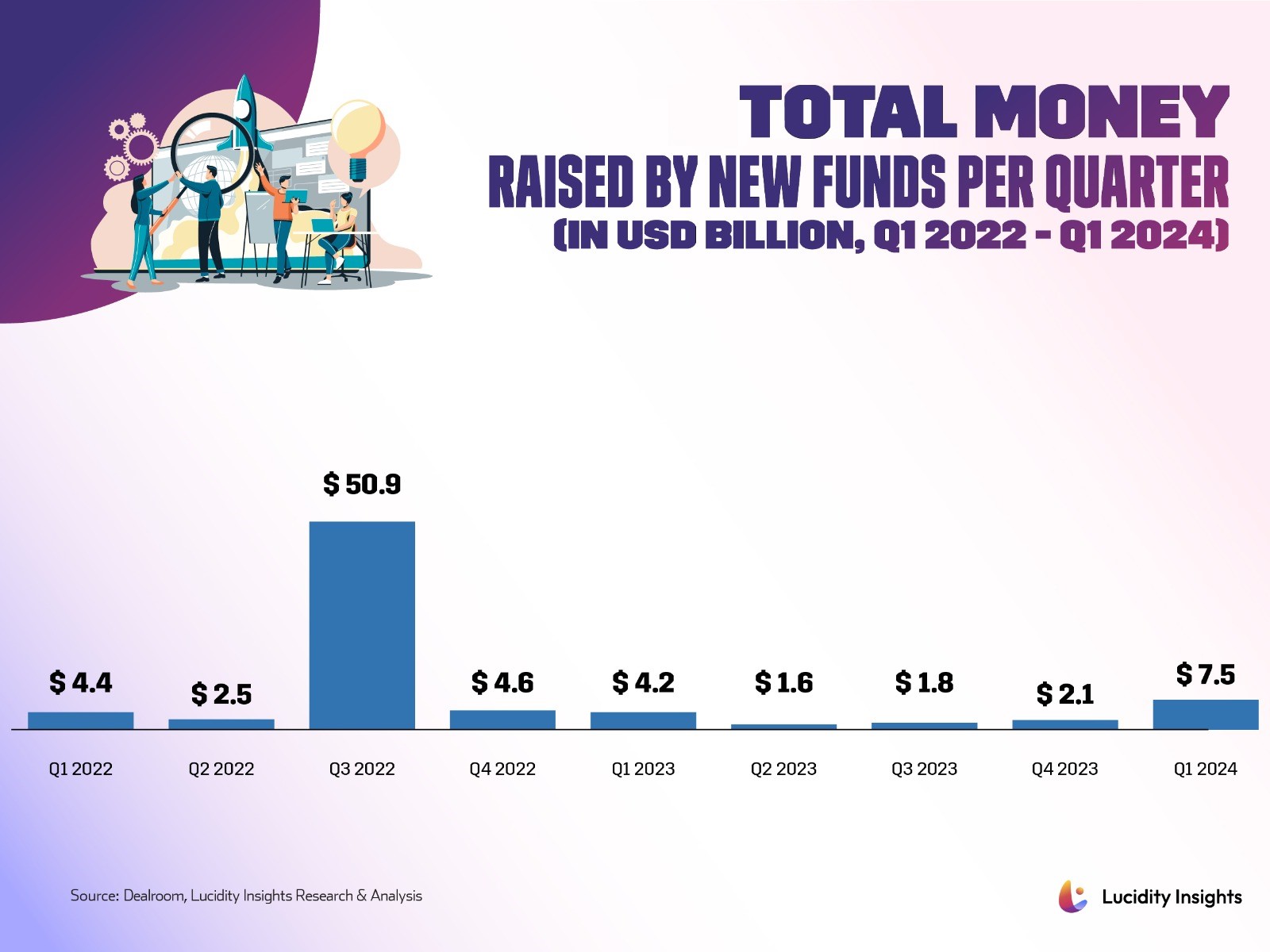

MENA’s New Funds: US $7.5 Billion Raised in Q1 2024

23 April 2024•

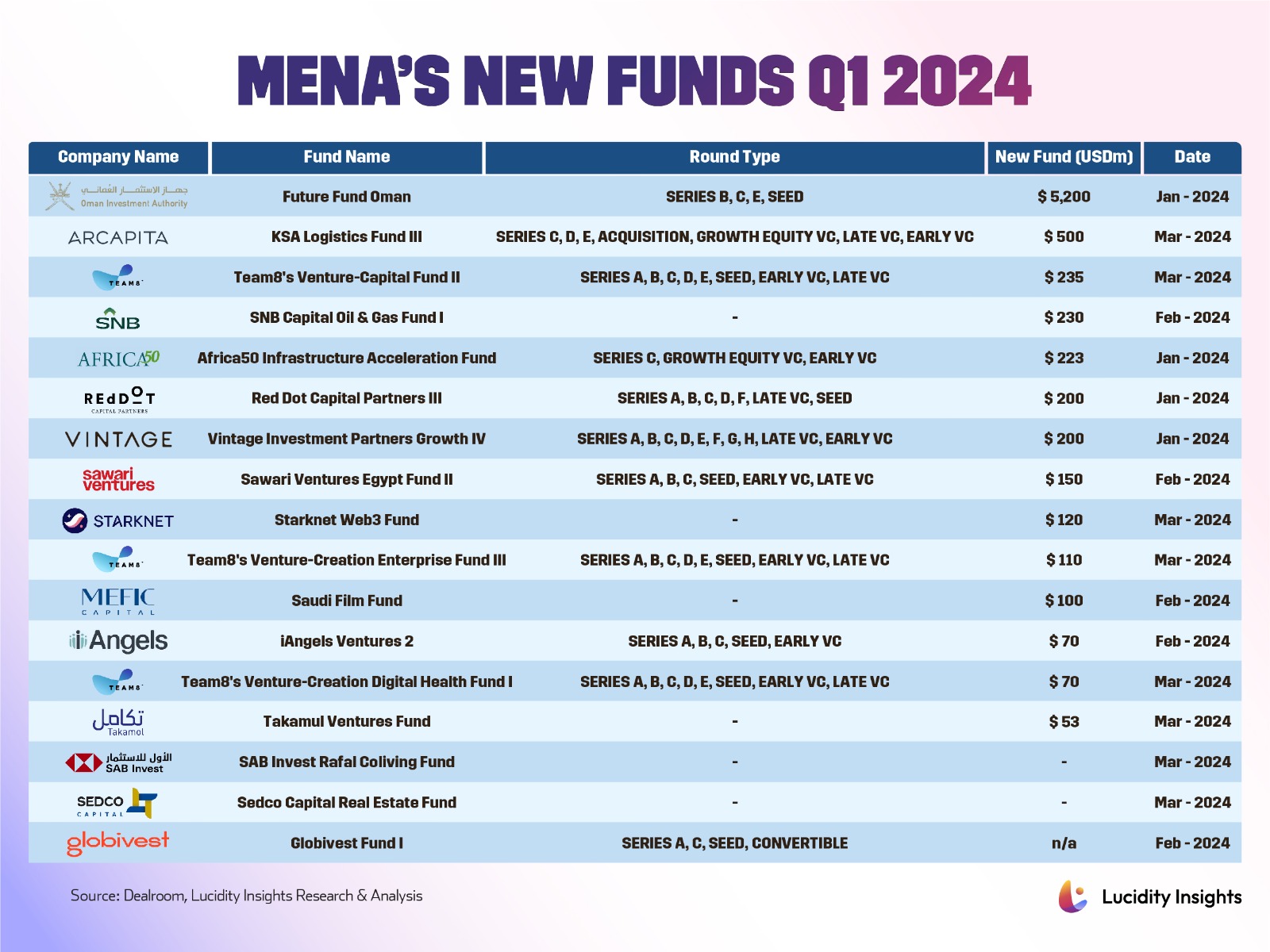

The MENA region started 2024 with a substantial increase raising an impressive US $7.5 billion in the first quarter alone across various fund types ranging from venture capital to private equity.

This figure is almost 2.5 times higher than the average raised in each quarter over the previous two years, if we set aside the exceptional spike in Q3 2022. That quarter saw US $50.9 billion raised, largely due to two major funds: PIF's US $37.8 billion fund and G42's US $10 billion fund.

Let’s explore the funds launched in Q1 2024 that are championing innovation and entrepreneurship both regionally and globally.

1. Oman Investment Authority

|

Fund Raised |

US $5.2 billion |

Fund Type |

Other |

|

Fund Name |

Future Fund Oman |

Round Types |

SEED, SERIES B, C, E |

|

Date |

January 2024 |

Location |

Oman |

The Future Fund Oman was launched on January 17th, 2024, with a capital of US $5,200 million to be used over a span of five years. According to the OIA, 90% of the fund will be directly invested in new or existing investment projects that are commercially and economically viable, while the remaining 10% will be divided into 7% allocated to SMEs and 3% allocated to startups.

