Meet Some of Egypt's Most Active Venture Capitalists

17 April 2024•

Egypt boasts over 160 venture capital firms and investors supporting its startup ecosystem.

These include both local and international investors, which have collectively participated in over 800 deals in the five years between 2019 to 2023. The local investors have been a lot more active, however the investor landscape is dominated by the presence of more international investors.

Infobyte: Number of Investors in Egypt

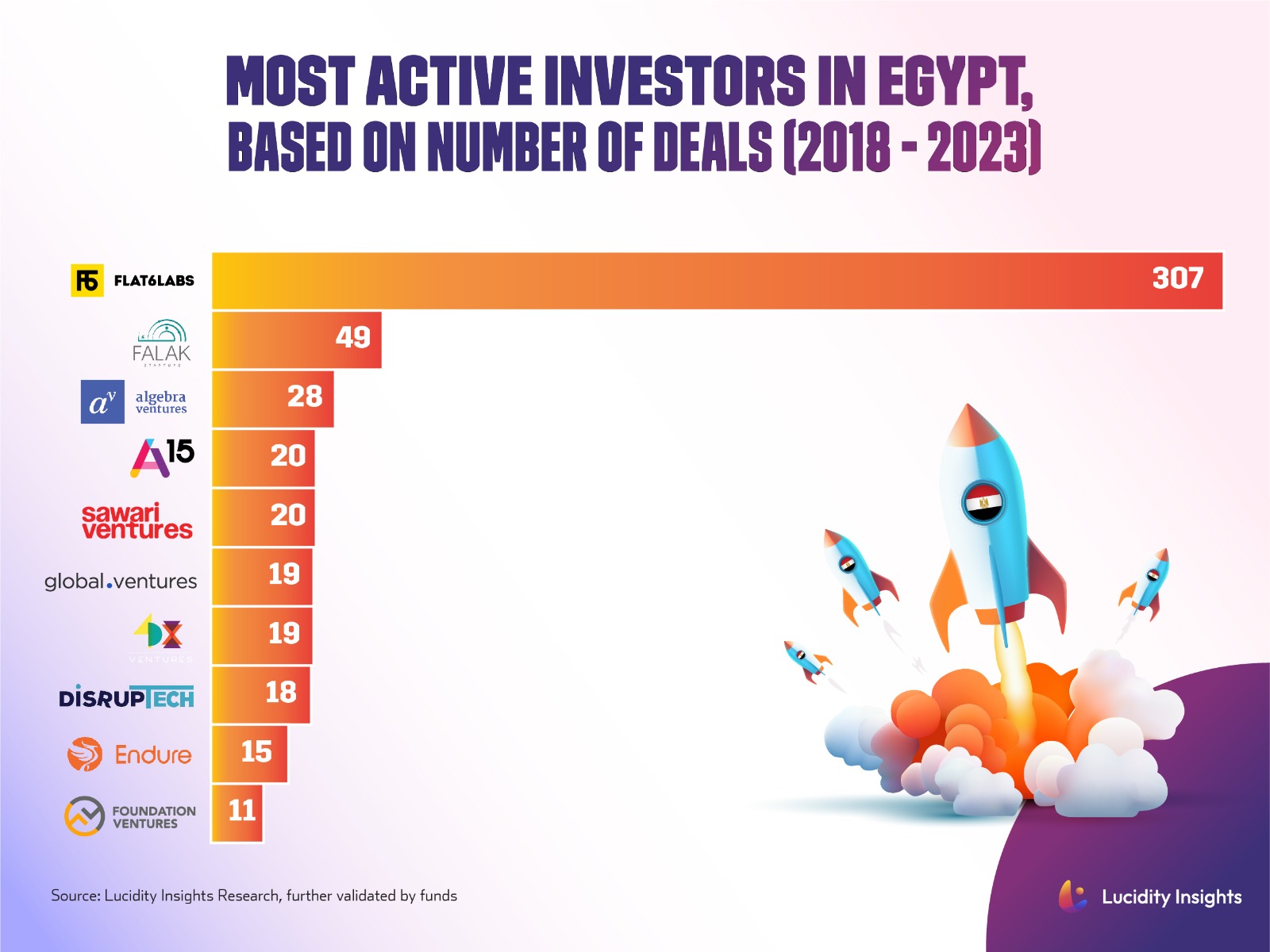

Most active investors in Egypt, purely based on the number of deals, are primarily local, with the top 2 being accelerators, Flat6Labs and Falak Startups. Out of the top 10, 8 are local while two are international with a regional focus. Global Ventures, a UAE-based VC firm focuses on the region, while 4DX Ventures is a Pan-Africa focused VC fund, based in New York.

1. Flat6Labs

Flat6Labs is a leading seed and early-stage venture capital firm with presence in Cairo, Jeddah, Abu Dhabi, Beirut, Tunis, Manama and Amman and runs multiple theme focused programs.

2. Falak Startups

Falak Startups is a leading early stage investment firm, Falak Startups is the VC arm of Egypt Ventures. The firm has already supported over 60 startups, through both the General Track and specialized Fintech Track, in partnership with EFG Hermes.

3. Algebra Ventures

Algebra Ventures is a leading tech VC firm, which provides multi-stage capital. The firm has been able to successfully raised two funds totaling over US$ 150 million, since its founding in 2016.

4. A15

A15 is an early stage venture capital firm focused on the MENA tech landscape, investing in pre-seed and seed stages in companies. The firm already has an impressive portfolio of 39 companies, of which it has successfully exited 6 companies.

5. Sawari Ventures

Sawari Ventures was one of the first to start VC investments in Egypt, Sawari Ventures is a growth stage investment firm. The company has invested in over 20 companies and 2 seed-stage vehicles, including Flat6Labs.

6. Global Ventures

Global Ventures is a growth-stage venture capital firm based in Dubai, the firm has invested in 60 companies since establishing in 2019, across at least 12 different sectors, including healthtech, fintech, e-commerce, logistics and supply chain.

7. 4DX Ventures

4DX Ventures is a Pan-Africa focused VC firm, established in 2017 with a focus across a range of industries including fintech, B2B e-commerce, healthcare and logistics, and focused on the Big 4 African markets of Egypt, Kenya, Nigeria, and South Africa.

8. Disruptech Ventures

Disruptech is a VC firm focused on early-stage fintech and fintech-enabled digital services, investing across 18 portfolio companies, all in Egypt.

9. Endure Capital

Endure Capital is an early-stage investment fund, which has invested US$ 27 million across 52 startups (to date). It has a sector-agnostic approach and has recently announced the US$ 200 million Arak Fund.

10. Foundation Ventures

Foundation Ventures is an early growth stage venture capital fund focused on investments in Egypt, in partnership with US-based VC, HOF Capital and Egyptian PE company, BPE Partners. Since its establishment in 2019, Foundation has invested in 12 portfolio companies.

For more information you can read the Special Report on Investing in Egypt’s Startup Ecosystem, and access investor profiles through the All-Access Pass.

Next Read: Egypt’s Most Active Investors: The Global, Regional & Local Investors Fueling the Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)