A Visual Feast: 10 Must-See Graphs on Saudi Arabia’s Food Delivery Landscape

03 June 2024•

Saudi Arabia's food delivery market is rapidly evolving, from the explosive rise of meal delivery services to the burgeoning grocery delivery segment. This visual guide features ten must-see infographics that highlight key trends, market drivers, and emerging players in the Kingdom's food delivery industry, offering a comprehensive overview of this vibrant and competitive sector.

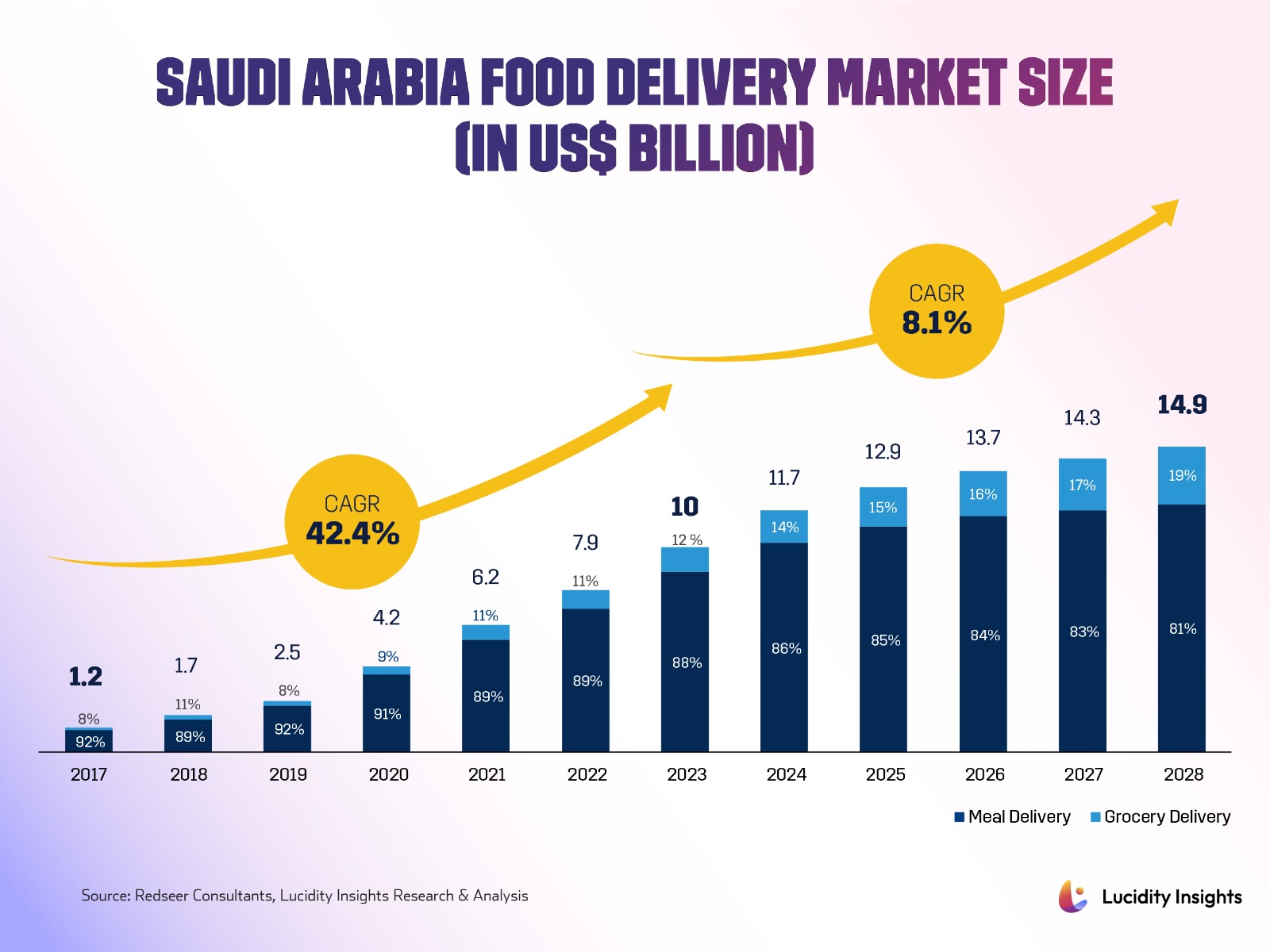

1. Saudi Arabia’s Food Delivery Market on the Rise Forecasted to Reach $14.9bn by 2028

The food delivery market in Saudi Arabia was estimated to be worth US $10 billion in 2023 and is expected to grow to US $14.9 billion by 2028 growing at a 8.1% compound annual growth rate. The meal delivery segment drives the lion’s share of the market at 88% in 2023 but it has been losing share to the grocery delivery segment driven by new entrants and changing grocery consumer habits.

Infobyte: Saudi Arabia Food Delivery Market Size (in US$ Billion)

Infobyte: Saudi Arabia Food Delivery Market Size (in US$ Billion)

