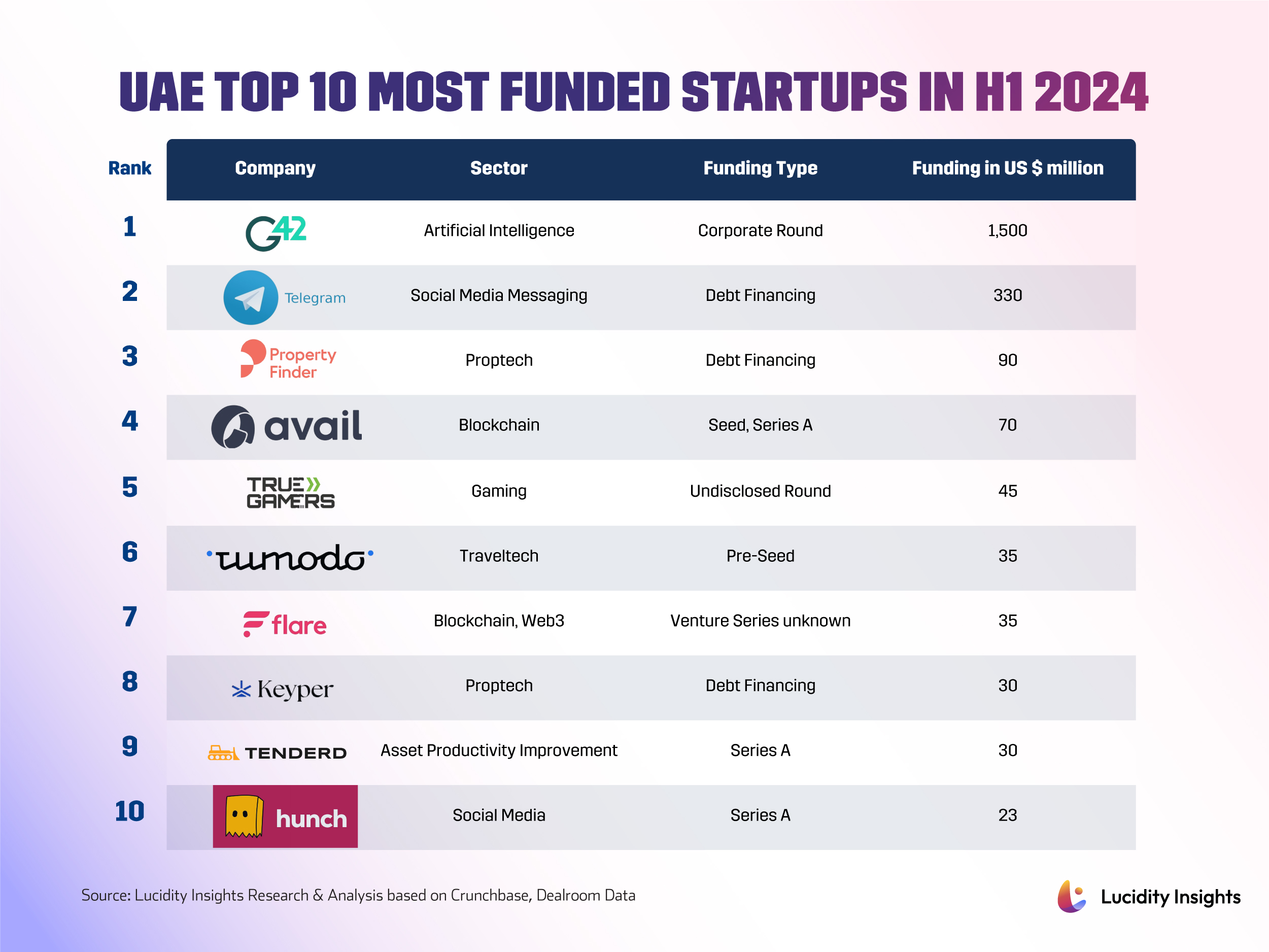

The Top 10 Most Funded Startups in UAE for H1 2024

31 July 2024•

The startup ecosystem in the United Arab Emirates showcases innovation and growth across a spectrum of industries, evidenced by the substantial funding rounds its startups have secured in the first half of 2024, highlighting the confidence of investors in the region's technological and economic potential. Funding varies from debt financing to venture rounds, which indicates a maturing startup ecosystem in the UAE, capable of attracting a variety of investment types from both regional and global investors.

Looking at the funding landscape for the top 10 startups in the region for H1 2024, it becomes evident that the UAE has solidified its position as a fertile ground for diverse startup ventures.

