MEAPT Funding Overview: Year-to-Date Trends and Top 10 Funding Rounds - January 2025

10 March 2025•

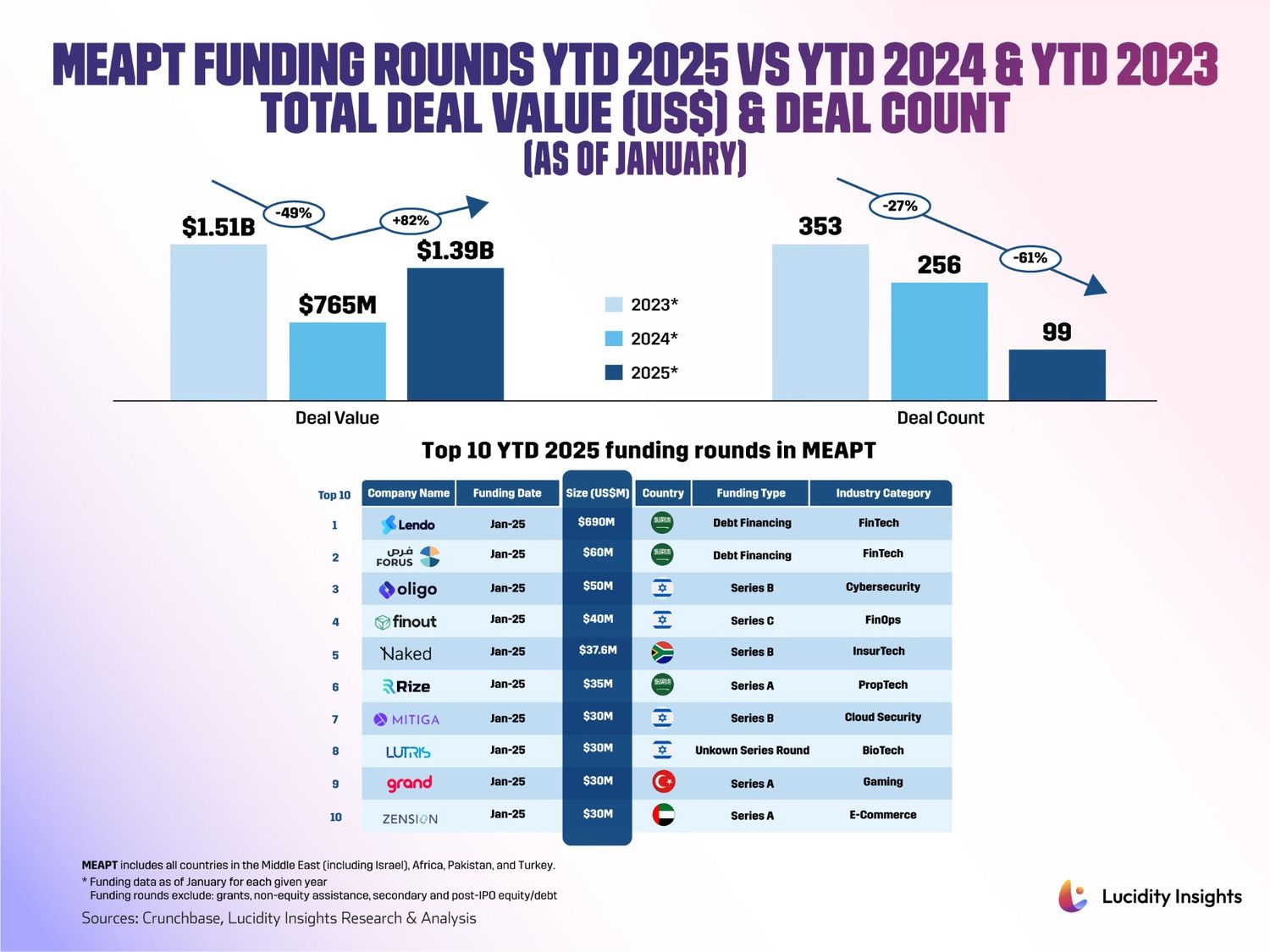

The MEAPT region’s venture capital activity has taken investors on a volatile ride since January 2023, with deal values and counts oscillating in response to shifting market conditions and mega-round dynamics. In January 2023, total funding reached US $1.51 billion across 353 deals, showcasing a robust spread of fintech investments—highlighted by MNT-Halan’s US $400 million venture round in Egypt and sizable debt financings in Israel (e.g., PayEm’s US $200 million).

