KLC Virtual Restaurants: Cloud Kitchens Re-Imagined

22 August 2023•

A Decade of Evolution: From Humble Beginnings to a Leading GCC Player

In the dynamic world of cloud kitchens in the GCC, one name that has been at the forefront is KLC Virtual Restaurants. What started as a humble family business has grown into a thriving enterprise driven by a passionate team with over a decade of experience working together. The Co-Founder & CEO Mubarak Jaffar and Managing Partner Mohammed Al Besharah firmly believe that the core belief systems ingrained in each KLC team member have been fundamental to KLC's success.

In frame: Mubarak Jaffar, Co-Founder and CEO of KLC Virtual Restaurants

In frame: Mubarak Jaffar, Co-Founder and CEO of KLC Virtual Restaurants

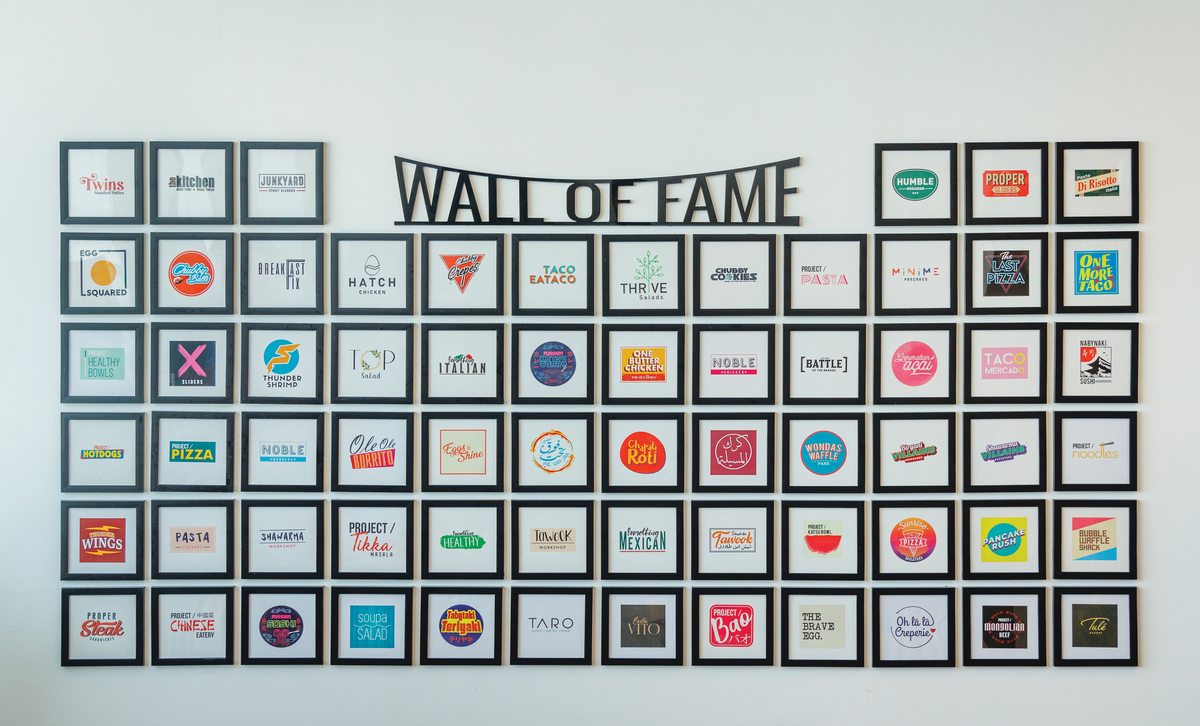

Over the past decade, KLC Virtual Restaurants has undergone a remarkable transformation, honing its business model and forging a strong identity. Today, the company operates as a multi-brand virtual restaurant enterprise, delivering delectable cuisines from various corners of the GCC region. Recognizing the rising demand for high-quality yet affordable food in the home delivery segment, KLC's virtual restaurants have successfully captured the online market's cravings. With over 75 locally developed brands spanning the UAE, Qatar and Kuwait, KLC proudly stands as a vertically integrated cloud kitchen restaurant company. "We create and develop brands in-house and operate them. Every aspect of brand creation and execution is handled internally," asserts Mubarak, a seasoned veteran in the regional foodtech landscape, having previously been a partner at Talabat, one of the region's largest online food delivery platforms.

