October 2024 - Top 5 Most Funded Startups in MENAPT

21 November 2024•

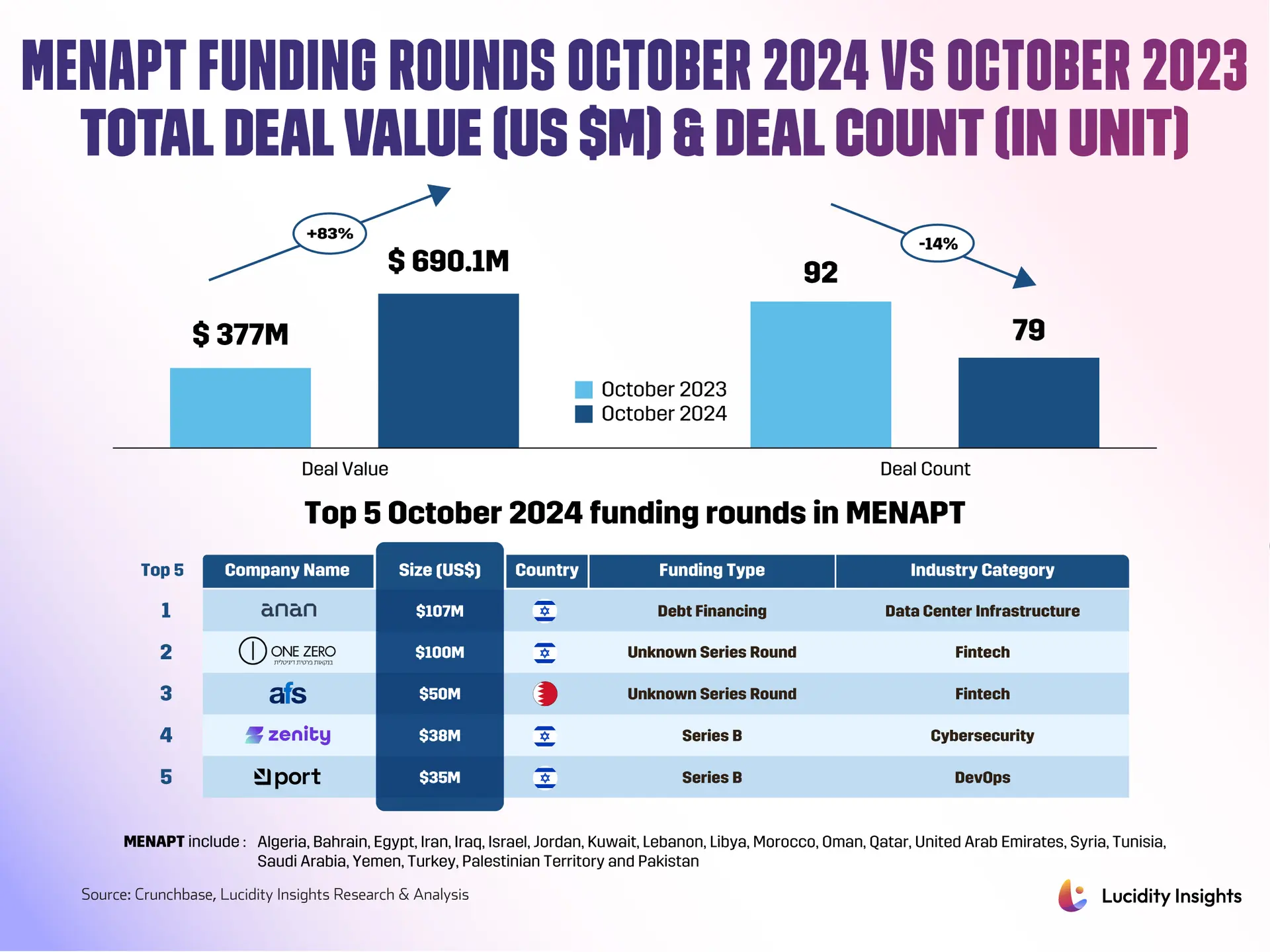

The MENAPT region saw the total value of VC funding reach US $690.1 million in October 2024, marking an impressive 83% year-on-year increase from October 2023's total of US $377 million. On the other hand, the number of deals fell to 79, a 14% decrease from the 92 deals recorded in the same month last year. This indicates a shift towards larger, more impactful investments highlighted by the two megarounds raising US $100 million or more seen in October 2024. Four out of the five largest funding rounds this month were in Israeli startups, pointing to a robust interest in high-growth opportunities within the region, despite Israel's current wars on several fronts and broader economic uncertainties.