“The establishment of the Oman Future Fund aims to advance the targeted economic sectors, as the Fund is considered a major possibility for stimulating the growth of the national economy, and a reliable partner for local and international investors wishing to expand the scope of their projects in the Omani economy or enter the Omani market,” said Abdul Salam bin Mohammed Al Morshedi, Chairman of the OIA. “It will be a major enabler in stimulating the growth of the national economy and a reliable partner for local and international investors wishing to expand the scope of their projects in Oman.”

2. Arcapita Ventures

|

Fund Raised |

US $500 million |

Fund Type |

Other |

|

Fund Name |

KSA Logistics Fund III |

Round Types |

SERIES C, D, E, ACQUISITION, GROWTH EQUITY VC, LATE VC, EARLY VC |

|

Date |

March 2024 |

Location |

Bahrain |

The KSA Logistics Fund III is a closed-end fund focused on high-quality income-generating logistics properties in the Kingdom of Saudi Arabia. It was officially announced and achieved its first closing in March 2024, established with a target of US $500 million.

“We currently manage over $1 billion of industrial warehousing assets in KSA and the GCC region, and our investor base includes pension funds, sovereign wealth funds, and financial institutions. The industrial and logistics sectors are key components of the Kingdom’s Global Supply Chain Resilience Initiative, which aims to attract $10.6 billion in investments," said Hisham Al Raee, Deputy Chief Executive Officer of Arcapita Group.

3. Team8

|

Fund Raised |

US $235 million |

Fund Type |

Venture Capital |

|

Fund Name |

Venture-Capital Fund II

|

Round Types |

SERIES A, B, C, D, E, SEED, EARLY VC, LATE VC |

|

Date |

March 2024 |

Location |

Israel |

Team8 nearly stole the show this quarter with the closing of 3 new funds totaling US $500 million in March 2024, bringing Team8’s AUM to well over US $1 billion. “This milestone is not just about financial growth; it's a validation of our unique methodology in building and investing in companies and the substantial value we consistently deliver to our portfolio companies,” said Yuval Shachar, Managing Partner and Chairman at Team8.

At the top of the list is its Capital Fund II, which has US $235 million aimed at investing in promising startups that operate across and in the intersection of various sectors, including cyber, enterprise infrastructure (data, AI, cloud, dev, devops), fintech, and digital health.

4. SNB Capital

|

Fund Raised |

US $230 million |

Fund Type |

Other |

|

Fund Name |

SNB Capital Oil & Gas Fund I |

Round Types |

Not specified |

|

Date |

February 2024 |

Location |

Saudi Arabia |

The SNB Capital Oil & Gas Fund I is a closed-end private equity fund announced in February 2024. It has already raised more than US $230 million to provide investors with exposure to the oil and gas sector under a shariah-compliant structure. The fund is also indirectly investing in Repsol E&P, a joint venture between Spanish energy company Repsol and private equity firm EIG Global Partners, highlighting a strategic move into high-quality oil and gas assets in OECD countries, with a keen eye on North American reserves. The transaction creates a unique opportunity to acquire a large-scale portfolio with a production capacity of 600,000 barrels of oil equivalent per day.

“This pioneering oil and gas fund serves as a testament to SNB Capital’s commitment to enhancing our international role, fostering deeper engagement with stakeholders and unlocking unparalleled global opportunities for our investors while achieving sustainable economic diversification, innovation, and prosperity in the investment sector,” said Mohammed Al-Saggaf, Head of Wealth Management at SNB Capital.

5. Africa50

|

Fund Raised |

US $223 million |

Fund Type |

Renewables |

|

Fund Name |

Africa50 Infrastructure Acceleration Fund

|

Round Types |

SERIES C, GROWTH EQUITY VC, EARLY VC |

|

Date |

January 2024 |

Location |

Morocco |

Africa50’s Infrastructure Acceleration Fund (IAF) is a 12-year closed-ended infrastructure private equity fund aimed to mobilize large scale and long-term institutional capital from African and international institutions. In an African first on December 29th, 2023, the Africa50-IAF the first close of US $223 million from 16 institutional investors, including sovereign wealth funds, pension funds, social security funds, insurance companies, banks, and Development Finance Institutions (DFIs). The capital raised will be deployed into a pipeline of transformative infrastructure projects spanning power and energy, transportation and logistics, water and sanitation, and digital and social infrastructure.

Alain Ebobissé, CEO of Africa50 Group, expressed enthusiasm about the first close, stating, “We are thrilled to see such strong support from African institutional investors for the Africa50 Infrastructure Acceleration Fund. This achievement is a testament to the increasing role that African institutional investors are playing in financing the real economy and being at the forefront of unlocking Africa’s potential.”

