February 2024 - Top 5 Funded Startups in MENAPT

05 April 2024•

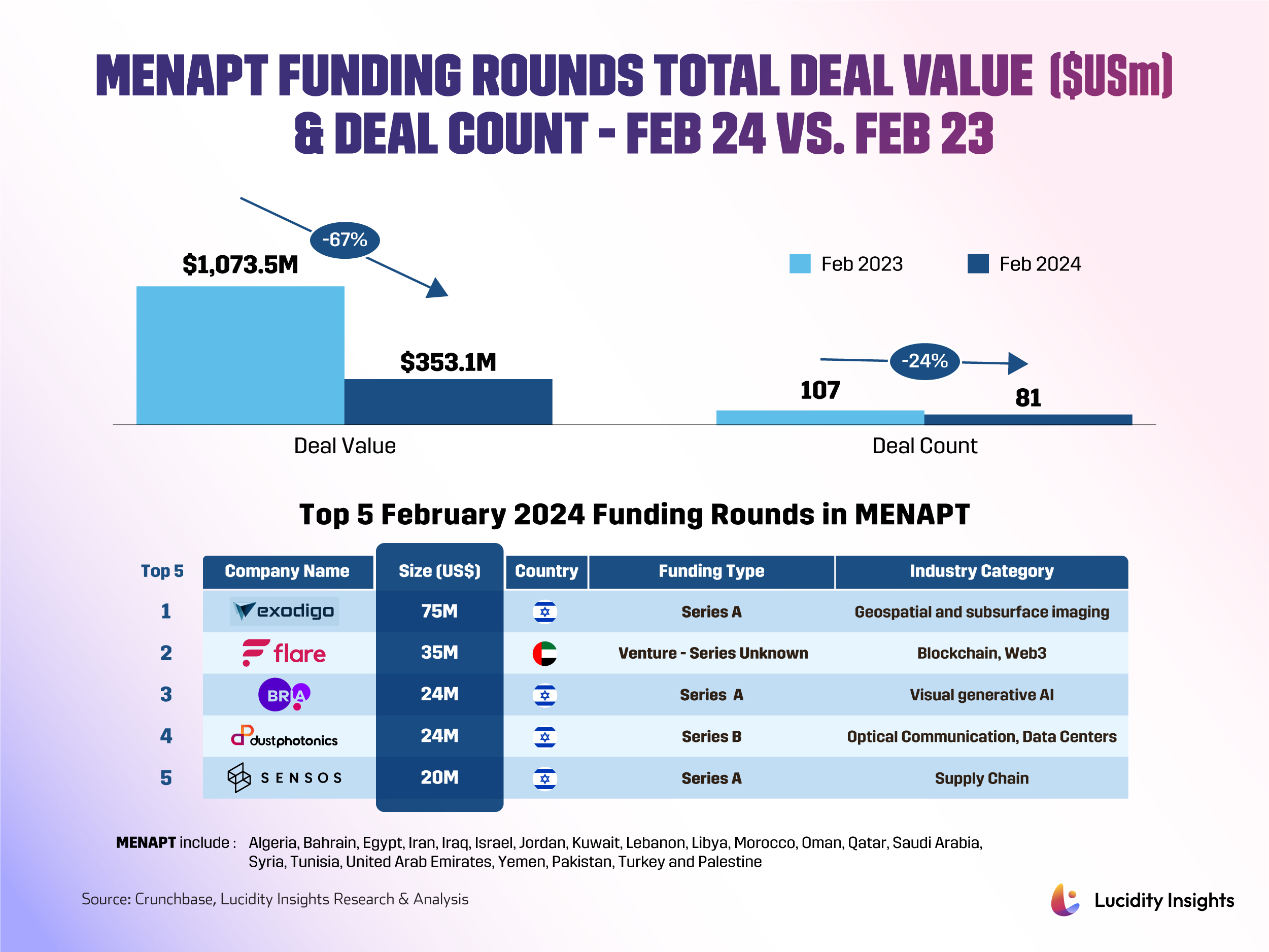

As we move into the second month of the year, we see even steeper declines in MENAPT funding when compared to January YOY comparisons. Deal value dropped from US$1,073.5 million in February 2023 to US$353.1 million in February 2024, marking a YOY decrease of 67%. Deal counts also declined from 107 deals in February 2023 to 81 in February 2024 for a 24% YOY decrease. This trend is a clear indication of the ever-persistent VC winter that the region is struggling to recover from.

Infobyte: MENAPT Funding Rounds Total Deal Value ($USm) & Deal Count - Feb 24 vs. Feb 23

Infobyte: MENAPT Funding Rounds Total Deal Value ($USm) & Deal Count - Feb 24 vs. Feb 23

Despite this continued downturn, however, the major funding rounds seen in February 2024 highlight continued investor interest in diverse sectors across MENAPT.

#1 - Exodigo | Geospatial and Subsurface Imaging

Tel Aviv, Israel | US $75 Million Series A

Exodigo led the way by far with a US $75 million Series A round, bolstered by the conversion of US $30 million secured in SAFEs from its previous Seed round. Founded in 2021, what sets Exodigo apart from other startups specialized in geospatial and subsurface imaging tech is its use of AI to interpret signals and provide accurate, non-invasive mapping of underground assets and hazards. This allows safe and efficient planning for construction, mining, and utilities so operations can be executed with minimal risks and reduced costs associated with underground exploration and excavation.