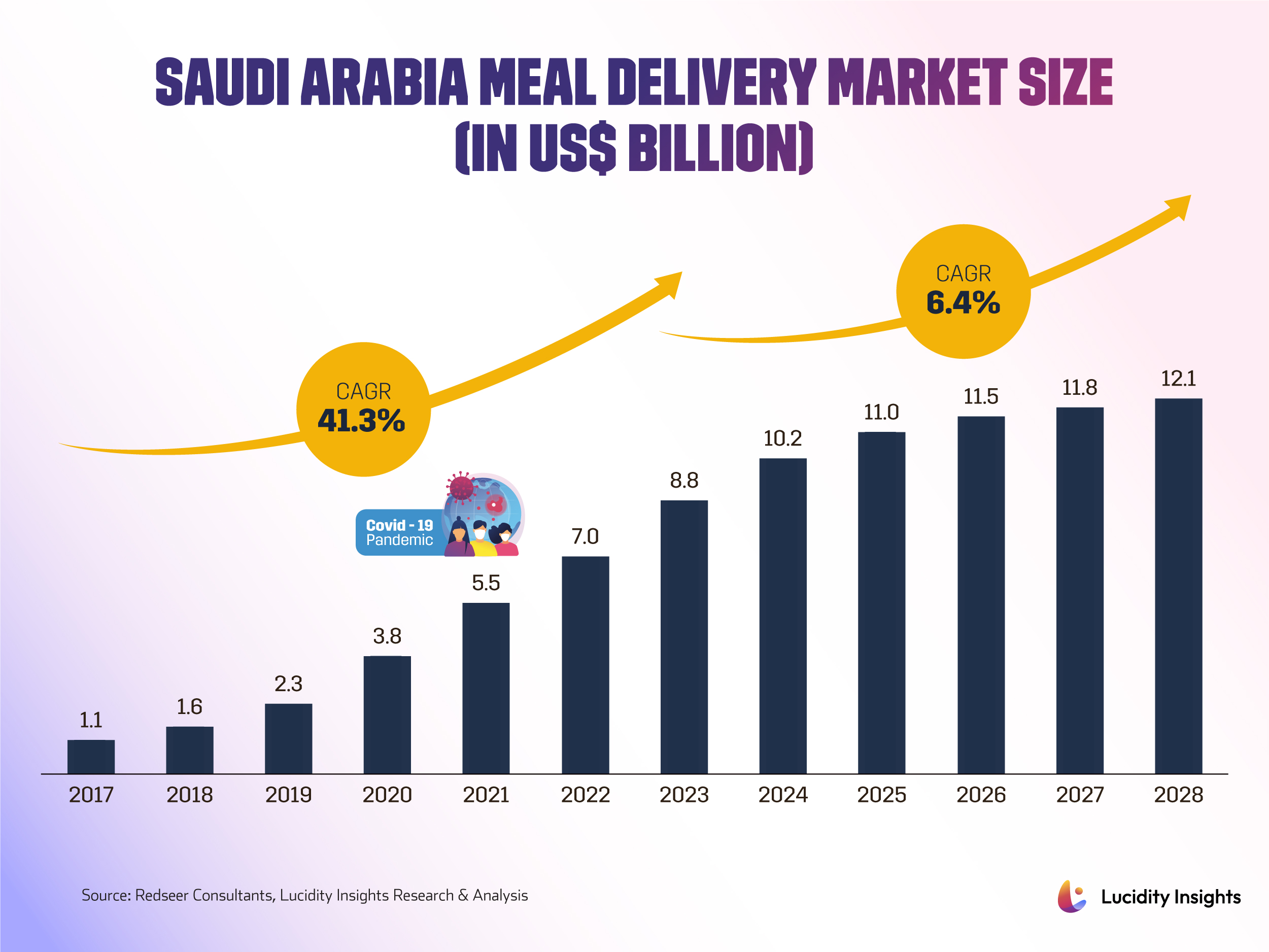

2. Post-Pandemic Shift: Saudi Arabia’s Meal Market Braces for Slower Growth

The meal delivery market is expected to grow to US $12.1 billion by 2028, with a CAGR of 6.4%; this slower pace of growth is indicative of the level of maturation reached in the Saudi market. In 2019, the meal delivery market was sitting at US $2.3 billion, just 1/4th of the current market size. At that time, consumers were highly concentrated in the capital city of Riyadh. In 2020-21, the Saudi market (like most global markets) experienced rapid growth; meal delivery adoption was being driven primarily by the pandemic’s stayat-home orders limiting restaurant visits. Instead, consumers increasingly turned to online food delivery options which significantly reshaped consumer behaviors. The main players active in the Saudi market at this time were HungerStation and Jahez.

Infobyte: Saudi Arabia Meal Delivery Market Size (in US$ Billion)

Infobyte: Saudi Arabia Meal Delivery Market Size (in US$ Billion)