In frame: Mohammed Al Besharah, Managing Partner at KLC Virtual Restaurants

In frame: Mohammed Al Besharah, Managing Partner at KLC Virtual Restaurants

Crafting a Winning Business Model and Solidifying Identity

KLC began its expansion into the UAE by first using a partnership model. “We had a lot of success with our partners at the beginning,” remarks Mubarak. “But after a few months, as we began to expand across multiple GCC markets, it was clear that KLC owning and operating all our own cloud kitchens would play to our strategic advantage.” Owning and operating their business from front to back seems to be in KLC’s DNA; it’s simply how they’ve run their Kuwait business for the past decade.

But maneuvering a transition from a partnership model to an own-and-operate model in tandem, while not disrupting consistent and seamless customer ordering through the same time period was no small feat. It involved building out, not just one, but three of their own kitchens across the Emirate in order to continue the level of service their customers had learned to expect from KLC’s virtual restaurant brands. “It was not an easy transition, to say the least,” says Mubarak. “It took us 6 to 9 months to complete the transition, but we now have three kitchens operating fully by us under our own management with over 75 live virtual brands across Dubai," he added. Two out of three of these kitchens were built and assembled from scratch, which of course comes with its advantages, but was also a massive undertaking.

Iconic Brands and Regional Culinary Influence: KLC's Portfolio

Aiming to become one of the top virtual delivery restaurants in the region, KLC successfully operates some of the most loved brands in the region, such as Project Pasta, Taco Eataco, Thrive Salad and at least 72 more. In the past 6 to 9 months, the company has been focusing on rapidly expanding its presence in Kuwait, Qatar and the UAE.

While about 30% of the restaurant's orders were initially fulfilled by their fleet, it has now reduced to 20%. "Our inhouse fleet has decreased since 2021 due to the shift in the food delivery landscape,” he says. He explains that there are a lot of on-demand delivery companies in the market today, and aggregators have also built much larger fleets than before. Today 100% of KLC’s deliveries in the UAE and Qatar are executed by aggregators. “It’s no longer worthwhile for us to invest in maintaining our own delivery fleets when there are players in the market that specialize in this,” Mubarak explains. KLC only maintains a small in-house delivery fleet in their home market of Kuwait, where they currently operate 15 kitchens across the country.

It is interesting to note that the top 3 best-selling cuisines in KLC’s portfolio remain consistent across the UAE, Kuwait and Qatar. Namely, Mexican, Italian and Healthy Foods.

Qatar was the other major market expansion KLC undertook in the past year. “It’s been the busiest 9 months of my life,” says Mubarak with a proud smile. While the business expansion in Qatar wasn't always meant to happen in the middle of the hustle and bustle of the 2022 FIFA World Cup, the decision led to the opening of three virtual kitchens in Qatar's Muaither, Abu Hamour, and Umm Salal areas. "We capitalized ourselves to invest in and set up our business in Qatar, building kitchen sites from scratch.” Luckily he adds that Abdulaziz Fakhroo, KLC’s Partner in Qatar introduced them to their first two kitchen locations. They will now soon be expanding into their fourth location. “We feel delighted with our expansion and performance in Qatar," he says.

