The Surge of Mega-Round Investments in MENA

06 July 2023•

Previously: UAE's Tech Scaleups Prominence Among MENA

Region’s Growth in Mega Rounds

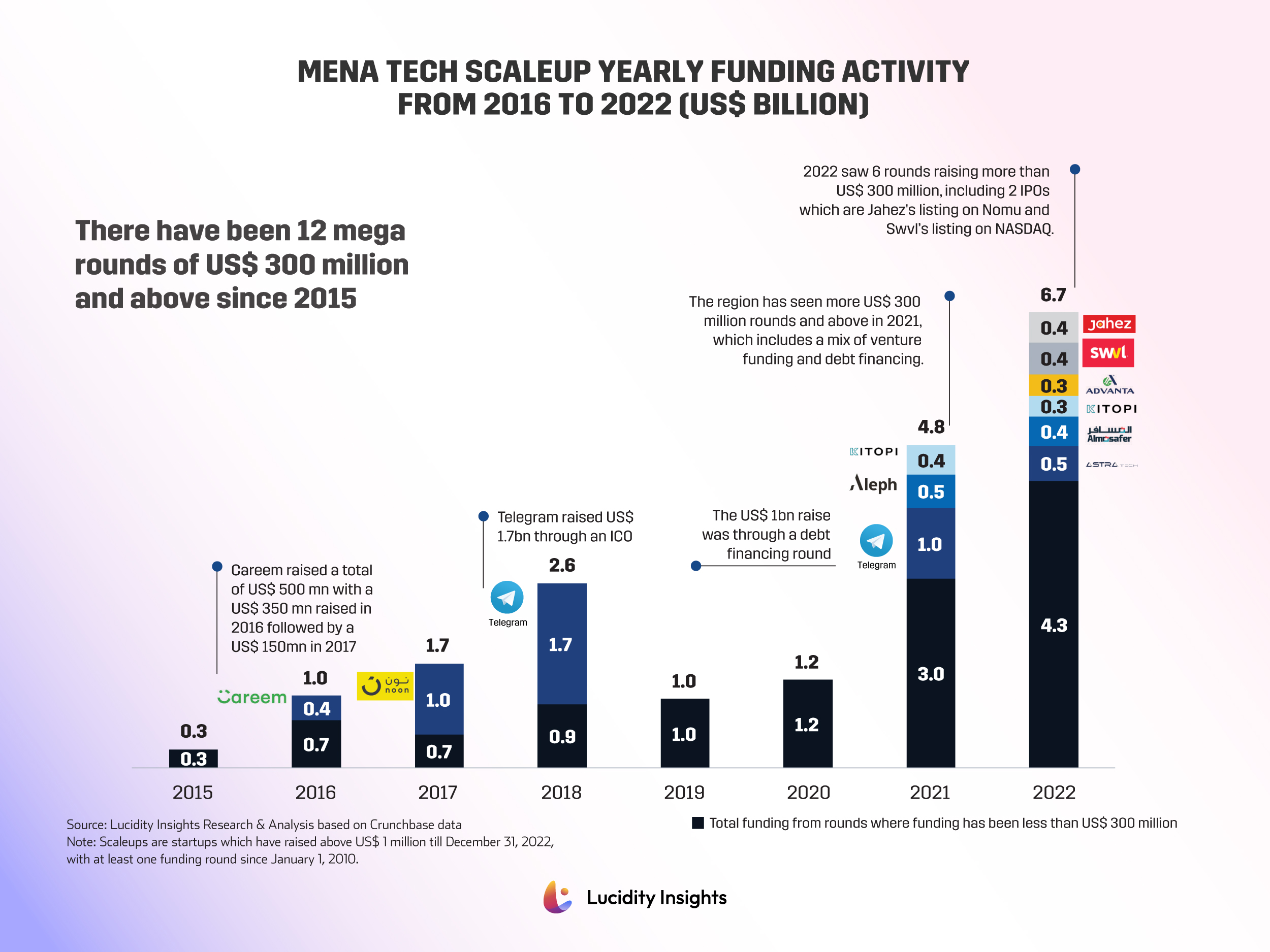

The growth of funding in the region has exceeded US$4 billion in both 2021 and 2022 and the number of mega-rounds of US$300 million or more has seen an increasing trend with three seen in 2021 and six in 2022, including two scaleups listing on stock exchanges.

Through the years, there have been large funding rounds, with Careem being one of the first ones to pave the way, having raised US$ 500 million through December 2016 and first half of 2017. The marquee fundraising was from Noon in 2017, the Saudi Arabia and UAE based e-commerce platform. More recently, Kitopi, the foodtech startup, has been aggressively fundraising, reeling in large funding in both 2021 and 2022.

