Saudi Arabia’s Food Delivery Market: A $14.9 Billion Industry by 2028

06 June 2024•

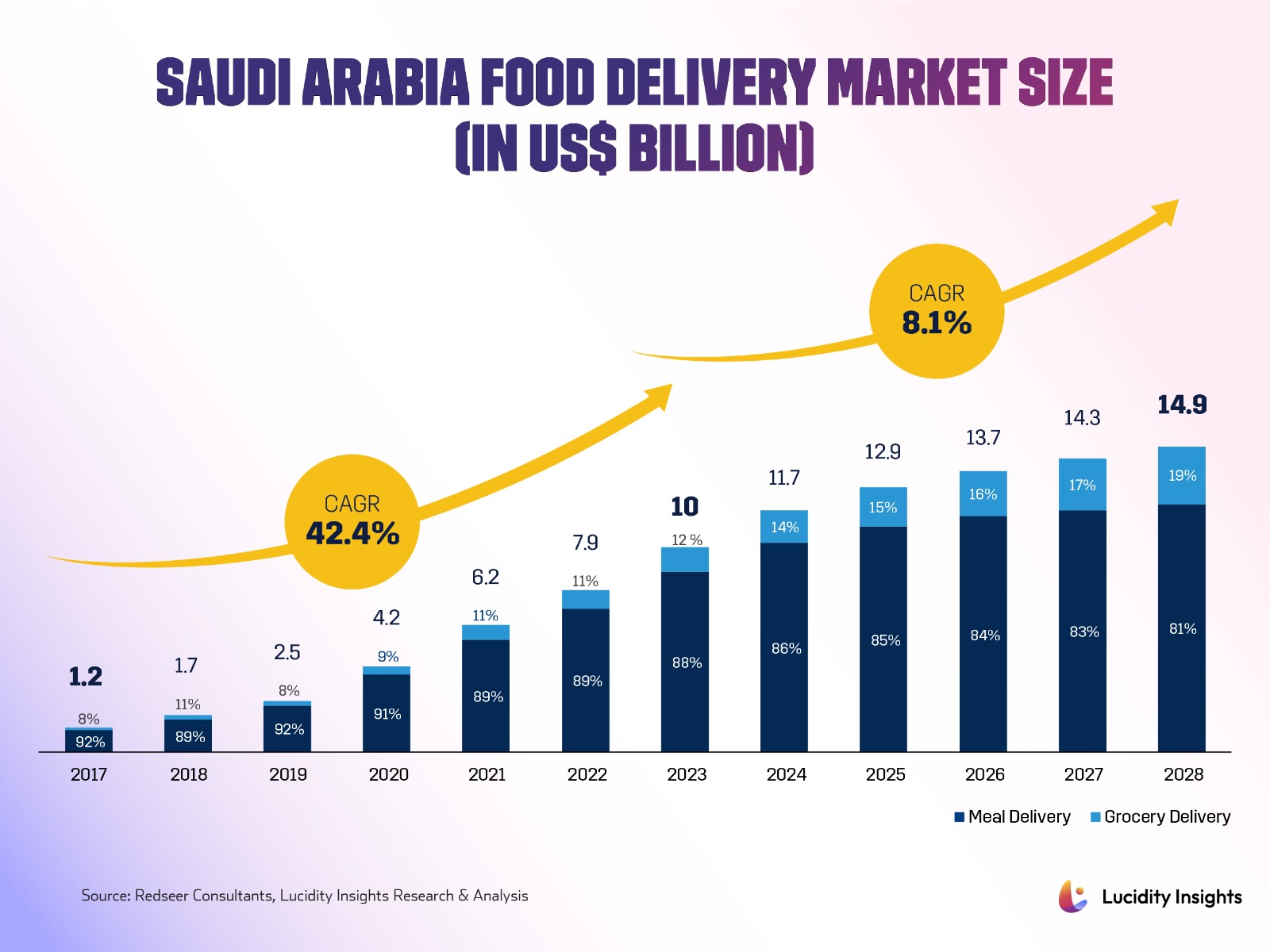

As Saudi Arabia’s food delivery sector matures, it presents a landscape ripe with innovation, growth, and transformation. The Kingdom’s food delivery market, already valued at $10 billion in 2023, is forecasted to reach an impressive $14.9 billion by 2028, fueled by the dynamism of startups capturing significant VC investments and interests from global competitors.

This market has been evolving and is forecasted to keep evolving driving by changing modern Saudi consumer’s demands. The bifurcation of the market into meal and grocery delivery segments reflects broader shifts in consumer behavior and technological adoption.

Infobyte: Saudi Arabia Food Delivery Market Size (in US$ Billion)

Infobyte: Saudi Arabia Food Delivery Market Size (in US$ Billion)