Abdulaziz Fakhroo, Partner at KLC Virtual Restaurants

Abdulaziz Fakhroo, Partner at KLC Virtual Restaurants

Methodical Expansion: Choosing UAE and Qatar Before Saudi Arabia

When Mubarak is asked why KLC entered Qatar and UAE before entering the goliath that is the Saudi food delivery market, he chuckles. “You know, market expansion is not as easy as people think. We decided to take it one-step at a time – and we’re glad we chose to flex our international expansion muscles in the UAE and Qatar first. Their proximity helps, and these are markets that are not too different from our home market, Kuwait. We think Saudi is an entirely different beast altogether – and quite frankly, we’d like to see a few other players try and expand before we do it ourselves.” Mubarak also tells us that he believes KLC is now the only virtual restaurant company with more than 15 brands under their belt operating in Qatar. He says this is unquestionably one of the many reasons why KLC dominated in Qatar from day one. Mubarak also explains that Qatar aggregator commissions capped at 19% has helped the company to turn around profitable numbers rather quickly in the country. “There have been many lessons learned in Dubai and Doha that will be transferable as we look to expand into Abu Dhabi in the next 12 months,” he says.

The Robust Multibrand Cloud Kitchen Model

KLC's business model is known as a fully-stacked multibrand cloud kitchen model. It is a powerful and demanding model as it takes on all operations of running such a business in-house, from sourcing ingredients to making the food and delivering the various meals to the customers. In 2009, when the company set up its first delivery kitchen, KLC spotted a gap in the online delivery services market. Understanding the potential to create a restaurant brand that delivered quality food led to the setting up of their first brand, The Kitchen. This was when the team spotted a need to set up multiple virtual restaurant brands - noticing the customer demand for a variety of cuisines.

Consistent Tastes: Top 3 Best-Selling Cuisines Across Regions

Today, KLC restaurants offer over 15+ cuisines, including Japanese, Arabic, Italian, Mexican, American, as well as healthy foods, desserts and much more. Within each cuisine, there are multiple brands to satisfy the rising customer demand of having specialized brands offering something new to order. "Dubai is an international hub which accommodates the diversity of food we offer. Having a diverse portfolio of brands suited our entry into Dubai due to the city’s international customer-base," explained Mubarak. Today, the top 3 best-selling cuisines in KLC’s portfolio remain consistent across the UAE, Kuwait and Qatar. Namely, Mexican, Italian and Healthy foods. KLC has also noticed that there is strong demand for their sweets and dessert brands in Dubai.

The Zero Brand Risk, Zero Emotion Approach

Even though KLC has over 75 brands, Mubarak points out that KLC's zero brand risk and zero emotion approach has been an intrinsic part of its growth strategy. "We strongly believe that having a brand that works in one market doesn't need to work in another. Therefore, we don't obsess over how much a brand sells in the market. Overall, we look at the group level - which cuisine is doing the best in which market, and how can we serve each market better?"

Comparing Dubai, Kuwait, and Doha Markets

Mubarak also comments on the differences and similarities between the Dubai, Kuwait and Doha markets. "Food delivery is gaining momentum in Qatar, and because of how nascent the market is, Qatari customers are keen to experiment and try new dishes and places.” He also says the average ticket size is much higher in Doha than it is in Dubai. However, in Dubai and Kuwait, because food delivery has been well-developed, and existent for some time – consumers behave differently. We learn that people are very conscious of where they order from in Dubai. Dubai-consumers won’t just order from some random new place. "It’s too competitive and there are too many options for that,” he says. He also explains that Dubaiconsumers are also incredibly cost conscious and sales are driven by discounts and promotions – which has taught KLC a lot about how they market and position their brands in such a market.

We strongly believe that having a brand that works in one market doesn't need to work in another.

Mubarak's remarks highlight the value they see in the Qatar market, despite it currently yielding lower revenue than other regions. They believe that being an early major player in this less saturated market can yield significant long-term benefits. The average ticket in both Kuwait and Qatar are comparable, whereas in Dubai it tends to be somewhat smaller, necessitating more transactions to achieve similar growth.