Related: The 11-Year History of HungerStation

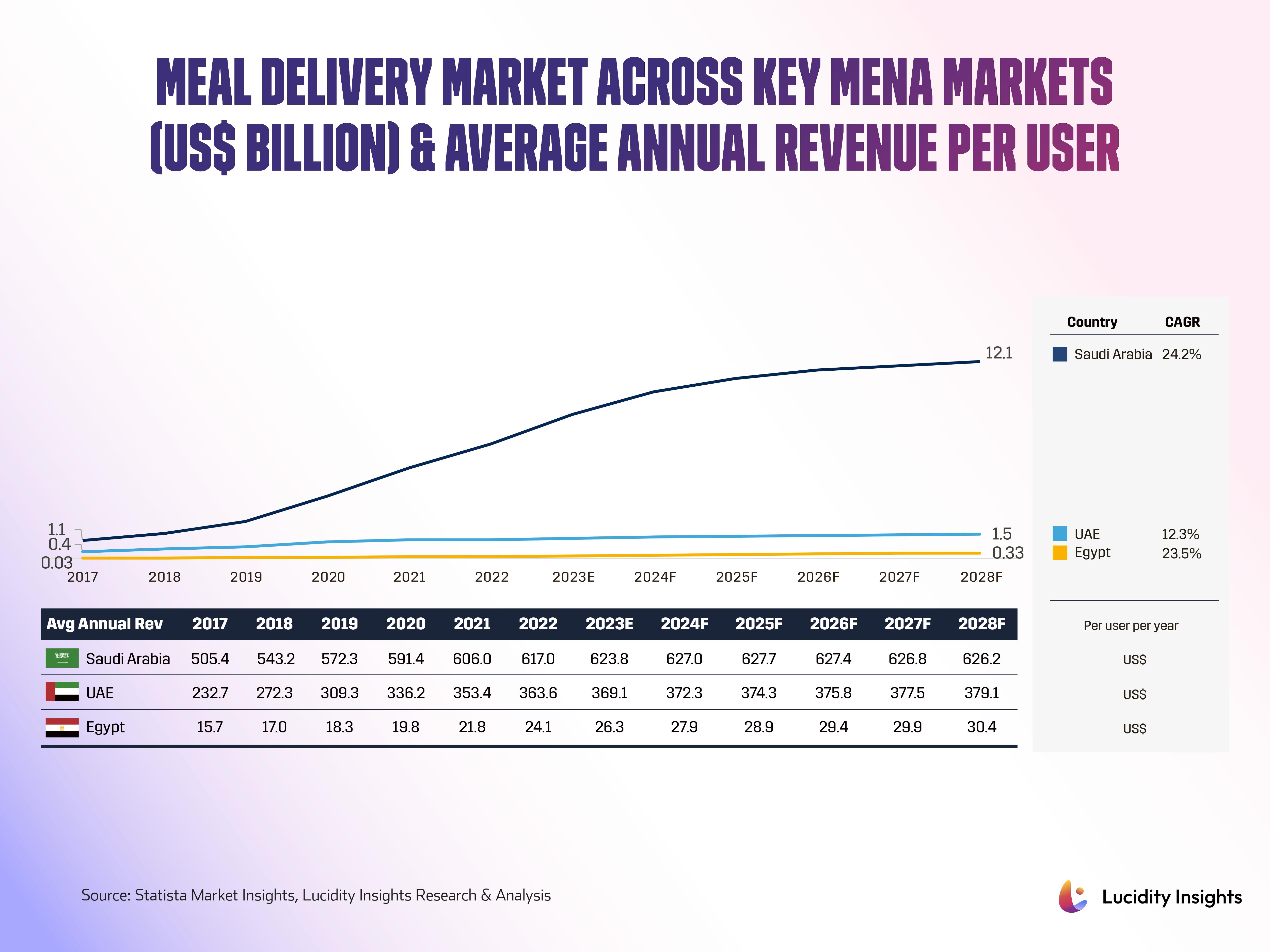

3. Saudi Consumers have Largest ARPU User Spend in MENA for Food Delivery

The meal delivery market is currently the largest in Saudi Arabia and is expected to balloon up to over US $12.1 billion by 2028 due to both the population and spending capability. In 2022, the average annual revenue per user per year (ARPU) was also the highest in Saudi Arabia, at over US $600 per person while it was the lowest in Egypt. The ARPU in the Kingdom was more than 25.6 times the average revenue in Egypt and 1.7 times the average revenue in the UAE.

Infobyte: Meal Delivery Market Across Key MENA Markets (US$ Billion) & Average Annual Revenue per User

Infobyte: Meal Delivery Market Across Key MENA Markets (US$ Billion) & Average Annual Revenue per User