Let’s take a look at the top funding rounds of October 2024.

#1 - Anan | Data Centre Infrastructure (Israel)

US $107 Million (Debt Financing)

Founded through a partnership between the Israeli PAI investment group and the Geneva-based LIAN Group in 2022, Anan operates secure, high-performance data centers designed to meet the needs of top-tier cloud companies, enterprises, IT services businesses, and the public sector. Anan offers advanced security measures, efficient cooling technologies, and high reliability with contracts ensuring maximum power availability for their sites as well as high levels of both physical and cyber-security.

In October 2024, Anan raised US $107 million in Debt Financing from Mizrahi Tefahot Bank. The funds will be used to finance the construction of a new server farm beside Kibbutz Tsor’a, which will have an eventual output of 32 megawatts and will be built to support high-performance computing and AI processing tasks

#2 - ONE ZERO | FinTech (Israel)

US $100 Million (Funding Round)

Founded by Amnon Shashua and Gil Rashman in 2019 and formerly known as the First Digital Bank, ONE ZERO was the first independent bank to receive a banking license in Israel in over 43 years. ONE ZERO is Israel’s first fully digital bank that uses artificial intelligence to offer personalized financial management and advisory services including checking accounts, credit cards, savings, loans, bank guarantees, and securities management.

In October 2024, ONE ZERO raised US $100 million in a funding round led by current shareholders alongside Sahshua, bringing its total fundraising to US $282 million. The capital will be allocated for AI-driven banking growth with the goal of achieving initial annual profitability by 2025.

#3 - AFS | FinTech (Bahrain)

US $50 Million (Funding Round)

Founded in 1984, Arab Financial Services (AFS) is a leading digital payment solutions provider and fintech enabler owned by 37 banks and financial institutions in the Middle East and Africa and regulated by the Central Banks of Bahrain and Egypt. AFS provides a wide range of digital payment services, including debit, credit, and Islamic card processing as well as digital mobile wallets, digital payroll solutions, and more. AFS's longstanding commitment to innovation is evident in AFS Pay and AFS One, which cater to a diverse range of merchant segments, as well as its newly launched AFS Open Banking hub driving financial inclusion and innovation in the region.

In October 2024, AFS raised US $50 million in capital, bringing its total funds raised to US $148 million. The investment comes as AFS plans to expand into new markets, scale up its operations in existing ones, and leverage its Payment Services Provider license in Egypt to broaden its scope of activities in the acquiring market. Approved by AFS shareholders at an Extraordinary General Meeting earlier in the year, the funds will fuel growth significantly and enhance AFS's financial position.

#4 - Zenity | Cybersecurity (Israel)

US $38 Million (Series B)

Founded by Ben Kliger and Michael Bargury in 2021, Zenity is a cybersecurity company that empowers Fortune 500 finance, tech, manufacturing, energy, and pharmaceuticals enterprises to securely deploy AI-driven solutions. Its security governance platform designed to protect low-code/no-code, AI, and copilots applications, helping organizations secure business-led development by offering visibility, risk assessment, and governance tools.

In October 2024, Zenity closed a Series B funding round of US $38 million led by DTCP and Third Point Ventures, bringing its total funds US $59.5 million. The investments are dedicated to growing the team across product, engineering, sales, and marketing, as well as launching a partner program to expand the ecosystem of supporting enterprises globally as Zenity adopts agentic workflows.

#5 - Port | DevOps (Israel)

US $35 Million (Series B)

Founded by Zohar Einy and Yonatan Boguslavski in 2022, Port provides an internal developer portal designed to streamline and unify software development tools and workflows. The Port platform acts as a central hub for developers, integrating various tools and workflows needed to manage the entire software development lifecycle with features for managing cloud resources, handling incidents, and ensuring compliance with organizational standards.

In October 2024, Port raised US $35 million in its Series B round led by Accel and Bessemer Venture Partners, bringing its total fundraising to US $60 million. This funding will be used to further their internal developer portal and integrate more AI capabilities continue to stay agile and productive.

%2Fuploads%2Fdubai-digitized-economy-2%2Fcover.jpg&w=3840&q=75)