MENAPT 2024 Funding Wrap-Up: A Clear Shift in Investment Dynamics

18 February 2025•

The global venture capital landscape in 2024 has been marked by a shift toward concentration over expansion. While overall funding remained stable, the number of deals declined significantly, signaling a trend of fewer but larger rounds. Artificial intelligence (AI) emerged as the dominant sector, drawing an unprecedented one-third of global VC dollars.

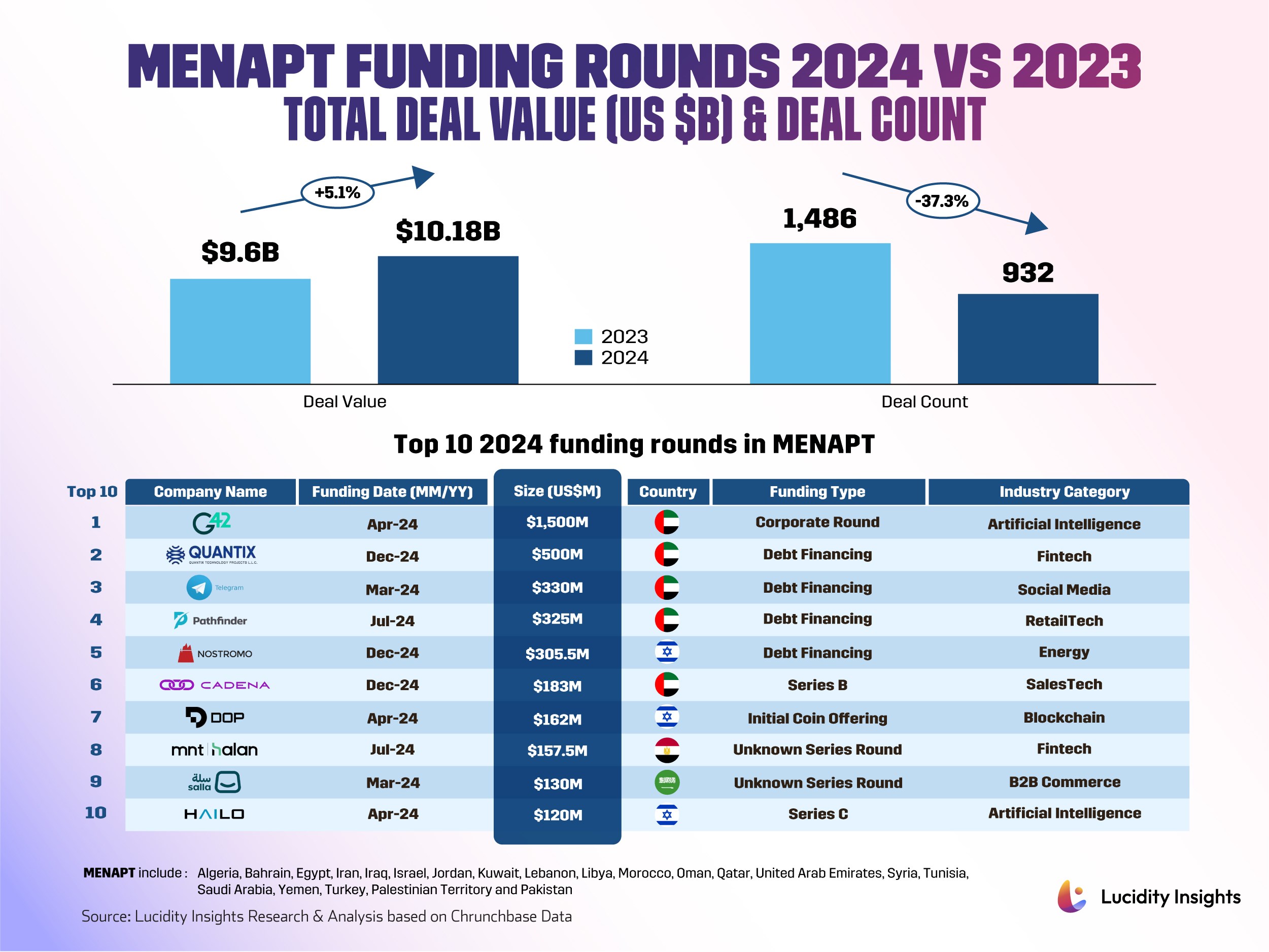

The MENAPT region mirrored this shift but with a notable distinction: funding volume increased. In 2024, MENAPT startups raised US $10.19 billion across 932 deals, compared to US $9.69 billion across 1,486 deals in 2023. While global markets faced uncertainty, the region continued to attract capital, with larger funding rounds reflecting investor confidence in scalable, high-growth businesses.

