From Souq to Careem: The Rise of Unicorns in the UAE’s Startup Ecosystem

01 October 2024•

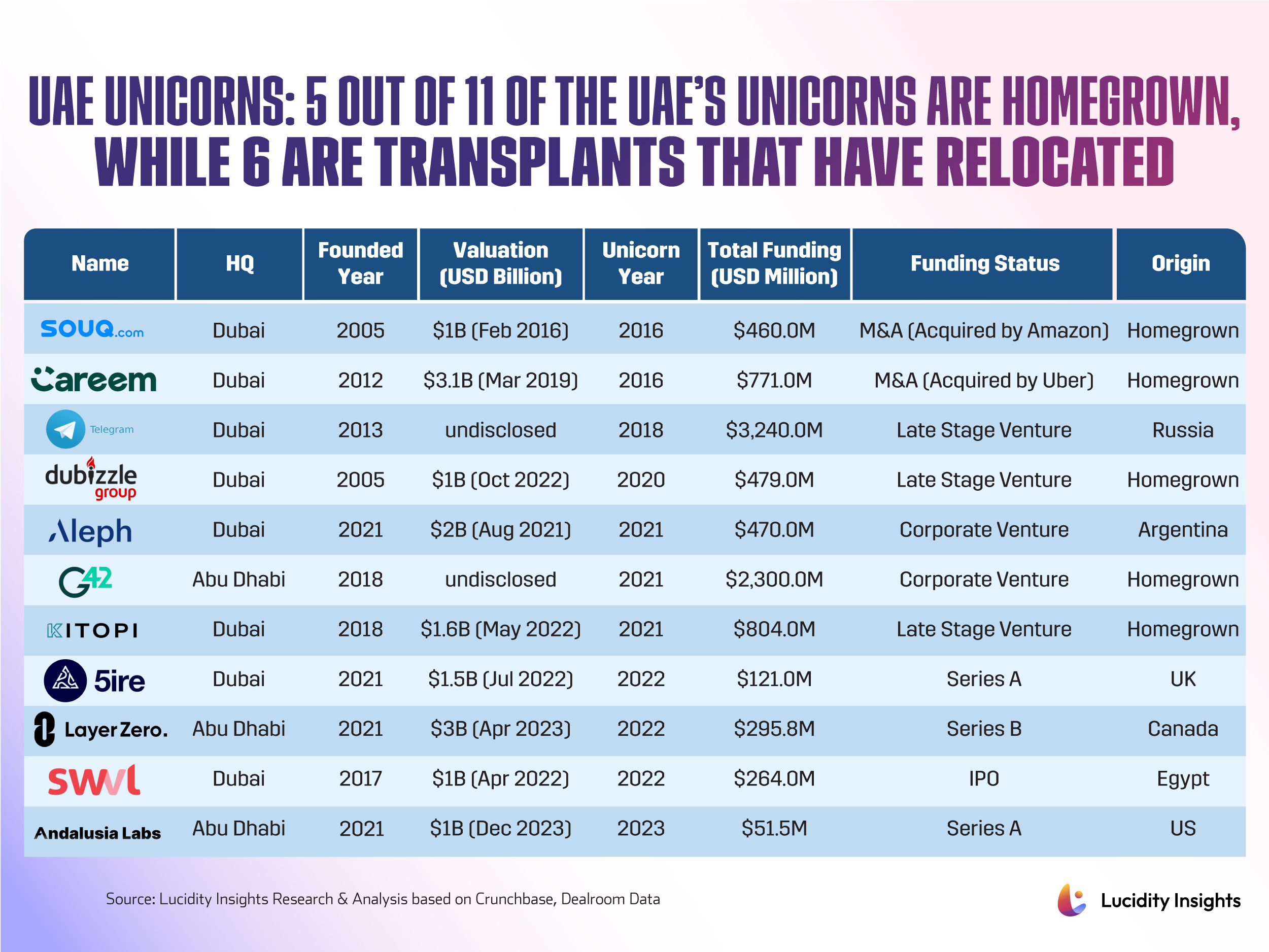

The UAE is fast becoming the go-to entrepreneurship powerhouse in the Middle East, with Dubai leading the charge. One indication of the UAE's tech prowess is the number of unicorns that call the country home — in the world of business and VC funding, a "unicorn" is any privately held, unlisted company valued at over US $1 billion, thus, the number of unicorns a region boasts signals a fertile ground for high-value opportunities. Known as a melting pot of technological innovation, the UAE isn’t just the Arab world's innovation hub though; it has also become a magnet for ambitious entrepreneurs from across the globe, moving their businesses to the UAE's thriving startup landscape in increasing numbers over recent years.