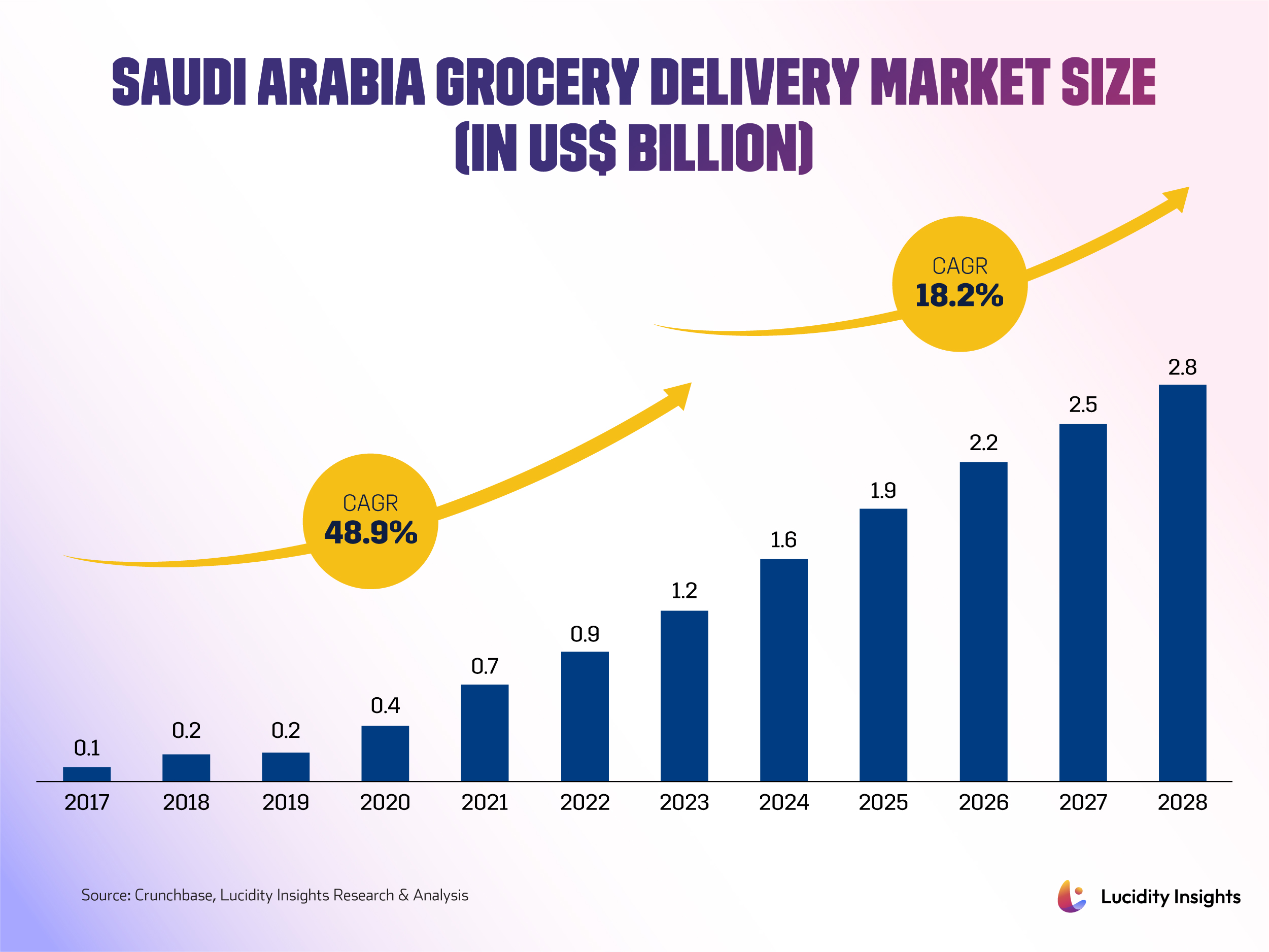

4. Saudi Arabia’s Grocery Delivery Market Set to Double in the Next 5 Years

The grocery delivery market is expected to grow to US $2.8 billion by 2028 at an 18.2% CAGR; a growth rate 3 times higher than the 6% CAGR of the meal delivery market. This growth is driven by the fact that grocery delivery is still in its infancy in Saudi, due to the segment coming later into the Saudi market. There are a growing number of grocery delivery players in the space such as Nana and Ninja, and Saudi is still witnessing the early days of changing consumer habits towards online grocery shopping. Moreover, incumbent retailers such as Panda and Al Rawa are yet to enter the market with their e-commerce operations, which will further sustain that growth.

Infobyte: Saudi Arabia Grocery Delivery Market Size (in US$ Billion)

Infobyte: Saudi Arabia Grocery Delivery Market Size (in US$ Billion)

Related: Nana: Revolutionizing Grocery Shopping in Saudi Arabia

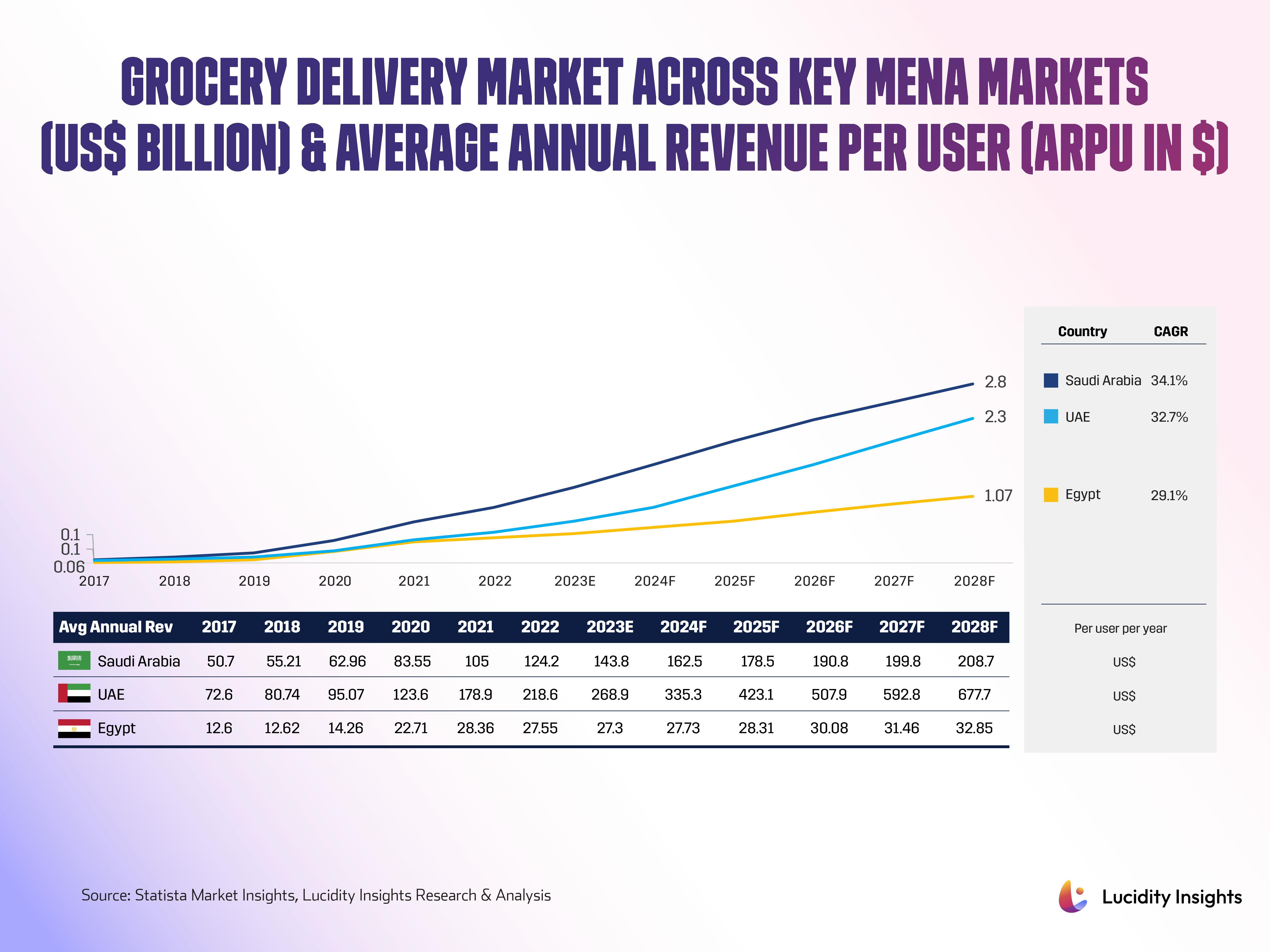

5. Saudi Arabia’s Grocery Delivery Users Spend 1.9x Less than its UAE Counterparts

The grocery delivery market size in Saudi Arabia modestly exceeds that of the UAE, largely due to Saudi Arabia’s significantly larger (3.8X) population size, despite the UAE having a much higher grocery delivery penetration rate. Moreover, the UAE’s average annual revenue per user surpasses that of Saudi Arabia by 1.9 times today, and is expected to maintain a strong benchmark. Saudi Arabia’s average annual revenue per user (ARPU) is forecasted to reach just over US $209 per user in 2028, while the ARPU of a UAE consumer is expected to exceed US $677 by 2028.

