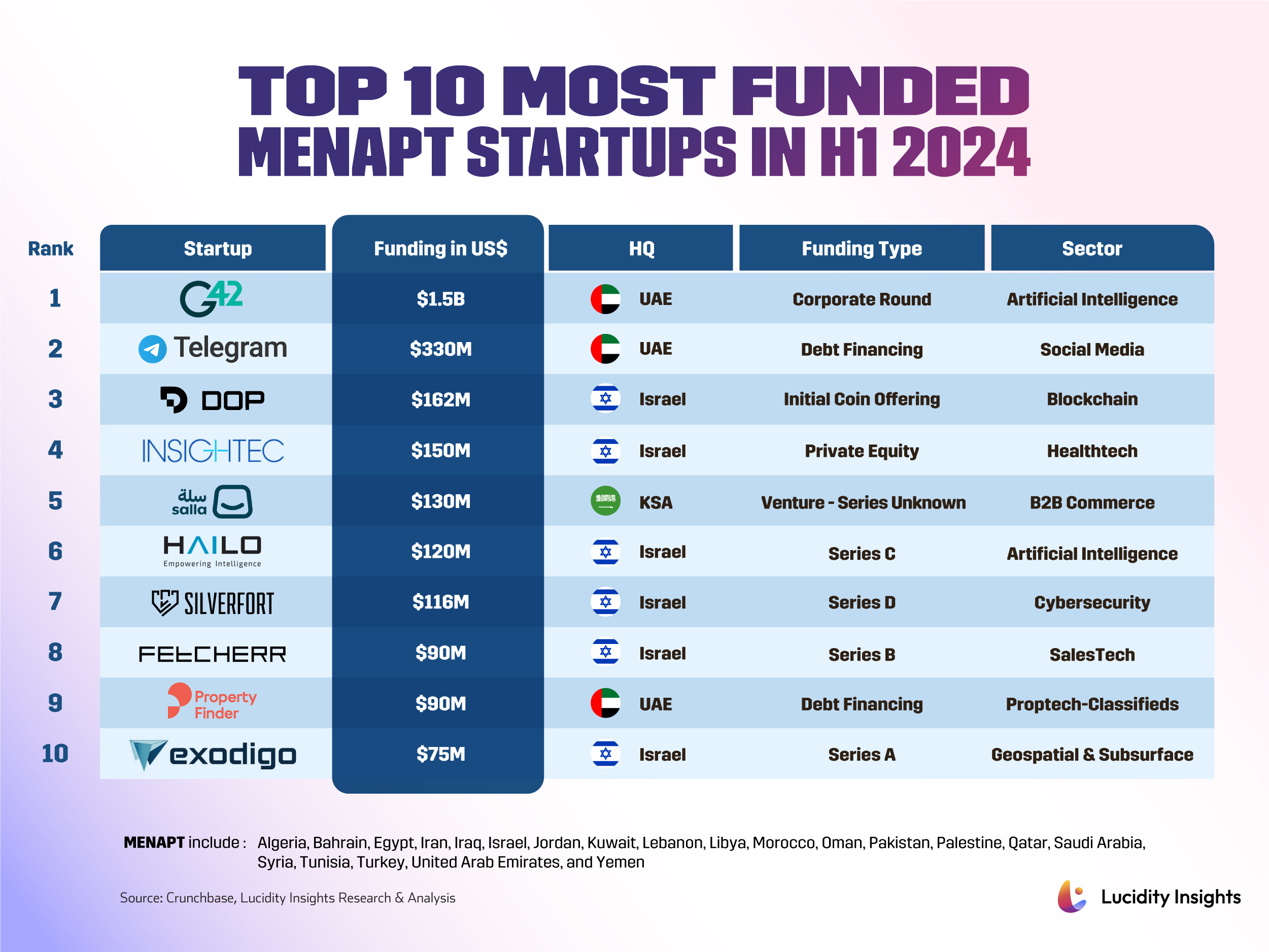

The Top 10 Most Funded Startups in H1 2024 for MENAPT Countries

16 July 2024•

As the first half of 2024 closes, let's take a closer look at the venture capital scene in MENAPT. Yearly comparison with 2023 data highlights a strategic shift towards larger, more mature investment opportunities. Average deal size saw a significant rise from US $5.62 million per deal in 2023 to US US $11.19 million in 2024. This is because the number of VC deals plummeted by 48.6% from 823 in 2023 to 423 in 2024 while total funding increased from US $4,622 million in 2023 to US $4,733 million in 2024, mainly driven by some large megarounds this year such as G42’s US $1.5 billion round.

Infobyte: Top 10 Most Funded MENAPT Startups in H1 2024

AI continues to dominate the investment landscape. Israel stands out with six startups making it to the top-funded list, however, the UAE and Saudi Arabia continue to be central hubs for tech development as usual.

