Is the MENA VC Winter Thawing?

02 November 2023•

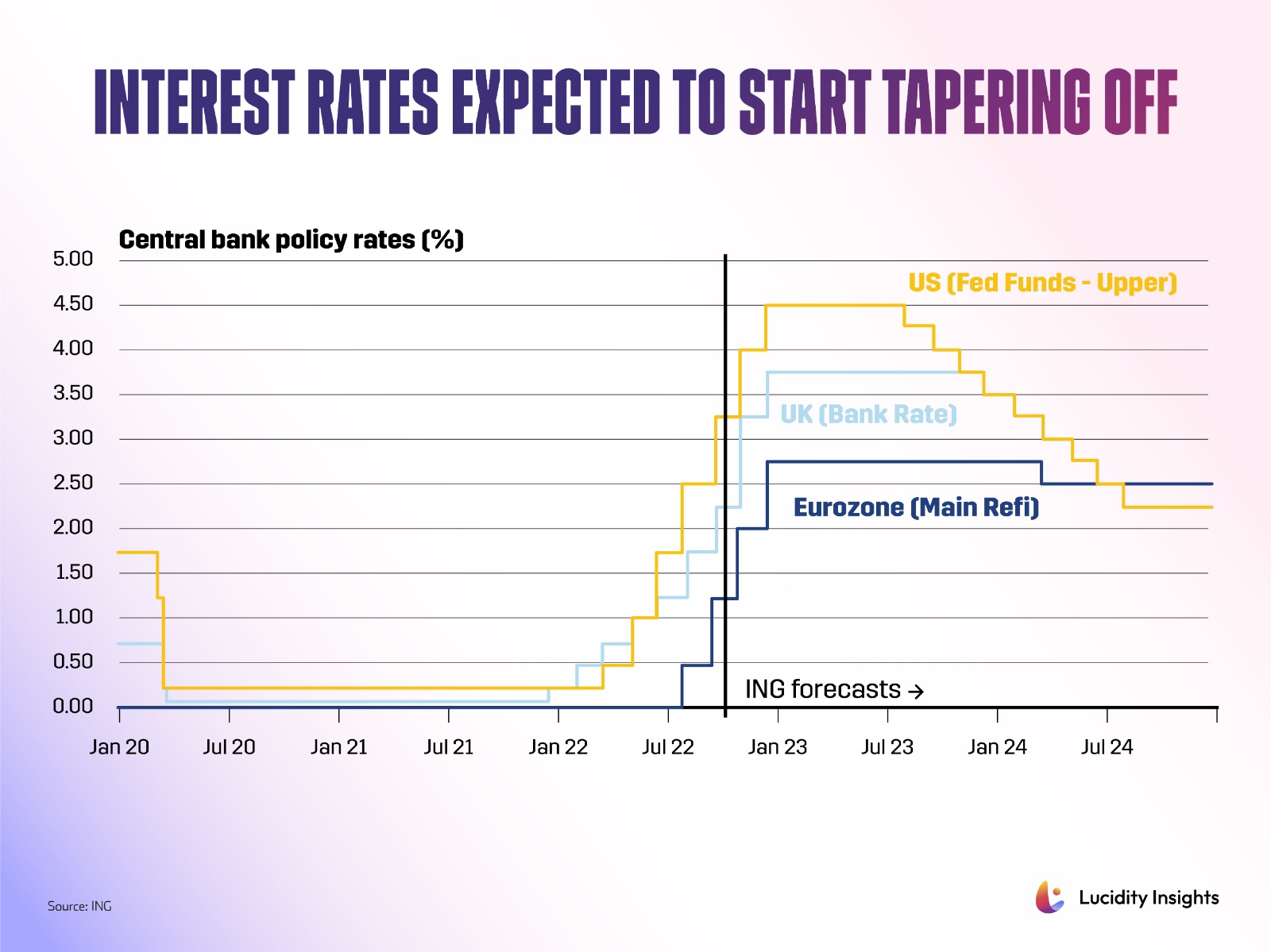

MENA's VC investments have waned over the past 18 months, echoing a trend initiated in Silicon Valley due to economic downturns, global conflicts, and rising interest rates. However, emerging indicators hint at a potential revival.

Despite economic challenges, the region's startup ecosystem is vibrant with numerous startups securing significant investments, underscoring the persistent allure of innovation. Rewaa and Jisr both recently announced $30m Series A rounds in KSA. Alma Health and Kaso in UAE announced $10m rounds in July. Fuze and MyZoi in UAE raised $14m each in September, while Redbox in KSA just recently announced a $15m investment round.

The VC slump prompts startups to focus on cost efficiency and optimizing business models to prolong their operational lifespan.