The top 10 funding rounds of 2024 highlight three key trends:

- AI and Deep Tech at the Forefront – G42’s US $1.5 billion round from Microsoft underscores the global race for AI leadership. Meanwhile, companies such as Pathfinder, Cadena, and Hailo reflect continued investor confidence in AI-driven innovation.

- Debt Financing Gains Prominence – With equity investments tightening, startups like Quantix Technology (US $500M) and Telegram (US $330M) turned to debt financing to drive expansion.

- Pre-IPO Rounds Signal Market Maturity – Companies like Salla (US $130M) and Cadena (US $183M) secured late-stage capital, reinforcing a growing pipeline of regional startups preparing for public listings.

The following list showcases the largest funding rounds of 2024, offering insight into the companies shaping the region’s innovation ecosystem.

1. G42 (UAE) | Artificial Intelligence | US $1.5 Billion Corporate Round

Group 42 Holding Ltd (G42) is an AI development holding company established in Abu Dhabi in 2018 that specializes in AI solutions across the government, healthcare, finance, oil and gas, aviation, and hospitality industries. Chaired by National Security Advisor of the UAE, Sheikh Tahnoon bin Zayed Al Nahyan, G42 has become a leader in the UAE’s hub of innovation driving technological advancement and excellence. Tailored to meet the UAE’s unique needs, G42 Cloud Services provide scalable, secure, and efficient solutions for businesses and organizations in the region. With a team of 20,000 scientists and engineers, G42 has published 300+ research papers surrounding AI evolution and applications and advanced tech across industries over the last 3 years.

G42 reached unicorn status in 2022, and now the company has received a US $1.5 billion investment by Microsoft. As the largest private round to go to an AI startup this year, this round comes as another move in the tech titan’s AI takeover. This collaboration will bring the latest Microsoft AI technologies and skilling initiatives to the UAE, empowering organizations of all sizes in new markets to harness the benefits of AI and the cloud in line with world-class standards in safety and security.

G42 CEO, Peng Xiao, said: “This partnership significantly enhances our international market presence, combining G42's unique AI capabilities with Microsoft’s robust global infrastructure. Together, we are not only expanding our operational horizons but also setting new industry standards for innovation.”

Samer Abu-Ltaif, Microsoft Corporate Vice President and President for Central and Eastern Europe, Middle East and Africa region, added: “Our investment in G42 stands as a testament to the thriving and dynamic tech landscape in the UAE and the broader region. This strategic partnership is well-positioned to ignite opportunities for our customers and partners, accelerate innovation, and fuel economic growth.”

2. Quantix Technology (UAE) | FinTech | US $500 Million Debt Financing

Founded by Abdallah Abu Sheikh in 2019, Quantix Technology operates as a subsidiary of Astra Tech specializes in consumer lending and financial services to provide technical services and computer system designs. Quantix integrates various functionalities into a seamless ecosystem through its Ultra app offering services such as payments, cross-border transfers, and financing solutions to a growing user base of over 150 million globally.

In December 2024, Quantix raised US $500 million in one of the largest debt financing rounds provided to a UAE fintech to date. The funds will be used to expand Quantix's range of financial services, enhance the Ultra app ecosystem, and develop new features such as Sharia-compliant lending, credit cards, and SME lending.

