MEAPT Funding Overview: Year-to-Date Trends and Top 10 Funding Rounds - February 2025

18 March 2025•

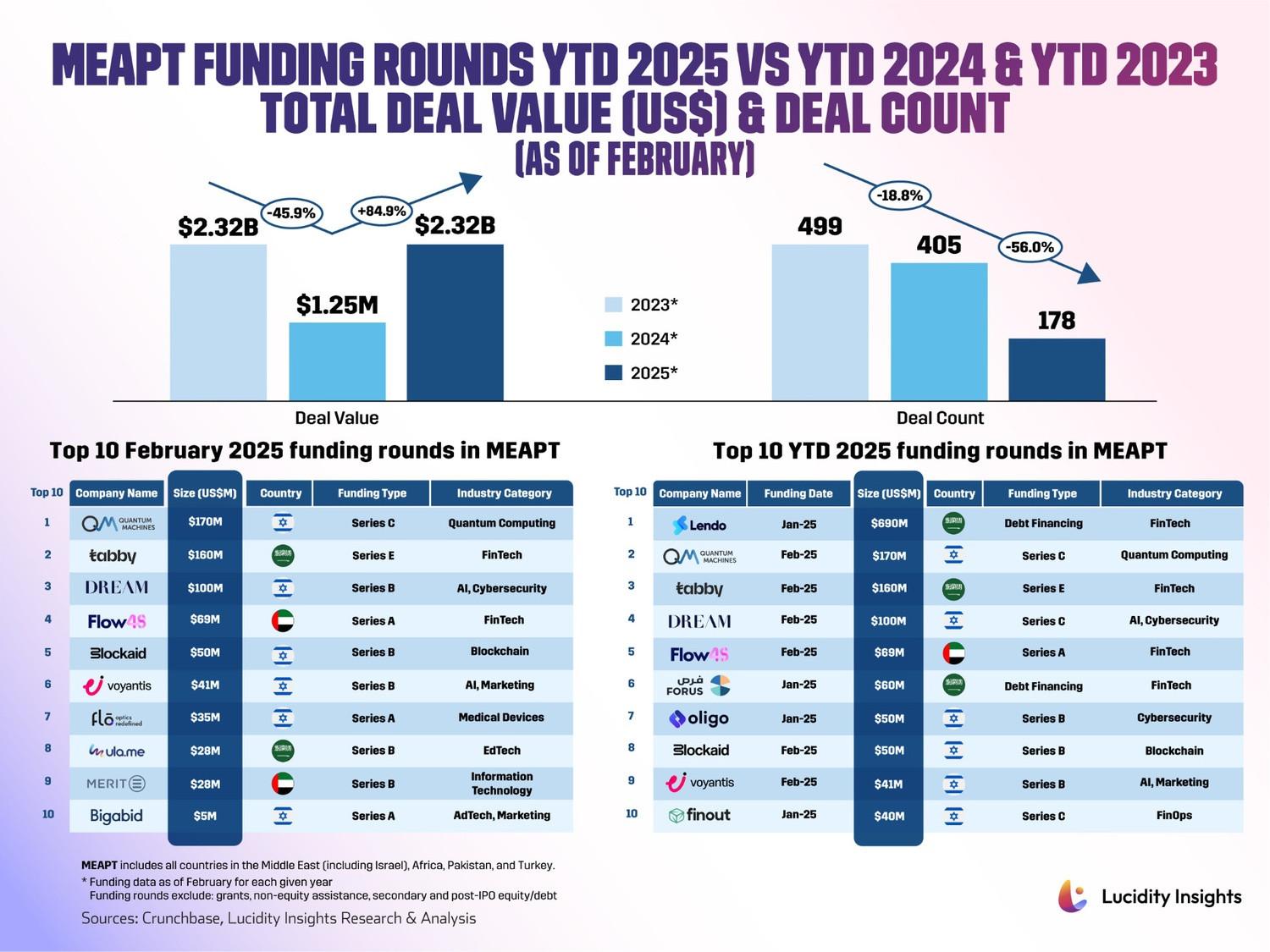

Venture capital activity in the MEAPT region has seen some dramatic swings over the last 2 years, and as we move into the second month of 2025 we see year-on-year fluctuations in deal values and counts similar to January. Interestingly, February has consistently brought in a lower total investment volume and a smaller number of deals than January of the same year since 2023, but year-to-date deal value made a surprising recovery this month surpassing 2023 figures and February took 6 of the top 10 YTD 2025 funding rounds in MEAPT.