Infobyte: Grocery Delivery Market Across Key MENA Markets (US$ billion) & Average Annual Revenue per User (ARPU in $)

Infobyte: Grocery Delivery Market Across Key MENA Markets (US$ billion) & Average Annual Revenue per User (ARPU in $)

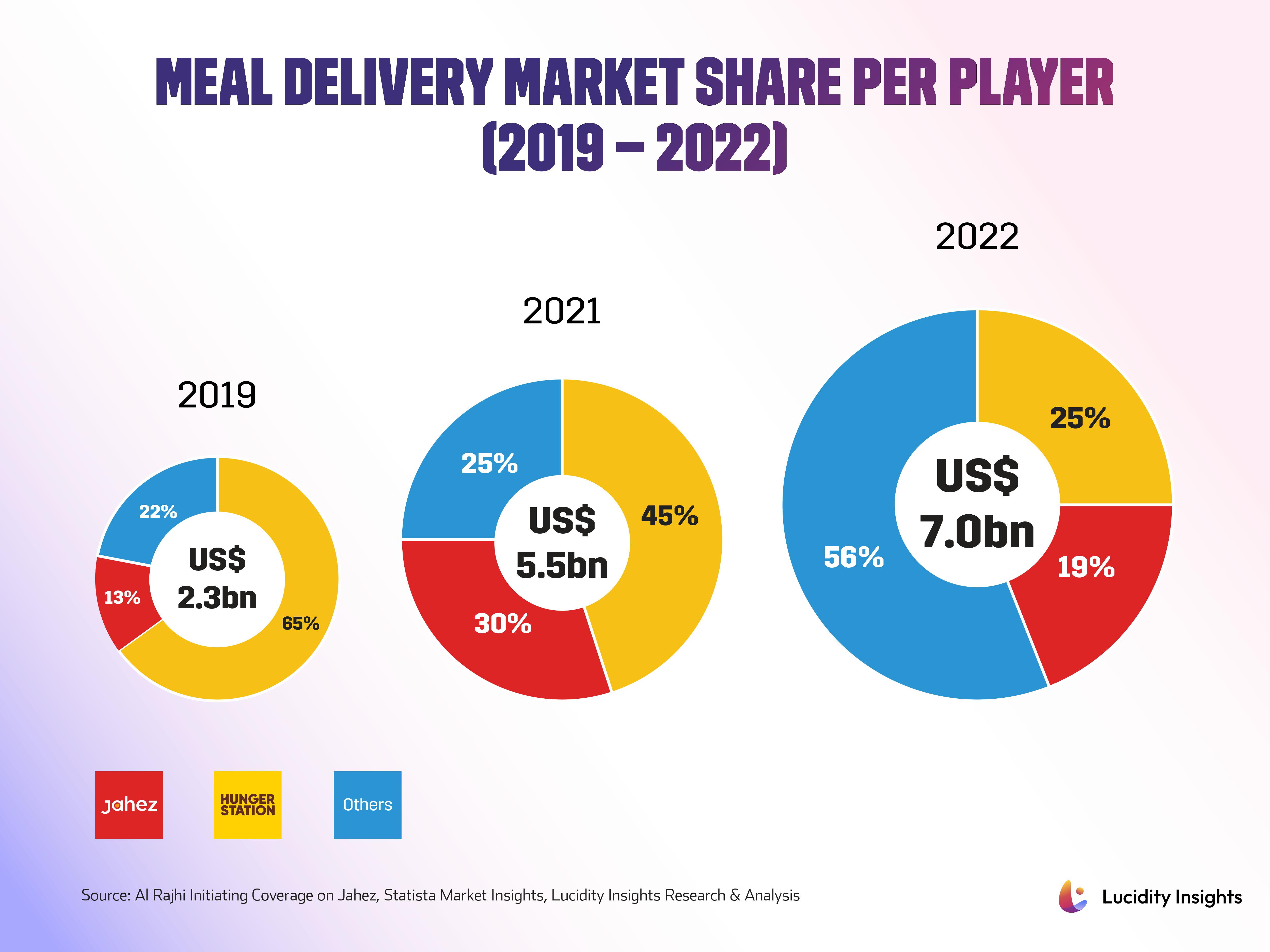

6. Dominance Under Pressure: HungerStation’s First-Mover Advantage in Saudi Arabia

There are two dominant players in the Saudi food delivery landscape, and that is HungerStation and Jahez. HungerStation was partially acquired by Rocket Internet’s FoodPanda in 2016; in 2023, the company was fully acquired and absorbed into Delivery Hero’s global portfolio of foodtech players. Jahez successfully IPO’d on Saudi Arabia’s secondary stock exchange in 2022. As the infobyte shows, HungerStation remains the dominant player, having been the first to market. Back in 2019, HungerStation boasted a 65% market share of the meal delivery segment while Jahez only held 13% of the market. Fast forward 3 years and in 2022, HungerStation and Jahez held less than 50% of the total Saudi market, indicating increased competition as new entrants such as MrSool gain momentum.

