Navigating the Regulatory Maze: Crypto’s Road to Legitimacy

24 July 2023•

Will 2023 be the year that tames the crypto Wild West? As the cryptocurrency landscape rapidly evolves and risks intensify, regulators are scrambling to strike the perfect balance between fostering innovation and ensuring stability, security, and consumer protection. Discover how a patchwork of regulatory approaches across the globe, pivotal litigation, and the need to regulate crypto investments are shaping the industry’s future. Can governments create a framework that allows this revolutionary technology to flourish without sacrificing safety? Dive in and decide for yourself.

The Fallout from FTX Collapse and Implications for Crypto Assets

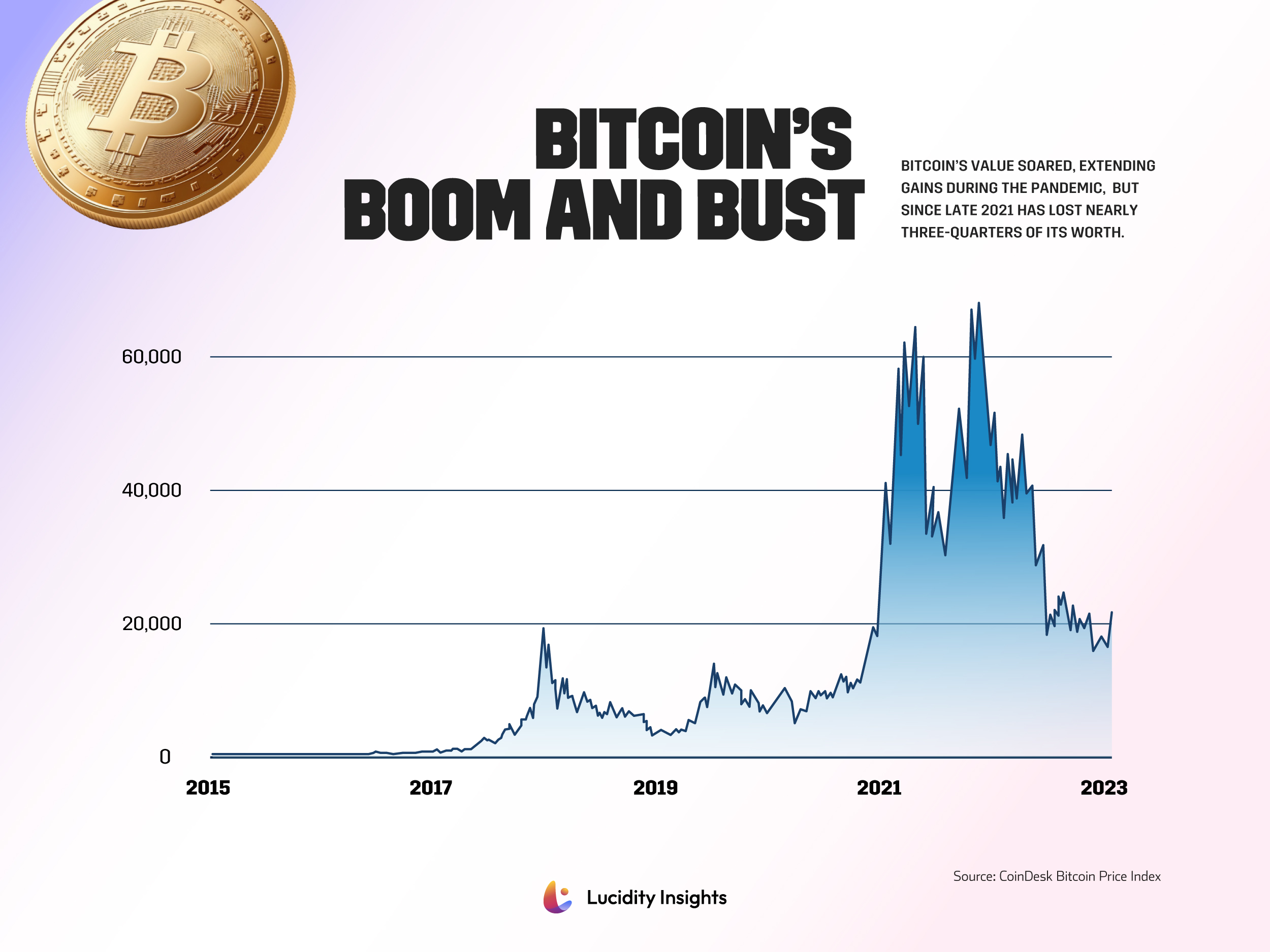

As the world of cryptocurrencies continues to evolve at a breakneck pace, it’s no wonder that governments and regulators have been scrambling to keep up. The turbulent world of cryptocurrencies has been thrown into further disarray following the collapse of one of its largest platforms, FTX in November 2022. The FTX collapse exposed the risks associated with crypto assets that lack fundamental safeguards. This collapse occurred amid a perilous period for the industry, where high inflation and tighter monetary policy affected crypto investors as well, causing the industry to enter another “crypto winter”. Bitcoin, the leading cryptocurrency, has declined by nearly two-thirds from its peak in late 2021, and a Bank for International Settlements analysis in November 2022 revealed that approximately three-quarters of investors have experienced losses.

