The History & Evolution of Impact Investing

15 December 2023•

In his seminal work “Impact Investing: A Brief History,” Brian Trelstad from Bridges Ventures navigates the intricate evolution of impact investing. His 2016 publication delves deep into the transformation from traditional investment approaches towards a more socially and environmentally conscious methodology. This transformation, as Trelstad articulates, encompasses a diverse ‘spectrum of capital’, highlighting a profound narrative of how investment strategies have matured to align with the evolving ethos of society and the planet.

The Historical Shift Towards Socially-Conscious Capital

Historically, the investment landscape was dominated by two primary types: fiduciary investors, focused solely on maximizing financial returns, and philanthropic donors, whose sole aim was social or environmental betterment without financial gain. This binary landscape began to evolve in the late 1960s and early 1970s, setting the stage for a more nuanced approach to investing.

The emergence of socially responsible investing (SRI) marked a significant shift, moving beyond the simple dichotomy of fiduciary and philanthropic capital. SRI introduced a middle path, where investments were screened not just for financial viability but also for their social impact. This era saw investors starting to shun companies and practices deemed harmful, like tobacco or weapons manufacturing, reflecting a growing consciousness about corporate responsibility and ethical investment.

Parallel to the rise of SRI, the Ford Foundation pioneered ‘program-related investments’ (PRIs), a concept that further blurred the lines between philanthropy and investing. PRIs were low-interest loans aimed at financing initiatives like urban redevelopment, effectively using philanthropic funds to create income-generating models. This approach allowed philanthropic capital to be recycled and leveraged more effectively, transitioning certain initiatives towards more traditional investments.

The Rise of Impact Investment

As the new millennium dawned, investors began to question if deliberately choosing investments based on positive social or environmental impact could yield equal or better returns. This line of thought gave birth to sustainable investing and, subsequently, impact investing. Leaders in sustainable investing, like Generation Investment Management co-founded by David Blood and Al Gore, championed the idea that capital allocation could create more substantial social or environmental benefits.

Impact investing emerged from this intersection, driven by the belief that investing in business models addressing significant challenges like climate change or public health could generate competitive financial returns alongside measurable social and environmental impact. This belief, now increasingly backed by empirical evidence, suggests that private fund strategies under impact investing can deliver returns competitive with traditional investment strategies.

The Dynamic Evolution of Impact Investing: Key Trends

Over the past 20 years, impact investing has undergone a remarkable evolution, driven by a confluence of societal, economic, and technological factors.

1. Governmental Financial Constraints: A Push Towards Private Capital

A significant driver of impact investing’s growth has been the evolving role of governments worldwide. Struggling with mounting debts and economic pressures, many governments have found themselves increasingly unable to shoulder the entire burden of social welfare and environmental conservation. This constraint has led to an opening for private capital to step in, addressing societal needs that were traditionally the domain of public funding. Impact investing has emerged as a crucial mechanism in this context, enabling private investors to contribute meaningfully to areas once funded predominantly by governments.

2. Demographic Shifts: The Challenge of Aging Populations

Another important factor has been demographic change, particularly the challenge posed by aging populations. As a larger segment of society enters retirement, governments are faced with increased healthcare and pension costs, reducing the funds available for other societal needs. This demographic shift has accentuated the need for alternative sources of funding for social initiatives, where impact investing has played an increasingly significant role.

3. Generation Z: A Quest for Purposeful Employment

The rise of Generation Z has brought a fresh perspective to the workforce. This generation, more than any before, seeks employment that aligns with their values and offers a sense of purpose. Their inclination towards careers that contribute positively to society has also influenced the investment landscape, with more funds being directed towards companies and projects that reflect these values.

4. The Power of Social Media: Amplifying Awareness

The advent and widespread adoption of social media have revolutionized access to information. Today, we are more connected and informed about global events and issues than ever before. This immediacy in knowledge has heightened awareness about major disasters, social injustices, and environmental issues, fueling a collective desire to contribute towards meaningful change. Impact investing provides a platform for this, allowing investors to directly address pressing global challenges.

5. The Rise of Social Capitalists

An intriguing development in the financial world has been the emergence of ‘Social Capitalists.’ These individuals, often young high-net-worth individuals (HNWIs) and predominantly from the tech industry, are redefining philanthropy. By using their wealth to establish foundations and impact investing funds, they are blending traditional philanthropic methods with a more investment-driven approach to social good.

6. The ‘Profit with Purpose’ Movement

Finally, the ‘Profit with Purpose’ movement encapsulates the ethos of impact investing. It’s a philosophy that challenges the traditional notion that financial success and social/ environmental impact are mutually exclusive. This movement advocates for a business and investment model that achieves both profit and purpose, symbolizing the essence of what impact investing is all about.