3. Telegram (UAE) | Social Media | US $330 Million Debt Financing

Telegram is a cloud-based instant messaging, voice over IP, and video calling service founded in 2013 by Pavel and Nikolai Durov. Having surpassed 5 million paying subscribers as of January this year with a user base of 900 million active monthly users, Telegram continues to grow its market presence as a global competitor to Meta Platforms’ owned WhatsApp. Known for its end-to-end encrypted communication, Telegram initiated a revenue-sharing program in March 2024, offering moderators up to 50% of the advertising revenue generated from their channels.

Telegram made headlines by securing US $330 million in debt financing, as the biggest funding round of March 2024 in the MENAPT region. With a bond offering said to be oversubscribed by CEO Pavel Durov, this marks a significant step in Telegram's financial strategy, bringing its total raised through debt financing to US $2.3 billion over the past three years. While the specifics of the bond issuance remain undisclosed, this maneuver demonstrates Telegram’s access to capital markets and its capacity to garner substantial funds, supporting its operational and growth ambitions in the competitive messaging and communication sector as the company plans to use these funds to maintain its accelerated pace of expansion.

4. Pathfinder (UAE) | RetailTech | US $325 Million Debt Financing

Founded in 1993 by Ahmed Hussain, Kristin MacDermott, and Sadique Ahmed, Pathfinder specializes in AI-based retail intelligence solutions aimed at enhancing retail operations. Pathfinder integrates physical and digital shopping experiences through RetailGPT featuring personalized recommendations and real-time sales visibility, streamlines lease management for brands with multiple outlets, ensuring efficient oversight and optimization of retail spaces, and provides real-time sales visibility across franchisees, reducing manipulation risks and building trust with accurate data insights.

In July 2024, Pathfinder secured US $325 million in debt financing led by Silver Rock Group. The new funds are dedicated to supporting the continuous development and global rollout of the RetailGPT platform, ensuring Pathfinder remains at the cutting edge of retail technology.

5. Nostromo (Israel) | Energy | US $305.5 Million Debt Financing

Founded by Yaron Ben Nun and Eyal Ziv in 2017, Nostromo Energy focuses on developing sustainable energy storage solutions using water-based technology. Nostromo's IceBrick® system is a modular thermal energy storage solution that uses water to store and discharge energy in the form of ice, helping commercial and industrial buildings manage their peak energy demand, reduce emissions, and lower energy costs.

In December 2024, Nostromo secured US $305.5 million in debt financing from the U.S. Department of Energy. The funds will be used for Project IceBrick®, which aims to deploy Nostromo's IceBrick® systems in 193 commercial buildings across California to help reduce costs, emissions, and grid strain related to electricity for commercial cooling.

6. Cadena (UAE) | SalesTech | US $183 Million Series B

Founded by Sid Dhamija and Yusuf Al Hasan in 2017, Cadena is a global leader in international business development, providing robust tools and services to streamline the process of overseas revenue growth. Its hybrid solution combines local sales expertise, AI-driven prospecting tools, and CadenaPay invoice factoring, a unique solution focused on getting service providers paid on time.

In December 2024, Cadena raised US $183 million in its Series B funding round led by ADCN for a total funding of US $258.3 million. The funds will be used to expand Cadena's AI-driven sales tools, enhance its global presence, and further develop its proprietary technology platforms.

7. Data Ownership Protocol (Israel) | Blockchain | US $162 Million Initial Coin Offering

Founded by Kohji Hirokado in 2023 and built on Ethereum, the Data Ownership Protocol (DOP) aims to enhance user control over personal data in the Web3 space by allowing selective transparency. DOP grants users the autonomy to decide what information they want to disclose or keep private on blockchain and decentralized platforms through selective disclosure of transactions, zero-knowledge cryptography, and dynamic context-based permissioning. DOP also supports an internal ecosystem for developers to create marketplaces and DeFi applications, fully compatible with major Ethereum wallets and services. By promoting customizable data control, DOP ensures that as blockchain technology evolves, user privacy and consent remain priorities, making selective transparency feasible.

DOP recently raised US $162 million through a pre-launch token sale of its $DOP token, marking it as the ninth-largest token sale in history and the first to surpass US $150 million since 2018. “It’s been a while since the crypto world has seen a token sale quite like this, and it underscores our innovative approach to data ownership. By leveraging blockchain technology, we aim to empower individuals with complete control over their data, ensuring privacy, security, and the opportunity to partake in the value it generates,” commented Hirokado.