Related: Kitopi, Dubai’s Latest Foodtech Unicorn

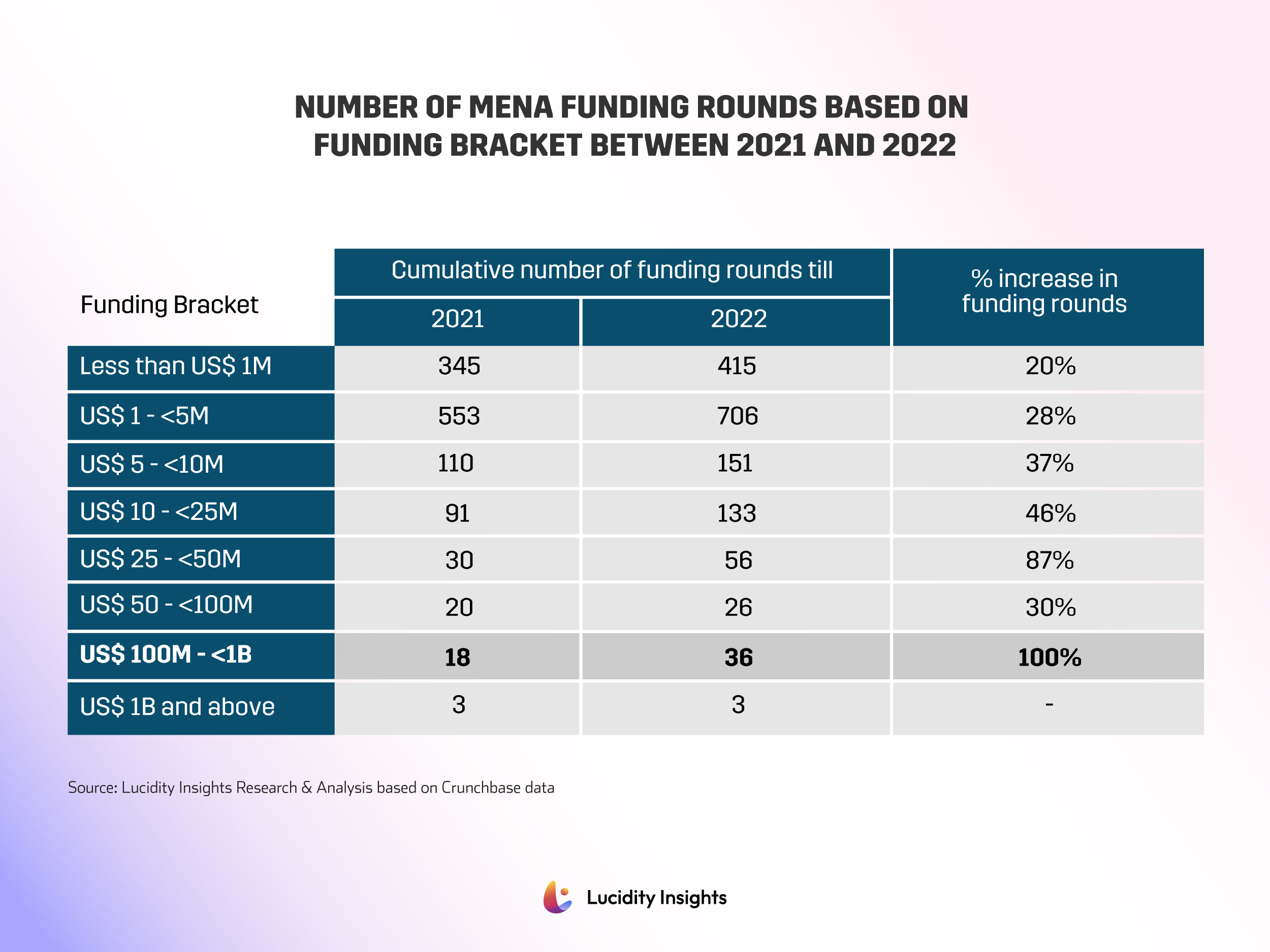

In 2022, there was a significant shift in the number of funding rounds, where scaleups raised funding, and a trend towards larger cheque sizes and funding bracket gained momentum. In the US$100 million to US$1 billion range, funding rounds increased by 100% between 2021 and 2022. Other funding ranges also saw increases between 20% to 87%.

