The Rise of Impact Investing Amid ESG Backlash

18 April 2024•

In the shifting sands of the investment world, ESG (Environmental, Social, and Governance) investing has faced growing skepticism and political backlash, particularly in the United States according to PitchBook Analysis. This skepticism has led to notable backlash, as critics argue that ESG principles, once hailed as the future of investing, have become politicized and controversial. In this context, Impact Investing has emerged as a compelling alternative, promising to address social and environmental issues directly while still achieving financial returns.

The ESG Backlash: A Catalyst for Impact Investing?

The landscape of ESG investing has changed dramatically, with asset managers reducing their public ESG commitments partly due to political pressures as some US states propose to criminalize ESG investment practices. As a result, the number of new General Partners (GPs) committing to ESG through the Principles for Responsible Investment (PRI) hit a peak in 2021 then had a significant drop in 2023.

This retreat, often called "greenhushing" as firms downplay their initiatives to avoid the backlash that can come with perceived greenwashing, reflects a broader hesitation around ESG, driven by a challenging macroeconomic environment and heightened scrutiny.

Impact Investing differentiates itself from broader ESG strategies by explicitly aiming to generate positive, measurable social and environmental outcomes along with financial returns. This approach has gained momentum as investors seek more tangible and targeted outcomes compared to the broader and sometimes ambiguous ESG criteria. In 2023, Impact funds, particularly those focusing on climate solutions, attracted significant interest, illustrating a strong market shift towards investments with direct, beneficial impacts on society and the environment.

Investors and fund managers are contemplating whether to pursue specialized Impact strategies targeting specific societal or environmental issues, or to adopt broader, more general Impact approaches. In 2023, the Impact investing sector saw 137 funds reach final closings, with 45 being debut funds for their managers, highlighting a diverse range of strategies spanning private equity, venture capital, real assets, real estate, and private debt sectors. This diversity reflects ongoing debates about the merits of targeted versus generalized Impact investing approaches, suggesting a nuanced market where both focused and broad-based Impact funds have found success.

Trends and Performance in Impact Investing

While overall fundraising for Impact funds decreased in 2023, emerging Impact managers experienced higher success rates compared to their peers in the broader fund landscape. Early 2024 data showed the closure of 25 Impact funds, amassing around US $5.9 billion in commitments, alongside active efforts from approximately 30 funds each targeting over US $1 billion.

Notably, 59.1% of the Impact funds closed in the past five years were managed by emerging managers, who accounted for 17.7% of the total Impact capital raised in 2023, indicating a dynamic segment with significant growth potential.

