Top 5 Funded Startups in MENAPT for March 2024: Insights into VC Funding Trends

16 April 2024•

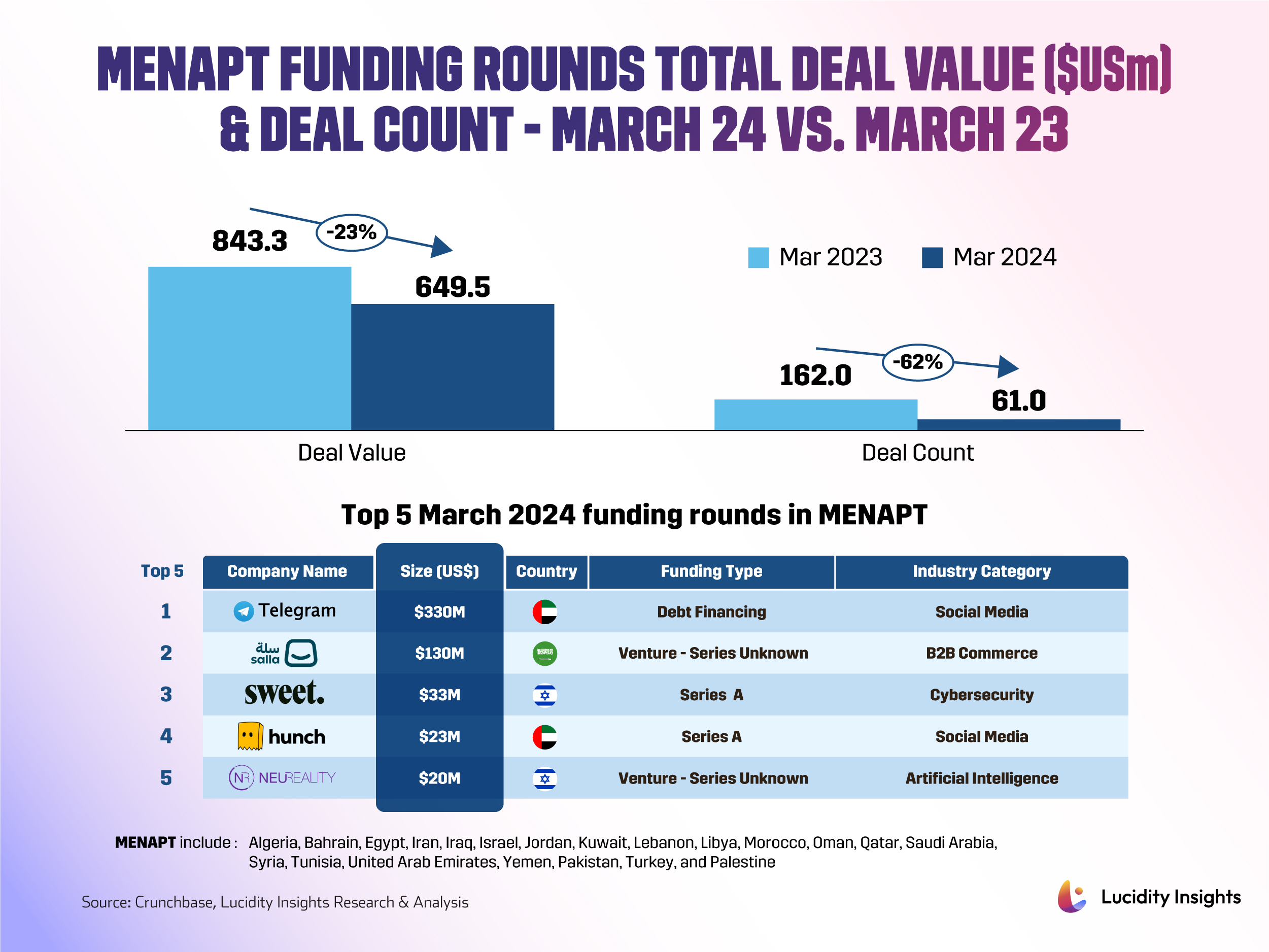

In the first quarter of 2024, the MENAPT region experienced a significant year-on-year decline in VC funding, with totals plummeting nearly 50% to US $1.52 billion compared to Q1 of the previous year. March 2024 alone contributed US $649.5 million to this quarter's funding, marking a 23% decrease from March 2023. Additionally, there were only 61 deals in March 2024, a sharp 62% decline from the same month last year. However, this downturn in deal volume was partially mitigated by two megarounds that occurred in March, which collectively raised more than the entire month of February 2024, amassing US $460 million.

Infobyte: MENAPT Funding Rounds Total Deal Value ($USm) & Deal Count - Mar 24 vs. Mar 23

1. Telegram | Social Media (UAE) | US $330 Million Debt Financing

Telegram is a cloud-based instant messaging, voice over IP, and video calling service founded in 2013 by Pavel and Nikolai Durov. Having surpassed 5 million paying subscribers as of January this year with a user base of 900 million active monthly users, Telegram continues to grow its market presence as a global competitor to Meta Platforms’ owned WhatsApp. Known for its end-to-end encrypted communication, Telegram initiated a revenue-sharing program in March 2024, offering moderators up to 50% of the advertising revenue generated from their channels.

