Nana: Revolutionizing Grocery Shopping in Saudi Arabia

06 June 2024•

In the burgeoning market of e-commerce, Nana has distinguished itself as a transformative force in Saudi’s new grocery delivery space.

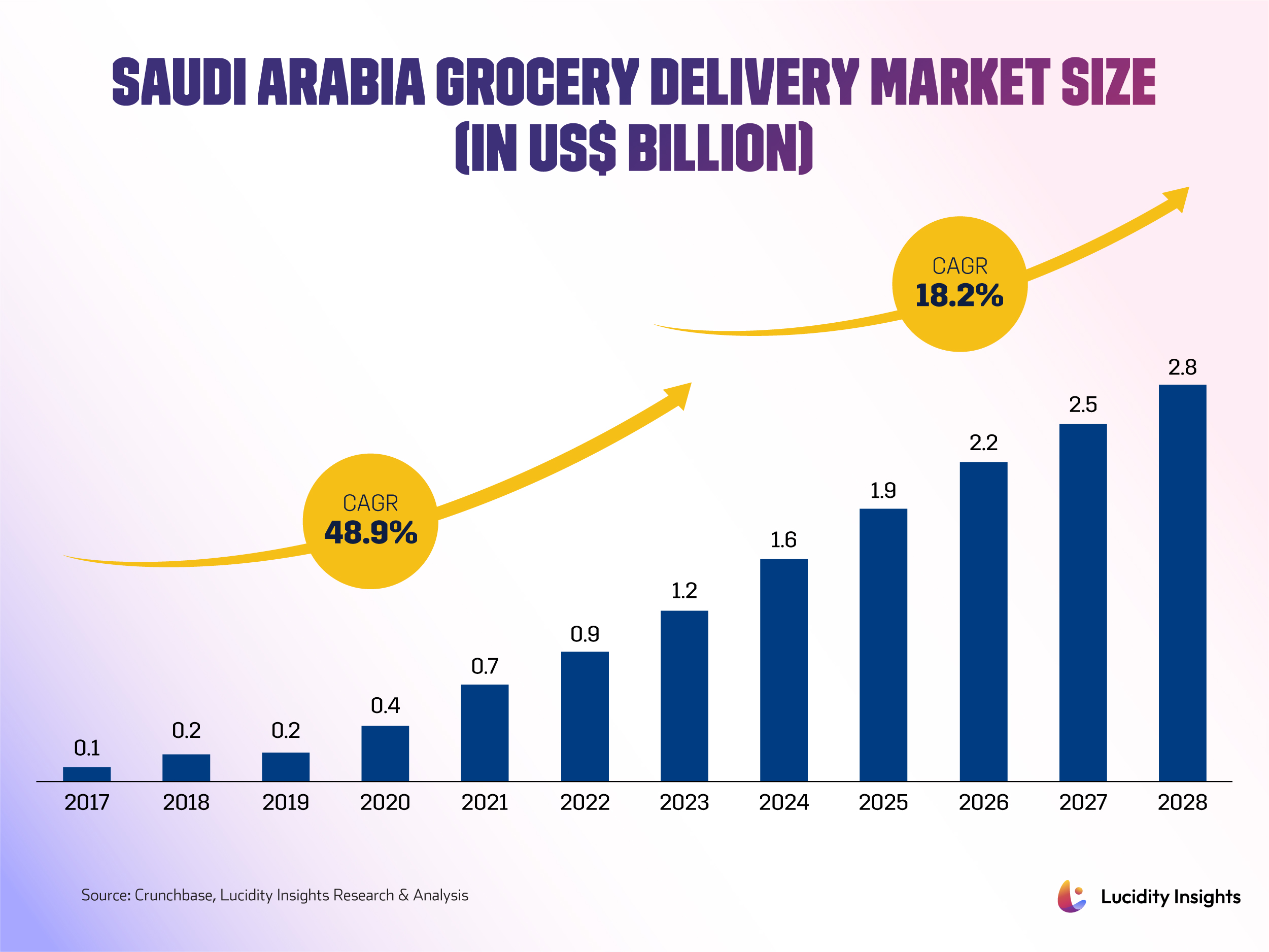

Founded in early 2016 by Sami Al-Helwah and Ahmed Al Samaani, Nana embarked on a mission to streamline the grocery shopping experience, making it more convenient, efficient, and accessible for everyone. Since its inception, Nana has been able to capitalise on the growth of the local grocery delivery market increasing more than tenfold, going from US $100 million in 2017 to US $1.2 billion in 2023. Today, Nana claims the leadership position in this segment.