This landmark sale reflects DOP's commitment to using blockchain technology to allow selective transparency, enabling users to decide how they encrypt and share their information, thereby maintaining a balance between privacy and transparency. The support from DOP’s large community of 2.7 million testnet users underscores the demand and necessity for user-controlled data in the Web3 ecosystem, and these funds are set to facilitate the expansion of DOP as it prepares for its mainnet launch scheduled for May 2024.

8. MNT-Halan (Egypt) | FinTech | US $157.5 Million Venture - Series unknown

Founded in 2017 by Ahmed Mohsen, Mohamed Aboulnaga, Mounir Nakhla, MNT-Halan provides financial services to the unbanked and underbanked populations of MENA. MNT-Halan offers mobile wallets, virtual cards, and peer-to-peer transfers as well as lending services like microfinance, SME lending, nano loans, and payroll lending. It even has platforms for home appliances and FMCG products with Buy Now Pay Later options like credit limits for consumers to shop and pay in installments.

In July 2024, MNT-Halan raised US $157.5 million in a funding round led by the International Finance Corporation, bringing its total raised to US $627.5 million. The new funds will be used to expand their operations, including the acquisition of the fintech company, Tam Finans, in Turkey.

9. Salla (KSA) | B2B Commerce | US $130 Million Venture Series Unknown

Salla is an e-commerce platform that has been providing SMEs and aspiring entrepreneurs in the KSA with a proprietary SaaS solution to deliver on their e-commerce ambitions since 2016. It supports Arabic, ensuring businesses can operate and customers can shop in their native language, offers payment solutions that cater to regional preferences, including local payment methods like SADAD in Saudi Arabia, to support transactions in local currencies, and facilitates integration with local and regional online marketplaces, broadening access to customers and sales channels. The platform's strong local customer support and a community of users sharing knowledge and best practices make it a valuable resource for businesses venturing into e-commerce in the region. Since 2020, Salla has enabled US $7 billion in sales and now facilitates access to a US $20 billion e-commerce market to over 80,000 active merchants.

Salla secured a US $130 million pre-IPO investment round in March 2024, led by Investcorp, with contributions from Sanabil Investment and STV. Nawaf Hariri, CEO and co-founder of Salla, expressed gratitude for the trust and investment from Investcorp and Sanabil, highlighting it as a testament to their confidence in Salla's vision and potential. “This investment propels us forward in our ongoing mission to open opportunities and empower individuals, SMEs, and enterprises to start and expand their businesses both within and beyond Saudi Arabia. We are committed to delivering innovative, customer-centric solutions that simplify and enhance the e-commerce experience for our merchants,” said Hariri, as the capital injection is intended to accelerate Salla's growth in preparation for its potential public market debut.

10. Hailo (Israel) | Artificial Intelligence | US $120 Million Series C

Founded in 2017 by Orr Danon and Avi Baum, Hailo designs specialized chips optimized for AI operations on edge devices. These chips are known for their efficiency, using less memory and power than typical processors, making them ideal for use in compact, battery-operated, and offline environments like vehicles, smart cameras, and robotics. Today, Hailo serves over 300 customers across various sectors including automotive, security, retail, industrial automation, medical devices, and defense. The Hailo-8 AI Processor was named the 2021 Edge AI and Vision Product of the Year in its category, and more recently, the Hailo-15 AI Vision Processor won a Picks Award at CES 2024.

Hailo became a unicorn when it raised $136 million in a Series C in October 2021, and now it has raised another megaround of US $120 million bringing the company valuation to US $1.2 billion. The team plans to use the new funds to accelerate their growth and execute faster on their roadmap, aiming to become a publicly traded company in the near future.

“The closing of our new funding round enables us to leverage all the exciting opportunities in our pipeline while setting the stage for our long-term future growth. Together with the introduction of our Hailo-10 GenAI accelerator, it strategically positions us to bring classic and generative AI to edge devices in ways that will significantly expand the reach and impact of this remarkable new technology,” said Danon.