Moove.io: Financial Inclusion for Mobility Entrepreneurs

29 May 2023•

The world has come a long way in the last decade. It’s hard to imagine for many of us, a world where mobility platforms such as Uber, Lyft, Grab, Didi Chuxing and Careem did not exist. There are over 1.1 billion gig workers globally and half are denied access to financial services1 and are invisible to credit.

Ride-hailing apps have been expanding rapidly across Africa, including Nigeria, Egypt, Ghana, Tanzania, Uganda, Côte d’Ivoire and Kenya. In many of these countries, the arrival of ride-hailing apps is transforming urban transportation systems and providing new employment opportunities as well as providing increased access to transportation for underserved and remote communities. According to the ILO, transportation accounts for roughly 8% of total employment in Africa. That means that nearly 1 in 10 jobs involve driving a taxi, a shuttle bus, a lorry or a vehicle of some kind.

In May 2022, Uber announced that it achieved a significant milestone by completing 1 billion rides across all of its African markets since entering 2013. The mobility start-up also said it had created over 6 million economic opportunities in over 50 cities across sub-Saharan Africa. And that doesn’t include over 80,000 uber drivers in Cairo (Egypt), let alone the thousands of drivers spread out across North Africa. It’s an impressive milestone, to be sure, but it leads to another question, which is, “How much of a socio-economic impact are these ride-hailing apps having on the African mobility entrepreneur?” The answer is quite complex.

Car Ownership

Car ownership is important for several reasons, as it can influence various aspects of society, the economy and individuals’ lives. Owning a car can greatly enhance personal mobility and provide better access to essential services, such as healthcare, education and employment opportunities. In many areas with limited or unreliable public transportation, having a car can be crucial for maintaining a higher quality of life. Car ownership can also be an indicator of a country’s economic development and purchasing power of its citizens. Higher car ownership rates correspond to higher levels of income, as many people can afford to purchase and maintain a vehicle. Car ownership also happens to be a requirement to work for ride-hailing apps, meaning that many people around the world do not have access to mobility entrepreneurship.

