eToro: From Social Trading Visionary to Global Fintech Leader

18 March 2025•

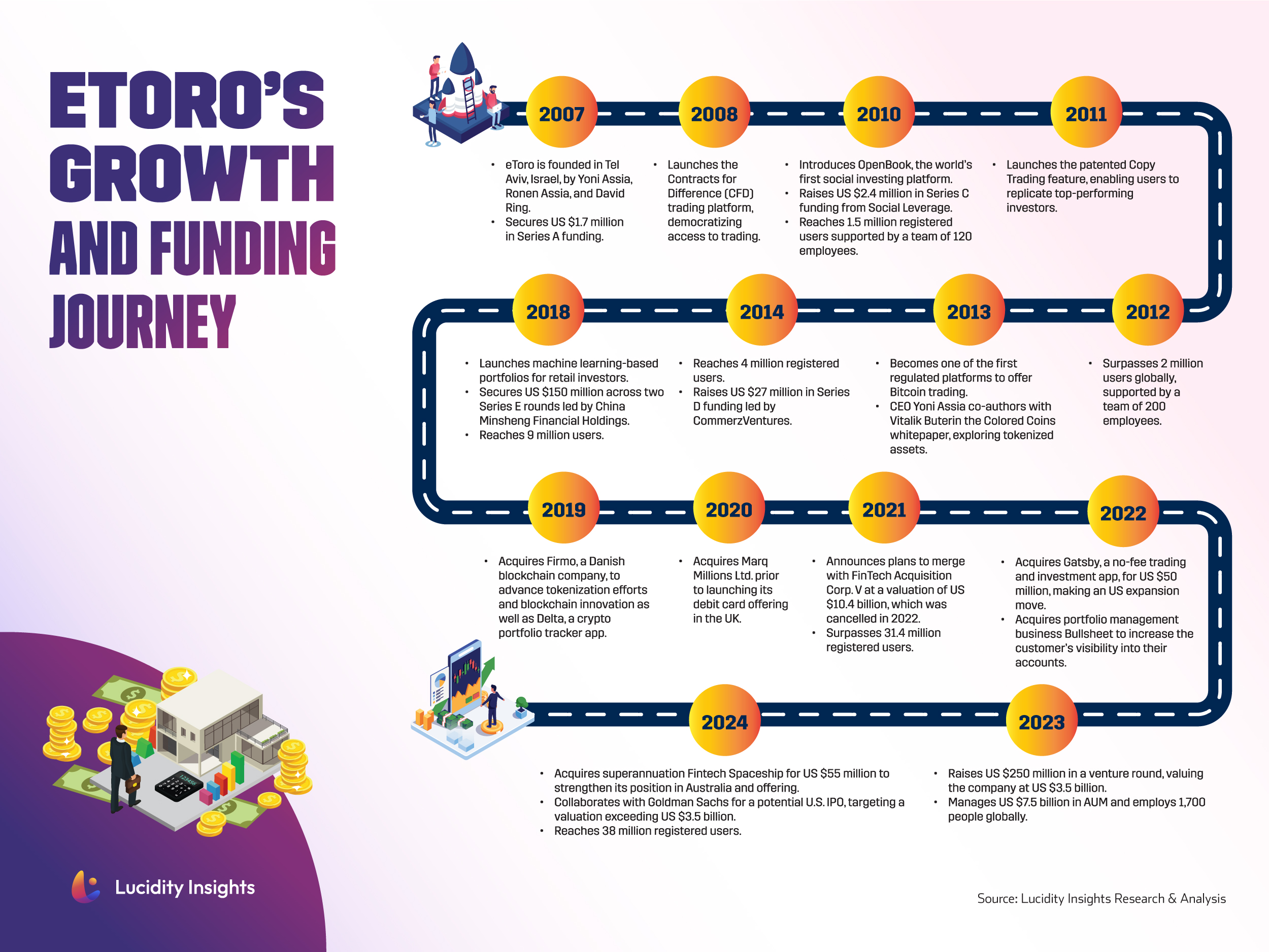

eToro, founded in 2007 in Tel Aviv, Israel, has transformed how people engage with financial markets by democratizing trading and investing. Combining cutting-edge technology with a social approach, the platform empowers 38 million users across 75 countries to trade assets ranging from stocks to cryptocurrencies. With milestones like introducing Bitcoin trading in 2013 and its patented Copy Trading feature, eToro has consistently pushed the boundaries of innovation. But how did it all start?

