5 Most Funded Startups in Sub-Saharan Africa in January 2025

10 February 2025•

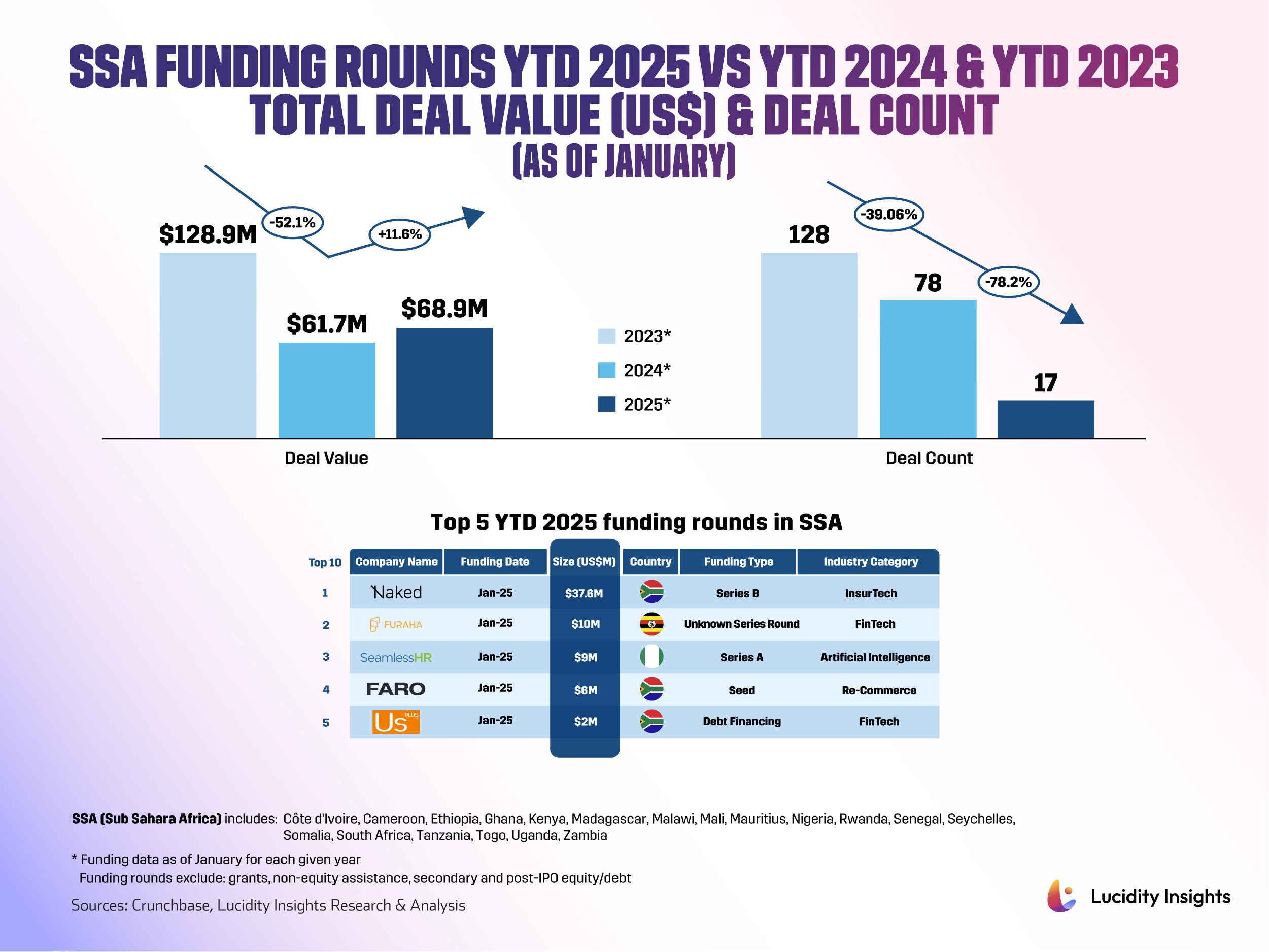

The venture capital funding landscape in the Sub-Saharan Africa (SSA) region has reflected broader global economic headwinds and shifting investor priorities in January 2025. In a dramatic year-on-year drop, total deal value plunged more than 52% from US $128.97 million in January 2023 to just US $61.78 million in January 2024, before showing a modest recovery to US $68.95 million in January 2025. This fluctuation is attributed to an unstable macroeconomic environment characterized by slowing GDP growth, rising inflation, geopolitical tensions, and escalating climate challenges, all of which have dampened investor confidence in the region in recent years.

