Foodtech Startups in the Middle East Raise over US $2.6 Billion in the past Two Years

21 August 2023•

Lucidity Insights in partnership with Entrepreneur Middle East and Foodics recently published a Special Report titled “The Growing Business of Foodtech,” which sheds light on the global foodtech industry and its unicorns, and details the hot up-and-coming trends in the sector according to the latest funding data.

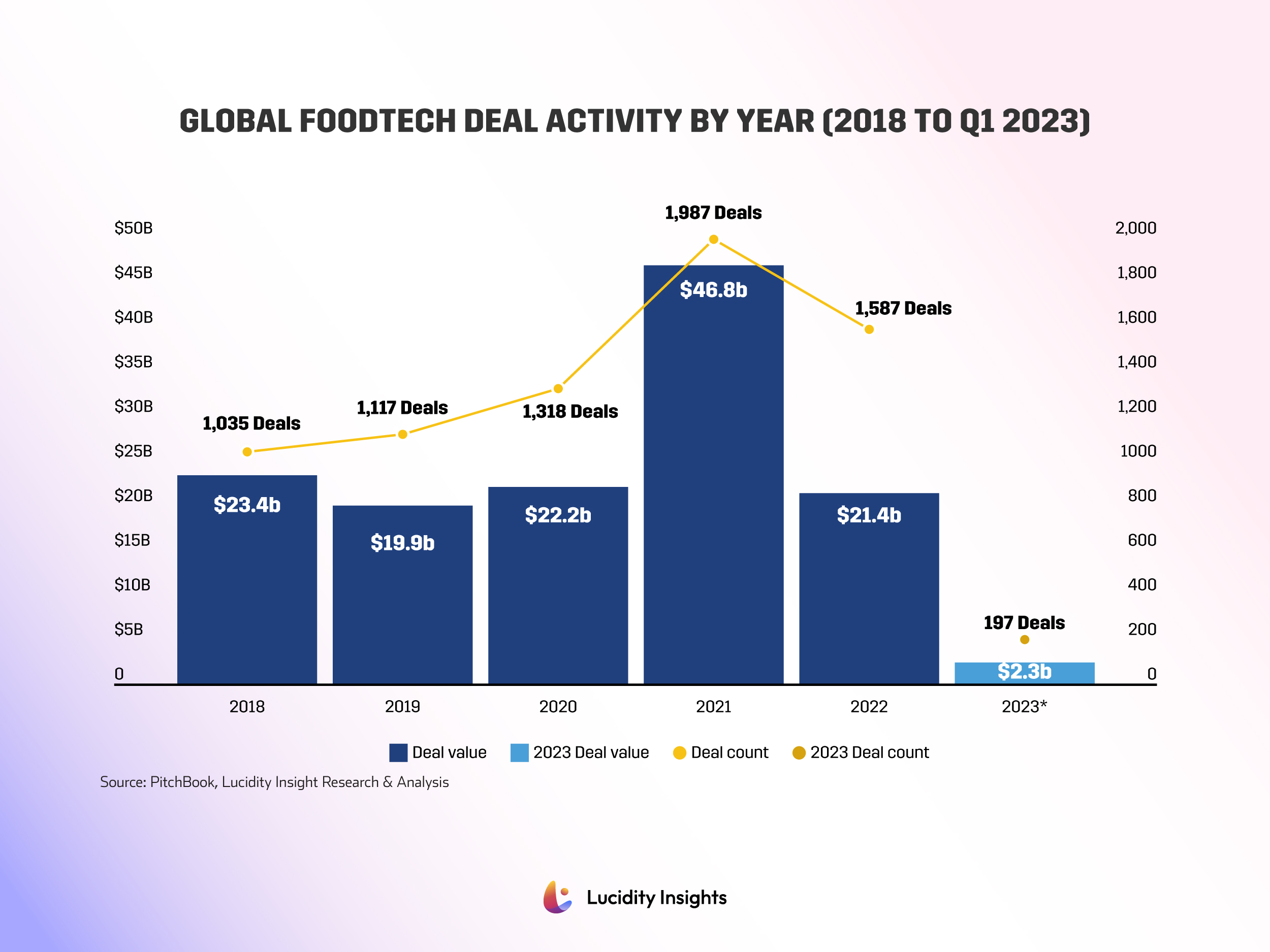

Globally, foodtech hit an all-time-high in 2021, when the sector raised a landmark US $46.8 billion across 1,987 deals. 2022 saw a market stabilization back to the US $21.4 billion invested, which was typical of years before. Time will tell if the VC winter has taken hold of the sector in 2023, but preliminary data for the year show a slowdown in foodtech exits. By the end of Q1 2023, there were only 15 exits for VC-backed foodtech startups worth a combined US $1 billion. There were no IPOs and only one buyout, leaving M&A deals to make up the majority of exits during the quarter, indicating a period of consolidation has begun.

Due to the popularity of food delivery marketplaces, aggregators and q-commerce players feeding consumers’ appetites for quickly delivered groceries and ready-to-eat meals, e-Commerce still dominates Foodtech’s deal activity around the world; but it is alternative protein or Alt-Protein players that have been steadily growing their share of investor funding in the past 18 months. If it’s lab-grown meat via cell cultivation, or plant-based or insect-based meat, it seems investors are hoping the reduced ecological footprint and lower time and resource cost will mean efficiencies to meet the world’s ever-growing demand for protein. As the global human population grows from 8 billion to 10 billion by 2050, there will be much work to be done to ensure all mouths are fed, and little food produced is wasted.

Due to the popularity of food delivery marketplaces, aggregators and q-commerce players feeding consumers’ appetites for quickly delivered groceries and ready-to-eat meals, e-Commerce still dominates Foodtech’s deal activity around the world; but it is alternative protein or Alt-Protein players that have been steadily growing their share of investor funding in the past 18 months. If it’s lab-grown meat via cell cultivation, or plant-based or insect-based meat, it seems investors are hoping the reduced ecological footprint and lower time and resource cost will mean efficiencies to meet the world’s ever-growing demand for protein. As the global human population grows from 8 billion to 10 billion by 2050, there will be much work to be done to ensure all mouths are fed, and little food produced is wasted.

Other hot trends discussed in the Special Report include predictive analytics used in Agtech, 3D printing food, personalized nutrition, restaurant SaaS, artificial intelligence minimizing food wastage, creating efficiencies in the supply chain, and new fintechs delivering quick financial aid to f&b establishments, based on algorithm’s which determine ability to pay, based on daily customer orders and POS data.

Beyond the global data, the report highlights the regional heavy-weights in the Foodtech scene, from unicorn Kitopi to expected soonicorns, Foodics and Pure Harvest; each of which have made the region’s most funded foodtech startups list. Others like KLC Virtual Restaurants, Yango Tech, KASO, and Yango Delivery are carving out market leading roles for themselves, and expanding methodically across the region. These are just some of the 356 foodtech startups from across the MENA region that have raised some kind of capital since January 2010.

Beyond the global data, the report highlights the regional heavy-weights in the Foodtech scene, from unicorn Kitopi to expected soonicorns, Foodics and Pure Harvest; each of which have made the region’s most funded foodtech startups list. Others like KLC Virtual Restaurants, Yango Tech, KASO, and Yango Delivery are carving out market leading roles for themselves, and expanding methodically across the region. These are just some of the 356 foodtech startups from across the MENA region that have raised some kind of capital since January 2010.

%2Fuploads%2Ffoodtech-2%2Fcover15.jpg&w=3840&q=75)