Algebra Ventures: Egypt's Multi-Stage VC Firm Bridging Market Gaps

11 April 2024•

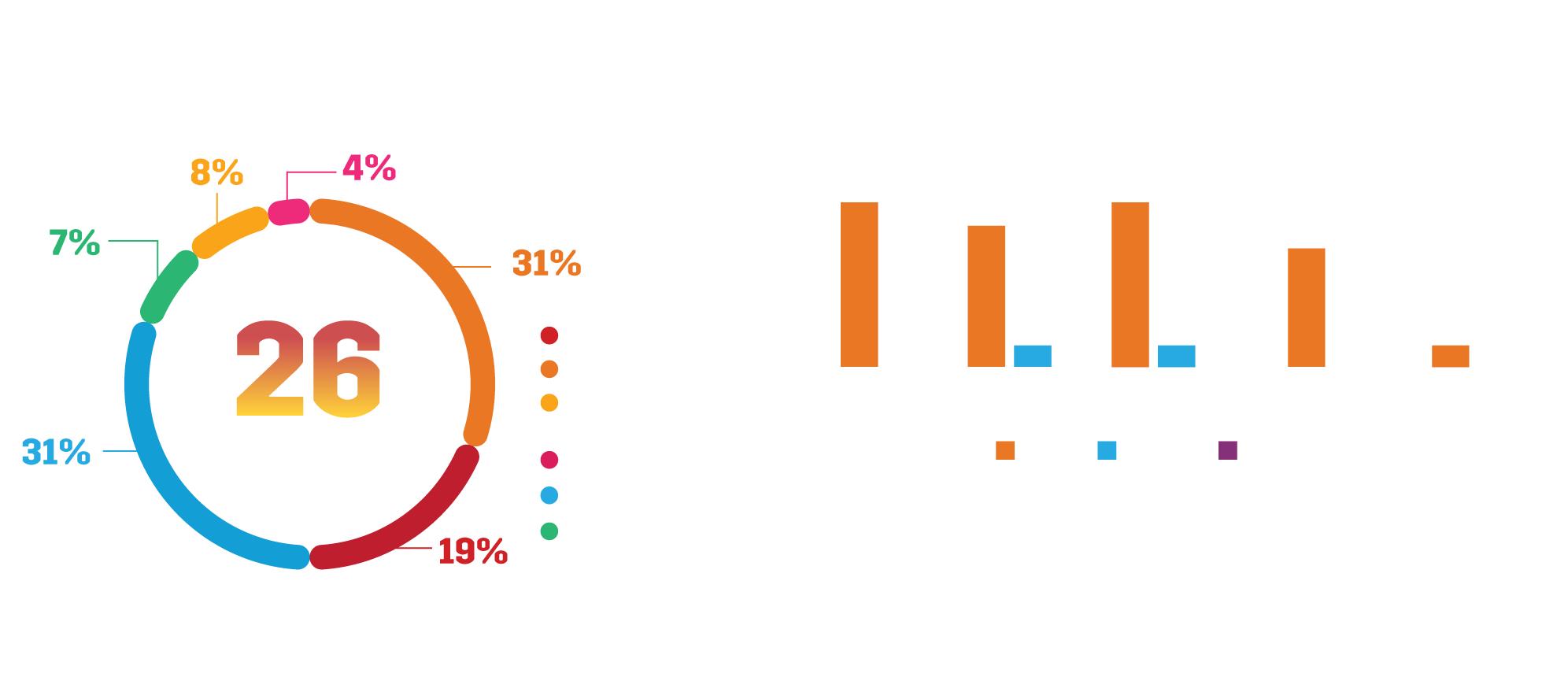

Algebra Ventures is a leading tech Venture Capital firm providing multi-stage capital, assisting with strategy and operations as well as helping build star teams. Its first fund was US$ 54 million, which it deployed across 21 startups. Its 2nd fund is US$ 90 million, which the firm is hoping to deploy across 30 companies.

- Year Established: 2016

- HQ: Cairo, Egypt

- AUM: N/A

- # of Portfolio Companies: 28

- % of companies in Egypt: 85%

- Total # of deals*: 91

- Avg # of deals per year: 5-7

- Number of exits: 5

- Funding Stage: Pre-Seed, Seed, Series A and Series B

- Ticket Size: US$ 0.5 million - US$ 5 million

- Team Size: 12

- Website: https://www.algebraventures.com/

Algebra Ventures is one of the leading tech Venture Capital firms in Egypt that came in the second wave of investors establishing themselves in Egypt. Tarek Assaad, Founding Partner at Algebra Ventures moved back from Silicon Valley and started his Egyptian VC career in 2009, managing the Technology Development Fund (TDF), Egypt’s first tech-focused investment vehicle, backed by the Egyptian Government.

Algebra Ventures is one of the leading tech Venture Capital firms in Egypt that came in the second wave of investors establishing themselves in Egypt. Tarek Assaad, Founding Partner at Algebra Ventures moved back from Silicon Valley and started his Egyptian VC career in 2009, managing the Technology Development Fund (TDF), Egypt’s first tech-focused investment vehicle, backed by the Egyptian Government.

Algebra’s first fund of $54M was launched in 2016 and has invested in some of Egypt’s most prominent startups including unicorn MNT-Halan. The fund was backed by heavyweights, like the International Finance Corporation and the European Bank for Reconstruction and Development. Algebra Ventures has always been bullish on the Egyptian market, with 21 out of 24 investments from Fund I being local Egyptian startups.

Also Read: MNT-Halan: From Ride-Hailing Roots to Becoming a Payments SuperApp Unicorn in 2023

Fast forward to 2022, Algebra Ventures took another giant leap raising a second fund of $100 million, its biggest to date, aimed at startups in Egypt and the rest of Africa. This fund, backed by returning LPs and prominent new ones, is a testament to Algebra’s unwavering commitment to nurturing tech innovation in Egypt and beyond.

Tarek tells us his rationale for an Egypt + Africa fund. “We believe that strong performing startups in Egypt are solving real-world problems; and that these issues and problems that they are solving for – whether it’s something like financial inclusion and access to credit in a market where less than 5% of the country owns a credit card – are issues more likely faced by other African nations, not wealthy GCC markets. We’ve had 5 exits to-date, of which two instances have witnessed African late-stage startups acquire Egyptian startups.”

Algebra Ventures invests in various technology sectors including fintech, agtech, edtech, logistics, and healthcare - sectors ripe for transformation. By partnering with high-potential founders, Algebra aims to bridge specific market gaps and propel these industries into a new era of innovation and efficiency. The firm says it’s about more than funding; it’s a complete growth platform for startups. With a wealth of experience in multi-stage investment and portfolio support, Algebra’s team, led by partners Tarek Assaad, Karim Hussein, Omar Khashaba and Laila Hassan, offers comprehensive assistance in strategy, operations, and talent. Their approach is holistic, nurturing startups like Mozare3, Yodawy, Mtor, Sylndr and Khazna from early stages right up to Series B. Algebra has also supported its portfolio in attracting capital from strong international institutional investors.

“This is a very challenging time for Egypt,” says Tarek. “I’ve never seen this amount of turbulence in the economy. But, particularly for tech startups, the picture is not as bleak as the rest of the economy, and there is still tremendous opportunity. As long as the fundamentals are there, I am confidence that things will work out.”

Having invested in over 27 transformative tech companies to date, Algebra’s portfolio is reshaping how technology impacts lives in Egypt and Africa.

Visit Algebra Ventures’ Investor Page here

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)