eToro’s Founding Vision and Early Days

In 2007, Yoni Assia, along with his brother Ronen Assia and David Ring, embarked on a mission to revolutionize the way people access financial markets. Yoni’s vision was rooted in his personal passion for finance and technology—a passion that began in his teenage years. “I started trading when I was 13 and started programming at about the same age. I've always been excited about the intersection of finance and technology,” Yoni shared. This unique combination of skills and interests laid the foundation for what would become one of the world’s most innovative trading platforms.

eToro Founders (L-R):Ronen Assia, Yoni Assia, and David Ring

Yoni’s journey wasn’t just about financial markets; it was about solving a real problem he experienced firsthand. Early trading platforms were complex, intimidating, and designed for professionals. Determined to break down these barriers, Yoni envisioned a platform that would simplify trading for everyone, regardless of experience or background.

The result was the launch of eToro’s Contracts for Difference (CFD) trading platform in 2008. This tool allowed users to speculate on asset prices without owning them outright, lowering the entry barriers for retail investors. It was a step toward democratizing financial markets, aligning perfectly with the founders’ mission.

eToro’s next breakthrough came in 2010 with the introduction of OpenBook, the world’s first social investing platform. Inspired by the growing popularity of social networks like Facebook, OpenBook allowed users to share portfolios, discuss strategies, and learn from one another. This was followed by the launch of the patented Copy Trading feature in 2011, which took collaboration a step further, enabling users to replicate the portfolios of top-performing investors with a single click.

This innovative approach struck a chord with users worldwide. By the end of 2010, eToro had attracted 1.5 million registered users, supported by a team of 120 employees. For Yoni, this was just the beginning of a much larger vision: “We wanted to simplify access to financial markets and make it as easy as buying a book on Amazon,” he explained. These early years set the stage for eToro’s rapid ascent as a leader in social investing and financial innovation.

Embracing Crypto and Driving Innovation

A major turning point for eToro came in 2013, when it became one of the first regulated platforms to offer Bitcoin trading. As Bitcoin and other digital assets gained traction, eToro positioned itself as a leading platform for crypto enthusiasts, offering a growing range of cryptocurrencies to meet the needs of a rapidly expanding market.

eToro has also been a proactive player in integrating blockchain technology and exploring tokenized assets. In 2013, Yoni, co-authored the Colored Coins whitepaper with Vitalik Buterin, marking one of the earliest explorations into representing real-world assets on the blockchain. This initiative aimed to establish a framework for tokenizing assets, laying the groundwork for future developments in digital finance.

To further its tokenization efforts, eToro acquired Danish blockchain company Firmo in 2019. This strategic move facilitated the development of eToroX, eToro's blockchain subsidiary, which focuses on tokenizing a variety of assets. eToroX (now eToro Crypto) offers a suite of stablecoins pegged to major fiat currencies, such as USDEX (U.S. dollar), EURX (euro), and GBPX (British pound), enabling seamless trading between cryptocurrencies and traditional assets. eToro's vision extends to the tokenization of a wide range of assets, including commodities like gold (GOLDX) and silver (SLVX), as well as other real-world assets. By creating digital representations of these assets on the blockchain, eToro aims to enhance liquidity, accessibility, and efficiency in trading. This approach allows for fractional ownership, enabling investors to hold and trade portions of assets that were previously indivisible.

In 2017 and 2018, eToro introduced machine learning-based portfolios, bringing sophisticated, AI-driven tools to retail investors. These portfolios empowered users with advanced data analysis and decision-making capabilities, traditionally reserved for institutional players.

eToro’s ability to scale its operations globally has been crucial. While Israel serves as the central hub for technology and compliance, regional offices across Europe, the U.S., Asia, and the UAE ensure that the platform caters to local market demands. This balanced approach, supported by strong backend systems, enables eToro to maintain consistency across its operations while adapting to the unique regulatory and cultural needs of each market. With over 200 employees dedicated to regulatory technology (regtech) and compliance, the company has built a robust framework to navigate complex and evolving global regulations. The use of advanced systems have been instrumental in ensuring seamless integration between centralized and decentralized functions, allowing eToro to adapt quickly to new regulatory requirements, manage risk effectively, and provide a consistent user experience across its diverse markets.