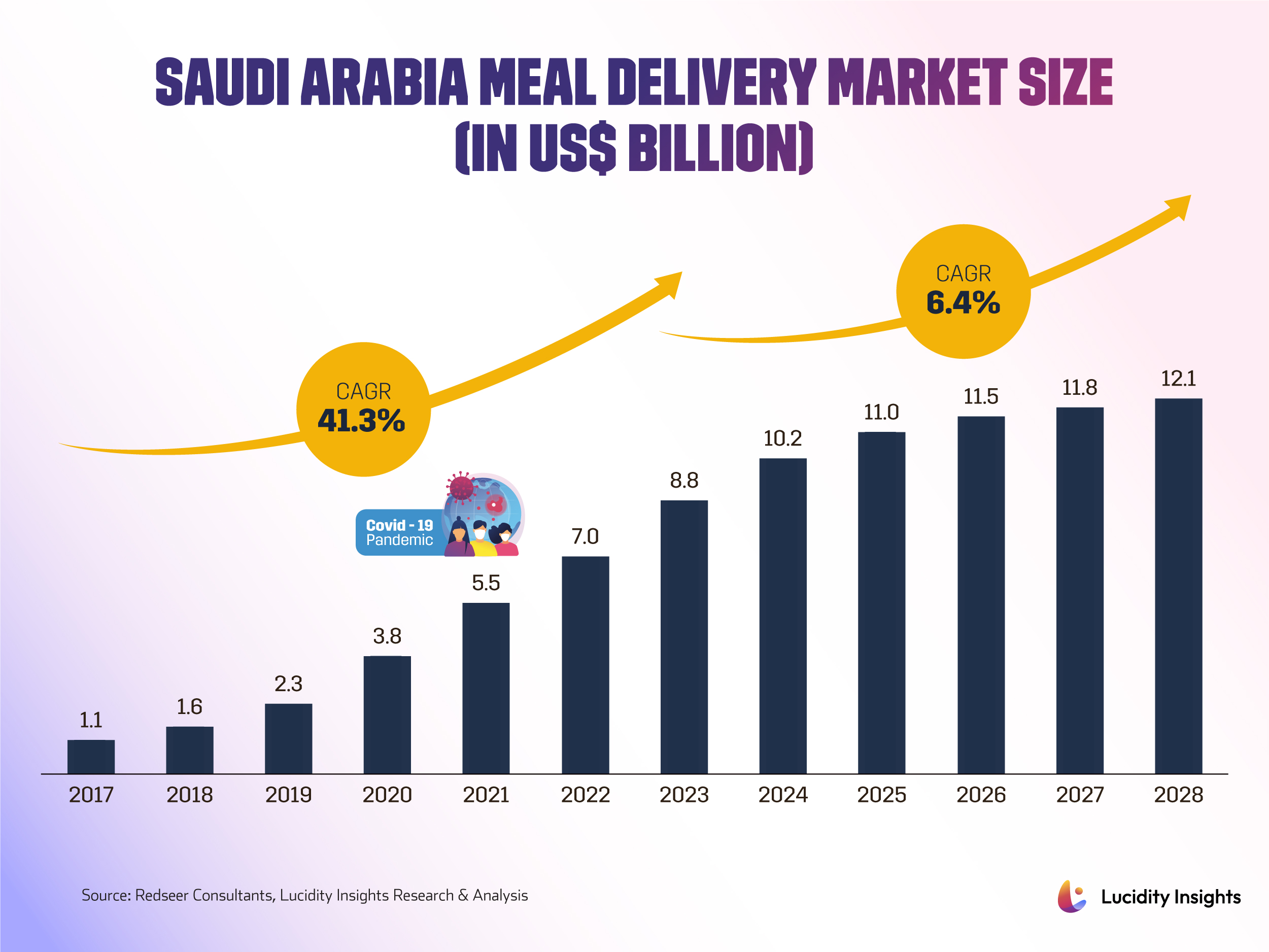

Meal delivery, while currently dominant, is gradually yielding market share to the burgeoning grocery delivery segment, illustrating changing consumer habits and the incursion of innovative players. The meal delivery market itself, expected to grow to $12.1 billion by 2028, mirrors the sector’s maturation, moving from rapid expansion to more sustainable growth rates. This transition, from a hyper-growth phase spurred by the pandemic to a focus on consolidation and efficiency, signals a maturing market that still harbors vast potential for targeted, consumer-centric innovations.

Infobyte: Saudi Arabia Meal Delivery Market Size

Infobyte: Saudi Arabia Meal Delivery Market Size

Central to the narrative of growth is the strategic significance of funding, with startups like Nana securing monumental investments, such as its latest round of $133 million, highlighting investor confidence in the market’s potential. These investments are not merely financial injections but endorsements of a future where digital platforms redefine how food and groceries are consumed in the Kingdom.

The Saudi food delivery market’s vibrancy is also underscored by its capacity to embrace and integrate technology for greater efficiency and enhanced customer experiences. Innovations, such as HungerStation’s foray into AI to simplify meal selection or Nana’s usage of BigQuery to improve customer engagement through data-driven interactions, reflect a deeper understanding of consumer needs and a commitment to leveraging technology to meet those needs more effectively. This embrace of technology has been and will remain a crucial element and a key driver to materialize the forecasted growth.

In conclusion, Saudi Arabia’s food delivery sector is at an exciting crossroads, buoyed by technological advancements, changing consumer preferences, and robust investment activity. The dual growth of meal and grocery delivery segments heralds a new era of convenience, customization, and consumer engagement.

As the sector continues to evolve, it promises not only to meet the immediate needs of Saudi consumers but also to redefine the contours of the food delivery market in the Kingdom and beyond. With a solid foundation and a clear vision for the future, the food delivery sector is poised to remain an essential pillar of Saudi Arabia’s digital economy, offering a template for innovation, growth, and consumer-centricity in the foodtech industry.

Next Read: 10 Must-See Graphs on Saudi Arabia’s Food Delivery Landscape

%2Fuploads%2Fsaudi-food-delivery%2Fcover21.jpg&w=3840&q=75)