Telegram made headlines by securing US $330 million in debt financing, as the biggest funding round of March 2024 in the MENAPT region. With a bond offering said to be oversubscribed by CEO Pavel Durov, this marks a significant step in Telegram's financial strategy, bringing its total raised through debt financing to US $2.3 billion over the past three years. While the specifics of the bond issuance remain undisclosed, this maneuver demonstrates Telegram’s access to capital markets and its capacity to garner substantial funds, supporting its operational and growth ambitions in the competitive messaging and communication sector as the company plans to use these funds to maintain its accelerated pace of expansion.

2. Salla | B2B Commerce (KSA) | US $130 Million Venture Series Unknown

Salla is an e-commerce platform that has been providing SMEs and aspiring entrepreneurs in the KSA with a proprietary SaaS solution to deliver on their e-commerce ambitions since 2016. It supports Arabic, ensuring businesses can operate and customers can shop in their native language, offers payment solutions that cater to regional preferences, including local payment methods like SADAD in Saudi Arabia, to support transactions in local currencies, and facilitates integration with local and regional online marketplaces, broadening access to customers and sales channels. The platform's strong local customer support and a community of users sharing knowledge and best practices make it a valuable resource for businesses venturing into e-commerce in the region. Since 2020, Salla has enabled US $7 billion in sales and now facilitates access to a US $20 billion e-commerce market to over 80,000 active merchants.

Salla secured a US $130 million pre-IPO investment round in March 2024, led by Investcorp, with contributions from Sanabil Investment and STV. Nawaf Hariri, CEO and co-founder of Salla, expressed gratitude for the trust and investment from Investcorp and Sanabil, highlighting it as a testament to their confidence in Salla's vision and potential. “This investment propels us forward in our ongoing mission to open opportunities and empower individuals, SMEs, and enterprises to start and expand their businesses both within and beyond Saudi Arabia. We are committed to delivering innovative, customer-centric solutions that simplify and enhance the e-commerce experience for our merchants,” said Hariri, as the capital injection is intended to accelerate Salla's growth in preparation for its potential public market debut.

3. Sweet Security | Cybersecurity (Israel) | US $33 Million Series A

Despite launching just last year, Sweet Security came in 3rd with a US $33 million Series A funding round in March 2024. Sweet Security is a cybersecurity company that combines network security monitoring and defensive capabilities with an emphasis on automation and ease of deployment. It's designed to be a comprehensive solution that can be easily set up on small devices like a Raspberry Pi or other low-cost hardware, and aims to make advanced network security accessible to organizations of all sizes, especially those with limited resources.

Led by Evolution Equity Partners, the recent financial investment came just six months after Sweet Security emerged from stealth mode. This influx of capital is set to fuel Sweet Security's expansion in the U.S. market and enhance its platform capabilities, including pioneering features for runtime posture enhancement and non-human identity management. ”At first, our broad vision for cloud runtime security was met with skepticism, but we trusted our experience because we have lived the pain our customers experience every day and we knew we could build something they’d love,” said Dror Kashti, co-founder and CEO of Sweet Security. “This round is an incredible validation of our approach; it will enable us to expand our U.S. presence and make cloud runtime insights actionable across a wider set of practitioners”, Kashti added.

4. Hunch | Social Media (UAE) | US $23 Million Series A

Another newcomer on this list is Hunch, the social media platform founded in 2022 that just secured US $23 million in Series A funding from investors including Alpha Wave and Hashed Emergent. Hunch allows users to start conversations by creating polls which others vote and comment on, and the platform has already recorded over 115,000 polls, garnering more than 10 million opinions through user votes. Currently, nearly 85% of Hunch's user base comes from India, but the company plans on using the new funds to strengthen tech infrastructure, improve feed personalization, and accelerate its expansion into the US and Indian markets, growing its MAUs to the low single-digit millions with an expected 40% to 50% of this growth coming from the US.

5. NeuReality| Artificial Intelligence (Israel) | US $20 Million Venture Series Unknown

NeuReality is a cloud security startup whose next-gen AI-centric architecture combines the NR1 Network Addressable Processing Unit (NAPU) with inference-serving building blocks in software. Established in 2019, their approach optimizes data-path functions from software to hardware through an innovative AI-optimized system designed for ultra-scalability, with benefits including removing bottlenecks, streamlined computational processes, lower energy consumption, and reduced data center footprints.

“Our disruptive AI Inference technology is unbound by conventional CPUs, GPUs, and NICs. We didn’t try to just improve an already flawed system. Instead, we unpacked and redefined the ideal AI Inference system from top to bottom and end to end, to deliver breakthrough performance, cost savings, and energy efficiency,” said NeuReality’s CEO Moshe Tanach, pointing to the paltry 30-40 percent utilization rate of AI accelerators.

Following the successful delivery of its 7nm AI inference server-on-a-chip, the NR1 NAPU (Network Addressable Processing Unit) last year, NeuReality raised US $20 million in March 2024 which will be used to accelerate the deployment of its NR1AI Inference Solution as the company shifts from early deployment phase to growth in other markets, regions, and generative AI.

March Takeaway

Despite a consistent month-on-month decrease in deal count during the first quarter of 2024, March witnessed the highest funding value of the year driven by 2 mega rounds. As the year progresses, it might be interesting to see how many mega rounds the MENAPT region will secure, reinforcing the narrative of its rapidly evolving startup ecosystem. Observers like us and stakeholders alike are watching closely, eager to see future momentum and its potential impact on the regional VC landscape in the months to come.

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)