The Top 10 Most Funded Startups in India for H1 2024

30 October 2024•

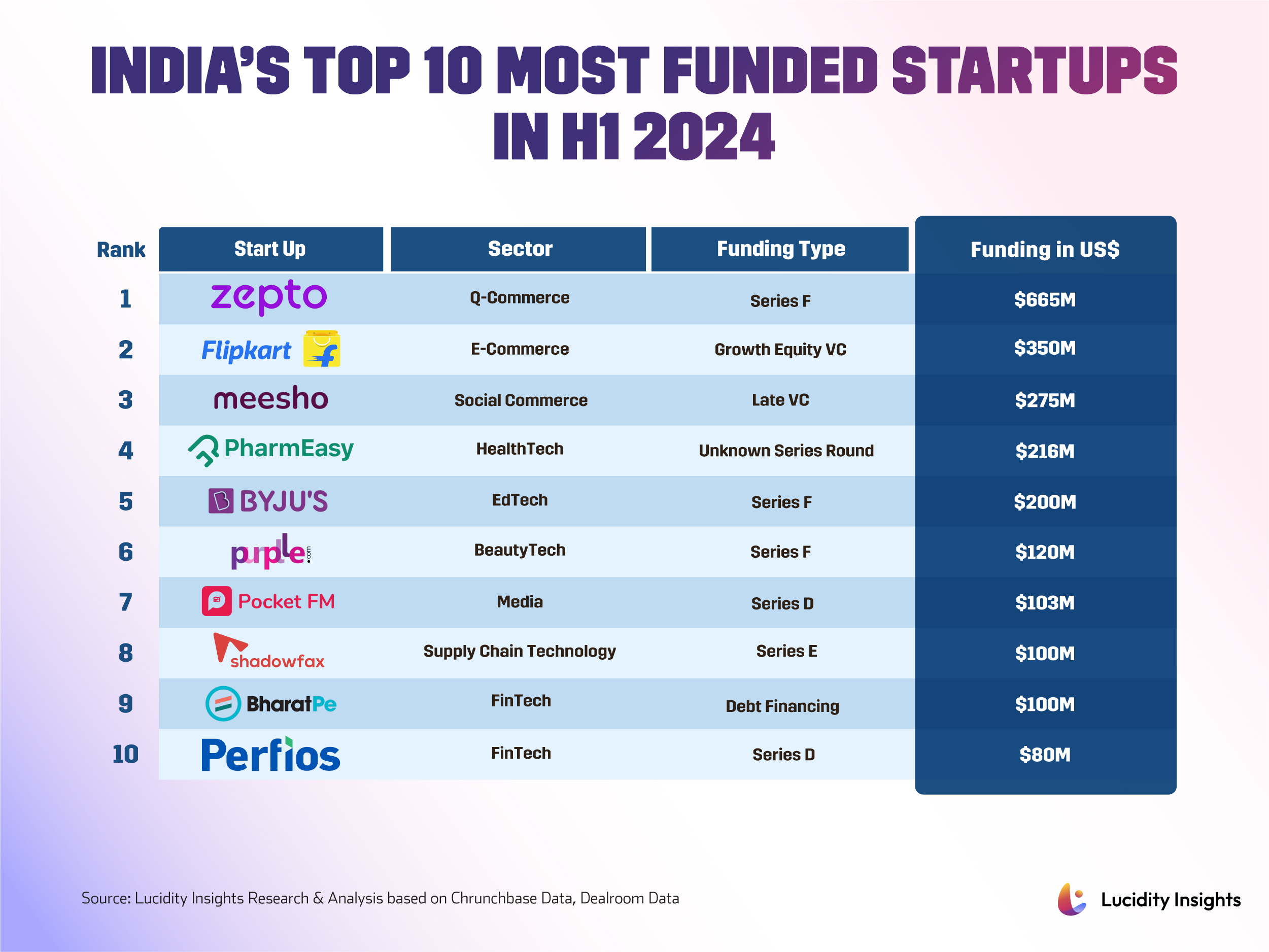

India's startup ecosystem has demonstrated its dynamism in the first half of 2024, attracting US $5.3 billion across 504 funding deals, down only 2% from the previous year. According to Inc42’s Indian Startup Financials Tracker, 110 out of 146 leading new-age tech companies reported losses in FY23. Nonetheless, the Indian entrepreneurial spirit remains undeterred, with the largest funding rounds in H1 2024 demonstrating continued investor confidence and a significant portion of these investments being directed towards startups that have either achieved or previously held unicorn valuations. This list not only reflects the substantial scale of investments but also highlights the sectors driving India's innovation frontier, from Social and Q/E-commerce to EdTech, and beyond.