Infobyte: Meal Delivery Market Share Per Player (2019-2022)

Infobyte: Meal Delivery Market Share Per Player (2019-2022)

Related: Tracking Jahez’s Five-Year Journey to Become a Unicorn

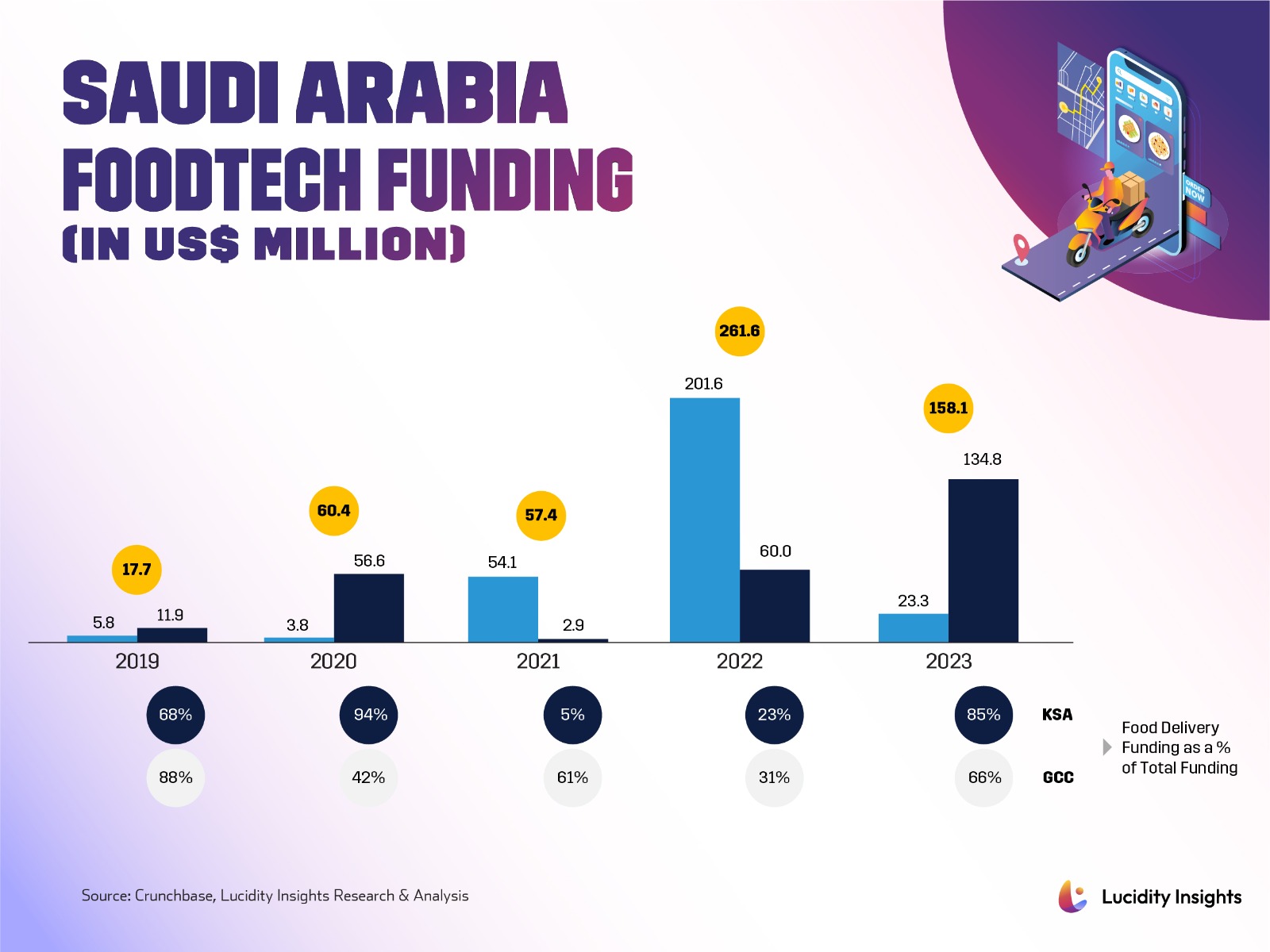

7. Fueling the Feast: Food Delivery’s Central Role in Saudi Foodtech Funding

In 2020, 94% of funding went to delivery-related startups driven by Jahez and Nana raising US $36.5 million and $24.6 million, respectively. In 2021 and 2022, Foodics’ two consecutive rounds eclipsed food-related funding as it went on to raise an additional US $170 million. Finally, in 2023, food-related delivery startups are back capturing 85% of the total funding amount driven by Nana’s US $133 million Series C raise.

Infobyte: Saudi Arabia FoodTech Funding (in US$ million)

Infobyte: Saudi Arabia FoodTech Funding (in US$ million)

