UAE's Tech Scaleups Prominence Among MENA

05 July 2023•

Scaleups in MENA

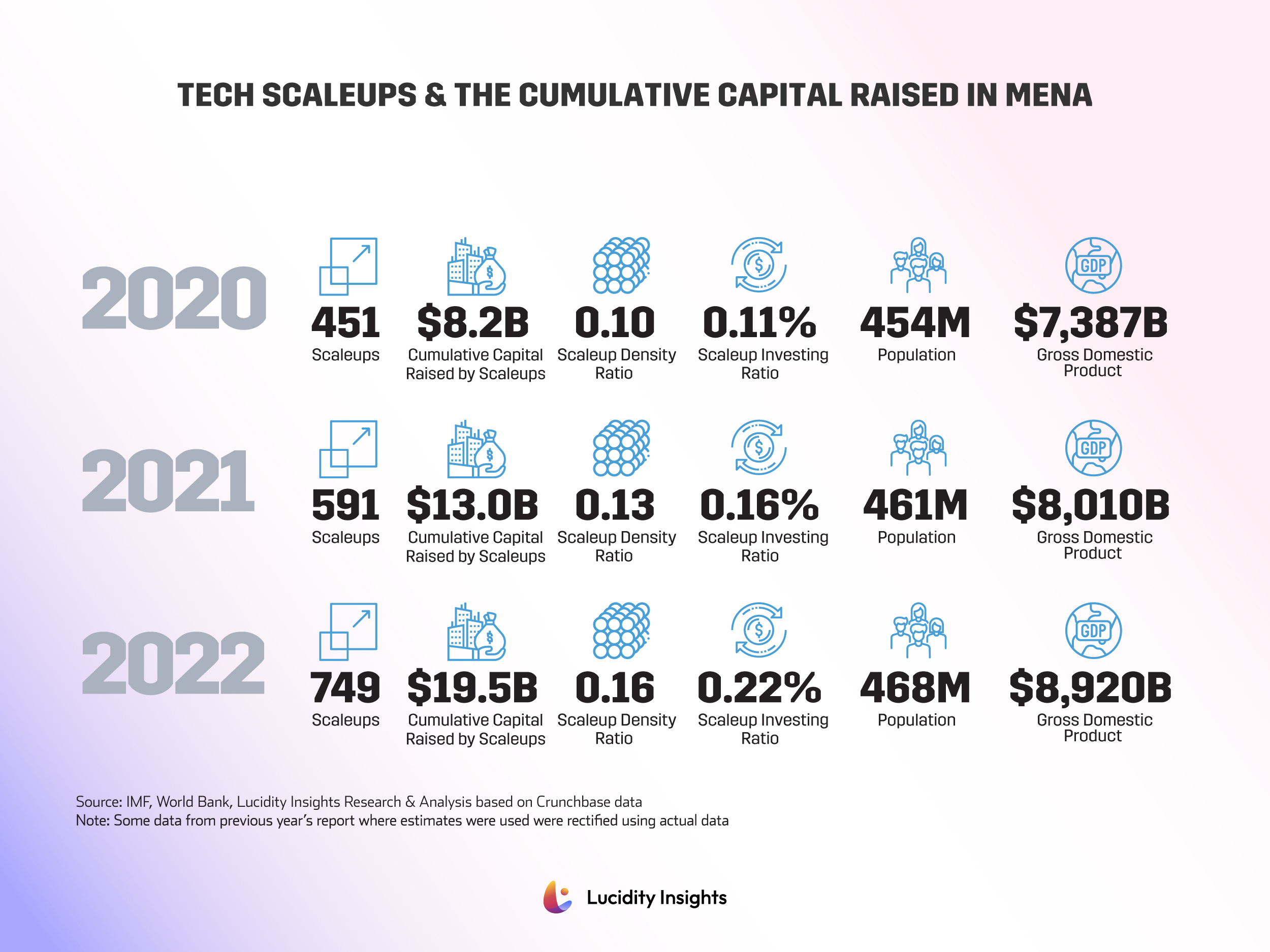

Scaleups are companies that have raised funds above US$ 1 million since inception. As of December 2022, 749 scaleups across 19 countries in the Middle East and North Africa region attracted a total of US$ 19.5 billion in capital raised.

This demonstrated impressive growth from 2021, when the number of scaleups totaled 591, resulting in a total capital raise of US$13.0 billion, representing 50% growth from 2021 to 2022. In comparison, the GDP growth across the region was also impressive at 11%, as per IMF, during the same period. The past three years have resulted in growth in the number of scaleups, from 451 to 749 between 2020 and 2022.

The Scaleup Density ratio, which is the number of scaleups per 100,000 inhabitants, and Scaleup Investing ratio, which is the Capital Raised as a proportion to the GDP, has also seen an increase of 61% (from 0.10 to 0.16) and 97% (0.11% to 0.22%), respectively, from 2020 to 2022.