Let's take a closer look at the top 10 most funded startups in India for H1 2024.

1. Zepto | Q-Commerce | US $665 Million Series F

Founded by Aadit Palicha and Kaivalya Vohra in 2021, Zepto is a quick-commerce company that promises to deliver food and groceries within minutes in major cities across India using its network of dark stores with more than 50,000 delivery partners. Zepto became the first Indian unicorn of 2023 when it recorded a 14x surge in FY23 revenue and raised US $200 million at a US $1.4 billion valuation.

In June 2024, Zepto raised US $665 million in a series F funding round led by Glade Brook Capital Partners, Nexus Venture Partners, StepStone Group. After a series G round of US $340 million, its total funding reached US $1.6 billion. Valued at US $5 billion now, Zepto is using the recent funds to expand its network of dark stores to over 700 by March 2025.

2. Flipkart | E-commerce | US $350 Million Growth Equity VC

Founded by Sachin Bansal and Binny Bansal in 2007, Flipkart is one of India's leading e-commerce companies that offers consumer electronics, fashion, home essentials, groceries, and lifestyle products. Flipkart is known for its pioneering services such as Cash on Delivery, No Cost EMI, and easy returns, which make online shopping more accessible and affordable for millions of Indians. In 2018, Walmart acquired a 77% majority stake in Flipkart for US $16 billion, and in 2023, Flipkart recorded its highest revenue at over 560 billion Indian rupees (approximately US $6.83 billion), marking a 9% increase from the previous year.

In May 2024, Flipkart raised US $350 million in Growth Equity VC from Alphabet’s Google, bringing Flipkart’s valuation to US $37 billion. Under this investment, Flipkart is also furthering its partnership with Google Cloud to bolster its cloud infrastructure, grow its business, and modernize its digital infrastructure.

3. Meesho | Social commerce| US $275 Million Late VC

Founded by Vidit Aatrey and Sanjeev Barnwal in December 2015, Meesho is an Indian social commerce platform that connects small businesses and individuals with customers through social media, where sellers can list their products and reach a wide audience without the need for a physical store. Meesho operates across all major cities in India, including Tier 2 and Tier 3 cities, offering accessories and apparel, home essentials and electronics as well as beauty and personal care products. Meesho was the first horizontal e-commerce company in India to turn profitable, has over 150 million monthly active users, and has raised more than US $1.3 billion to date.

In May 2024, Meesho raised US $275 million in a venture round from SoftBank, Prosus, Elevation Capital, and Peak XV Partners among other existing investors. Meesho is using the capital to handle tax liabilities associated with moving its headquarters back to India from Delaware as well as preparing for an IPO in India.

4. PharmEasy | HealthTech | US $216 Million Venture Series Unknown

Founded by Dharmil Sheth and Dr. Dhaval Shah in 2015, PharmEasy is an Indian e-pharmacy company that sells medicines, diagnostics, and telehealth services online, connecting users to local pharmacies and diagnostic centers offering teleconsultation with doctors. PharmEasy reached a valuation of US $5.6 billion in 2021, which has since plummeted nearly 90% to US $710 million as the company faced a significant debt-repayment burden, with finance costs surging more than 2.5 times and net loss widened by 31% from FY22 to FY23. PharmEasy had reduced its advertising and promotional expenses by more than half and staff costs by 12%, however, these reductions were not enough to offset other rising costs.

In April 2024, PharmEasy raised US $216 million in a funding round led by Ranjan Pai's Manipal Education and Medical Group (MEMG). Since PharmEasy has struggled with net profit performance, it has been taking steps to address these issues, clear pending debt, and continue growing its business. It aims to convert its convertible preference shares into equity to manage its debt obligations. This restructuring is intended to raise sufficient capital to settle outstanding debt with Goldman Sachs, following a default on its loan repayment terms in June 2023.

5. BYJU'S | EdTech | US $200 Million Late VC

Founded by Byju Raveendran and Divya Gokulnath in 2011, BYJU'S is an educational technology company that provides online tutoring and learning programs. The platform services students from kindergarten to 12th grade, and even higher education, available in over 150 countries across the globe with a Parent Connect feature that helps parents track their child's progress. Byju's was valued at US $22 billion in 2022, but has suffered since early 2023 with its auditor resigning and lenders beginning bankruptcy proceedings.