In February 2023, year-to-date cumulative investments amounted to US $2.315 billion across 499 rounds at an average deal size of US $4.6 million. The MEAPT VC landscape in 2023 was characterize by a focus on large-scale, high-impact deals that continued to attract substantial capital following the investment boom in both 2021 and 2022 post pandemic.

By February 2024, the landscape had shifted dramatically. Year-to-date investments plummeted to US $1.252 billion, a nearly 46% decrease compared to that same time frame the previous year. The number of deals also fell to 405 for an average deal size of only US $3 million as February saw a distinct absence of mega-rounds, reflecting a cautious investment climate amid broader economic uncertainties and geopolitical dynamics that impacted investor confidence and market stability. Israel continued to take the bulk of funding, funneling into AI, IT, biotech, and cloud security despite its own escalating of regional tensions since October 2023.

February 2025 saw a rewarding spike in VC investments, with total funding increasing by nearly 85% year-over-year to reach US $2.316 billion. Though a large chunk of this came from Lendo’s US $690 million debt financing in January, other significant investments spanned multiple sectors this February, spurring the 2025 YTD funding to exceed both 2024 and 2023 totals. Though this increase wasn't mirrored in the number of deals, which continued to decline falling over 56% to a mere 178 deals, the high-impact deals boosting total funding amounts these past 2 months may be signs of recovery as global interest rates decline and inflation stabilizes.

The World Bank has projected that MENA economic growth will rebound to 3.8% in 2025, up from 2.2% in 2024. This recovery is driven by improved performance among GCC countries especially which are boosting investor confidence and attracting more venture capital to the region. This shifting landscape hints at an exciting phase of strategic consolidation and innovation-driven growth, but keeping a close watch on how things unfold throughout the year will be crucial to understanding the sustainability and impact of these positive trends.

Let’s take a look at the top 10 funding rounds in the MEAPT in February 2025.

#1 - Quantum Machines (Israel) | Quantum Computing | US $170 Million Series C

Founded by Dr. Itamar Sivan, Dr. Yonatan Cohen, and Dr. Nissim Ofek in 2018, Quantum Machines develops hardware and software solutions for the control and operation of quantum systems used by quantum computing companies and research centers in 15 countries. Their flagship product is the Quantum Orchestration Platform, which enables seamless execution of complex quantum algorithms and real-time quantum control.

In February 2025, Quantum Machines raised US $170 million in a Series C round led by PSG Equity, bringing its total funding to US $363 million. The funds will be used to drive the development of quantum computers with tens of thousands of qubits and to further advance their quantum control technology.

#2 - Tabby (KSA) | FinTech | US $160 Million Series E

Founded by Hosam Arab and Daniil Barkalov in 2019, Tabby operates a financial platform that offers consumers a "buy now, pay later" (BNPL) option to pay for online and offline purchases either in a deferred single payment or in multiple installments. Essentially, the platform provides flexible credit options for safe payments. It currently caters to 15 million active shoppers across the UAE, KSA, Kuwait, and Bahrain, selling 40,000+ global brands and merchants like H&M, Adidas, IKEA, SHEIN, and Bloomingdale’s.

In February 2025, Tabby secured US $160 million in a Series E round led by Blue Pool Capital and Hassana Investment Company (HIC), bringing its total funds to US $1.9 billion. The funds will be used to expand Tabby's financial services, including digital spending accounts, payments, cards, and money management tools to drive the Kingdom's cashless economy forward as it plans for IPO.

#3 - Dream Security (Israel) | Cybersecurity | US $100 Million Series B

Founded by Shalev Hulio, Sebastian Kurz, and Gil Dolev in 2023, Dream is rebuilding cybersecurity with a suite of proprietary AI models designed to think like both a defender and an attacker. By fusing advanced posture management with AI predictive detection, Dream has created a robust data ecosystem that not only anticipates but actively eliminates threats before they materialize.

In February 2025, Dream Security raised US $100 million in its Series B funding round led by Bain Capital Ventures for a total funding of US $153.6 million. The funds will be used to accelerate the development of Dream's Cyber Language Model (CLM), a first-of-its-kind family of Language Models specifically trained for cybersecurity operations, and fuel the company's expansion with a strategic focus on markets where cyber threats continue to pose significant national security challenges.

#4 - Flow48 (UAE) | FinTech | US $69 Million Series A

Founded by Idriss Al Rifai in 2022, Flow48 provides revenue-based financing to small and medium-sized enterprises (SMEs), allowing them to secure upfront capital based on their future revenues as a flexible alternative to traditional debt and equity financing. Flow48 has cemented its position in the UAE and strengthened its market presence in South Africa while introducing new products for SMEs.