6. Red Dot Capital Partners

|

Fund Raised |

US $200 million |

Fund Type |

Venture Capital

|

|

Fund Name |

Red Dot Capital Partners III |

Round Types |

SERIES A, B, C, D, F, LATE VC, SEED |

|

Date |

January 2024 |

Location |

Israel |

Red Dot Capital Partners III is an early-stage venture capital fund which invests across tech industry sectors, including enterprise software, fintech and cybersecurity. Officially announced in January 2024, the fund achieved its first closing with commitments for over US $200 million from investors in Southeast Asia and Japan, Europe, and the USA.

7. Vintage Investment Partners

|

Fund Raised |

US $200 million |

Fund Type |

Venture Capital |

|

Fund Name |

Vintage Investment Partners Growth IV |

Round Types |

SERIES A, B, C, D, E, F, G, H, LATE VC, EARLY VC |

|

Date |

January 2024 |

Location |

Israel |

Announced in January 2024, the Vintage Investment Partners Growth IV has raised over $200 million, surpassing its target early on. The fund’s objective is to invest in 15-20 leading Israeli, European, and U.S. growth-stage technology startups, together with its trusted network of tier-one venture capital funds. It will operate in parallel to Vintage’s Fund of Funds and Secondary Funds, all driven by a deep database and network, and brings Vintage’s total assets under management to roughly US $4 billion.

8. Sawari Ventures

|

Fund Raised |

US $69 million |

Fund Type |

Venture Capital |

|

Fund Name |

Sawari Ventures Egypt Fund II |

Round Types |

SERIES A, B, C, SEED, EARLY VC, LATE VC |

|

Date |

February 2024 |

Location |

Egypt |

The Sawari Ventures Egypt Fund II was officially announced in February 2024. It has commitments for over US $69 million that will invest in Egyptian startups, both seed-stage and growth-stage companies. A tenth of the fund will be dedicated to seed-stage startups, with investments managed through Flat6Labs in Egypt and Tunisia. Specifically, Flat6Labs Cairo is set to fund 80-100 startups and may provide additional capital to 30-40 of them. Similarly, Flat6Labs Tunisia will back 60-70 companies and consider follow-on investments for 30-40. The remaining 90% of the fund will target growth-stage companies, with typical investments ranging from $2 to $3 million.

“Our aim is to create exceptional returns through investing in knowledge-driven companies, which have the potential of bringing transformational changes to the Egyptian economy. The fund will support local companies with dedicated capital, in addition to quality expertise from our seasoned and specialized team, and the value add of our investors,” says Ahmed El Alfi, the founder and Chairman of Sawari Ventures.

9. StarkNet

|

Fund Raised |

US $120 million |

Fund Type |

Corporate |

|

Fund Name |

Starknet Web3 Fund |

Round Types |

Not specified |

|

Date |

March 2024 |

Location |

Israel |

Starknet, an Ethereum Layer 2 rollup, has taken a major step forward in the gaming industry by launching a $120 million fund to enhance Web3 gaming experiences within its ecosystem. This move signifies a critical development for both developers and gamers, positioning Starknet to strengthen its presence in the rapidly evolving blockchain gaming sector.

10. Team8

|

Fund Raised |

US $110 million |

Fund Type |

Venture Capital |

|

Fund Name |

Venture-Creation Enterprise Fund III |

Round Types |

SERIES A, B, C, D, E, SEED, EARLY VC, LATE VC |

|

Date |

March 2024 |

Location |

Israel |

Next for Team8 comes the launch of the Venture-Creation Enterprise Fund III with US $110 million dedicated to collaborating with leading entrepreneurs (often serial founders) to jointly build and invest the Seed rounds in 1-2 new startups a year in the fields of cyber, data infrastructure & AI.

11. MEFIC Capital

|

Fund Raised |

US $100 million |

Fund Type |

Other |

|

Fund Name |

Saudi Film Fund |

Round Types |

Not specified |

|

Date |

February 2024 |

Location |

Saudi Arabia |

The Saudi Film Fund is a closed-end private equity fund announced in February 2024 to spur investment in the film and media sector in the KSA, and provide financing for innovative content production and distribution projects. The fund has a total capital of US $100 million, including a 40% investment from the Cultural Development Fund, and Roaa Media Ventures is acting as the technical partner to foster relationships with leading international studios and produce content that reflects Saudi culture and values.

12. iAngels

|

Fund Raised |

US $70 million |

Fund Type |

Venture Capital |

|

Fund Name |

iAngels Ventures 2 |

Round Types |

SERIES A, B, C, SEED, EARLY VC |

|

Date |

February 2024 |

Location |

Israel |

Despite challenges in fundraising within the region, VC firm iAngels successfully closed its second fund, iAngels Ventures 2, in February 2024, securing US $70 million with the majority of capital sourced from international investors. This venture is set to allocate funds to nascent startups, earmarking amounts between US $2 to $4 million for Seed funding rounds.