Infographic: Bitcoin’s Boom and Bust

The mounting pressures have led to the failure of stablecoins, crypto-focused hedge funds, and crypto exchanges, raising grave concerns over market integrity and user protection. As the connections between cryptocurrencies and the core financial system continue to deepen, worries about potential systemic risks and financial stability loom on the horizon. These events have pushed 2023 to the forefront as a year where regulators will play a central role in shaping the industry’s future. Yet, striking a balance between regulating the investment side of crypto to ensure stability, security, and consumer protection while promoting innovation is crucial.

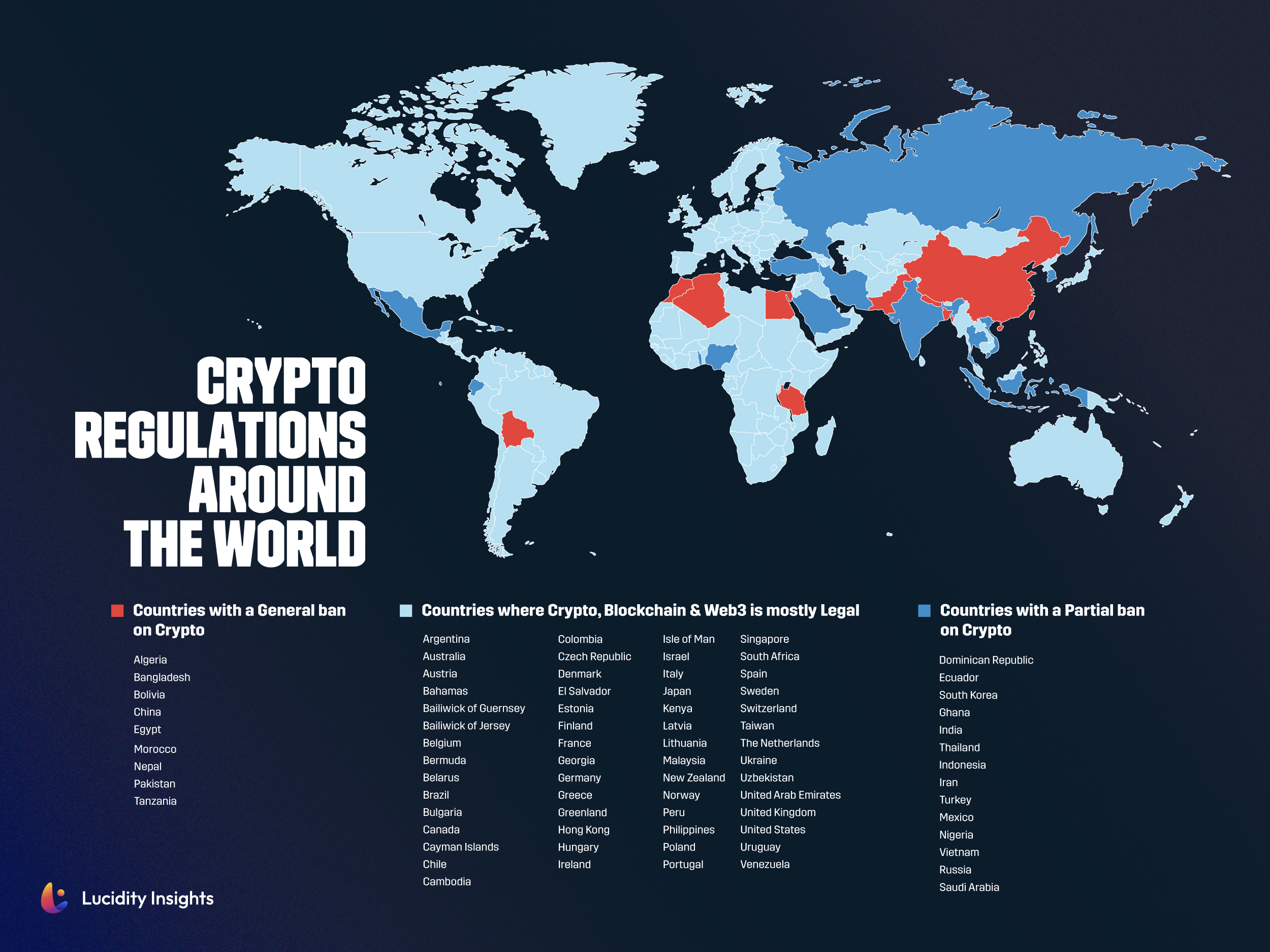

Regulatory Diversity Across Countries

As of today, globally, we are facing a patchwork of regulations made up of diverse regulatory approaches across countries. Among the 80 countries analyzed, 57 have legalized cryptocurrencies, while around 14 have partial bans, and 9 have general bans. Interestingly, there is a weak correlation between cryptocurrency adoption rates and regulatory restrictiveness. For instance, 12 of the top 20 countries in cryptocurrency adoption have partial or general bans in place. Emerging-market economies tend to lag behind advanced economies in terms of regulatory development. In many cases, this is due to a lack of resources or expertise to address the complexities of the digital asset market. A significant portion of the regulatory framework for cryptocurrencies is still evolving, with regulations and limitations differing based on their use in areas such as payments, investments, derivatives, and taxation. Most countries have established methods for taxing income or gains resulting from cryptocurrencies, though some have more detailed requirements than others.