Infobyte: Saudi Arabia Grocery Delivery Market Size

From Nana Direct to Nana Express and Nana Hyper

Initially, Nana Direct introduced a typical marketplace model that connected consumers with supermarkets and specialty stores through a seamless network of in-store pickers and a last-mile delivery fleet. Nana operated on a sharing economy business model and utilized three interconnected apps. The first app caters to grocery shoppers on both Apple and Android platforms. The second app is designed for online store owners, enabling them to track sales and update their product offerings. The third app is for the delivery team, facilitating the process of bringing orders directly to the customers. This model rapidly gained traction, expanding from Riyadh where it started to 12 cities by early 2019 and offering over 13,000 products through its Arabic-only apps for iOS and Android. The founders decided on Riyadh as the first city for their launch. This decision stemmed from Riyadh’s robust purchasing power and substantial population, even in the face of stiff competition from established brands such as Carrefour and Danube. By 2020, Nana claimed the title of Saudi’s leading grocery marketplace, boasting partnerships with retail giants like Panda and Carrefour and marking its presence in 14 cities.

The COVID-19 pandemic served as an unforeseen catalyst for Nana, significantly increasing demand as consumers sought safer shopping alternatives. Responding with agility, Nana tripled its capacity in just ten days, ensuring that the surge in consumer demand was adequately met. This sudden shift in behavior contributed to exposing consumers to Nana’s services, building trust, and shifting behaviour towards digital contributing to the sustained long-term growth potential of Nana.

By 2022, Nana introduced two new service offerings, Nana Express and Nana Hyper. Nana Express, with its network of micro-fulfillment centers or Dark Stores, promised delivery of daily grocery needs within 15 minutes, showcasing an inventory of up to 2,000 SKUs. Meanwhile, Nana Hyper catered to the weekly and monthly grocery requirements with a vast selection of more than 20,000 SKUs, emphasizing convenience and quality. By April 2023, Nana’s operations had expanded to 18 cities, underpinning its commitment to growth and customer satisfaction.

Leveraging Technology for Efficiency and Engagement

As Nana’s journey evolved from a startup to a scale-up, the team needed to go back to the fundamentals and to really focus on what could be improved beyond the mature set of features and functionalities it was offering its customers. Nana went on to implement cutting-edge technology to enhance infrastructure and customer experience. Partnerships with tech giants for solutions like Cloud Fleet Routing, Vertex AI and BigQuery have enabled Nana to optimize stock levels and delivery routes, centralize data analysis, and personalize customer engagement. In 2023, Nana partnered with Yango Deli Tech to provide the company with the technological and operational capabilities to address stock inaccuracies and replenishment inefficiencies, enabling almost 100 per cent stock accuracy, showcasing Nana’s ongoing commitment to innovation and excellence.

Related: Yango Delivery: The First Choice for Last Mile Delivery

In frame: Sami Alhelwah, Nana Co-Founder and CEO.

Fueling Growth with Funding

Nana’s impressive funding journey includes a $6.6 million Series A in February 2019, an $18 million Series B in March 2020, and a monumental $133 million Series C in February 2023. These rounds, particularly the Series C led by Kingdom Holding and Uni Ventures, underscored the market’s confidence in Nana’s vision and growth trajectory. At the time of writing, this is the 6th largest VC investment round for a Saudi startup. The funds have been instrumental in expanding Nana’s footprint both nationally but also internationally, enhancing technological infrastructure, and scaling operations to meet growing demand.

Nana’s New Identity

In February 2022, Nana unveiled a new brand identity, symbolized by the ‘Nana the camel’ emblem, reflecting attributes of reliability, strength, and endurance. This rebranding resonates with Nana’s commitment to being a dependable partner in the daily lives of its customers, mirroring the company’s appreciation for its cultural heritage and aspirations for the future. The new brand identity marked the start of Nana’s transformation. It underscores Nana’s achievements in developing, modernizing, and enhancing a potent Saudi brand, with aspirations to evolve into an internationally recognized yet locally anchored brand.

Nana’s Future Plans

With the successful close of its Series C funding, Nana is poised for unprecedented growth. Having delivered to date more than 45 million orders and boasting more than 600 thousands delivery drivers, the company intends to capitalise on these achievements and aims to achieve 40% market share by the end of 2026, driven by a strategy that focuses on expanding its network of Dark Stores, leveraging technological advancements for operational efficiency, and continuously enhancing the customer experience. Nana’s journey is not just about transforming grocery shopping in Saudi Arabia—it’s about setting a new standard for retail in the digital age.

As Nana continues to evolve, its foundational mission remains unchanged: to empower households with an effortless, reliable, and quality grocery shopping experience. Through strategic partnerships, technological innovation, and a deep understanding of consumer needs, Nana is not just navigating the future of e-commerce—it’s leading the way.

Next Read: The Future of Food Delivery in Saudi Arabia: A Transformative Market on the Rise

%2Fuploads%2Fsaudi-food-delivery%2Fcover.jpg&w=3840&q=75)