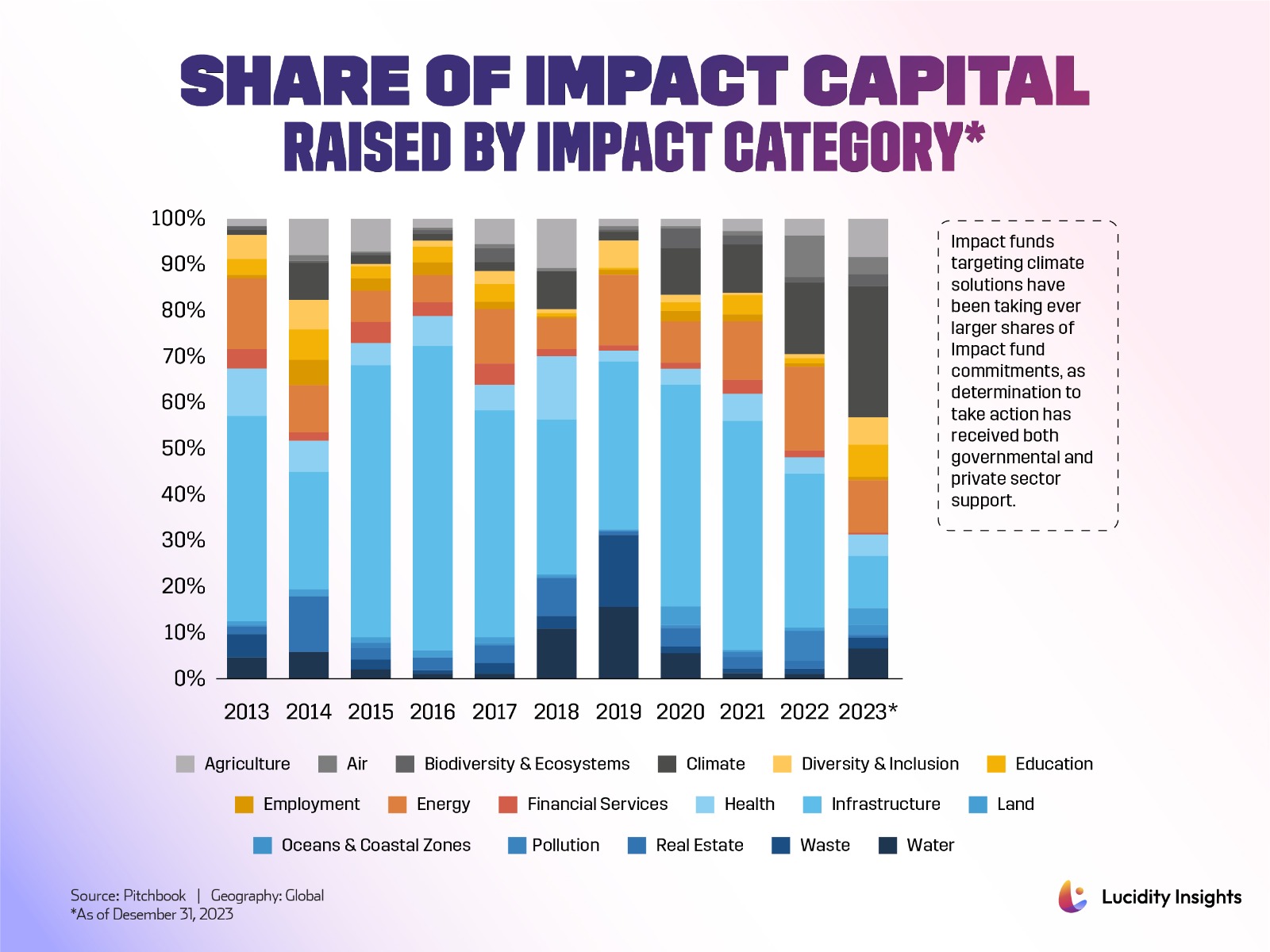

Climate-related Impact investments have garnered significant attention and capital, with nearly US $100 billion allocated to such funds over the past three years. The share of Impact funds targeting climate solutions has increased continually since 2019, now making up 30% of Impact capital raised in 2023 as it is supported by both governmental and private sector commitments to tackle climate change. In 2023, 51 funds with a partial or full focus on climate solutions raised substantial funds, ranging from large-scale funds like a US $7.1 billion Blackstone private debt fund to smaller VC initiatives.

This trend reflects a global commitment to addressing climate change, with investments spanning various regions including the UK, Australia, Canada, Japan, India, and Singapore.