Infographic: Tech Scaleups & Cumulative Capital Raised by Scaleups in MENA

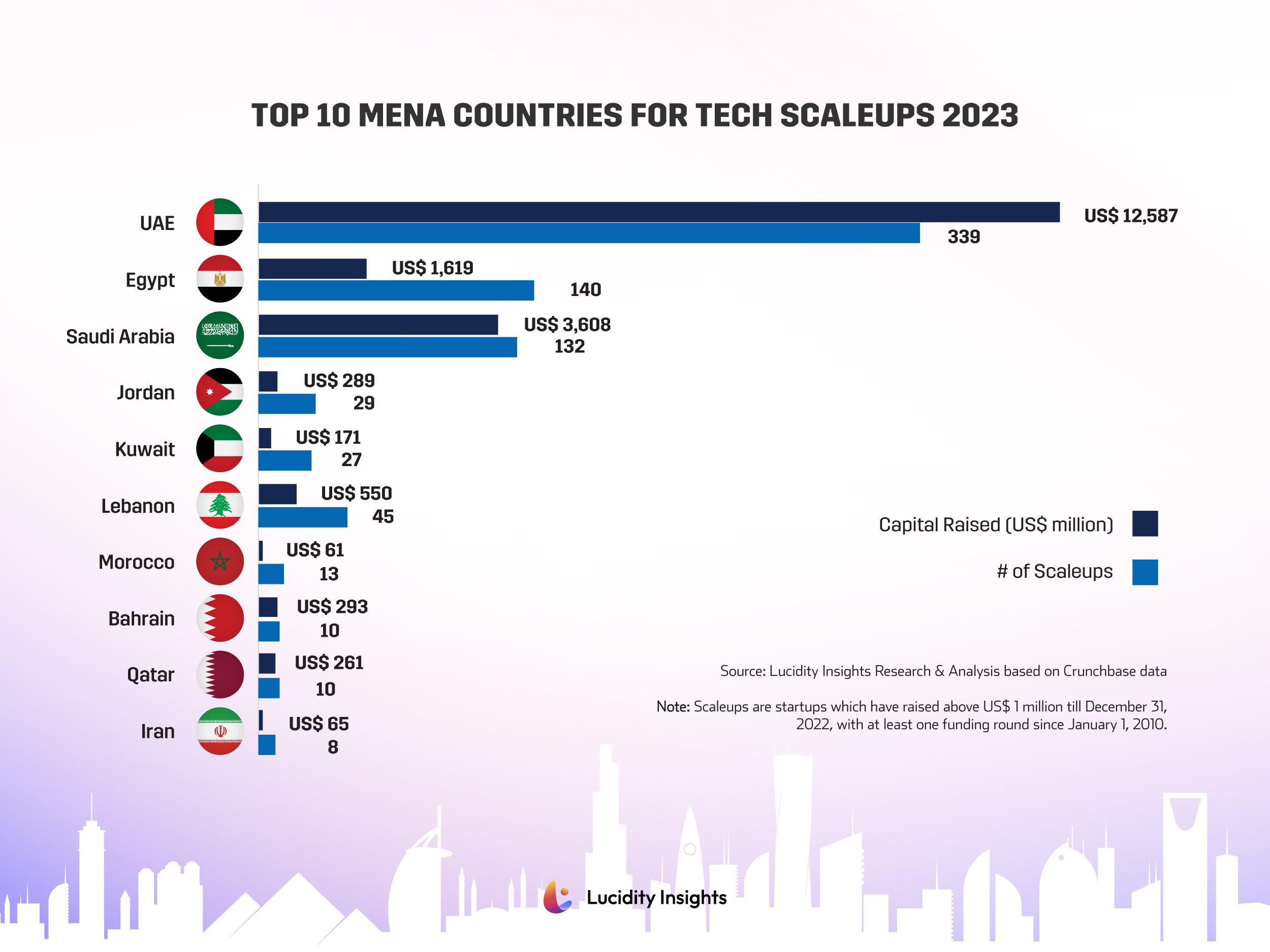

The UAE led the MENA region being home to 339 scaleups, while Egypt and Saudi Arabia follow with 140 and 132 scaleups, respectively. UAE scaleups accounted for 65% of total cumulative capital raised across the region, while Saudi Arabia-headquartered scaleups account for 19% of the total capital raised by scaleups to date. Scaleups setup outside of United Arab Emirates, Egypt and Saudi Arabia, in one of the 16 other countries in MENA region, account for under 20% of all scaleups in the region, while only accounting for 9% of capital raised in the region.

Infographic: Top 10 MENA Countries for Tech Scaleups 2023

To get the lay of the investor landscape across Dubai and MENA, and for insights provided by the investors backing the start-ups and scale-ups that are changing the face of entrepreneurship in the region, read the report by clicking here.

Related Articles:

- MENA’s Growth in Birthing Mega-Rounds

- Expected Headwinds in Dubai’s Funding Landscape

- In Conversation with Dany Farha, Managing Partner of BECO Capital

- Dubai's Global Attractiveness: Perspectives from Venture Capitalists

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)