5m in a Seed round: Calo secured US $13.5 million in seed funding, led by Nuwa Capital and STV.

2022

- January 2022 – Jahez reaches Unicorn status at IPO: Jahez lists on Saudi Exchange’s Parallel Market (Nomu), with a market capitalization of US $2.4 billion raising $430 million and achieving Unicorn status.

- February 2022 – Nana raises additional US $50m: Nana raises US $50 million in a round led by FIM Partners and STV, bringing the total funding to US $80 million to date.

- March 2022 – GEC secures US $13.8bn in investments: Investment deals worth US $13.8 billion are signed at the Global Entrepreneurship Congress held in Riyadh of which a portion go to foodtech startups.

- March 2022 – BinDawood acquires majority share in e-grocery partner for US $29m: BinDawood’s subsidiary, Future Tech Retail, acquires majority stake in IATC for US $29 million, which developed and currently operates BinDawood Holding’s Danube and BinDawood ecommerce channels in a move to accelerate e-commerce business growth and strengthen omni channel presence.

- July 2022 – Jahez reaches 100 million cumulative orders: Jahez reaches a precious milestone of fulfilling over 100 million cumulative orders since inception.

- July 2022 – Ninja, a quick-commerce startup launches: Ninja, a quick-commerce (q-commerce) offering the delivery of groceries and other products in under 25 minutes from its network of “dark stores”, comes out of stealth mode.

- August 2022 – HungerStation reaches 300 million cumulative orders: HungerStation reaches a precious milestone of fulfilling over 300 million cumulative orders since inception.

- November 2022 – Jahez acquires The Chefz for US $172.9m: Jahez signs a share purchase agreement (SPA) to acquire 100% of the share capital of The Chefz for SAR 650 million (US $172.9 million).

- December 2022 – Calo raises US $13m in Series A: Calo raises a US $13m Pre-Series A round led by Nuwa Capital and STV.

2023

- January 2023 – Ninja raises an undisclosed amount in pre-Seed: Ninja closes a pre-Seed round led by Bunat Ventures operating in Jeddah, Riyadh and the Eastern Province of the country.

- February 2023 – Nana raises US $133m in Series C: Nana raises US $133 million in a Series C round led by Kingdom Holding and Uni Ventures.

- July 2023 – Delivery Hero acquires remaining stake in HungerStation at $803m valuation: Delivery Hero acquires the remaining 37 percent stake in HungerStation for US $297 million valued at US $803 million.

- July 2023 – Rebel Foods enters Saudi market: Indian cloud kitchen startup Rebel Foods enters the Saudi market with the launch of two cloud kitchens in Riyadh.

Infobyte: The Complete History of Food Delivery in the Kingdom of Saudi Arabia

Infobyte: The Complete History of Food Delivery in the Kingdom of Saudi Arabia

Next Read: The Future of Food Delivery in Saudi Arabia: A Transformative Market on the Rise

Read more in the Special Report, ‘The Future of Food Delivery in Saudi Arabia’.

%2Fuploads%2Fsaudi-food-delivery%2Fcover.jpg&w=3840&q=75)