The first unicorn birth within the UAE took place just 8 years ago, in 2016. Today, the country boasts 11 unicorns, 8 of which are headquartered in Dubai. And startups are reaching unicorn status faster than ever before, thanks to recent technological advancements, globalization, consistent and reliable data security infrastructure, and increased access to capital. Dubai's digital ambitions are sky-high, and the city is not being quiet about them. In 2022, the Dubai Chamber of Digital Economy announced its intentions of drawing in over 300 new digital businesses by 2024 and to support the cultivation of more than 20 unicorns by 2030. This benchmark has been raised to 30 unicorns by 2033 under the D33 strategy (Dubai Economic Agenda 2033), highlighting the rapid success of Dubai's startup scene and the Emirate’s unwavering support for its startup economy, both now and in the future.

Homegrown startups epitomize the UAE's potential to nurture and scale ventures that resonate locally and internationally, not only reinforcing the strength of the local startup ecosystem but also projecting an image of the UAE as fertile ground for genuine innovation. They embody the aspirations of local entrepreneurs and serve as role models, proving that local initiatives can reach global heights. Take for example, Souq.com; born and bred in Dubai, its journey from a Dubai-based startup to becoming the GCC's first unicorn by February 2016 then acquired by Amazon for an estimated US $580 million in 2017, illustrates a regional success story. Careem has a similar homegrown story, achieving unicorn status just a month after Souq, followed by its acquisition by Uber for US $3.1 billion in 2019.

The UAE has not only been growing their own tech giants, though, it has also become a favored destination for international startups and businesses to relocate. One example is Telegram, a messaging company rivaling WhatsApp, which surpassed 1 billion downloads globally by 2021 and now boasts over 950 million monthly active users. Founded in Russia, the messaging giant chose Dubai as its new base in 2017; drawn by the Emirate's strategic location, business-friendly environment, and robust digital infrastructure, the company quickly reached unicorn valuation not a year later. The relocation of such global players to Dubai underscores the city's status as an attractive hub for international business and innovation. These international transplants bring diverse expertise and global perspectives, enhancing the local market's competitiveness and dynamism.

The interaction between homegrown startups and international transplants creates a rich tapestry of entrepreneurial activity in the UAE, providing a diverse range of opportunities and experiences for stakeholders, too. This dual narrative of local ingenuity and global appeal is key to understanding the UAE’s strategy in positioning itself as a leading global hub for technology and entrepreneurship. So, let's take a look at the unicorns spearheading this success in the UAE.

1. Souq.com

#HomegrownUnicorn #MadeintheUAE #DubaiUnicorns

Founded by Ronaldo Mouchawar, Samih Toukan in 2005, Souq.com is a pioneering e-commerce platform from Dubai often referred to as the “Amazon of the Middle East.” Souq.com started out as a C2C auction site but later transitioned into a full-fledged e-commerce platform, now offering a wide range of products from consumer electronics and household goods to fashion, health, beauty, and baby products. Souq was the first GCC startup to reach unicorn status after a venture funding round of US $275 million led by Tiger Global Management brought its total funding amount to US $460 million in 2016. It had already made several acquisitions itself like WING and Sukar before it was then acquired by Amazon for US $650 million in 2017. Now, it has rebranded as Amazon.ae in the UAE, Amazon.sa in Saudi Arabia, and Amazon.eg in Egypt, marking the end of the Souq.com brand but a significant milestone for the region’s tech ecosystem.