Infographic: MENA Tech Scaleup Yearly Funding Activity from 2016 to 2022 (US$ Billion)

Table 1 – Number of MENA Funding Rounds Based on Funding Bracket between 2021 and 2022

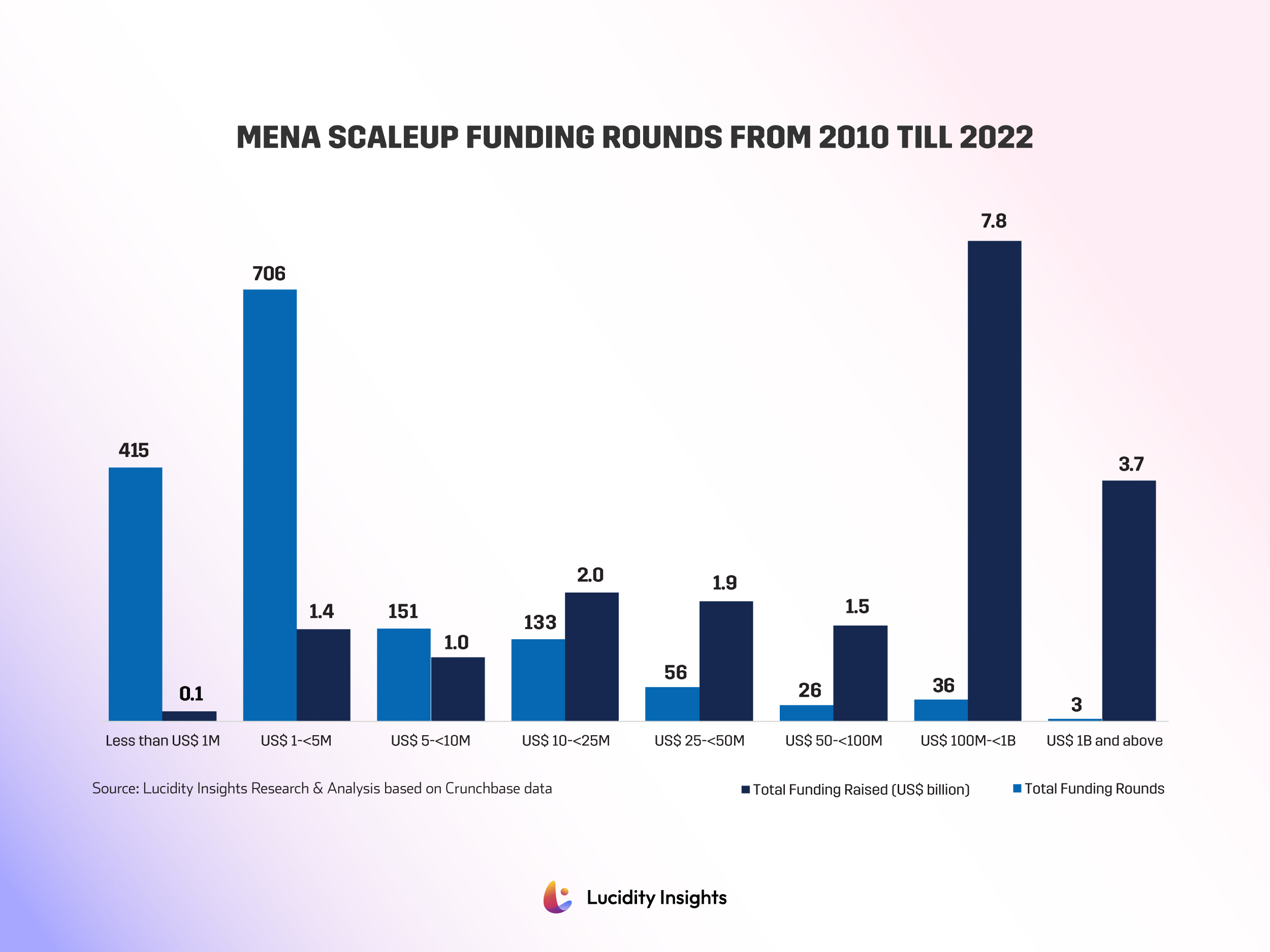

Graph - MENA Scaleup Funding Rounds from 2010 till 2022

Source of Capital Raised by MENA Scaleups

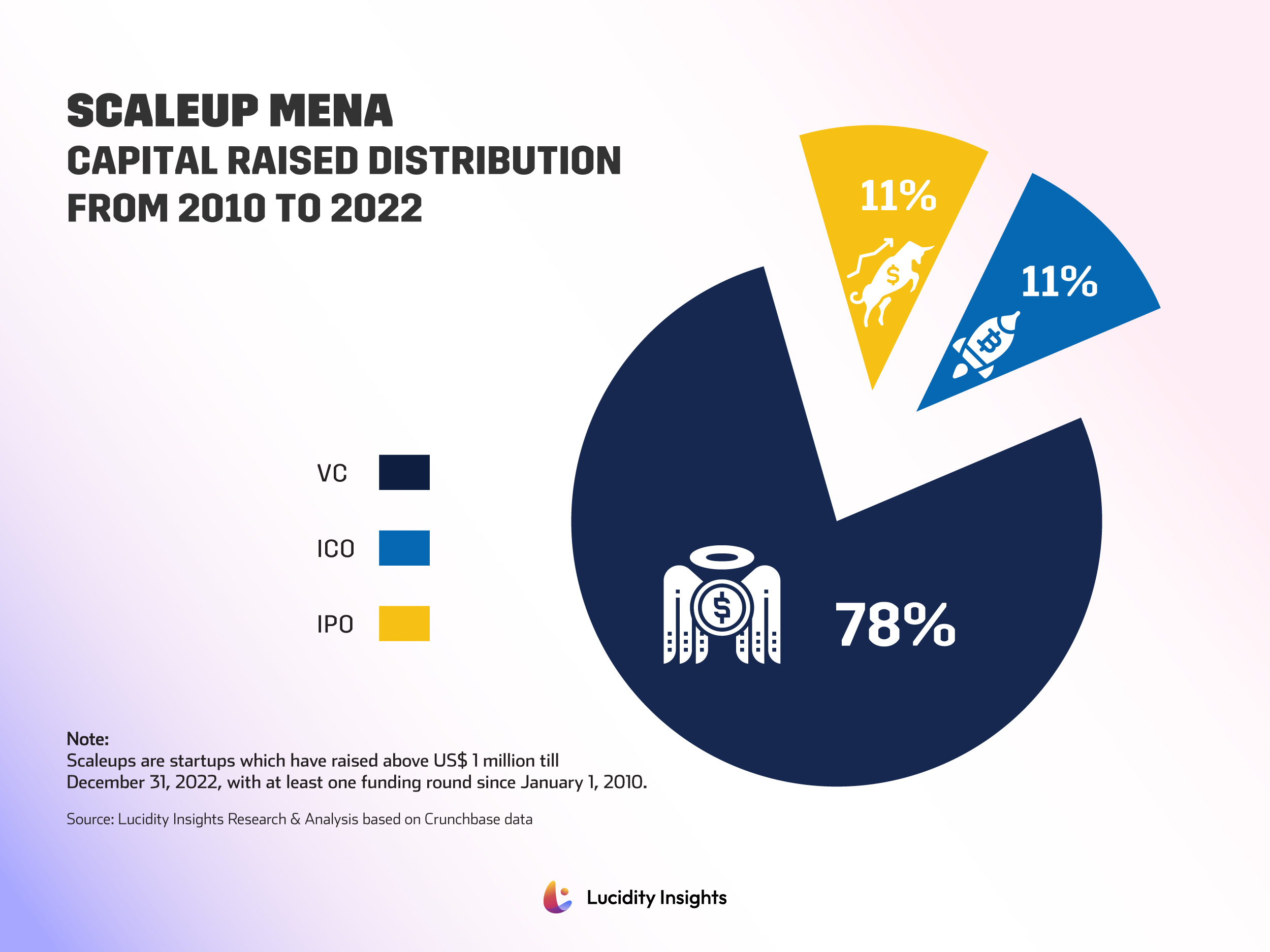

Considering the source of capital raise, venture capital and corporate rounds accounted for over three quarters of the capital raised, while IPOs and ICOs accounted for nearly equal share. Telegram’s ICO in 2017 resulted in US$1.7 billion raise, while the region experienced two major exits in IPOs from Jahez International and Swvl raising over US$400 million each.

Infobyte: Scaleup MENA - Capital Raised Distribution from 2010 to 2022

To get the lay of the investor landscape across Dubai and MENA, and for insights provided by the investors backing the start-ups and scale-ups that are changing the face of entrepreneurship in the region, read the report by clicking here.

Related Articles:

- Driving Scaleup Success: Dubai's Attractiveness for Startup Growth

- Expected Headwinds in Dubai’s Funding Landscape

- In Conversation with Dany Farha, Managing Partner of BECO Capital

- Dubai's Global Attractiveness: Perspectives from Venture Capitalists

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)