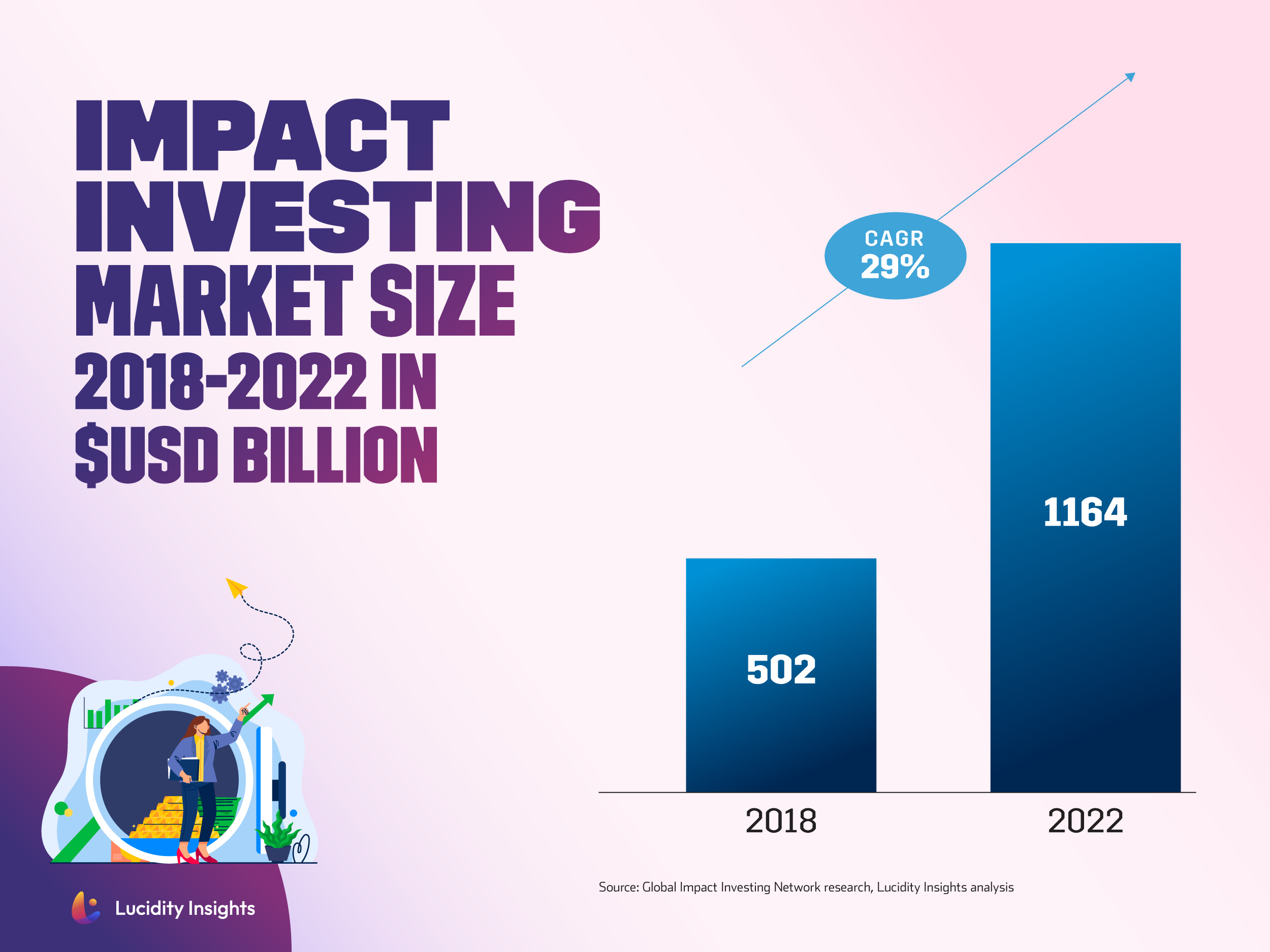

Infobyte: Impact Investing Market Size 2018-2022 in $USD Billion

The impact investing market has demonstrated remarkable growth, achieving a Compound Annual Growth Rate (‘CAGR’) of 29% over the last four years, reaching an impressive total of $1,164 billion in 2022. According to GIIN’s research, 92% of impact Asset Under Management (‘AUM’) is allocated by organizations headquartered in developed markets, while those in emerging markets account for only 8%.

To read more about impact investing and the state of impact investing in the world today, download and read the Special Report here.

Next Read: The Challenges & Barriers Facing Impact Investing Today

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)