A Global Downturn in VC Investments

In 2023, a 51% dip in first-half VC investments marked a transformative period for the global VC ecosystem, with Q2 being particularly bleak. Q2 2023 global venture funding fell to the lowest level in 3 years, since Q2 2020. But a 11% Quarter on Quarter (QoQ) rebound was witnessed in Q3 2023, when global venture funding jumped to US $64.6 Billion.

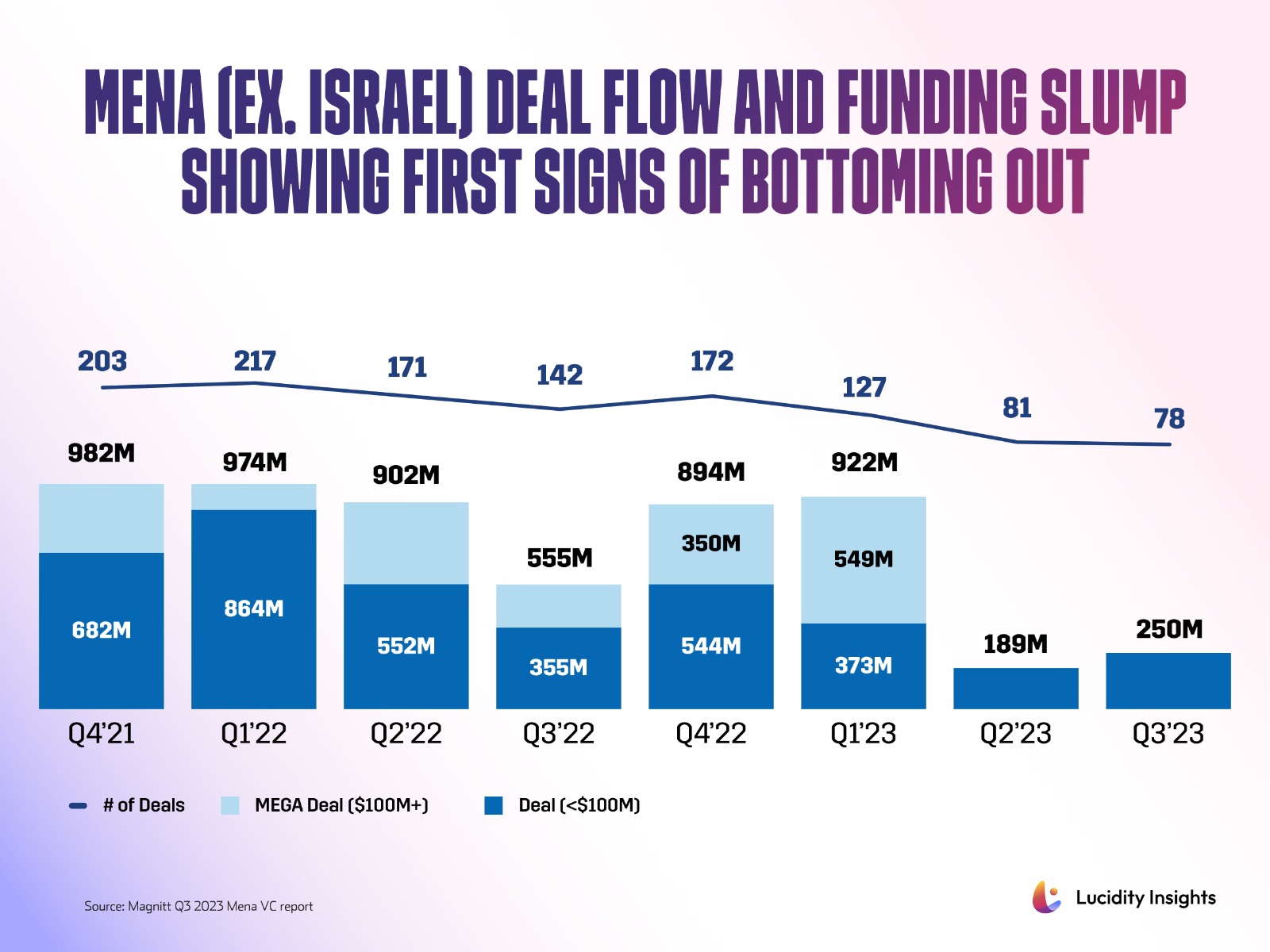

The MENA region has felt a sharper sting. Despite the robust support of DFIs and SWFs, the region recorded a near 40% drop in venture financing for H1 2023, bringing the total to US $1.1 billion, when excluding Israel.

As we end 2023’s third quarter, data points towards the weakest VC investment quarter in two years. This contraction is underscored by the diminished emergence of unicorns. 2023 has only birthed 120 new unicorns globally, compared to 669 in 2022.