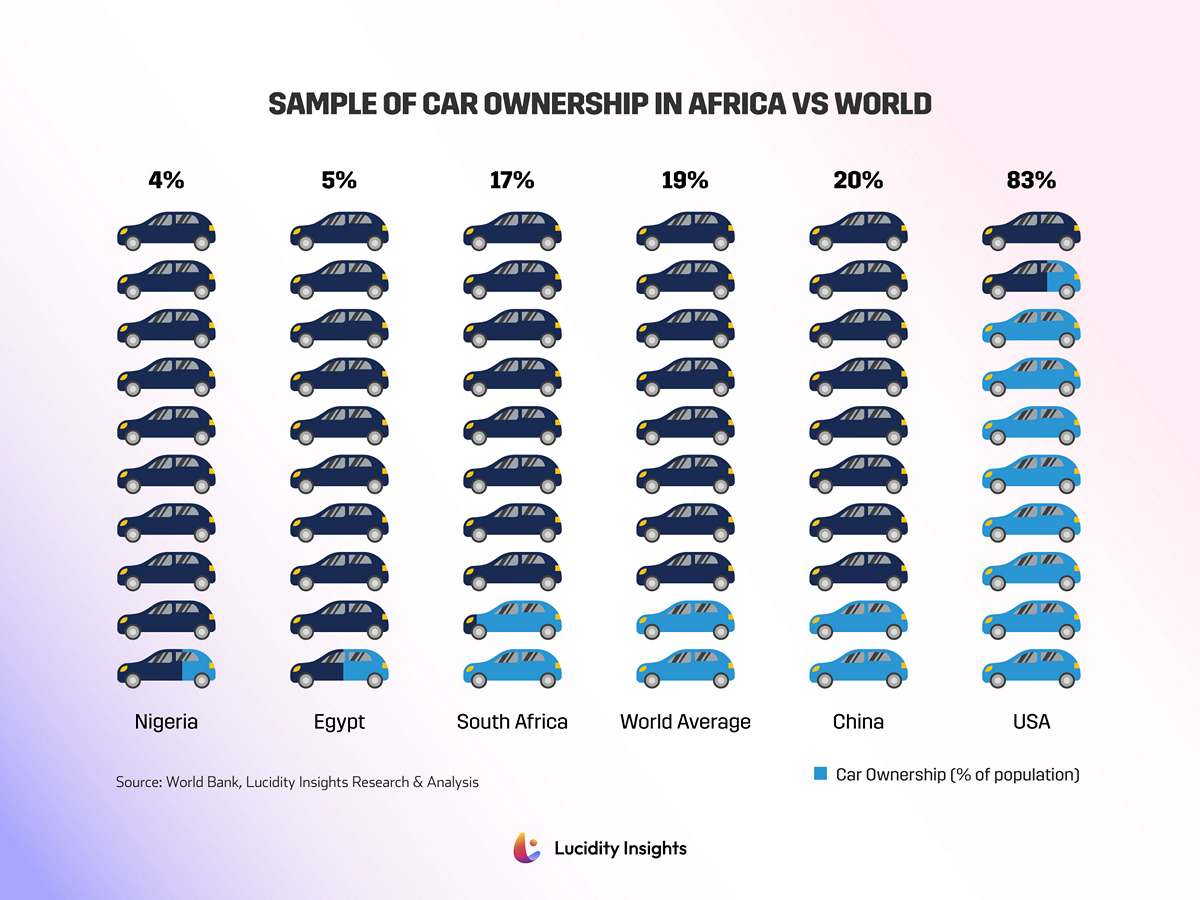

Car ownership is markedly lowest in Africa, compared to the rest of the world. According to the World Bank, the global average car ownership rate is estimated to be 190 passenger cars per 1,000 people. South Africa has the highest car ownership rates in Africa with ±170 passenger cars per 1,000 people in 2020 but is still lower than the global average. Egypt’s rate is ±50 passenger cars per 1,000 people, while Nigeria only has roughly ±35 passenger cars per 1,000 people as of 2020. In comparison, the United States has ±838 passenger cars per 1,000 people, and China has approximately ±200 passenger cars per 1,000 people.

Infographic: Sample of Car Ownership in Africa vs World

Fintech Solutions for Mobility Entrepreneurs

Poverty and low incomes in Africa make car ownership unattainable for large segments of the population. Access to financing options like loans or leasing is limited in Africa, making it difficult for people to afford a car, even if they have the means to pay for it over time. Two British-born Nigerian entrepreneurs, Ladi Delano and Jide Odunsi hope to solve this problem with Moove, a startup they co-founded together.

Moove offers a digital platform where users and entrepreneurs in the transport sector have access to loan options for the purchase of vehicles. Ladi Delano and Jide Odunsi are serial entrepreneurs, having first launched Grace Lake Partners together, a Venture Studio in Nigeria employing over 200 staff across its portfolio companies, prior to launching Moove. Ladi completed his Master’s degrees at both the University of Oxford and the London School of Economics and Political Science. Jide, a former investment banker at Goldman Sachs, also brings academic pedigree with an MBA from MIT and a Masters at the University of Oxford. According to Ladi, he and Jide have been friends for over 20 years. We sit down with the two co-founders and co-CEOs to discuss their latest venture established in 2020.

Ladi speaks to the challenge Moove is attempting to solve. “Moove was born out of the urgent need to solve the problem of mobility entrepreneurs in Lagos who, despite working for years, still didn’t own their cars due to a lack of access to credit. We subsequently discovered that this problem was faced by millions of other mobility entrepreneurs around the world, preventing them from moving up the socioeconomic pyramid.” Moove’s mission is to financially empower every mobility entrepreneur in the world by welcoming them into the global financial system using Moove’s proprietary credit scoring products and fintech platform.

Jide further explains that the company provides financial services and sustainable employment opportunities to mobility entrepreneurs who are often underserved by traditional financial institutions due to the absence of historical data. “Moove’s alternative credit-scoring technology and revenuebased financing model leverage the future productivity of mobility entrepreneurs to provide them with access to credit and other financial services.” Moove’s expansion beyond Africa shows the power of creating sustainable employment opportunities through democratising access to financial services for mobility workers globally. By leveraging the future productivity of mobility entrepreneurs, Moove is able to provide financing to those who would otherwise be unable to access it.”

The Moove technology is embedded in ride-hailing and other mobility marketplaces, allowing Moove to access and use mobility entrepreneurs’ proprietary performance and revenue analytics to underwrite loans. Moove leverages its unique access to customer productivity, earnings and spending data to build credit models that allow them to assess the risk profiles of these loan customers, who would otherwise be ineligible for traditional financial services. The fintech platform product, including the Moove App and Wallet, allows customers to check their plan and vehicle details, send and receive payments, and keep track of their performance KPIs.