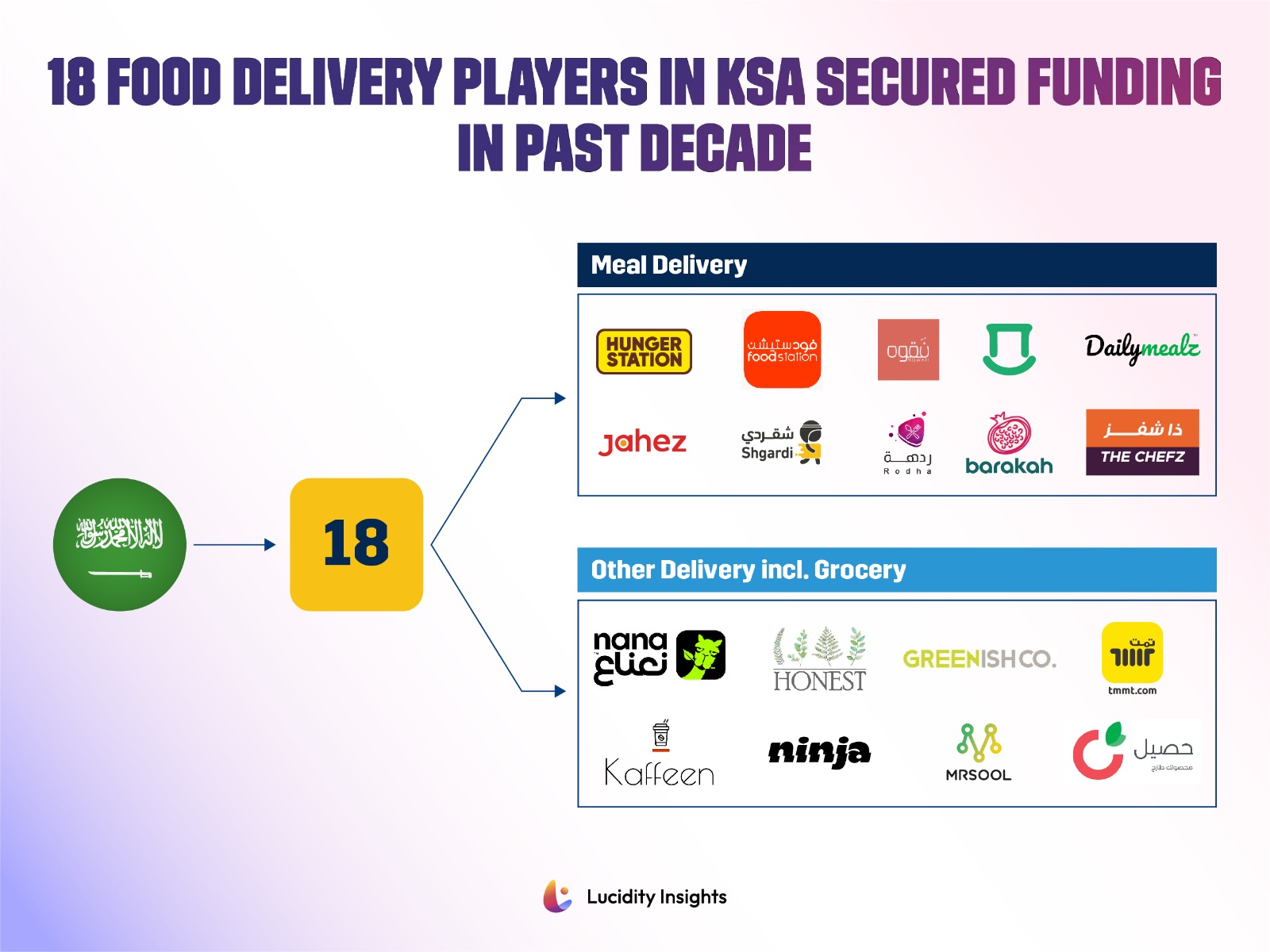

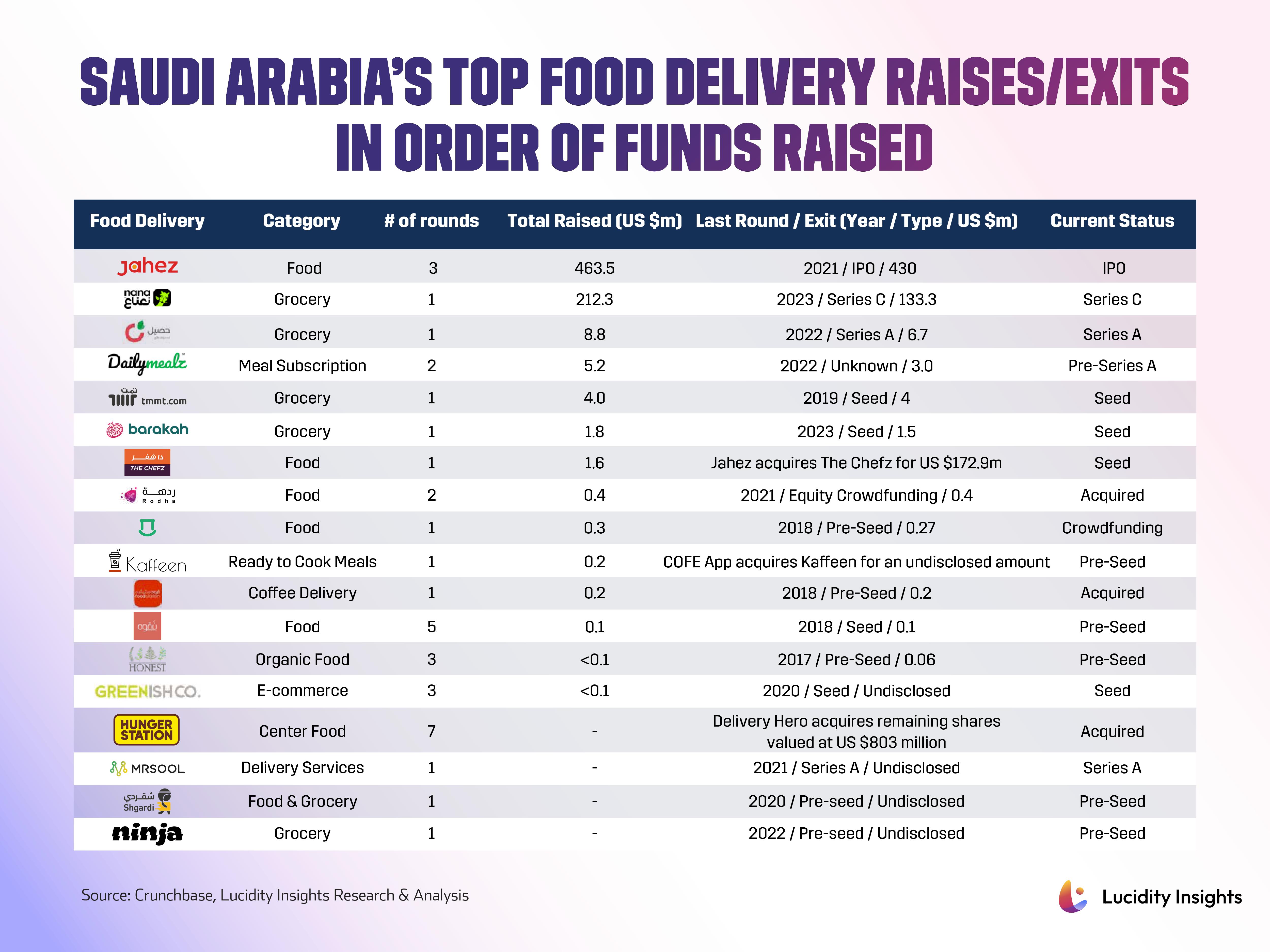

8. There are 18 Food Delivery players in KSA that have successfully fundraised at least one round in the past decade

The major meal delivery players in KSA which have received funding include Hungerstation and Jahez. While Hungerstation was acquired, Jahez IPOed in 2021 raising US $430 million through the public offering. Grocery delivery has the likes of Nana and MrSool, of which Nana has received the most funding at US $ 212 million, with its largest single round being the US$ 133 million Series C raised in February 2023. Other players are more specialized, including Kaffeen (specialized in online coffee ordering and now acquired by Kuwait-based online coffee marketplace, COFE App) and Honest (specialized in organic produce).