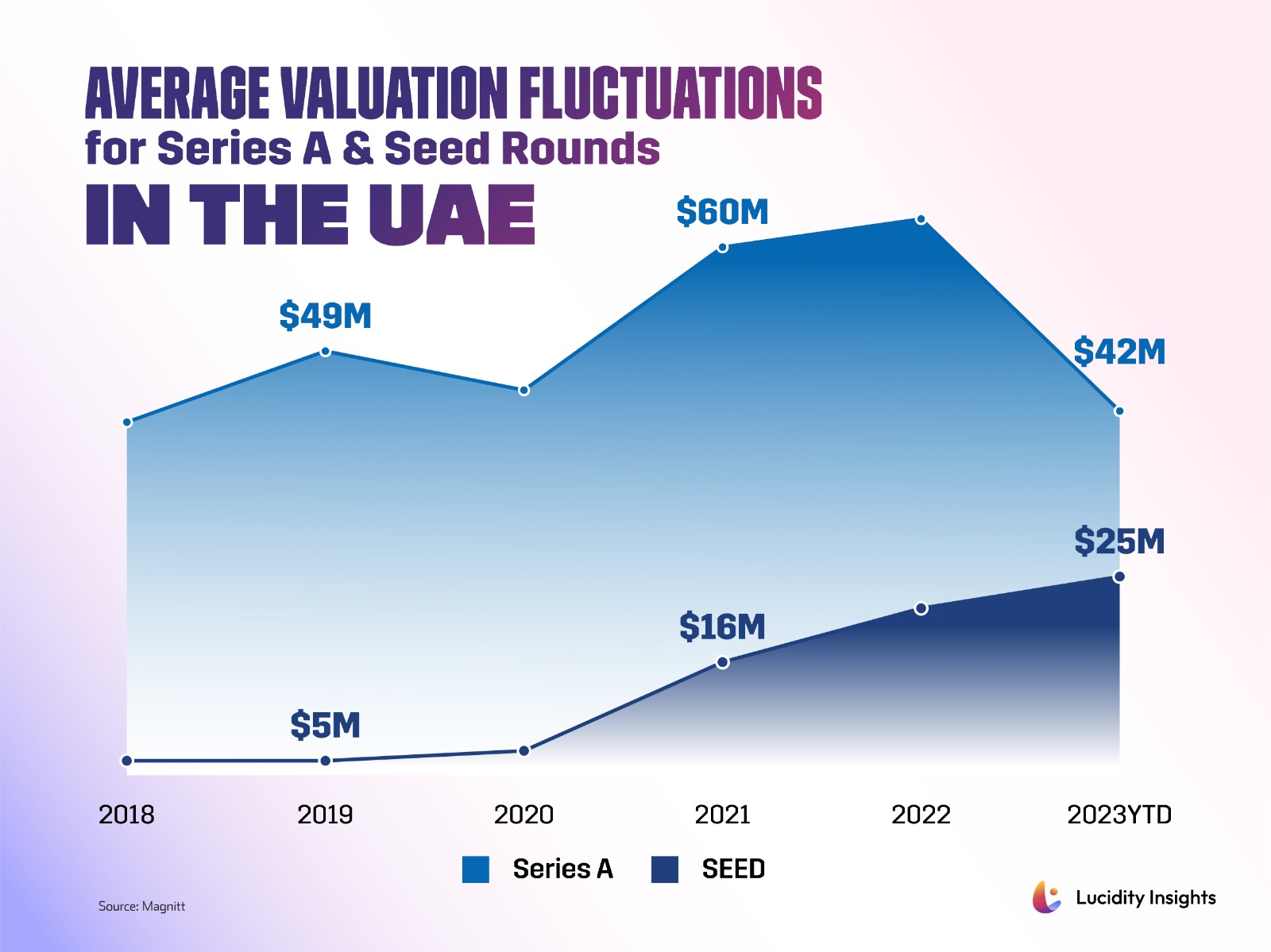

Delving into the root causes of this downturn, high valuations stand out as a primary deterrent. Coupled with decelerating growth and spiraling capital costs, the allure for potential investments has dulled. MENA startups grapple with governance issues, inflated valuations, and regulatory challenges. As expected, globally and across MENA, seed stage valuations are significantly more resilient than later stage valuations. The retreat of late-stage investors and infrequent IPOs are prompting a strategy reassessment among mid- to late-stage investors.

However, it's not all doom and gloom

Globally, diminishing US recession fears and stabilized inflation and oil prices indicate a recovery. In emerging markets like MENA, despite current challenges, there's an undercurrent of optimism. The increased presence and investment from Gulf sovereign wealth funds, robust fundraising levels and public offerings such as Instacart, Klaviyo and ARM hint at a brighter end to 2023.