By January 2024, total funding had dropped 49% year over year to US $765 million, while deal count declined 27% to 256. Israel still attracted notable late-stage checks (Silverfort, Quantum Machines, Aqua Security), indicating sustained investor demand for cybersecurity and deep-tech innovations. However, the sharply lower regional total reflected a broader slowdown, as caution prevailed in the face of global economic headwinds.

This caution quickly gave way in January 2025, when total funding rebounded 82% year over year to US $1.39 billion—though still below the January 2023 peak. Deal count, on the other hand, continued its downward trend, falling 61% to just 99—a climate in which fewer but larger deals now dominate. Chief among these is Lendo’s US $690 million debt financing in Saudi Arabia, accounting for nearly half of the month’s aggregate. Other standouts spanned fintech (Forus Financial), cybersecurity (Oligo Security, Mitiga), proptech (Rize), insurtech (Naked Insurance), and gaming (Grand Games), underscoring the MEAPT region’s growing sector diversity.

While Saudi Arabia’s fintech prominence drove much of the January 2025 funding, the global context cannot be overlooked. In 2024 alone, AI-related categories garnered tens of billions of dollars worldwide in one-third of all global VC investments (e.g., the AI model layer), suggesting that nascent AI ventures in the MEAPT startup ecosystem could see heightened attention later in 2025. Still, it’s crucial to remember that January data is an early snapshot—one mega-round or emerging trend can dramatically shape month-to-month statistics. Investors are watching whether the concentration of capital into bigger deals will persist or if a rebound in deal count might accompany further macroeconomic stabilization.

From fintech to AI and cybersecurity, the MEAPT region’s evolving venture capital narrative underscores a contraction in deal volumes alongside expanding ticket sizes, leaving open questions about how the rest of 2025 will unfold. All eyes are on the coming months, where fresh rounds may confirm this year’s bullish start—or reveal another twist in the MEAPT startup ecosystem.

Let’s take a look at the top 10 funding rounds of January 2025 in the MEAPT!

#1 - Lendo (KSA) | FinTech | US $690 Million Debt Financing

Founded by Osama Alraee and Mohamed Jawabri in 2019, Lendo operates as a Shariah-compliant, peer-to-peer digital lending marketplace to help pre-finance outstanding invoices for small and medium-sized enterprises (SMEs) across Saudi Arabia. Lendo has facilitated over US $667 million in financing through more than 5,000 transactions, generating US $33.3 million in returns for investors.

In January 2025, Lendo raised US $690 million led by J.P. Morgan, bringing its total funding to US $725.2 million. The funds will be used to increase Lendo's lending capacity, introduce more innovative products, and expand its SME coverage in the Kingdom, which aligns with Saudi Vision 2030's goal of increasing SME lending from 4% in 2018 to 20% by 2030.

#2 - Forus Financial (KSA) | FinTech | US $60 Million Debt Financing

Founded by Nosaibah Alrajhi and Abdulwahab Majeed in 2018, Forus Financial operates as a debt crowdlending platform, providing innovative working capital solutions for SMEs in Saudi Arabia. Forus offers a debt marketplace that bridges the funding gap for SMEs by providing businesses with funds to support their operational needs, offering up to SAR 5 million with terms from 1 to 36 months. It also offers short-term financing against POS receipts and cash financing against company invoices, covering up to 80% of the invoice value with terms from 1 to 12 months.

In January 2025, Forus Financial secured US $60 million in debt financing from Fasanara Capital. The funds will be used to scale Forus' lending operations, provide more than US $150 million in working capital loans to hundreds of Saudi SME borrowers, and support the company's growth towards becoming one of the largest non-bank providers of debt financing to SMEs in Saudi Arabia.

#3 - Oligo Security (Israel) | Cybersecurity | US $50 Million Series B

Founded by Nadav Czerninski, Gal Elbaz, and Avshalom Hilu in 2022, Oligo Security specializes in Application Detection and Response, focusing on securing applications against vulnerabilities and attacks in real-time. Oligo provides a platform that offers deep, real-time visibility into application behavior to detect vulnerabilities and stop attacks, particularly in cloud-native environments.

In January 2025, Oligo Security raised US $50 million in its Series B funding round led by Greenfield Partners for a total funding of US $78 million. The funds will be used to fuel Oligo's global expansion, enhance its go-to-market strategy, and meet increasing demand by improving the platform's capabilities to detect and neutralize exploitable application vulnerabilities in real-time.

#4 - Finout (Israel) | FinOps | US $40 Million Series C

Founded by Roi Ravhon, Asaf Liveanu, and Yizhar Gilboa in 2021, Finout provides a cloud cost management platform that helps enterprises understand, allocate, and optimize their cloud spending through real-time insights and transparency into cloud costs, enabling smarter financial decisions.