In February 2025, Flow48 secured US $69 million in Series A funding led by Breega, bringing its total amount raised to US $94 million. The funds will be used to further expand in its two key markets and replicate its solution in Saudi Arabia as well as add new features to enhance its platform capabilities, leveraging alternative data sources and advanced risk assessment tools to deliver tailored financial solutions to SMEs.

#5 - Blockaid (Israel) | Blockchain | US $50 Million Series B

Founded by Ido Ben-Natan and Raz Niv in 2022, Blockaid has developed a unified platform that monitors, detects, and automatically responds to fraud and attacks on infrastructure, assets, and end users. The platform provides exclusive access to the largest repository of real-time transaction data through integrations with leading Web3 wallets, allowing it to identify and neutralize new threats in advance.

In February 2025, Blockaid raised US $50 million in its Series B funding round led by Ribbit Capital, bringing its total funds to US $83 million. The funds will fuel Blockaid's expansion in operations and R&D, ensuring it stays ahead of the ever-growing demand for ironclad onchain protection.

#6 - Voyantis (Israel) | AI, Marketing | US $41 Million Series B

Founded by Ido Wiesenberg and Eran Friendinger in 2020, Voyantis is designed to help businesses acquire and retain high-value customers. Its predictive AI platform optimizes customer acquisition and lifecycle management, focusing on maximizing customer lifetime value (LTV) to drive value-based campaigns on platforms like Google and Meta. Operating globally with offices in Israel, the US, Europe, Middle East, Africa, and Latin America, Voyantis has tripled its annual recurring revenue (ARR) two years in a row.

In February 2025, Rize raised US $41 million in its Series B funding round led by Intel Capital, bringing its total funds raised to US $60 million. Voyantis will use the funds to expand hiring efforts across sales, marketing, and delivery teams to optimize GTM strategy and pursue further R&D initiatives.

#7 - Flo-Optics (Israel) | Medical Devices | US $35 Million Series A

Founded by Jonathan Jaglom, Ben Levitan, Dr. Claudio Rottman, and Benny Bilenko in 2018, Flo-Optics specializes in digital coating platforms for optical lenses primarily in Israel and Switzerland. Its technology aims to redefine lens manufacturing by offering on-demand micro-precision printing on various substrates, delivering consistent quality, cost-effective productivity, and enhanced sustainability.

In February 2025, Flo-Optics secured US $35 million in Series A funding led by Jaglom family. Flo-Optics will use the funds to speed up development, expand production capabilities, and increase operations to meet its growing demand.

#8 - Ula.me (KSA) | EdTech | US $28 Million Series B

Founded by Alaa Jarrar in 2022, Ula.me provides a personalized learning experience by analyzing students’ performance and individual needs, ensuring more efficient and effective education. After just 2 years in operation, Ula.me already plans to integrate Augmented Reality (AR) and Virtual Reality (VR) tech into its platform to create an interactive and immersive learning environment, making educational content more engaging and stimulating for students.

In February 2025, Ula.me secured US $28 million in a Series A round led by Rua Growth Fund. Ula.me will use the funds to expand its operations in Saudi Arabia and launch an advanced digital learning platform powered by generative AI, offering cutting-edge learning models that cater to the needs of future generations and contribute to building a knowledge-based society.

#9 - Merit Incentives (UAE) | Information Technology| US $28 Million Series B

Founded by Julie Barbier-Leblan and Thrishan Padayachi in 2016, Merit Incentives provides customer and employee engagement solutions, as its platform offers digital gift cards, loyalty programs, employee engagement tools, and rewards and incentives strategies to enhance customer loyalty and employee motivation through innovative engagement technologies. Merit Incentives currently connects over 5,000 brands like Adidas and Amazon with more than 20 million users in the UAE, KSA, Kuwait, Egypt, and Jordan.

In February 2025, Merit Incentives secured US $28 million in a Series B funding round led by Alistithmar Capital and Tech Invest Com, bringing its total amount raised to US $45 million. Merit Incentives will use the funds to expand its presence in key markets as well as enhance its technology infrastructure and product offerings.

#10 - Bigabid (Israel) | Ad-Tech, Martketing | US $25 Million Series A

Founded by Amit Attias, Ido Raz, and Yaron Nahari in 2016, Bigabid is a data-driven ad-tech company specializing in performance marketing for the mobile advertising industry. It leverages machine learning to optimize user acquisition and retargeting campaigns, ensuring high lifetime value (LTV) for their clients with a strong presence in Israel and North America.

In February 2025, Bigabid secured US $25 million in Series A funding led by MobilityWare, bringing its total funds to US $33.5 million. The funds will allow Bugabid to strengthen its development team with key talent while improving on its ad-based gaming models.