Infobyte: 18 Food Delivery Players in KSA Secure Funding in Past Decade

Infobyte: 18 Food Delivery Players in KSA Secure Funding in Past Decade

Related: Mrsool’s Journey from eCommerce to Superapp Contender

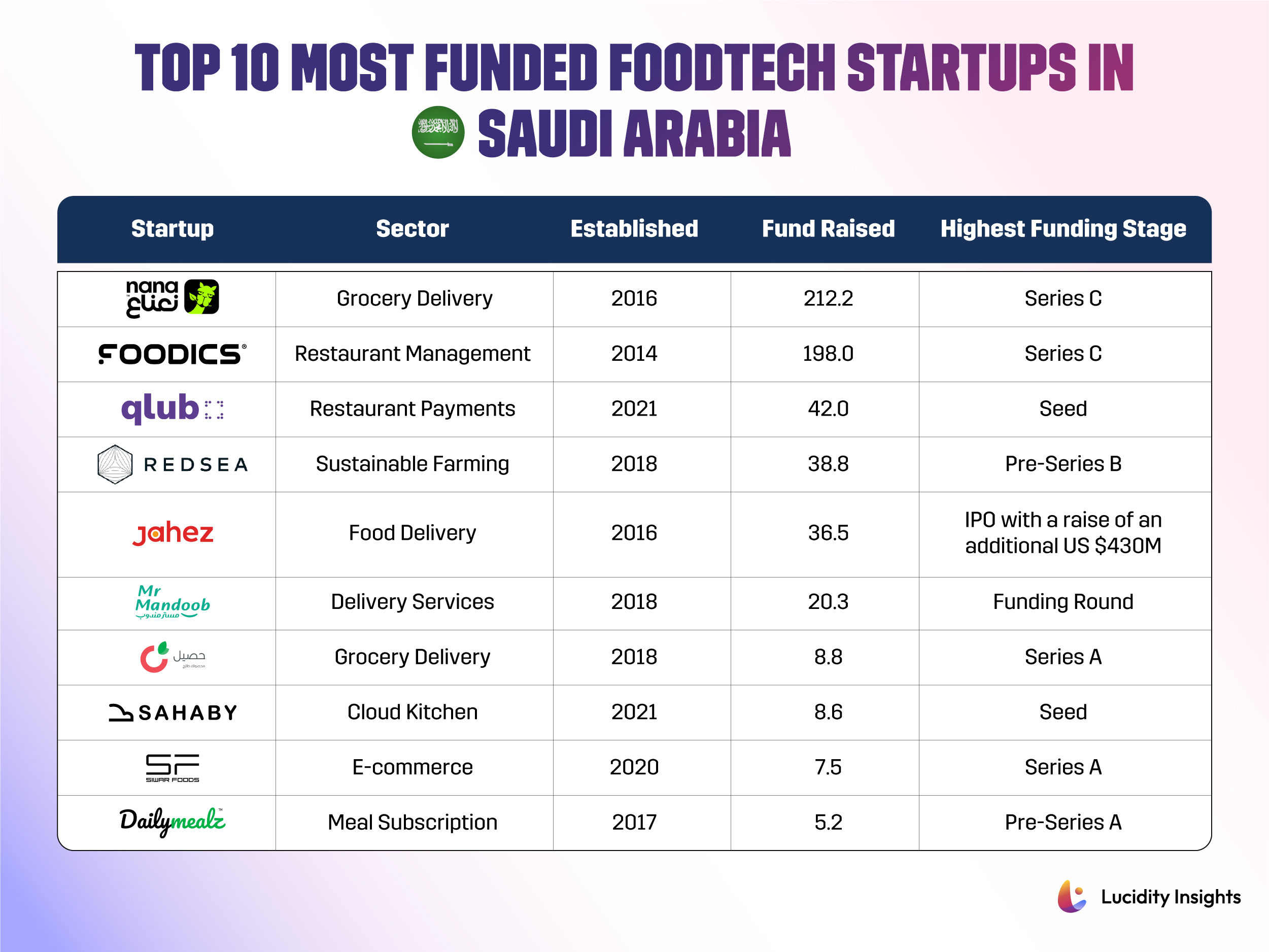

9. Top 10 Most Funded Foodtech Startups in Saudi Arabia

Nana takes the top spot as the most funded foodtech with US $212.2 billion raised to date.

Infobyte: Foodtech: Saudi Arabia’s Top 10 Most Funded Startups

Infobyte: Foodtech: Saudi Arabia’s Top 10 Most Funded Startups

10. Saudi’s Foodtech Market Is Consolidating & Has Had Several Successful Exits

In the meal delivery market, key players have achieved notable exits, highlighting the sector’s robust growth and investor confidence. In 2023, HungerStation was acquired by Delivery Hero in a landmark deal valued at $803 million, marking a significant milestone in the industry. Meanwhile, Jahez made headlines in 2021 by going public and achieving unicorn status, underscoring the vibrant potential of meal delivery startups. On the grocery delivery front, Nana stands out as a leader, having secured funding seven times over as it ambitiously expands its dark stores network to further solidify its market presence.

Infobyte: Saudi Arabia’s Top Food Delivery Raises/Exits in Order of Funds Raised

Infobyte: Saudi Arabia’s Top Food Delivery Raises/Exits in Order of Funds Raised

Next Read: The Future of Food Delivery in Saudi Arabia: A Transformative Market on the Rise

%2Fuploads%2Fsaudi-food-delivery%2Fcover.jpg&w=3840&q=75)