In January 2025, Finout secured US $40 million in Series C funding led by Insight Partners, bringing its total amount raised to US $84.8 million. The funds will be used to double its engineering team in Tel Aviv and expand its go-to-market teams.

#5 - Naked Insurance (South Africa) | InsurTech | US $37.6 Million Series B

Founded in 2016 by Alex Thomson, Ernest North, and Sumarie Greybe, Naked Insurance offers short-term retail insurance products which allow customers to manage their insurance policies entirely through a digital platform, providing quotes in under 90 seconds. According to a price comparison from BusinessTech, Naked Insurance currently offers the cheapest car insurance in South Africa.

In January 2025, Naked Insurance raised US $37.6 million in its Series B funding round led by BlueOrchard. The funds will be used to enhance its AI-driven platform and automation, expand its products and markets, and drive its advertising campaigns to attract and retain customers as well as meet regulatory capital requirements.

#6 - Rize (KSA) | PropTech | US $35 Million Series A

Founded by Ibrahim Balilah and Mohammed AlFraihi in 2021, Rize is the first Saudi real estate technology company to offer a "Rent Now, Pay Later" (RNPL) service, allowing tenants to pay annual rents in flexible monthly installments instead of a one sum payment. Since its founding, the company has achieved significant milestones, including reaching a total rental value of over half a billion SAR through its platform.

In January 2025, Rize raised US $35 million in its Series A funding round led by Raed Ventures, bringing its total funds raised to US $37.9 million. The funds will support Rize's growth plans and expand its services in line with the Kingdom’s vision for digital transformation and enhancing the real estate sector.

#7 - Mitiga (Israel) | Cloud Security | US $30 Million Series B

Founded by Ofer Moar, Tal Mozes, and Ariel Parnes in 2019, Mitiga is a cloud security startup specialized in threat detection, investigation, and response (TDIR) for cloud and SaaS environments. Mitiga's solutions integrate with various cloud and SaaS providers to offer comprehensive security coverage to help organizations across the globe prepare for and respond to cyber incidents, ensuring their cloud services remain secure.

In January 2025, Mitiga secured US $30 million in Series B funding led by SYN Ventures, bringing its total amount raised to US $75 million. The funds will fuel Mitiga's expansion in both the US and Europe by expanding its sales and marketing divisions, improving its AI-driven platform, broadening Cloud and SaaS integrations, and establishing new strategic partnerships.

#8 - Lutris Pharma (Israel) | BioTech | US $30 Million Venture Round

Founded by Dr. Antoni Ribas in 2015, Lutris Pharma aims to improve patients' quality of life and allow them to continue their cancer treatment without interruption due to skin toxicity. Lutris Pharma focuses on reducing cutaneous dose-limiting toxicity, which can be a significant side effect of certain cancer treatments.

In January 2025, Lutris Pharma secured US $30 million in financing led by Columbus Venture Partners and Pontifax, bringing its total amount raised to US $35 million. The funds will be used to advance the development of Lutris Pharma's key product, LUT014, a topically applied gel designed to reduce rashes caused by Epidermal Growth Factor Receptor inhibitors (EGFRi) used in cancer treatment.

#9 - Grand Games (Turkey) | Gaming | US $30 Million Series A

Founded by Mustafa Fırtına, Mehmet Çalım, and Bekir Batuhan Çeleb in 2024, Grand Games is a mobile gaming company with a unique approach to game development, leveraging AI to generate up to 30% of its codebase and platforms like MidJourney for art concept creation. This allows Grand Games to build, test, and iterate faster than many competitors, and its games have collectively generated over US $4 million in monthly gross in-app revenue within just three months of their launch.

In January 2025, Grand Games secured US $30 million in a Series A funding round led by Balderton Capital, bringing its total amount raised to US $33 million. The funds will be used to fuel Grand Games' expansion efforts, which include releasing a new game and broadening its international reach, particularly in the US, with plans to triple its game design, coding, art, music and business development team by the end of 2025.

#10 - Zension (UAE) | E-commerce | US $30 Million Series A

Founded by Khalid Saiduddin in 2016, Zension focuses on promoting a circular economy that minimizes electronic waste and support sustainable practices in the mobile device industry across the GCC. Zension offers flexible device access that covers upgrade options, unlimited repairs, and replacements, as well as buyback and trade-in programs.

In January 2025, Grand Games secured US $30 million in Series A funding. The funds will allow Zension to launch its subscription service for personal tech devices, Zaam, in Saudi Arabia and the UAE throughout the first quarter of 2025.