2. Careem

#HomegrownUnicorn #MadeintheUAE #DubaiUnicorns

Founded by Mudassir Sheikha and Magnus Olsson in 2012, Careem started out as a ride-hailing service but has since evolved into a prominent “super app” in the Middle East, offering over 20 services including digital payments and micromobility as well as food and grocery delivery in over 70 cities across 10 countries in the Middle East, Africa, and South Asia. Careem achieved unicorn status in 2016, and as of its latest Series F funding of US $200 million led by Kingdom Holding Company in 2018 had raised a total of US $771.7 million before its acquisition by Uber for US $3.1 billion in 2019. Since then, Careem has made several acquisitions itself including Denarii Cash and MUNCH:ON in 2022, and in 2023, the company announced its ‘everything app’ business, a new entity separating non-rideshare businesses from Careem managed by Sheikha and Olsson with Emirates Telecommunications Group Company’s e& acquiring a 50.03% stake. The ride-hailing business remains separate and fully owned by Uber, but is also available on the super app.

3. Telegram

#TransplantUnicorn #UAEUnicorns #DubaiUnicorns

Telegram is a cloud-based instant messaging, voice over IP, and video calling service founded by Pavel and Nikolai Durov in Russia before moving to Dubai in 2017 and achieving unicorn status in 2018. Having surpassed 5 million paying subscribers with 950 million active monthly users, Telegram continues to grow its market presence as a global competitor to Meta Platforms’ WhatsApp. Telegram secured US $330 million in debt financing as the biggest funding round of March 2024 in the MENAPT region. With a bond offering said to be oversubscribed by current CEO Pavel, this was a significant step in Telegram's financial strategy, bringing its total raised through debt financing to US $3.2 billion. This demonstrates Telegram’s access to capital markets and its capacity to garner substantial funds, supporting its operational and growth ambitions in the competitive messaging and communication sector as the company plans to use these funds to maintain its accelerated pace of expansion.

4. Dubizzle Group

Founded by J.C. Butler and Sim Whatley as EMPG (Emerging Markets Property Group) in 2005, Dubizzle Group is best known for dubizzle.com, a leading online classifieds platform in MENA where users can buy, sell, or rent real estate, automobiles, household goods, jobs, and other miscellaneous services. As one of the older companies on this list, Dubizzle Group owns and operates its subsidiary brands Dubizzle and Bayut (UAE), as well as Zameen in Pakistan. It was fully acquired by the OLX Group (Greater MENA Region and Pakistan) in 2019. Homegrown in Dubai, the company attained unicorn status just a year later and rebranded to Dubizzle Group as it expanded operations, thus acquiring Lamudi, Kaidee, and most recently Drive Arabia. Dubizzle has raised a total of US $479 million across 6 funding rounds, and its latest funding of US $200 million led by Affinity Partners in 2022 was earmarked for the UAE, its largest market where it operates the Bayut and dubizzle brands.

5. Aleph Holding

Founded in Argentina in 2005, Aleph Holding is a prominent digital media services provider, connecting advertisers with consumers across major digital platforms like Twitter, Meta, Microsoft, Snapchat, TikTok, Spotify, and Twitch. It handles payments in multiple currencies, enabling advertisers to maximize their digital advertising potential in emerging markets. Aleph Holding was valued at US $2 billion during its IPO planning in 2021 and has acquired Clever Ads, Connect Ads, Ad Dynamo as well as Entravision most recently this year. Since launching new innovative proprietary technology to enhance its digital advertising services in 2022, Aleph Holding now reaches close to 3 billion consumers in 77 countries from its HQ in Abu Dhabi. Aleph has raised a total of US $470 million across 3 funding rounds, with its latest investment led by Snap Inc. in 2022 to support Aleph's global educational efforts in its mission to power the digital ecosystem in emerging countries to unlock and drive economic growth.

6. G42

#HomegrownUnicorn

Group 42 Holding Ltd (G42) is a development holding company established in 2018 that specializes in AI solutions across the government, healthcare, finance, oil and gas, aviation, and hospitality industries. Chaired by National Security Advisor of the UAE, Sheikh Tahnoon bin Zayed Al Nahyan, G42 Cloud Services provide scalable, secure, and efficient solutions for businesses and organizations in the region. With a team of 20, 000 scientists and engineers, G42 has published 300+ research papers surrounding AI evolution and applications and advanced tech across industries over the last 3 years. G42 acquired Bayanat in 2020 then reached unicorn status in 2021, and received a US $1.5 billion investment by Microsoft in April 2024 bringing its total funds to US $2.3 billion. The collaboration brought Microsoft's latest AI technologies and skilling initiatives to the UAE, empowering organizations of all sizes in new markets to harness the benefits of AI and the cloud in line with world-class standards in safety and security.