Debt financing seems to be favored lately for its non-dilutive nature, as companies like Telegram and Property Finder show how suitable it is for businesses aiming to expand without equity dilution. However, the different stages of equity financing present reflect a dynamic VC environment, demonstrating a healthy VC environment that supports a wide range of startup maturities.

The first half of 2024 illustrates a tightening VC market in MENAPT, with capital concentrating on fewer but larger and potentially more mature investments. This trend could signify a strategic shift towards lower-risk ventures. Now, let's delve into the top 10 most funded startups in the region for H1 2024.

#1 - G42 | Artificial Intelligence

Abu Dhabi, UAE | US $1,500 Million Corporate Round

Founded in 2018 and chaired by the UAE’s national security advisor Tahnoun bin Zayed Al Nahyan, Group 42 Holding Ltd (G42) is an AI development holding company that specializes in AI solutions across the government, healthcare, finance, oil and gas, aviation, and hospitality industries. Tailored to meet the UAE’s unique needs, G42 Cloud Services provide scalable, secure, and efficient solutions for businesses and organizations in the region. With a team of over 20,000 scientists and engineers, G42 has published 300+ research papers surrounding AI evolution and applications and advanced tech across industries over the last 3 years.

In April 2024, G42 received a US $1.5 billion investment by Microsoft, bringing the company's total funds raised to US $2.4 billion. This collaboration brought Microsoft's latest AI technologies and skilling initiatives to the UAE, empowering organizations of all sizes in new markets to harness the benefits of AI and the cloud in line with world-class standards in safety and security.

#2 - Telegram | Social Media

Dubai, UAE | US $330 Million Debt Financing

Founded in 2013 by Pavel and Nikolai Durov, Telegram is a global cloud-based instant messaging, voice over IP, and video calling service. Having surpassed 5 million paying subscribers as of January this year with a user base of 900 million active monthly users, Telegram initiated a revenue-sharing program in March 2024, offering moderators up to 50% of the advertising revenue generated from their channels.

Telegram secured US $330 million in debt financing in March 2024, bringing its total funding amount to US $3.2 billion. With a bond offering said to be oversubscribed by CEO Pavel Durov, the company plans to conduct an IPO by March 2026. This maneuver demonstrates Telegram’s access to capital markets and its capacity to garner substantial funds, supporting its operational and growth ambitions in the competitive messaging and communication sector as the company plans to use these funds to maintain its accelerated pace of expansion.

#3 - Data Ownership Protocol | Blockchain

Tel Aviv, Israel | US $162 Million Initial Coin Offering

Founded in 2023 by Kohji Hirokado and built on Ethereum, the Data Ownership Protocol (DOP) aims to enhance user control over personal data in the Web3 space by allowing selective transparency. DOP grants users the autonomy to decide what information they want to disclose or keep private on blockchain and decentralized platforms through selective disclosure of transactions, zero-knowledge cryptography, and dynamic context-based permissioning. DOP also supports an internal ecosystem for developers to create marketplaces and DeFi applications, fully compatible with major Ethereum wallets and services. By promoting customizable data control, DOP ensures that as blockchain technology evolves, user privacy and consent remain priorities, making selective transparency feasible.

In April 2024, DOP raised US $162 million through a pre-launch token sale of its $DOP token, marking it as the ninth-largest token sale in history and the first to surpass US $150 million since 2018. The support from DOP’s large community of 2.7 million testnet users also underscored the demand and necessity for user-controlled data in the Web3 ecosystem, and these funds allowed for the expansion of DOP as it prepared for its mainnet which went live in May this year.

#4 - InSightec | Healthtech

Haifa, Israel | US $150 Million Private Equity

Founded in 1999 by Kobi Vortman, InSightec is a global healthcare company that pioneers focused ultrasound technology. With a mission to transform lives by delivering therapeutic acoustic energy, InSightec focuses on treating tremors associated with Essential Tremor and Parkinson’s Disease using non-invasive methods.

In June 2024, InSightec secured the only megadeal of the month at US $150 million in a Private Equity round led by Ally Bridge Group, Fidelity, and Nexus NeuroTech, bringing its total funding to US $882.9 million. InSightec has released that the new funds are dedicated to expanding its incisionless neurosurgery offerings while simultaneously pursuing strategic investments in new medical areas.

#5 - Salla | B2B Commerce

Makkah, Saudi Arabia | US $130 Million Venture Series Unknown

Founded in 2016 by Nawaf Hariri and Salman Butt, Salla is an e-commerce platform that has been providing SMEs and aspiring entrepreneurs in the KSA with a proprietary SaaS solution to deliver on their e-commerce ambitions. It supports Arabic, ensuring businesses can operate and customers can shop in their native language, offers payment solutions that cater to regional preferences to support transactions in local currencies, and facilitates integration with local and regional online marketplaces. Since 2020, Salla has enabled US $7 billion in sales and now facilitates access to a US $20 billion e-commerce market to over 80,000 active merchants.