1. G42 | Artificial Intelligence (UAE) | US $1,500 Million Corporate Round

Group 42 Holding Ltd (G42) is a development holding company established in 2018 that specializes in AI solutions across the government, healthcare, finance, oil and gas, aviation, and hospitality industries. Chaired by National Security Advisor of the UAE, Sheikh Tahnoon bin Zayed Al Nahyan, G42 Cloud Services provide scalable, secure, and efficient solutions for businesses and organizations in the region. With a team of 20, 000 scientists and engineers, G42 has published 300+ research papers surrounding AI evolution and applications and advanced tech across industries over the last 3 years.

G42 reached unicorn status in 2022, and the company has received a US $1.5 billion investment by Microsoft in April 2024. The collaboration brought Microsoft's latest AI technologies and skilling initiatives to the UAE, empowering organizations of all sizes in new markets to harness the benefits of AI and the cloud in line with world-class standards in safety and security.

2. Telegram| Social Media (UAE) | US $330 Million Debt Financing

Telegram is a cloud-based instant messaging, voice over IP, and video calling service founded in 2013 by Pavel and Nikolai Durov. Having surpassed 5 million paying subscribers with 900 million active monthly users, Telegram continues to grow its market presence as a global competitor to Meta Platforms’ WhatsApp.

Telegram secured US $330 million in debt financing as the biggest funding round of March 2024 in the MENAPT region. With a bond offering said to be oversubscribed by CEO Pavel Durov, it was a significant step in Telegram's financial strategy, bringing its total raised through debt financing to US $2.3 billion over three years. This demonstrates Telegram’s access to capital markets and its capacity to garner substantial funds, supporting its operational and growth ambitions in the competitive messaging and communication sector as the company plans to use these funds to maintain its accelerated pace of expansion.

3. Property Finder | Proptech — Classifieds (UAE) | US $90 Million Debt Financing

Founded in 2007 by Michael Lahyani and Renan Bourdeau, Property Finder provides a platform for property listings, real estate search, and property management, as their websites, apps, and tools help users find, buy, sell, or rent properties in MENA. Property Finder has expanded across the region, including Qatar, Bahrain, and Egypt, with a focus on Saudi Arabia and Turkey, competing with platforms like Dubizzle and Bayut.

In May 2024, Property Finder secured US $90 million in debt financing from Francisco Partners to repurchase shares from its initial investor, BECO Capital, amidst ongoing domestic and international interest in the UAE's thriving real estate market. BECO Capital, which has previously invested in notable companies like Careem and Fetchr, has exited its investment in Property Finder with a significant return.

4. Avail | Blockchain (UAE) | US $70 Million Seed, Series A rounds

Founded in 2022 by Anurag Arjun and Prabal Banerjee, Avail is a blockchain dedicated to transforming the blockchain world by helping other blockchains scale. Avail serves as a fundamental layer of modular blockchain infrastructure, solving blockchain fragmentation at scale, and enables users to execute bridgeless transactions while acting as a unification layer connecting various blockchains.

In 2024, Avail raised a total of US $70 million over a Seed round in February then Series A funding led by cyber—Fund, Dragonfly, and Founders Fund in June. The funding is being used to develop Avail's Unification Layer, a sophisticated technology stack designed to enhance the scalability and interoperability of modular blockchains through data availability, aggregation, and shared security, as well as its "Fusion Security" layer, which integrates cryptocurrencies to bolster the security of the Avail ecosystem, anticipated to launch in early 2025.

5. True Gamers | Gaming (UAE) | US $45 Million Funding round

Founded by Anton Vasilenko and Vlad Belyanin in 2019, True Gamers is melding entertainment, technology, and competitive spirit to capitalize on the burgeoning gaming and e-sports market in MENA.

Founded by Anton Vasilenko and Vlad Belyanin in 2019, True Gamers is melding entertainment, technology, and competitive spirit to capitalize on the burgeoning gaming and e-sports market in MENA.

True Gamers made the spotlight in January 2024 with a US $45 million investment earmarked for establishing a formidable presence in Saudi Arabia. "Recognizing the tremendous potential of this market, we have embarked on a strategic expansion into the Kingdom, aligning with the ambitious Vision 2030 development plan," says True Gamers co-founder Vlad Belyanin, divulging their strategic blueprint for Saudi Arabia, which is anticipated to double the company's existing network.

6. Tumodo | TravelTech (Abu Dhabi, UAE) | US $35 Million Pre-seed round

Founded in 2022, Tumodo is a TravelTech that helps companies set up business processes and optimize the management of travel expenses, enhancing employee productivity and ensuring compliance with travel policies as well as reduce the costs of business travel of clients by 35% on average.

Founded in 2022, Tumodo is a TravelTech that helps companies set up business processes and optimize the management of travel expenses, enhancing employee productivity and ensuring compliance with travel policies as well as reduce the costs of business travel of clients by 35% on average.