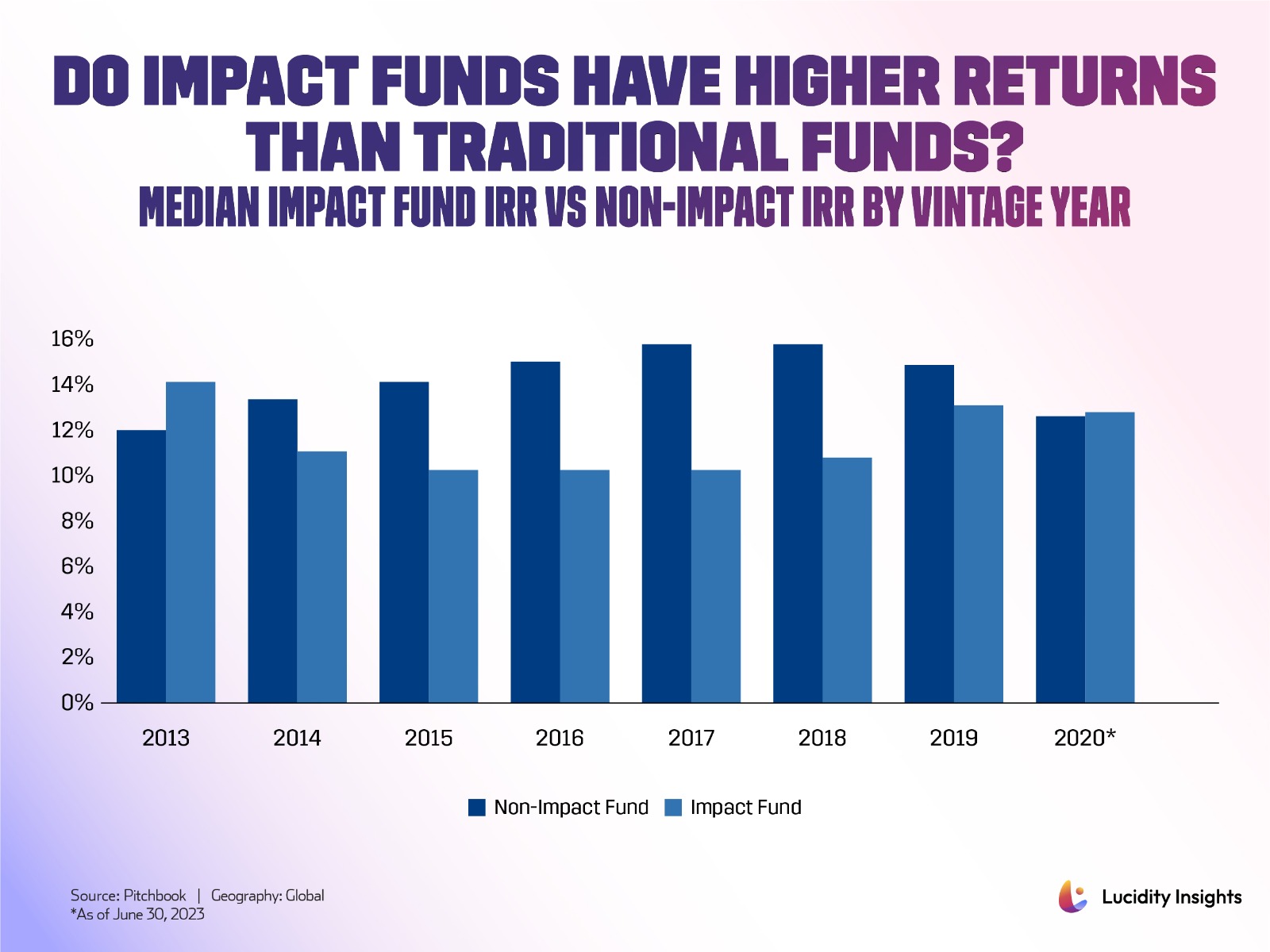

Contrary to popular belief that Impact Investing yields lower returns, data suggests that these investments can be significantly financially competitive as recently Impact funds have performed comparably to their non-Impact counterparts, with some sectors even outperforming traditional investment funds. While some Impact funds intentionally accept lower returns for higher social or environmental benefits, such as affordable housing projects, the broader Impact investing sector offers a range of financial returns.

The sector's performance is influenced by its substantial engagement in real assets, which has historically shown different return patterns compared to other investment types. According to PitchBook Analysis, the lowest-performing Impact fund managers between 2007 and 2013 still outperformed the lowest-performing non-Impact fund managers, and the highest-performing (top 10%) Impact funds frequently achieved better returns than the highest-performing non-Impact funds. Despite the median returns for Impact investments often being lower, the variability in performance highlights the critical role of selecting the right fund manager, as this choice significantly influences the investment outcomes.

Takeaway

Recent backlash against ESG has inadvertently propelled Impact Investing into the spotlight, highlighting its potential to effectively bridge the gap between financial performance and societal impact. This trend is set to deepen, as Impact Investing not only addresses the growing demand for investments that yield tangible social and environmental benefits but also caters to the financial objectives of investors.

The future of Impact Investing appears to be driven by a discerning investor base that increasingly values sustainability and societal impact alongside financial returns. Regulatory changes, particularly those emphasizing transparency and accountability, are likely to further bolster the credibility and attractiveness of Impact Investing.

Moreover, the global socio-economic landscape, marked by urgent calls for action on climate change and social inequities, is poised to amplify the role of Impact Investing in mobilizing capital towards meaningful and measurable outcomes.

In this context, Impact Investing is positioned to fulfill the dual mandate of achieving competitive financial returns while fostering positive change in the world. As investors become more sophisticated in their approach, and as the market for Impact Investing matures, the sector is expected to grow in size and significance, thereby reinforcing its integral role in the broader investment ecosystem.

Learn more about the journey of Impact Investing from a niche to a mainstream strategy in our Special Report, The Business of Impact Investing in 2023, diving into the evolving ethos of the investment world where financial success and societal progress are increasingly intertwined.

%2Fuploads%2Fimpact-investing%2Fcover19.jpg&w=3840&q=75)