Driving Scaleup Success: Dubai's Attractiveness for Startup Growth

17 July 2023•

Previously: The Surge of Mega-Round Investments in MENA

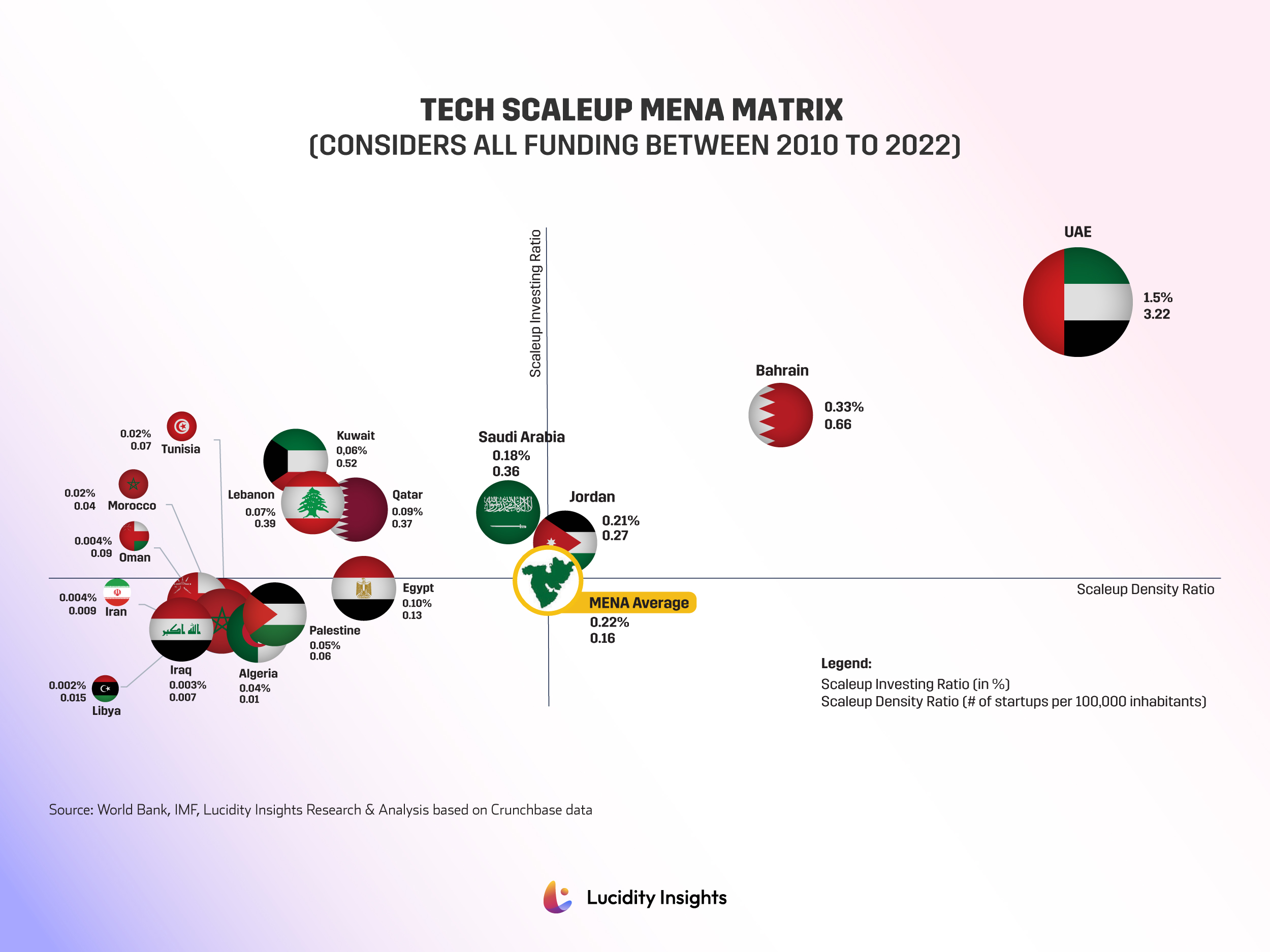

Scaleup Investing Ratio: UAE's Impact on the MENA Average

The UAE, with its sheer number of scaleups has tipped the MENA average to a higher value of 0.2% Scaleup Investing ratio and 0.16% for Scaleup Density ratio. While a number of countries in the region have a lower Scaleup Investing ratio than MENA average, countries like Jordan, Saudi Arabia, Qatar, Lebanon and Kuwait all have above regional ratios, showing preference for startups to operate from these countries.

Graph: Tech Scaleup MENA Matrix - Considers all funding between 2010 to 2022

Dubai’s Appeal

The region and the UAE’s numbers are dominated by Dubai, which has been the major benefactor of funding with over 300 scaleups calling the metropolis their home. In comparison, the second largest group of scaleups are based in Cairo at 135, less than half based in Dubai. The UAE’s dominance is also bolstered further by Abu Dhabi-based scaleups, ranking fourth in the list of top 20 cities, with Riyadh-based scaleups ranking third. While, there is no doubt that Dubai is a preferred startup destination, the fact that over half of startups that have raised more than US$1 million of capital, based on disclosed values, is a further testament to Dubai’s attractiveness for startups.