Meanwhile deal count witnessed an even sharper decline, decreasing by nearly 40% from 128 deals in January 2023 to 78 deals in January 2024, culminating in a pronounced 78% drop to only 17 deals in January 2025. The persistently low number of mega-rounds in SSA over the past two years reflects a cautious investment landscape shaped by economic uncertainty, constrained access to later-stage capital, and shifting investor priorities. Rather than a deliberate preference for smaller, evenly sized deals, this trend is largely a consequence of risk-averse capital deployment, with investors favoring early- to mid-stage funding rounds where valuations are lower and downside risks are more manageable. While a few notable mega-rounds did occur in 2024, such as Showmax securing ZAR 2.8 billion (approximately US $150 million) in a corporate round and Moove raising US $100 million in a Series B, these remain exceptions rather than indicators of a broader resurgence in late-stage funding.

Notably, there has been a distinct shift in the sectoral composition of funding ventures lately. The biggest deals in January 2023 and January 2024 centered around the energy, renewable resources, and agriculture sectors, highlighting the significant contribution of agriculture to the GDP in various SSA countries while also reflecting regional priorities in sustainability and food security. However, January 2025 marked a strategic pivot toward technology-driven sectors with FinTech, InsurTech, and AI taking the top spots in SSA similar to global trends as of late. This aligns with regional ambitions for digital transformation and investor expectations for higher returns. 3 out of 5 of the top deals this month went to startups in South Africa, whose 4IR strategy is leveraging advanced technologies like AI, IoT, and blockchain to drive economic growth and innovation.

Let’s take a look at the top 5 funding rounds of January 2025 in SSA.

#1 - Naked Insurance (South Africa) | InsurTech

US $37.6 Million | Series B

Founded in 2016 by Alex Thomson, Ernest North, and Sumarie Greybe, Naked Insurance offers short-term retail insurance products which allow customers to manage their insurance policies entirely through a digital platform, providing quotes in under 90 seconds. According to a price comparison from BusinessTech, Naked Insurance currently offers the cheapest car insurance in South Africa.

In January 2025, Naked Insurance raised US $37.6 million in its Series B funding round led by BlueOrchard. The funds will be used to enhance its AI-driven platform and automation, expand its products and markets, and drive its advertising campaigns to attract and retain customers as well as meet regulatory capital requirements.

#2 - Furaha (Uganda) | FinTech

US $10 Million Venture | Unknwon Series Round

Founded by Yustus Aribariho and Ian Fernandes in 2023, Furaha is a purpose-driven lending platform aiming to make finance accessible across Sub-Saharan Africa, with its first offering being in the education financing space. Originally headquartered in UAE’s Dubai International Financial Centre (DIFC), Furaha has extended its offerings to local operating markets in Africa, starting with Uganda as its first market.

In January 2025, Furaha secured US $10 million in debt financing from SC Ventures. The funds will be used to help enhance purpose-driven financing in Africa and support their work to rewire the DNA in banking by expanding to other countries in Africa.

#3 - SeamlessHR (Nigeria) | AI

US $9 Million | Series A

Founded by Emmanuel Okeleji and Deji Lana in 2018, SeamlessHR serves over 2,000 medium and large enterprises globally, managing HR and payroll processes for about 300,000 employees in 20 African countries. With offices in Nigeria, Ghana, and Kenya, its platform supports organizations from recruitment to retirement.

In January 2025, SeamlessHR raised US $9 million in its Series A funding round led by the Gates Foundation and Helios Digital Ventures. The funds will support the startup's plans to expand across Africa, improve workforce productivity, and introduce AI-driven workforce management tools and embedded finance solutions.

#4 - FARO (South Africa) | Re-commerce

US $6 Million | Seed

Founded by David Torr and William McCarren in 2023, FARO has redefined retail with its re-commerce model, sourcing unsold inventory and overstock from brands such as ASOS, Boohoo, and Levi’s. The company offers discounts of up to 70%, appealing to cost-conscious consumers while promoting sustainability. FARO began with a pop-up store in 2023, generating US $100,000 in its first month. With only four stores, it exceeded US $2.3 million in revenue last year—20 times its initial projections.

In January 2025, Faro secured US $6 million in Seed funding led by Bloomberg President JP Zammitt, alongside notable VC firms like Presight Capital and Garage Ventures. The funds will drive Faro's expansion goals for 1,000 locations within the next decade, focusing on emerging markets and using regional pricing strategies.

#5 - UsPlus (South Africa) | FinTech

US $2 Million | Debt Financing

Founded by Leon Kirkinis in 2015, UsPlus is a key player in invoice factoring supporting South African businesses that have historically struggled to access traditional financing. With a strong focus on local manufacturers, logistics providers, renewable energy firms, and agricultural businesses, UsPlus helps SMEs meet procurement demands from multinational corporations while enhancing financial inclusion.

In January 2025, UsPlus secured US $2 million in Debt Financing led by the Verdant Capital Hybrid Fund. The funds will bolster the startup's capital base and attract additional senior debt, further strengthening its capacity to support economic growth.

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)