In February 2024, BYJU'S raised US $200 million in late-stage funding led by Prosus Ventures, however the funds were shortly placed in an escrow account, temporarily restricting their use for business operations. Byju's is currently facing insolvency proceedings after initially settling a dispute with the BCCI, which was then challenged by US lenders who have escalated their claims. CEO Byju Raveendran criticized lenders for pursuing profits at the expense of stakeholders and noted the extensive investor influence on the company’s rapid international expansion. Despite ongoing financial challenges, Raveendran remains hopeful for a revival, citing robust user engagement and potential for significant revenue.

6. Purplle | BeautyTech | US $120 Million Series F

Founded by Manish Taneja and Rahul Dash in 2012, Purplle is a multi-brand beauty retailer that sells cosmetic and wellness products through its online store available in over 18,000 delivery zones across India. Its website features over 60,000 beauty and personal care products as well as accessories from more than 1,000 renowned brands, and in FY22 recorded a gross merchandise value of US $200 million.

In June 2024, Purplle raised a US $120 million round led by Abu Dhabi Investment Authority and Premji Invest, closing its Series F funding at US $179 million. This financing supports Purplle's goal of extending its market presence to a wider audience and democratizing beauty access.

7. Pocket FM | Media | US $103 Million Series D

Founded by Rohan Nayak, Nishanth Srinivasagowda, and Prateek Dixit in 2018, Pocket FM is a media platform that offers audio stories, audiobooks, podcasts, and other audio programs to provide listeners long-form audio entertainment and engaging content on the go. Available in over 20 countries globally, Pocket FM has achieved an annual recurring revenue (ARR) of US $150 million with 57% growth on a quarter-on-quarter basis.

In March 2024, Pocket FM raised US $103 million in a Series D round led by Lightspeed Venture Partners and StepStone Group. The funds are being used to fuel growth within the US as well as to expand into European and Latin American markets this year.

8 . Shadowfax | Supply Chain Technology | US $100 Million Series E

Founded by Abhishek Bansal and Vaibhav Khandelwal in 2015, Shadowfax is an on-demand hyperlocal delivery platform that helps businesses outsource their last-mile delivery services with one-stop delivery for e-commerce, restaurants, FMCG, pharmacy companies, and online and offline retailers. Shadowfax operates in over 2,500 cities and towns across India handling 1.5 million orders a day using its eco-friendly electric vehicle fleet.

In February 2024, Shadowfax raised US $100 million in a Series E funding round led by TPG NewQuest, with participation from leading e-commerce company, Flipkart. Shadowfax is using the new investment to expand its middle-mile network and increase last-mile delivery coverage across all 20,000 delivery zones in India over the coming year, while also preparing for IPO.

9 . BharatPe | FinTech | US $100 Million Debt Financing

Founded by Ashneer Grover, Bhavik Koladiya, and Shashvat Nakrani in 2018, BharatPe provides digital payment and financial services to small merchants and grocery stores, aiming to make financial inclusion a reality for Indian merchants. BharatPe One is India’s first all-in-one payment product that integrates POS, QR, and speaker into one device, planned to launch in 450+ cities over the next few months.

In January 2024, BharatPe raised US $100 million in debt financing led by InnoVen Capital. BharatPe opted for debt financing since it is nearing break-even and preferred not to dilute its equity during its strategic growth stages currently.

10 . Perfios | FinTech | US $80 Million Series D

Founded by Velamur Rangachari Govindarajan (Govi) and Debasish Chakraborty in 2008, Perfios is a FinTech software company that specializes in extracting, categorizing, and analyzing thousands of data types in real-time. It provides solutions for financial institutions in 18 countries across the globe, helping them with income analysis, fraud checks, verification, automated customer onboarding, and more.

In March 2024, Perfios raised US $80 million in Series D funding led by Teachers’ Venture Growth. Perfios is using the funds to expand internationally, enhance its presence worldwide, and explore opportunities for inorganic growth.

Takeaway

India remains one of the few resilient funding markets, standing strong amid the global VC winter that began in 2023. These companies keep pushing the envelope, proving that they can thrive under pressure and attract large investments. We can't wait to see which Indian startups will stand out, emerge as unicorns, and draw the most investor interest as the rest of the year unfolds!