In March 2024, Salla secured a US $130 million pre-IPO investment round led by Investcorp, with contributions from Sanabil Investment and STV. Nawaf Hariri, CEO and co-founder of Salla, expressed gratitude for the trust and investment from Investcorp and Sanabil, highlighting it as a testament to their confidence in Salla's vision and potential as the capital injection is intended to accelerate Salla's growth in preparation for its potential public market debut.

#6 - Hailo | Artificial Intelligence

Tel Aviv, Israel | US $120 Million Series C

Founded in 2017 by Orr Danon and Avi Baum, Hailo designs specialized chips optimized for AI operations on edge devices. These chips are known for their efficiency, using less memory and power than typical processors, making them ideal for use in compact, battery-operated, and offline environments like vehicles, smart cameras, and robotics. Today, Hailo serves over 300 customers across various sectors including automotive, security, retail, industrial automation, medical devices, and defense. The Hailo-8 AI Processor was named the 2021 Edge AI and Vision Product of the Year in its category, and more recently, the Hailo-15 AI Vision Processor won a Picks Award at CES 2024.

In April 2024, Hailo raised US $120 million in a Series C funding round, bringing the company valuation to US $1.2 billion. The funds are being used to accelerate long-term future growth while bringing classic and generative AI to edge devices in ways that significantly expand their reach and impact, as Hailo aims to become a publicly traded company in the near future.

#7 - Silverfort | Cybersecurity

Tel Aviv, Israel | US $116 Million Series D

Founded in 2016 by current CEO Hed Kovetz, Yaron Kassner, and Matan Fattal, Silverfort is a cybersecurity player that has made a name for itself for revolutionizing the field of authentication. Through its network-based approach, Silverfort enables multi-factor authentication (MFA) across entire enterprise environments with a holistic approach which ensures that every access point, from legacy systems to modern cloud applications, is secured under a single, unified platform.

In January 2024, Silverfort raised US $116 million in its Series D mega round led by Brighton Park Capital, bringing its total funds raised to US $222.5 million. Having just experienced 100% revenue increase year to year, Silverfort earmarked the funding for internal growth, market presence expansion, and platform development.

#8 - Property Finder | Proptech

Dubai, UAE | US $90 Million Debt Financing

Founded in 2007 by Michael Lahyani and Renan Bourdeau, the Property Finder Group is a leading tech company that aims to offer the best property experience in the MENAPT region. Property Finder provides a platform for property listings, real estate search, and property management, as their websites, apps, and tools help users find, buy, sell, or rent properties. Property Finder has expanded across the region, including Qatar, Bahrain, and Egypt, with a focus on Saudi Arabia and Turkey, competing with platforms like Dubizzle and Bayut.

In May 2024, Property Finder secured US $90 million in debt financing from Francisco Partners to repurchase shares from its initial investor, BECO Capital, amidst ongoing domestic and international interest in the UAE's thriving real estate market, bringing its total funds raised to US $232 million. Michael Lahyani, CEO and founder of Property Finder, commented, ”Our commitment to the real estate market stands firm, as we aim to continue to drive strong returns for our ecosystem. It is my hope that this event sets the precedent for other founders in the region to take their innovative companies to new heights, attracting global talent and, in turn, creating the returns that fuel the entrepreneurial ecosystem across MENA.”

#9 - Fetcherr | Salestech

Netanya, Israel | US $90 Million Series B

Founded in 2019 by Uri Yerushalmi, Robby Nissan, Roy Cohen, and Shimi Avizmil, Fetcherr is an AI-powered price intelligence engine that has engineered a unique agnostic AI-driven market engine. Fetcherr’s software offers deep price neural network technology that collates and combines data from various industry verticals, including supply pricing and demand curves. Its Large Market Model (LMM) and cloud-based continuous pricing systems understand market dynamics and trends, enhancing performance and enabling real-time business decision-making.

In June 2024, Fetcherr raised US $90 million in Series B funding led by Battery Ventures, bringing its total funding amount raised to US $114.5 million. The new funds go towards developing an AI-powered “offer engine” to bundle and price multiple carrier services together and increased recruitment in 2024.

#10 - Exodigo | Geospatial and subsurface imaging

Tel Aviv, Israel | US $75 Million Series A

Founded in 2021 by Jeremy Suard, Yogev Shifman, and Ido Gonen, Exodigo specializes in geospatial and subsurface imaging tech using AI to interpret signals and provide accurate, non-invasive mapping of underground assets and hazards. This allows safe and efficient planning for construction, mining, and utilities so operations can be executed with minimal risks and reduced costs associated with underground exploration and excavation.

In February 2024, Exodigo raised a US $75 million Series A round led by Greenfield Partners and Zeev Ventures, bringing its total funds raised to US $116 million.Exodigo dedicated the funds to its global workforce, self-service product suite, and global market penetration to increase the depth accuracy and precision of its scans as it readily integrates the latest advances in physics and sensor technology while simultaneously establishing itself in the UK, France, and Italy.