7. Kitopi

Founded in 2018 by P Mohamad Ballout along with his friends Andres Arenas, Bader Ataya, and Saman Darkan, Kitopi is a leading cloud kitchen operating as a “Kitchen as a Service” (KaaS) platform based in Dubai. It provides kitchen infrastructure as well as delivery and management solutions, enabling restaurants to open delivery-only locations with minimal capital expenditure. Homegrown in Dubai, Kitopi achieved unicorn status in 2021 as it expanded into Saudi Arabia, Kuwait, and Bahrain, eventually acquiring AWJ Investments in 2023. The company has now raised US $806 million across 5 funding rounds, the latest of which was led by SoftBank Vision Fund in a Series C round extension in line with Kitopi's new growth strategy targeting investments in brick-and-mortar restaurants, as consumers headed back to indoor dining in 2022. Kitopi also has a Robotics Hub in Denmark developing industrial technology that detects food waste and eliminates in line with its sustainability efforts to reduce food waste to 0% across all of its kitchens.

8. 5ire

Founded by Pratik Gauri, Prateek Dwivedi, and Vilma Mattila in 2021, 5ire is a blockchain company focused on sustainability and innovation. Its sustainability-driven blockchain ecosystem includes a hybrid consensus and reward distribution mechanism, nominated proof of stake, and proof of benefit and donation. This platform aims to enable individuals and enterprises to develop, build, transact, and participate in sustainable economic growth. 5ire achieved unicorn status in 2021 then moved HQ from the UK and had established its presence in the UAE by 2022 when it also acquired Network Capital. The company has now raised a total of US $121 million, after receiving a 7-figure grant from Gotbit Hedge Fund this year to boost 5ireChain’s US $10 million grant program that is nurturing projects to drive innovation within the blockchain industry.

9. LayerZero

Founded by a team of Canadian blockchain developers, LayerZero is a blockchain interoperability protocol that aims to connect different blockchain networks, enabling seamless cross-chain communication globally. LayerZero offers omnichain interoperability as well as decentralized and trust-minimized intermediary support compatible with Ethereum, Solana, Avalanche, and Binance Smart Chain platforms. Within a year up and running, LayerZero had not only established its presence in the UAE with a global influence but also achieved unicorn valuation. The company has now raised US $295.8 million across 8 funding rounds, and its token ZRO first hit the market this year with a price tag of US $4.4 performing better than tokens of some competing Ethereum Layer 2 networks, zkSync (ZK) and Starknet (STRK) thanks to a combination of Sybil filtering and laser focus on prioritizing developers and “durable” users, says CEO Bryan Pellegrino.

10. Swvl

Founded in 2017 by Egyptian Mostafa Kandil, Ahmed Sabbah, and Mahmoud Nouh, Swvl is tech-driven mass transit solutions provider now based in Dubai operating in 135 cities across 20 countries, including Egypt, Kenya, Pakistan, Jordan, and Mexico. Swvl offers a semi-private alternative to public transportation, providing intercity, intracity, B2B, and B2G transportation services like ridesharing, vanpooling, and even transportation solutions for businesses and government entities. By 2022, Swvl had acquired Urbvan, door2door, Viapool, and Shotl as well as achieved unicorn valuation and gone public on the Nasdaq stock exchange having raised a total of US $264 million across 8 funding rounds.

11. Andalusia Labs

Founded in 2021 as US-based RiskHarbor, Andalusia Labs specializes in blockchain and digital asset risk infrastructure to address security challenges in the blockchain industry. Its products include risk management infrastructure and marketplace for digital assets, Karak and Subsea, as well as Watchtower, an institutional security platform. In 2023, Andalusia Labs achieved unicorn valuation after raising a total of US $51.5 million in funding, with its Series A round led by Lightspeed Venture Partners accompanied by the launch of Andalusia Labs’ global headquarters in Abu Dhabi’s Financial Center, Abu Dhabi Global Markets to expand its global footprint.

Takeaway

The startup ecosystem in the UAE offers a fascinating narrative of homegrown innovation alongside a welcoming landscape for global endeavors making the UAE their home and reaching unicorn status faster than ever. As these unicorns thrive, they elevate the entire region onto the global stage, heralding a new era of innovation and economic dynamism in the UAE. It seems only a matter of time before the UAE's 2030 aspirations become a reality.

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)