However, the operational costs and revenue per customer, known as unit economics, are approximately equivalent across all three markets. Despite this, the heightened competition in Kuwait necessitates a more measured and strategic approach, honing in on a long-term perspective and precision in execution.

KLC’s Flexible Business Model

Also, since KLC's business model isn't country-specific, it holds the ability and flexibility to be molded according to the economics of another region, "The quality of food is the number one priority," says Mubarak, explaining how the reduced cost of rent (for a kitchen versus a kitchen plus full restaurant) becomes a reinvestment into the quality of food, service and delivery process. The savings from paying excessive rent towards a dining location gets put back into the product, which ultimately enhances its quality and ensures greater customer satisfaction.

Quality and Efficiency: KLC's Operational Focus

Unlike dining restaurants, delivery restaurants focus single-mindedly on tailoring the brand for delivery. In a concept such as this, packaging remains of utmost significance. While KLC focuses on using the best quality packaging for each brand and dish, setting up kitchens takes quite a lot of time and patience. While recruiting staff is not a significant issue for KLC in Dubai and Qatar, finding the right places to build a commercial kitchen with the minimum prerequisites, such as adequate electrical and gas supply and relevant licensing and approvals, remains a concern.

Mubarak also points out that everything is documented in such a data-driven industry. This means they can look at the orders, hourly and area sales and track every critical metric that helps make better business decisions. "At the end of the day, we see ourselves as a food business that is tech-enabled," says Mubarak, a firm believer in not entertaining any risk to their growth.

Despite successfully expanding in Dubai and Qatar over the past 6 to 9 months, challenges remain. The challenge that seems never-ending, lies in trying to ensure consistency, reliability, and a satisfactory delivery experience – every single time. "We are excited to share our food, culture, and quality with the countries where we want to be established. The challenge is correlation and consistency, ensuring that all our brands are prepared and served the KLC way, using the same ingredients and maintaining the same quality everywhere we go. This establishes trust and loyalty with our customers," says Mubarak. The process of delivering seamless similarity is more complicated than it sounds. It involves getting all things right, time and time again; this level of consistency requires training the team, making sure all brands are onboarded successfully, introducing new team members to understand precisely how the restaurants operate, and especially being cognizant of the fact that each zone has their own particular popular cuisines and therefore rearranging kitchens accordingly.

With a focus on high-quality standards, KLC sends trained chefs to oversee the operations and ensure that the same quality and flavors are maintained throughout. As the restaurant grows and innovates its brands, the latest feather in its hat is the launch of Tule Bakery, a speciality cake brand launched during Ramadan. "Next, we plan to launch new brands focused on group orders and catering," he says.

Expanding Horizons: Abu Dhabi, Bahrain, and Riyadh in the Pipeline

As long as KLC continues to identify gaps in the market, and creates brands to cater to everyone's cravings – the future seems bright and limitless for KLC. By the end of 2024, Mubarak says the company has its sights set on expanding into Abu Dhabi, Bahrain and Riyadh. When asked about the growing competitive environment, Mubarak says, “I think it has actually worked in our favour. Today, there are so many new channels and cloud kitchen support businesses that we don’t even know about yet – that could significantly aid our business when entering new territories in the future. I’m actually excited to explore all of the new options that are being presented to us today to see how differently we’ll do business tomorrow.”

There continues to be a substantial entrepreneurial focus across the GCC, and KLC seems to be enjoying the innovation-oriented environment bubbling across the GCC. "We're the only model doing what we are doing today. It is something that doesn't exist otherwise. Different players are using one or two elements of our model, but how we have set ourselves up remains unique," concludes Mubarak.

The quality of food is the number one priority.

To read more about the future of food and the growing business of foodtech – read the full report here.

Related: What's a Cloud Kitchen, Anyway?

%2Fuploads%2Ffoodtech-2%2Fcover%2520(1).jpg&w=3840&q=75)