"We want to transform the entire built world and are committed to making underground exploration safer, faster, and more sustainable so our customers can design, dig, and build safely with confidence. As the only subsurface imaging company to put AI-interpreted signal processing into practice, Exodigo solves a massive, longstanding problem for industries where what lies underground matters," says Co-Founder and CEO, Jeremy Suard. "Thanks to the support of such dedicated investors and advisors, our team will be able to keep meeting increasingly complex customer needs as we dive deeper into the unknowns of the underground."

Backed by SquarePeg, 10D VC, JIBE, and National Grid Partners, Exodigo has dedicated the fresh funds to its global workforce, self-service product suite, and global market penetration. Accumulating over 500 GB of data per scanned acre, these funds will go to increasing the depth accuracy and precision of its scans as it readily integrates the latest advances in physics and sensor technology while simultaneously establishing itself in the UK, France, and Italy.

#2 - Flare Network | Blockchain, Web3

Dubai, UAE | US $35 Venture — Series unknown

Founded in Dubai in 2019, Flare Network stands out from the rest of the pack as the only startup featured in this month’s top 5 hailing from the UAE with a US $35 million investment. Flare focuses on enabling the secure and scalable execution of smart contracts on its network, facilitating interoperability between different blockchain systems. It has integrated the Ethereum Virtual Machine (EVM) with its protocol, which allows for the use of smart contracts on non-Ethereum blockchains, significantly expanding the functionality and reach of decentralized applications (dApps) across various blockchain ecosystems. This approach enhances the utility of blockchain technology by creating a more interconnected and efficient decentralized network.

After Google Cloud announced that it was joining Flare Network as a validator earlier this year, sparking a 5% increase in its token value, early investors doubled down, extending FLR token distribution into the first quarter of 2026. Flare's recently acquired funds will also be used to foster ecosystem growth with selling limits to reduce market pressure and token burning to ensure stability.

“Agreements over liquidity are excellent for a growing ecosystem," said Flare co-founder Hugo Philion. "At this final anticipated liquidity event, I am very grateful to our early backers for continuing to be Flare’s biggest proponents and codifying a supportive, objective relationship aligned and beneficial to Flare’s growth.”

#3 - Bria | Visual generative AI

Tel Aviv, Israel | US $24 Million Series A

BRIA has announced a successful US $24 million Series A funding round led by GFT Ventures, Intel Capital, and Entrée Capital. A front-runner to the relatively nascent field of visual generative AI founded in 2020, BRIA practices the use of licensed images only to promote ethical AI and ensure compliance with copyright regulations. The new funding will enhance BRIA's developer-centric open platform and expand its text-to-video technologies, contributing to the company's global operations.

“This strategic move not only ensures a secure path through potential legal pitfalls but also empowers companies to sculpt their own competitive advantage. Bria’s transformative influence is set to reshape the retail landscape, allowing companies to not just keep pace but surge ahead in the race for innovation and visual excellence,” says BRIA CEO and Founder, Dr. Yair Adato, emphasizing the value of ethical and unbiased generative AI in today's growing tech ecosystem and expressing gratitude for investors’ faith in the company’s capacity for sustained growth despite challenges of the present and the future.

#4 - DustPhotonics | Optical Communication, Data Centers

HaMerkaz, Israel | US $24 Million Series B

DustPhotonics also raised US $24 million in a Series B follow-on funding round from a mix of new and returning investors including Sienna Venture Capital, Greenfield Partners, Atreides Management, and Exor Ventures. DustPhotonics has specialized in silicon photonics solutions since 2017, primarily for data center and high-performance computing applications, using silicon-based materials to produce optical components that enable rapid data transfer over optical fibers. This technology is crucial for improving the speed and efficiency of data centers, telecommunications, and cloud computing services, as it allows for higher bandwidth and lower power consumption compared to traditional electronic data transmission methods.

DustPhotonics' new capital is being directed towards R&D of the company's next-gen products designed for 1.6Tbps applications, as well as scaling up production of its Carmel-4 and Carmel-8 lines, integral to 400Gbps and 800Gbps applications.

"We are seeing a lot of design-win momentum with our products and are excited by the new opportunities ahead in both AI and cloud service data centers. We are grateful to have a strong group of investors who have been supporting us from the early days, and are delighted to have new partners join our journey ahead," said CEO Ronnen Lovinger, commenting on investor confidence in the company's trajectory and their role in advancing high-speed data transmission technologies.

#5 - Sensos | Supply Chain

Tel Aviv, Israel | US $20 Million Series A

Supply-chain player Sensos just secured a US $20 million Series A funding after less than 2 years in business. Established as an independent spin-off of Sony Semiconductor Israel in 2022, Sensos has revolutionized supply chain management by facilitating faster shipments, reduced inventory requirements, and enhanced production planning for a multitude of shipping clients. With this latest round of funding, Sensos aims to address gaps in the smart logistics sector by offering comprehensive solutions for remote tracking and inventory management while actively contributing to sustainability practices within the industry. The financial backing underscores market and investor confidence in Sensos as a pioneer in streamlining and greening supply chain processes.

February 2024: The Take-Aways

The February 2024 investment landscape in the MENAPT region illustrates an obvious contraction of YOY funding and deal counts. Despite the sharp and persistent declines, however, venture capitalists remain committed to innovative startups within the region, exercising selectivity and caution amidst the VC winter.

Nonetheless, we can see the tactical approach centered on technological innovation, market expansion, and ethical practices taken with these investments, indicating a clear focus on startups with scalable solutions and the potential for a significant return on investment in a more stabilized future market.

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)