In August 2023, the Saudi Ministry of Investment announced a $1.5b top-up for SVC. SVC and Jada both announced commitments into regional VC firm Venturesouq and Qatar’s QIA invested $1b in Reliance Retail Ventures, the largest retail company in India. Just last quarter, Mubadala invested $28m in Moove during Q3 2023 and this month Galaxy Interactive led a $55m round into Dubai-based HyperSpace.

The investment shifts don't stop at venture capital. Traditional investment entities are adopting a more cautious stance, while sovereign funds, particularly from the Middle East, are becoming increasingly involved in the global startup scene, signifying the fluid nature of the investment terrain.

Furthermore, specific sectors are capturing more interest. Investors are gravitating towards domains like AI, digital health, fintech, and clean technologies, while sectors like consumer tech and e-commerce are witnessing diminished attention. In tandem, SaaS entities are morphing, leaning towards a product-driven model, reminiscent of the older service-based offshoring paradigm, albeit with a fresh twist.

So when will the MENA VC winter end?

VC community opinions vary. Some regional VC giants, encouraged by recovery signs, anticipate a revival as early as Q4 2023. Others regionally and globally at renowned VC firms such as Sequoia and Andreessen Horowitz are less bullish with estimates of a global thawing of the VC winter by Q3-Q4 2024.

While there's no unanimous consensus, there is a palpable optimism on the horizon. The charts below depict signs of a soon-to-be stabilizing interest rates and increased appetite from startup founders and investors, ranging from investment amounts to the number of deals and average deal size, providing further evidence of the evolving scenarios.

Despite the challenging macroeconomic environment, there are a number of factors that suggest that the VC Winter in the MENA region may be nearing its end. First, there is still a strong demand for investment opportunities from regional and international VCs. Second, a number of startups in the MENA region have raised significant funding rounds in recent months. Third, there is a growing trend of VCs investing in early-stage startups.

The actual timing will depend on several determinants, including the global economic outlook, the wars in Ukraine and Gaza, and the performance of startups in the MENA region. Based on the current macroeconomic trends and the predictions of expert VCs, it is likely that the MENA region will start to emerge from the VC Winter towards the end of 2023.

According to a recent report by the World Bank, the MENA region is expected to grow at a healthy rate of 3% in 2023, but down from 5.8% in 2022. This slowdown is attributed to factors such as the global economic slowdown, the wars in Ukraine and Gaza, and the rising cost of living.

It is important to note that these are just predictions and the actual timing of the end of the VC winter will depend on varied elements. However, the fact that expert VCs are optimistic about the future of the MENA startup ecosystem is a positive sign. It suggests that they believe that the region has the potential to produce the next generation of global tech giants.

Factors that will facilitate VC Activity in MENA

MENA's VC scene, poised for expansion, is underpinned by key factors including improved economic conditions, increased government support, global recognition of MENA startups, a maturing VC ecosystem, and notable startup successes. The following factors are instrumental:

- Improved Macroeconomic Conditions: The resolution of ongoing economic challenges is expected to usher in strong growth, making the region attractive for VC investment.

- Increased Government Support: With enhanced financial incentives, direct investments, and startup-friendly regulations, governments are nurturing a conducive environment for VC influx.

- Increased Awareness of the MENA Startup Ecosystem: The global VC community’s growing awareness of successful MENA startups is drawing increased attention and investment.

- Development of the MENA VC Ecosystem: A growing and maturing base of VCs in the region is facilitating easier access to funding for startups.

- Success of MENA Startups: Demonstrated success stories amplify MENA’s attractiveness, pulling in more VC investments.

Given this backdrop, what should startups in the region be doing?

To capitalize on these favorable conditions, startups should focus on innovation, strong management, and clear exit strategies. The government’s supportive stance provides a foundation for a startup boom, with financial and regulatory incentives in place.

Specific Actions for MENA Startups:

- Develop Innovative Products and Services: Craft compelling offerings that appeal to VCs.

- Build Strong Management Teams: Assemble experienced teams to inspire VC confidence.

- Have a Clear Exit Strategy: Provide VCs with a clear, viable path to recoup and profit from their investment.

Amidst the VC winter, MENA’s young entrepreneurs, growing population, and global economic integration are positive indicators. A resurgence is anticipated by Q4 2023, marked by deeper tech innovations and a trend of early-stage investments.

Despite uncertainties, the resilience and diversity of MENA's startup ecosystem are setting the stage for a significant upswing. The ongoing VC winter is not a stagnation but a precursor to a storm of innovation and growth, underscoring the region’s burgeoning influence on the global VC landscape.

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)