Legal Battles and Regulatory Focus

2023 will see no shortage of litigation as regulators crack down on illicit activities in the crypto space. The US Treasury Department sanctioned Tornado Cash, a decentralized Ethereum crypto-mixing service, in August 2022. Meanwhile, the SEC continues its case against XRP creator Ripple Labs for alleged unregistered securities sales. Bankruptcy courts will settle matters involving Three Arrows Capital, FTX, Voyager, and Celsius, likely setting legal precedents for the industry. To prevent the repetition of the Terra and FTX failures, the investment side of crypto which covers centralized exchanges (CEX) and stablecoins, will most likely require rigorous oversight. Recurring regulatory audits and transparency measures will ensure that stablecoins remain fully collateralized and that CEXs maintain adequate capitalization.

Notable Legislation and Considerations in the EU and US

Moreover, addressing counterparty credit risks is vital to mitigating the domino effects witnessed in these past few months. As a result, stablecoins, which are usually backed by a fiat currency, have emerged as the next frontier of crypto regulation. In the EU, US, UK, and Thailand, stablecoin regulation is under consideration. Meanwhile, in Mexico, financial institutions are prohibited from issuing stablecoins. One key piece of legislation that has garnered attention is the European Union’s Markets in Crypto-Assets (MiCA) Regulation. This wide-ranging bill covers everything from money laundering and the environment to corporate reporting and consumer protection. If passed, it would require stablecoin issuers to hold enough reserves to prevent their collapse and mandate crypto miners to disclose their energy consumption. The legislation also calls for exchanges operating in the region to be monitored by a financial regulator from an EU member state.

In the US, the Biden administration’s recent report on stablecoins has proposed regulation for stablecoins and the possibility of a digital dollar. Rep. Patrick McHenry’s (R-N.C.) stablecoin bill, which would allow the Federal Reserve to license stablecoin issuers, has faced competing disputes over who should regulate stablecoin issuers. The wording of this bill could impact major US stablecoin issuers like Circle and Paxos.

Infographic: Crypto Regulations Around the World

With more than 60 countries in an advanced phase of exploration (development, pilot, or launch) for their Central Bank Digital Currency projects, it is evident that countries are exploring both CBDCs and updating cryptocurrency regulations simultaneously. The challenge of creating a comprehensive regulatory framework in such a new and disruptive area will likely take years to finalize, with the ambiguous nature of digital assets themselves and the lack of standardized definitions creating questions of overlap and jurisdiction.

Related: These Countries are hot for CBDCs

As 2023 unfolds, regulators worldwide must strike a delicate balance between fostering innovation and ensuring the safety and stability of the digital asset ecosystem. A highly restrictive approach could hinder innovation and drive the industry towards friendlier jurisdictions, considering the intrinsically global and boundary-less character of the crypto space. Conversely, inadequate regulation might result in the recurrence of catastrophic incidents like the FTX and Terra collapses, eroding confidence in the sector and discouraging potential investors.

Regulatory Clarity and the Path Forward

The race to regulate is now underway, and market participants eagerly seek a clearer regulatory framework that provides certainty. With a new crypto bull market potentially in the cards, regulatory clarity is essential to restoring investor confidence. This will likely involve the introduction of new rules, regulations, or at the very least, official guidance. Countries will need to collaborate and learn from each other’s experiences, using tools such as regulatory sandboxes and industry associations to test and refine their approaches, helping both advanced and emerging economies.

While it is impossible to predict the exact direction that global cryptocurrency regulation will take in the coming years, what is clear is that regulators can no longer afford to sit on the sidelines. By taking proactive steps to understand and shape this rapidly evolving industry, governments have the opportunity to harness the potential of digital assets while safeguarding the interests of consumers, investors, and the broader financial system. Only time will tell if regulators rise to the challenge and create a framework that allows this revolutionary technology to flourish while mitigating its inherent risks.

"The days of the crypto Wild West are numbered. As the industry matures and embraces a more defined regulatory environment, the future of cryptocurrencies and digital assets will be shaped by the delicate balance between promoting innovation and ensuring stability, security and consumer protection."

To read more about the future of web3, the decentralized web – read the full report here.

Next Read: Why Governments Around the World are going Ga-Ga for CBDCs

%2Fuploads%2Fopportunities-web3%2Fcover14.jpg&w=3840&q=75)