Graph: Top 10 Tech Scaleup Cities in MENA (By Number of Scaleups in 2022)

The number of scaleups have also increased considerably, in Dubai, growing 26% between 2021 and 2022. While Riyadh and Cairo had higher growth rates, in terms of absolute numbers, Dubai saw an increase of 64 scaleups between 2021 and 2022 growing from 242 to 306 scaleups.

Infobyte: Increasing Number of Dubai Scaleups: 2021 to 2022

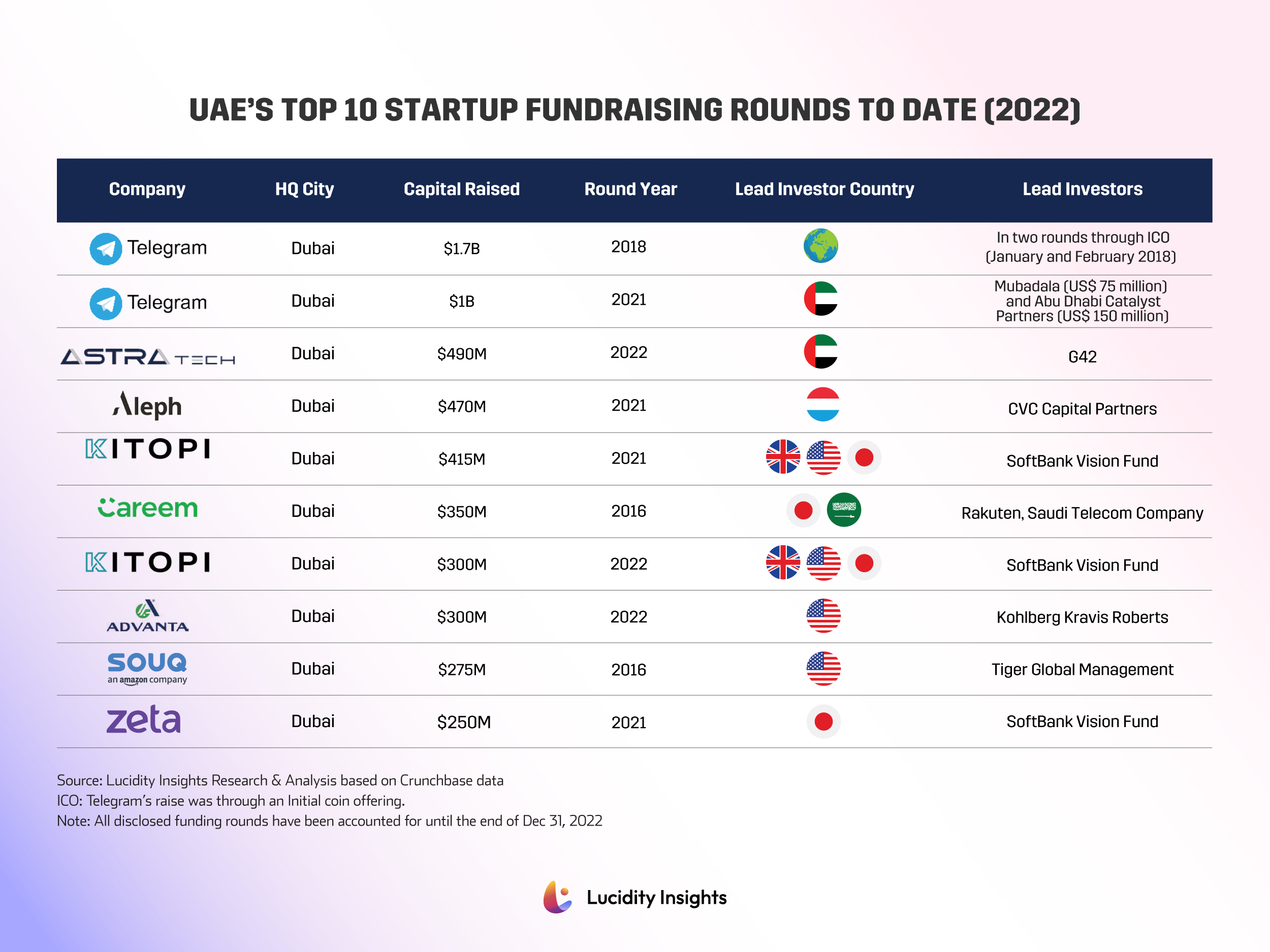

Ranking: UAE's Top 10 Startup Fundraising Rounds to Date (2022)

Dubai’s allure as a startup hub is prominent in the country, since the top 10 disclosed funding rounds of all time are all from startups headquartered in the emirate. In 2022, the top four funding rounds were all from Dubai-based startups, with the fifth from an Abu Dhabi-based agtech startup, Pure Harvest Smart Farms.

Ranking: UAE's Top 5 Disclosed Funding Rounds in 2022

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)