13. Team8

|

Fund Raised |

US $70 million |

Fund Type |

Venture Capital |

|

Fund Name |

Venture-Creation Digital Health Fund I |

Round Types |

SERIES A, B, C, D, E, SEED, EARLY VC, LATE VC |

|

Date |

March 2024 |

Location |

Israel |

Finally, Team8’s Venture-Creation Digital Health Fund I has US $70 million committed to partnering with experienced and often serial entrepreneurs uniquely positioned to revolutionize the digital health ecosystem that is undergoing a dramatic digital transformation.

14. Takamul Holdings

|

Fund Raised |

US $35 million |

Fund Type |

Venture Capital |

|

Fund Name |

Takamul Ventures Fund |

Round Types |

Early stage |

|

Date |

March 2024 |

Location |

Saudi Arabia |

Takamol Ventures is the latest investment fund announced by Takamol Holdings at the LEAP 2024 Conference in Riyadh, Saudi Arabia. This initiative aims to foster the advancement of the technology sector in MENA with US $35 million to fund innovation in early-stage tech companies.

15. SAB Invest

|

Fund Raised |

Nondisclosed |

Fund Type |

Other |

|

Fund Name |

SAB Invest Rafal Coliving Fund |

Round Types |

Not specified |

|

Date |

March 2024 |

Location |

Saudi Arabia |

The SAB Invest Rafal Coliving Fund is a closed-end private real estate fund that was announced in March 2024. The fund’s objective is to develop a co-living residential property on a plot of land spanning 3,581 square meters on King Salman Road, in close distance from Riyadh’s landmark mega projects.

Ali Al Mansour, CEO of SAB Invest, said: "The SAB Invest Rafal Co-living Fund offers an innovative model in the residential sector, and will be a unique addition to the sector. SAB Invest will continue to focus on quality investments in sectors with sustainable demand, aligning with Saudi Vision 2030."

16. SEDCO Capital

|

Fund Raised |

Nondisclosed |

Fund Type |

Other |

|

Fund Name |

Sedco Capital Real Estate Fund |

Round Types |

Not specified |

|

Date |

March 2024 |

Location |

Saudi Arabia |

The Sedco Capital Real Estate Fund is a closed-ended Real Estate Investment Traded Fund. The fund invests in income-generating real estate, mainly in Saudi Arabia, and distributes no less than 90% of its net profits with the objective to develop a co-living residential property on a plot of land spanning 3,581 square meters located on King Salman Road, in close distance from Riyadh’s landmark mega projects.

17. Globivest

|

Fund Raised |

Target US $25-30 million (In progress) |

Fund Type |

Venture Capital |

|

Fund Name |

Globivest Fund I |

Round Types |

SERIES A, C, SEED, CONVERTIBLE |

|

Date |

February 2024 |

Location |

Lebanon |

The Globivest Fund was officially announced in February 2024 with a target of US $25-30 million. Despite challenges in fundraising within the region, founders Jasmine and Laura-Joy, achieved their first closing target securing two-thirds of the target fund amount in six months. Aligned with the World Health Organization's "One Health" concept, their investment philosophy underscores the integral link between human health, animal well-being, and environmental health, seeking impact investments related to health and the environment, offering funding and investment solutions to various investor categories.

Jasmine and Laura-Joy have commented, "Challenges are where we find our strength. Facing constant difficulties and occasional paternalistic remarks only fuels our determination. We aim not only to establish our legitimacy in the industry but also to inspire more women and underrepresented individuals to tread a similar path."

Takeaway

As the first quarter of 2024 wraps up, MENA's US $7.5 billion in funds raised reflects an upswing from previous quarters. The influx of new capital raised in Q1 2024 could set the tone for a strong 2024 investment landscape potentially turning the tides away from the current VC winter. The variety seen in the types of funds raised so far this year highlights a diversified investment strategy in MENA, which could be a strategic approach to mitigate risks and tap into multiple growth sectors simultaneously. However, many of these funds align with broader economic goals or national initiatives, such as Saudi Arabia's Global Supply Chain Resilience Initiative or Oman's focus on stimulating its national economy, suggesting that the funds are being used as strategic tools for national development all over the region. With these firms making strides in infrastructure, technology, health, and creative industries, MENA continues to harness its entrepreneurial spirit as the global economic stage anticipates its next moves with keen interest.

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)