Moove’s customers have the opportunity to choose between two product options when they join Moove. The first is Drive to Own (DTO), which allows customers to own a new vehicle in 30, 36 or 48 months, using a percentage of their weekly revenues to make payment instalments. Alternatively, the Flexi Rental scheme allows customers to pay a weekly fee to have short-term access to a new car to drive on one of our partner mobility marketplaces. Customers are set KPIs with weekly remittances and the vehicle remains in their possession for the full duration of the product agreement.

With a global vision in mind, Moove now has operations across 3 continents: Africa, Asia and Europe. They have operations in Nigeria, Ghana, South Africa, Kenya, Uganda, Egypt, India, United Arab Emirates and the United Kingdom. The Co-founders explain that the company considers a number of strategic decision-making factors when expanding its geographic reach. A major factor is the regulatory environment of each potential market. Jide explains, “Moove works closely with local regulators to ensure that it is operating within the legal frameworks of each market, and can provide its services to customers without any issues.” They also explain that another important factor is market demand for Moove’s services, while also considering the availability of partnerships and resources in each market, as well as any potential logistical challenges that may arise during expansion factors.

Raising capital has been integral to their expansion ambitions. Commenting on this, Ladi says that raising capital for a venture in Africa is no small feat. “Despite the continent’s immense potential, it remains largely underfunded and underrepresented in the world of venture capital. At Moove, we were able to secure our Series A funding from a mix of local and international investors who saw the potential of our innovative mobility fintech solution. Moove has also raised additional debt financing from banks and other financial institutions, allowing the company to continue to expand its operations and serve more customers.”

Jide adds, “We think Moove’s success demonstrates that there is still tremendous potential for growth and investment on the continent.”

Ladi adds, “International investors should certainly be looking beyond traditional startup hotspots like Silicon Valley and exploring the diverse and rapidly-evolving startup ecosystems in Africa and other emerging markets. Not only can they find exciting new investment opportunities, but they can also contribute to the development and growth of these ecosystems, creating a positive impact for both investors and the local communities.”

Operationally, they both agree that their biggest challenge to date has been scalability of their technology infrastructure to support their growing customer base. Ladi explains, “we started in Lagos with 76 cars. We’re now in nine countries, 13 markets (cities), and are still scaling. Today, Moove products touch the lives of over 25,000 customers with over 20 million trips completed in Moove-financed vehicles.” The company has global partnerships with Uber, Careem, SWVL, LORI, and Glovo across 6 vehicle classes of CNG Cars, ICE cars, Electric cars, bikes, trucks and buses. They have also grown revenues by nearly 8X since 2021.

“This also re-establishes the fact that there’s nobody else at our scale in this space,” says Jide. “We’re solving a real-world problem and making a positive impact in the lives of our customers. Moove is focused on the human impact of the business, rather than just the numbers on a spreadsheet. For me, that is the bottom line.”

They also say that building a global, diverse team that can effectively navigate the complexities of operating in different markets around the world has been another challenge. They say that Moove has made a concerted effort to hire talent from a variety of backgrounds and cultures, recognizing the value of diverse perspectives in driving innovation and growth. However, they also stress that building and managing a global team requires effective communication, cultural sensitivity and a willingness to adapt to different working styles and norms. Today, Moove has grown to employ over 400 employees.

Moove also focuses on promoting sustainability, inclusivity and gender equality. It is targeting to have a minimum of 50% female customers and a minimum of 60% of Moove’s financed vehicles to be electric or hybrid vehicles. Moove expects to achieve 30% CNG and Electric vehicles across their global fleet by the end of 2023, halfway to their 60% target. This is set to deliver over 30,000 metric tonnes of CO2 emission reductions per year, which is equivalent to the amount of CO2 captured by 1.5 million trees.

As for the future, Moove is looking for further expansion in 2023 – both geographically and in product development. They are proud of the fact that Moove, an African-born startup, has found a solution to a global problem – and they think this demonstrates the potential for African startups to create an impact beyond the continent. “Good ideas can come from anywhere,” Ladi says with a smile. “And there’s no doubt that Africa has tremendous untapped potential when it comes to startups and innovation.”

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)