Tumodo took flight with a remarkable US $35 million pre-seed round in January 2024 after just a year up and running. It aims to reach 25 countries by 2026, aligning with the surging global business travel market as CCO Stan Klyuy says, "Tumodo is the future of business travel, and it is important for us to contribute to the MENA business travel market and make its recovery not only one of the fastest in the world but also to make this market the most technologically advanced."

7. Flare Network | Blockchain, Web3 (UAE) | US $35 Million Venture Series unknown

Founded in Dubai in 2019, Flare Network focuses on enabling the secure and scalable execution of smart contracts on its network, facilitating interoperability between different blockchain systems. It has integrated the Ethereum Virtual Machine (EVM) with its protocol, which allows for the use of smart contracts on non-Ethereum blockchains, significantly expanding the functionality and reach of decentralized applications (dApps) across various blockchain ecosystems. This approach enhances the utility of blockchain technology by creating a more interconnected and efficient decentralized network.

Flare raised US $35 million in February 2024, and after Google Cloud announced that it was joining Flare Network as a validator earlier this year, sparking a 5% increase in its token value, early investors doubled down, extending FLR token distribution into the first quarter of 2026. The funds are being used to foster ecosystem growth with selling limits to reduce market pressure and token burning to ensure stability.

8. Keyper | Proptech (UAE) | US $30 Million Debt Financing

Founded in 2022 by Omar Abu Innab and Walid Shihabi, Keyper is a Rent Now Pay Later (RNPL) startup aimed to revolutionize real estate transactions and property management in the region, making them seamless and efficient. Keyper offers a property management platform that allows tenants to track expenses and pay rent online, while investors gain access to real estate portfolios and data-driven insights. In 2024, Keyper onboarded 3,000 residential units worth US $2 billion, processed over US $10 million in annual rent payments, and deployed over US $1 million in annual rent facilitation.

Keyper raised US $4 million in pre-series A funding and secured an additional US $30 million through Shariah-compliant sukuk financing led by Dubai-based BECO Capital and Middle East Venture Partners in May 2024. The funds are being used to digitize the rental experience in the UAE and to scale Keyper’s (RNPL) solution, allowing landlords to receive their annual rents upfront while tenants will benefit from the flexibility of paying their rent in monthly installments using credit or debit cards and other digital payment methods.

9. Tenderd | Asset Productivity Improvement (UAE) | US $30 Million Series A

Founded in 2018 by current CEO Arjun Mohan, Tenderd operates in the heavy industries, focusing on construction, energy, marine, and logistics with a marketplace that allows companies to supply and rent construction machinery, while also providing customers with AI-generated insights to increase asset utilization and reduce emissions.

Founded in 2018 by current CEO Arjun Mohan, Tenderd operates in the heavy industries, focusing on construction, energy, marine, and logistics with a marketplace that allows companies to supply and rent construction machinery, while also providing customers with AI-generated insights to increase asset utilization and reduce emissions.

In June 2024, Tenderd raised US $30 million in Series A funding led by A.P. Moller Holding, bringing its total funds to US $35.8 million. Leveraging sector-specific data, Tenderd is developing industry-focused AI models, distinguishing itself from generic models and leading transformative efforts within these industries with support from partners in logistics, ports, energy, construction, and technology. The new funds will accelerate technological advancements and facilitate Tenderd's expansion globally, particularly in integrating AI with operations across construction, mining, and industrial sectors.

10. Hunch | Social Media (UAE) | US $23 Million Series A

Founded in 2022, Hunch is a social media platform that allows users to start conversations by creating polls which others vote and comment on. The platform has already recorded over 115,000 polls, garnering more than 10 million opinions through user votes.

Founded in 2022, Hunch is a social media platform that allows users to start conversations by creating polls which others vote and comment on. The platform has already recorded over 115,000 polls, garnering more than 10 million opinions through user votes.

In March 2024, Hunch secured US $23 million in Series A funding from investors including Alpha Wave and Hashed Emergent. Currently, nearly 85% of Hunch's user base comes from India, but the company is using the new funds to strengthen tech infrastructure, improve feed personalization, and accelerate its expansion into the US and Indian markets, growing its MAUs to the low single-digit millions with an expected 40% to 50% of this growth coming from the US.

Takeaway

The first half of 2024 has solidified the UAE as a dynamic hub for innovative startups across various sectors and a robust ecosystem attracting significant global and regional investments. The funding patterns observed, from AI to blockchain and proptech, not only reflect a strong investor confidence in the region’s technological and economic capabilities but also suggest a strategic diversification of the UAE's economy beyond its traditional industries. This trend towards substantial investment in technology-oriented companies is likely to propel the UAE forward as a leader in both regional and global markets, fostering a competitive, sustainable, and forward-thinking business environment. We can't wait to see what trends the second half of 2024 holds, and what startups will steal the spotlight, promising even more exciting developments in this thriving entrepreneurial landscape.