These initiatives reflected eToro’s ability to anticipate market trends and adopt emerging technologies, ensuring its platform remained relevant in an increasingly competitive landscape. This focus on innovation played a crucial role in its growth trajectory. By 2023, eToro boasted 31.4 million registered users, managing US $7.5 billion in assets under administration.

eToro’s Funding Journey

eToro’s funding journey reflects its evolution from a Fintech startup with a bold vision to a global leader in social trading and investment platforms. Since its inception in 2007, the company has raised US $522.7 million gathering interest from a diverse group of investors, each funding round marking a new chapter in its growth story.

The journey began with a modest US $1.7 million Series A in 2007, led by private investors, providing the initial capital to develop its groundbreaking Contracts for Difference (CFD) trading platform. By 2009, eToro had secured US $6.3 million in Series B funding, with contributions from BRM Capital and Cubit Investments, enabling the company to expand its market presence and refine its platform.

In 2010, eToro’s Series C funding round brought in an additional US $2.4 million from Social Leverage, reflecting investor confidence in its potential to disrupt traditional trading models. This capital injection coincided with the development of OpenBook, the platform that would later introduce the revolutionary Copy Trading feature, a key driver of its early success.

The company’s growth trajectory accelerated in the years that followed. By 2014, eToro had raised US $27 million in Series D funding, led by CommerzVentures and other strategic investors, to fuel global expansion and support its increasing user base. A subsequent US $12 million injection in 2015, also part of its Series D, underscored continued investor belief in the platform’s scalability and innovative edge.

A major inflection point came in 2018, with a US $100 million Series E funding round, led by China Minsheng Financial Holdings. This capital was pivotal for expanding eToro’s footprint into emerging markets including China and Russia and advancing its blockchain initiatives, including the acquisition of Danish blockchain company Firmo. Later that year, an additional US $50 million in Series E funding from the same lead investor further solidified eToro’s financial position.

The most recent round in March 2023 saw eToro raise US $250 million through a venture funding round, valuing the company at US $3.5 billion. The funding provided a crucial buffer against economic uncertainty, ensuring operational stability and continued innovation.

eToro’s Tumultuous IPO Journey

eToro’s first major attempt to go public was announced in March 2021 through a planned merger with Fintech Acquisition Corp. V, a SPAC led by Betsy Cohen. The deal initially valued eToro at US $10.4 billion, a figure that underscored the bullish market sentiment around Fintech and crypto platforms at the time.

However, as market conditions shifted and SPAC-related scrutiny increased, the valuation was revised to US $8.8 billion. By July 2022, the two parties mutually agreed to terminate the merger after the SPAC’s expiration deadline. This decision reflected both external challenges, including market volatility and tightening regulatory oversight, and internal factors within the SPAC structure. Despite the setback, the collaboration provided valuable insights for eToro, allowing it to refine its strategy for entering public markets. With a renewed focus on profitability and operational efficiency, eToro is now better positioned to pursue a public listing under more favorable conditions.

In 2024, eToro announced its collaboration with Goldman Sachs to explore an initial public offering in the United States. With a target valuation exceeding US $3.5 billion, the company is poised to leverage its strong financial performance and growing user base to attract investors. While details of the IPO are yet to be finalized, the move signifies eToro’s commitment to entering public markets on its own terms.

eToro’s journey reflects the dynamic and evolving nature of the Fintech industry. From its humble beginnings in Tel Aviv to becoming a global leader in social and crypto trading, the company has consistently demonstrated resilience, adaptability, and a commitment to innovation. As eToro prepares for its next chapter with a potential IPO in partnership with Goldman Sachs, it is clear that its vision of democratizing finance remains at the core of its mission.

With a strong foundation of advanced technology, global reach, and operational excellence, eToro is well-positioned to redefine the financial services landscape yet again.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)