Venturing into the Future: A15's Strategic Investment in MENA's Tech Ecosystem

12 April 2024•

A15 is an early stage venture capital firm focused on the MENA tech landscape. The firm seeks to invest in pre-seed and seed stages in companies operating in the digital products and technology sectors, primarily in Egypt.

- Year Established: 2014

- HQ: Cairo, Egypt

- AUM: Undisclosed

- # of Portfolio Companies: 33 currently, Invested in 39 companies

- % of companies in Egypt: ~90%

- Avg # of deals per year: 5-7

- Number of exits*: 6 fully exited, 1 partial exit (*as reported on Crunchbase)

- Funding Stage: Pre-Seed, Seed, Series A and B

- Ticket Size: US$ 100,000 to US$ 1 million

- Team Size: 50-200

- Website: http://www.a15.com/

A15 is a pioneering venture capital firm which established itself in Cairo among the 2nd wave of investors setting up shop to support the growth of innovative startups in Egypt and beyond. With investments in 39 portfolio companies, which have operations spanning more than 30 markets, A15 has been instrumental in shaping the startup ecosystem across Egypt as well as greater Africa and the MENA region.

Their notable achievement to date includes two dragon exits (an exit which returns more than the value of the entire fund from a single exit) with TPAY Mobile and Connect Ads marking significant milestones in the region’s venture capital history. Bassem Raafat, Principal at A15, highlights their early-stage, thesis-driven investment approach, focusing on companies that align with their vision of the future. Besides providing funding, A15 actively involves itself in the venture building and scaling, aiding in team building, strategic planning, business development and international expansion, as well as with capital raising and exit processes.

In frame: A15 and TPAY Mobile team

In frame: A15 and TPAY Mobile team

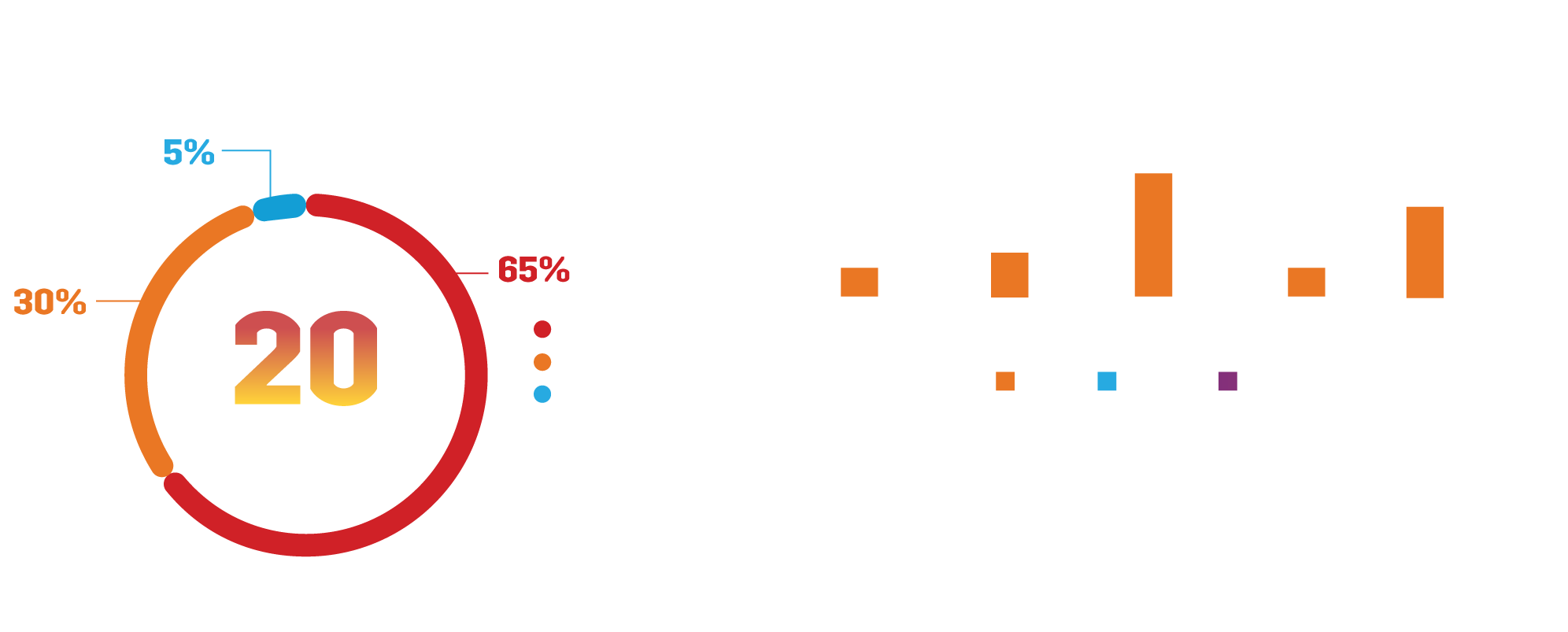

Impressively, from their first fund started in 2014, A15 achieved six full exits and one partial exit, distributing 9.7 times the paid-in capital to their limited partners. Their investment range varies, with initial checks between $100,000 to $1 million, and they adapt their target ownership stakes based on the investment stage. Its target ownership stake depends on the stage. At the pre-seed stage, the fund targets between 20 to 25%, around seed stage between 10-20% and Series A would probably be around 5-10%.

The fund adopts a sector agnostic strategy and looks for businesses that are leveraging technology to solve large problems efficiently and in a scalable way. A15 typically invests at the early stages of a company’s journey and invests a lot of time and effort by staying close to the companies they back to understand the challenges and opportunities, in order to best support the company.

Visit A15’s Investor Page here

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover.jpg&w=3840&q=75)